Total loss threshold is a state-level rule that determines when a car is considered “totaled” after an accident. This term can be confusing and stressful, but it’s not solely about the appearance of the damage. This guide clarifies how the rule operates and its implications for your insurance claim.

What a Total Loss Threshold Means for Your Car

Here’s the process in simple terms. After an accident, an insurance adjuster does two things:

- Estimates the cost to repair all the damage.

- Determines your car’s Actual Cash Value (ACV) — what it was worth right before the crash.

The total loss threshold is the tipping point where the repair costs get too high compared to the car’s value. If the repair bill crosses that line, the insurance company must declare it a total loss.

For example, let’s say your car’s ACV was $20,000. If you live in a state with a 75% threshold, any repair estimate over $15,000 (75% of $20,000) means your car is officially totaled.

How States Calculate a Total Loss

Every state sets its own rules, but they generally fall into one of two categories. Knowing which method your state uses is key to understanding your claim.

- Percentage Threshold: This is the most common method. The state government sets a specific percentage. If the cost of repairs exceeds that percentage of the car’s ACV, it’s a total loss.

- Total Loss Formula (TLF): This method is a simple calculation. The insurer adds the Cost of Repairs to the vehicle’s Salvage Value (what they can sell the wrecked car for). If that total is equal to or greater than the car’s ACV, it’s declared a total loss.

Why This Percentage Matters to You

The total loss threshold by state is a crucial number for any vehicle owner. These thresholds vary significantly across the U.S., from as low as 60% in Oklahoma to as high as 100% in states like Texas and Colorado.

For example, Alabama uses a 75% rule, while neighboring Florida uses 80%. That small difference can decide whether you get your car back from the shop or a settlement check to buy a new one. You can see how much these rules vary by checking state-by-state guides like this one from World Population Review.

An insurer’s initial ACV offer is just that—an offer. If they undervalue your car, it can prevent a heavily damaged vehicle from being declared a total loss. This could leave you with a poorly repaired car that has lost a significant amount of its value, a problem known as diminished value. This is where an independent appraisal report provides the proof you need to negotiate a fair settlement.

Find Your State’s Total Loss Threshold

Knowing your state’s specific rule is one of the most empowering things you can have after an accident. It turns the vague concept of a “total loss” into a hard number that directly impacts your insurance claim. The rules can change dramatically just by crossing a state line.

Percentage Threshold vs. The Total Loss Formula

The Percentage Threshold is a clear, bright-line test. States using this method set a percentage, typically between 70% and 100%. If repair estimates exceed that percentage of your car’s Actual Cash Value (ACV), it’s automatically a total loss.

The Total Loss Formula (TLF) is more of a financial calculation for the insurance company. It helps them decide if it’s cheaper to pay for repairs or pay you the vehicle’s value and sell the wreck for scrap.

The formula looks like this:

(Cost of Repairs + Salvage Value) ≥ Actual Cash Value (ACV)

If the repair costs plus the scrap value are equal to or more than your car’s pre-accident value, it’s a total loss. This method gives insurers more flexibility, so you need to pay close attention to how they calculate both repair costs and salvage value.

