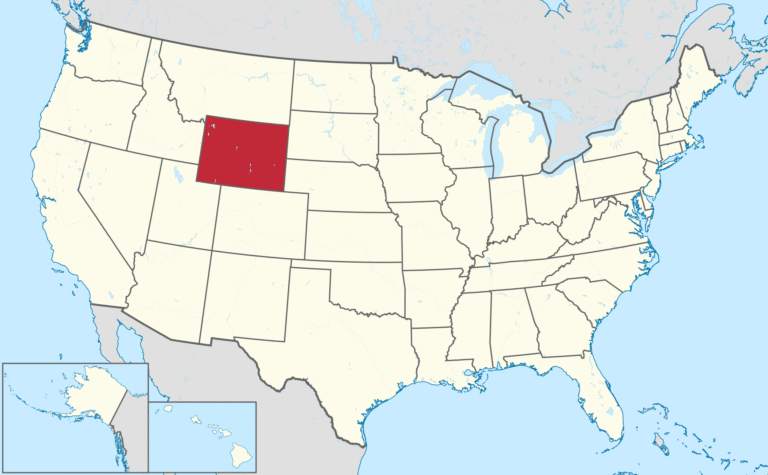

Total Loss Appraisal in

Wyoming

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Wyoming total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Wyoming: What You Need to Know

Wyoming Total Loss Appraisal — Get a Fair Settlement for Your Totaled Vehicle

If your vehicle was declared a total loss in Wyoming and the payoff from the insurance company seems light, you can request an independent Wyoming total loss appraisal to verify what your vehicle was really worth before the crash. From Cheyenne and Casper to Laramie, Gillette, Rock Springs, Sheridan, and smaller communities across the state, SnapClaim helps drivers recover their vehicle’s fair market value (ACV) and push back against low insurance offers. Our certified total loss appraisal reports are data-driven, USPAP-aware, and insurer-ready — frequently used by adjusters, attorneys, and small-claims courts in Wyoming.Why Get a Total Loss Appraisal in Wyoming?

Wyoming’s used-vehicle market is unique: long driving distances, heavy truck usage, winter conditions, and limited local inventory can all drive prices higher than what generic valuation tools show. Standard CCC, Mitchell, or Audatex reports may undervalue trucks, SUVs, and work vehicles that are in high demand for ranching, oil and gas, and outdoor recreation. A SnapClaim appraisal focuses on real Wyoming sales and listings, not lowball comparables from distant markets.Common Reasons to Question a Wyoming Total Loss Offer

- Vehicle listed with the wrong trim level, packages, or mileage

- Comparables pulled from cheaper urban markets in other states

- Unreasonable deductions for condition, prior use, or aftermarket equipment

- 4×4, off-road, and towing packages not properly valued

- Rural and winter-demand premiums ignored for trucks and SUVs

What’s Included in Your Wyoming Total Loss Appraisal Report

- Full VIN-based breakdown confirming trim, options, and mileage

- Local comparable listings from Cheyenne, Casper, Gillette, Rock Springs, Sheridan, and nearby regions

- Accurate pre-loss fair market value calculation for Wyoming conditions

- Clear adjustments for features, mileage, upgrades, and overall condition

- Documentation to invoke the appraisal clause under your Wyoming auto policy

- Optional expert support if your dispute escalates to negotiation or court

Wyoming Total Loss Rules & Appraisal Rights

Policyholders in Wyoming can dispute a total loss valuation and request an independent appraisal according to the appraisal clause in their auto policy. If the two appraisers cannot agree on value, a neutral umpire reviews both sides and decides the final number.- Wyoming Department of Insurance

- Wyoming Department of Transportation

- Wyoming Courts — Small Claims Information

How to Dispute a Total Loss Offer in Wyoming

- Request the insurer’s valuation report (CCC, Mitchell, or Audatex) and review it for errors.

- Order a SnapClaim total loss appraisal to determine your vehicle’s true ACV.

- Invoke the appraisal clause in your policy if the values are far apart.

- Send the independent appraisal to your adjuster or attorney for negotiations.

- Use documented market evidence — many Wyoming drivers recover significantly more than the first offer.

Wyoming Market Insights

- Half-ton and three-quarter-ton pickups (F-150, F-250, Ram, Silverado) often command a premium in rural areas.

- 4×4 and off-road packages are especially valuable due to snow, gravel roads, and mountain access.

- Lower overall vehicle supply in smaller towns can keep used prices higher than national averages.

- Well-maintained work trucks and ranch vehicles may be undervalued by generic software if local demand isn’t considered.