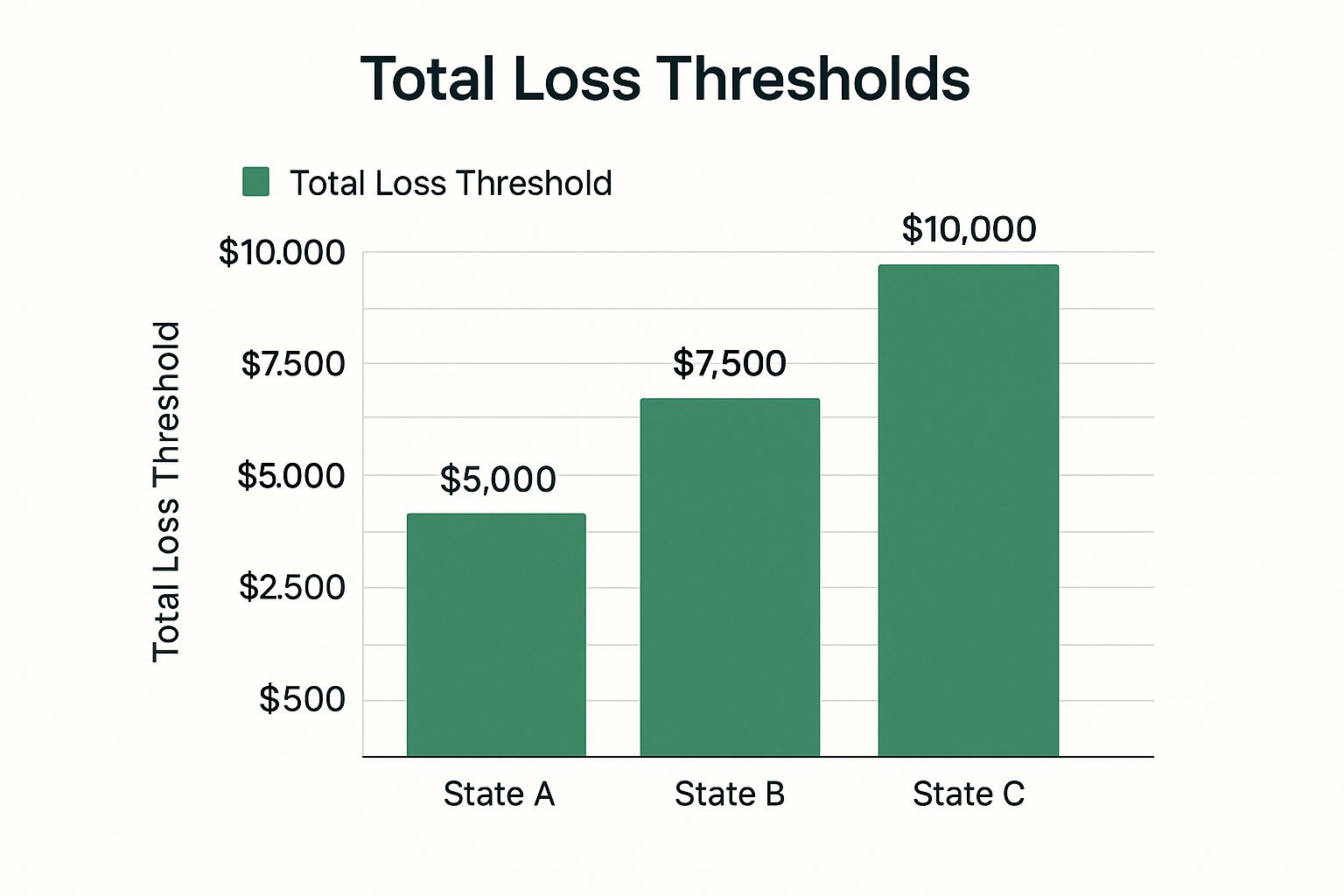

As you can see, even a small difference in the percentage can mean thousands of dollars, marking the line between getting your car back or getting a settlement check.

Vehicle Total Loss Thresholds for All 50 States

Navigating the specific total loss threshold by state is the core of your claim. The table below outlines which rule each state follows. Simply find your state to see the standard your insurance company must use.