Example Wyoming Case Study

Vehicle: 2018 Ford F-150 XLT 4×4Insurance Offer (CCC): $23,600

SnapClaim Appraisal: $27,900

Final Settlement: $27,250 after submitting our independent report and using the appraisal clause

Helpful Wyoming Resources

- Wyoming Department of Insurance — Consumer Help

- Self-Help & Small Claims Resources

- Wyoming DOT — Vehicle & Title Information

- NHTSA — Vehicle History Check

Ready to Get Your Wyoming Total Loss Appraisal?

- No upfront payment required

- Most reports ready in about 1 hour

- Includes a fair-market-value opinion and insurer-ready documentation

Related Wyoming Locations

Click a pin to open the city’s total loss page.

Find your Wyoming city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Wyoming

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Wyoming total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my truck was totaled outside Cheyenne during a winter storm, the insurance payout didn’t come close to what similar 4x4s go for in Wyoming. SnapClaim’s total loss appraisal used real rural and statewide market data, and it gave me exactly what I needed to challenge the offer. I ended up securing $3,200 more than the insurer’s initial estimate.”

Caleb R.,

Cheyenne, WY

Wyoming Total Loss – Frequently Asked Questions

When is a vehicle considered a total loss in Wyoming?

Wyoming uses a 75% total loss threshold. If the estimated cost of parts and labor needed to return your vehicle to its pre-accident condition is greater than about 75% of its Actual Cash Value (ACV), it is typically treated as a total loss and subject to salvage rules. You can see how Wyoming compares to other states in our guide to total loss laws by state.

What does Actual Cash Value (ACV) mean on a Wyoming total loss claim?

ACV is your vehicle’s fair market value in Wyoming just before the crash. It’s based on: year, make, model, trim, mileage, options, condition, and local market data (for example, Cheyenne, Casper, Laramie, Gillette, Rock Springs, and surrounding areas). To understand how ACV should be calculated correctly, check our Fair Market Value & ACV guide.

The valuation I received seems low for Wyoming — what can I do?

You are not required to accept a valuation that doesn’t match real Wyoming market prices. Ask for the full CCC/Mitchell or other valuation report, then check: missing options, wrong trim, incorrect mileage, or comps pulled from cheaper out-of-state markets. Many drivers and attorneys rely on a SnapClaim Wyoming total loss appraisal to present a stronger, data-backed value: order a Wyoming total loss appraisal.

Does the 75% total loss threshold mean my car must be totaled at that point?

In Wyoming, once estimated repairs exceed about 75% of the vehicle’s ACV, the vehicle generally meets the definition of a salvage vehicle and is treated as a total loss. Insurers may also consider safety, hidden damage risk, and market factors, but the 75% threshold is the main trigger for salvage branding. Our state-law overview explains how percentage thresholds work alongside insurer guidelines: learn about total loss thresholds.

What happens to my title if my car is totaled in Wyoming?

When a vehicle meets Wyoming’s total loss standard, it is usually branded as a salvage vehicle. The original title is surrendered and a salvage title or certificate is issued in its place. If the car is later repaired and passes all required inspections, it may qualify for a rebuilt (or similar branded) title before it can legally return to the road. Be sure you understand how the title will be branded before you agree to the settlement terms, especially if you plan to keep the vehicle.

Can I keep my totaled vehicle in Wyoming and fix it myself?

Often, yes. If you elect to retain the salvage, the insurance company typically reduces your cash settlement by the vehicle’s estimated salvage value, and the title will be branded as salvage under Wyoming law. You’ll then need to handle repairs and any required inspections before the vehicle can be driven or registered again. A SnapClaim appraisal can help you confirm whether both the ACV and salvage value are fair: talk to our Wyoming appraisal team.

Will my Wyoming total loss payout include taxes and registration fees?

Many total loss settlements include applicable taxes and certain fees needed to replace your vehicle, but practices can vary by insurer and policy. Always ask for an itemized breakdown showing: ACV, tax, title, registration, and any other line items. Our valuation guide breaks down how these components fit into ACV: understand ACV, tax, and fees.

What if I owe more on my auto loan than the insurance will pay in Wyoming?

If your loan payoff is higher than the total loss settlement, you have negative equity. You’re responsible for that remaining balance unless you carry GAP coverage or a similar add-on that covers the shortfall. The more accurate your ACV, the smaller that gap usually is. Wyoming drivers and law firms often use a SnapClaim report to show that the vehicle was worth more than the insurer’s number: request a Wyoming total loss appraisal.

How long do I have to deal with a Wyoming property damage or total loss claim?

Wyoming law sets specific statutes of limitations for vehicle damage and injury claims from crashes. These deadlines can span multiple years, but the exact time frame depends on your situation and may change if laws are updated. Missing a deadline can affect your rights, so it’s important to consult a Wyoming attorney about the timing for your particular case. SnapClaim’s role is to provide a clear, data-driven valuation that your attorney or adjuster can rely on during negotiations: see how our Wyoming reports are used.

Does my Wyoming policy have an appraisal clause, and how can it help me?

Many auto policies, including those used in Wyoming, contain an appraisal clause that applies when you and your insurer disagree about your vehicle’s value. Typically, each side hires an appraiser; if they can’t agree, they submit the dispute to a neutral umpire who helps set the value. This process usually applies when you’re making a claim under your own policy. A detailed SnapClaim report can support you if you decide to invoke appraisal: learn how our Wyoming appraisals support disputes.

Can I use SnapClaim if the accident happened in a rural part of Wyoming?

Yes. SnapClaim works across all of Wyoming—from larger cities like Cheyenne and Casper to smaller towns and rural areas. Instead of generic national values, we pull hyper-local comparable listings that reflect the real market in your part of the state. You can start from our Wyoming overview page or go directly to ordering a total loss appraisal: start a Wyoming total loss appraisal.

How fast can I get a Wyoming total loss appraisal from SnapClaim?

Most Wyoming total loss appraisals are completed the same business day after we receive your claim information and supporting documents—often within about an hour. That speed helps you push back on low offers before the claim drags on for weeks. Get started now: order your Wyoming total loss appraisal.

How does a SnapClaim report help Wyoming drivers and law firms negotiate better payouts?

SnapClaim builds a Wyoming-specific valuation file using verified comparables, condition adjustments, mileage, options, and market corrections for your area. The report clearly explains how ACV should be calculated and highlights where the insurer’s number may fall short. Many clients recover significantly more after presenting a SnapClaim appraisal: see how our Wyoming appraisals support negotiations.

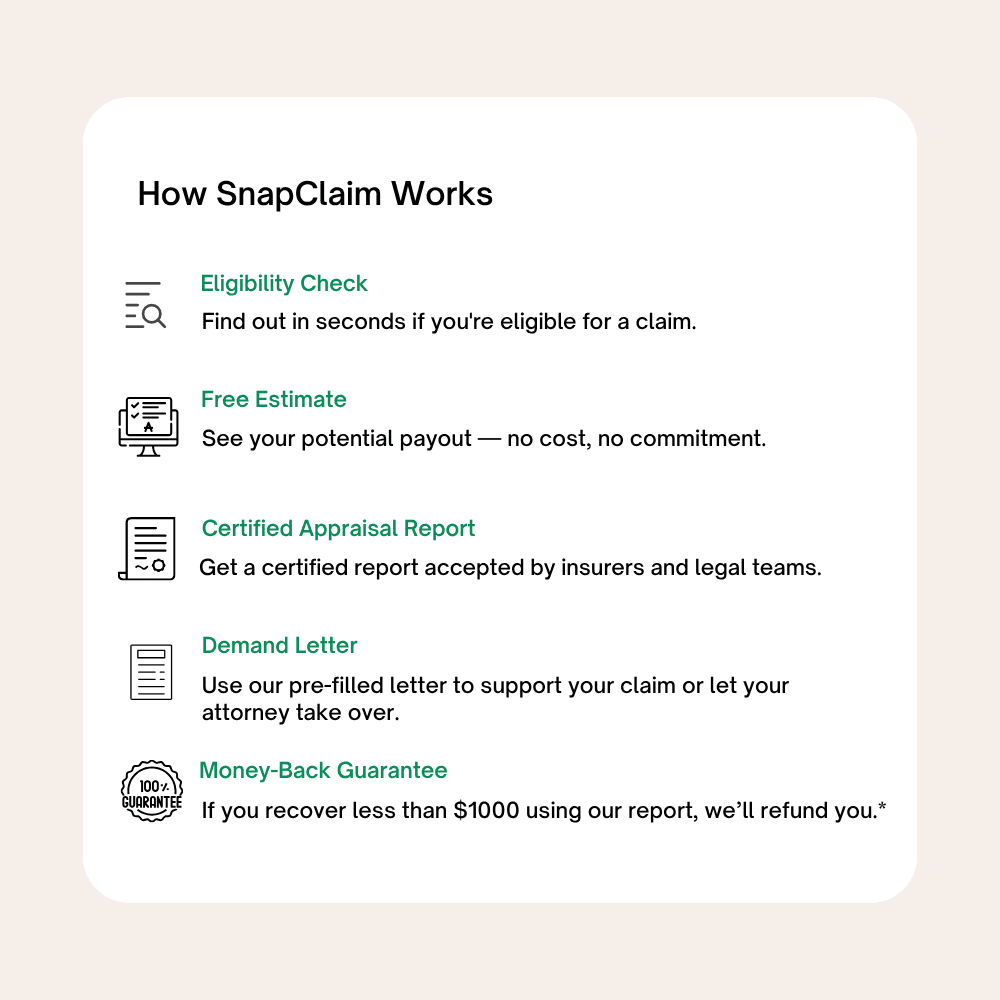

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.