| State | Total Loss Threshold |

|---|---|

| Alabama | 75% |

| Alaska | Total Loss Formula (TLF) |

| Arizona | Total Loss Formula (TLF) |

| Arkansas | 70% |

| California | Total Loss Formula (TLF) |

| Colorado | 100% |

| Connecticut | Total Loss Formula (TLF) |

| Delaware | Total Loss Formula (TLF) |

| Florida | 80% |

| Georgia | Total Loss Formula (TLF) |

| Hawaii | Total Loss Formula (TLF) |

| Idaho | Total Loss Formula (TLF) |

| Illinois | Total Loss Formula (TLF) |

| Indiana | 70% |

| Iowa | 70% |

| Kansas | 75% |

| Kentucky | 75% |

| Louisiana | 75% |

| Maine | Total Loss Formula (TLF) |

| Maryland | 75% |

| Massachusetts | Total Loss Formula (TLF) |

| Michigan | 75% |

| Minnesota | 80% |

| Mississippi | Total Loss Formula (TLF) |

| Missouri | 80% |

| Montana | Total Loss Formula (TLF) |

| Nebraska | 75% |

| Nevada | 65% |

| New Hampshire | 75% |

| New Jersey | Total Loss Formula (TLF) |

| New Mexico | Total Loss Formula (TLF) |

| New York | 75% |

| North Carolina | 75% |

| North Dakota | 75% |

| Ohio | Total Loss Formula (TLF) |

| Oklahoma | 60% |

| Oregon | 80% |

| Pennsylvania | Total Loss Formula (TLF) |

| Rhode Island | Total Loss Formula (TLF) |

| South Carolina | 75% |

| South Dakota | 75% |

| Tennessee | 75% |

| Texas | 100% |

| Utah | Total Loss Formula (TLF) |

| Vermont | Total Loss Formula (TLF) |

| Virginia | 75% |

| Washington | Total Loss Formula (TLF) |

| West Virginia | 75% |

| Wisconsin | 70% |

| Wyoming | 75% |

Why This Information Gives You Power

Knowing your state’s threshold is your best defense against a bad settlement. An insurance company’s first offer for your car’s Actual Cash Value is often just a starting point. If they undervalue your vehicle, they can make the repair costs seem lower in comparison—potentially keeping the damage estimate just under the total loss threshold. This is bad for you, as you could end up with a car that has suffered permanent diminished value and may never drive the same again.

This is why an independent appraisal is so important. A certified report from SnapClaim provides a detailed, data-backed analysis of your vehicle’s true fair market value. This evidence is what you need to challenge a lowball ACV and ensure the insurer uses accurate numbers.

Best of all, you can challenge the insurance company with zero risk. SnapClaim’s money-back guarantee means if the insurance recovery from the claim is less than $1,000, the appraisal fee is fully refunded. This lets you fight for the compensation you deserve without financial risk.

Decoding Your Car’s Actual Cash Value

Once you know your state’s total loss threshold, the next number you need to understand is your car’s Actual Cash Value (ACV). ACV is what your car was worth on the open market right before the accident. It has nothing to do with what you paid for it or what you still owe on your loan.

Insurers determine ACV by looking at your vehicle’s year, make, model, mileage, overall condition, and any special features. They also analyze recent sales data for similar cars in your local area to set a market price. However, their first offer is often lower than what your vehicle was truly worth.

Why Initial ACV Offers Are Often Too Low

Insurance companies are businesses managing financial risk, and their valuation methods sometimes favor their bottom line. Common reasons an initial offer might be too low include:

- Using Outdated Data: Their valuation guides may not reflect your current local market.

- Cherry-Picking “Comps”: An adjuster might use comparable vehicles that are in worse condition or have fewer options to justify a lower value.

- Overlooking Key Details: They often miss value-adding factors like recent major repairs, premium upgrades, or a pristine maintenance record.

A low ACV directly impacts the total loss threshold by state calculation. A lower vehicle value means it takes a much higher repair estimate to trigger a total loss, potentially leaving you with a poorly repaired car instead of a fair settlement.

The Power of an Independent Appraisal

So, what should you do when the insurer’s numbers don’t add up? You respond with facts. A certified, independent appraisal is your most effective tool for this. It replaces the insurer’s opinion with market-proven data.

A SnapClaim report is not a quick estimate; it’s a detailed analysis that supports your vehicle’s true fair market value. Here’s what it includes:

- Hyper-Local Market Analysis: We find real, recent sales of cars just like yours in your area.

- Attention to Every Detail: We factor in your car’s exact condition, maintenance history, and any custom upgrades.

- Verifiable Proof: You receive a professional report with evidence you can submit directly to the insurance company.

This documented proof provides the leverage you need to negotiate from a position of strength. It’s no longer just your word against theirs—it’s your evidence-backed report against their lowball offer. And with our money-back guarantee, there’s zero risk. If our report doesn’t help strengthen your claim and result in a recovery of at least $1,000 more, the appraisal is on us.

Your Guide to the Total Loss Claims Process

When an insurer totals your car, the claims process can feel overwhelming. It’s full of unfamiliar terms and confusing steps, but understanding the roadmap helps you take control. We’ve broken down the journey to help you navigate it with confidence.

Step 1: The Initial Claim and Damage Inspection

The process begins when you file a claim. The insurance company assigns an adjuster who will inspect your vehicle at a body shop, tow yard, or your home. The adjuster creates a report detailing the damage and writes up an initial repair estimate. This estimate is the first key number that gets compared against your car’s ACV to see if it meets the total loss threshold in your state.

Step 2: The Insurer’s Valuation

At the same time, the insurance company calculates your vehicle’s ACV using their preferred valuation tools. This is a critical moment. The insurer’s repair estimate and ACV calculation are the two figures that determine whether your car is repaired or totaled.

Pro Tip: Never automatically accept the insurer’s first ACV number. It is often a low opening offer. Start gathering your own evidence immediately to prepare for negotiations.

Collect documents that prove your car’s value, such as: car worth after accident

- Maintenance Records: Shows the vehicle was well-maintained.

- Receipts for Upgrades: New stereo, custom wheels, or other add-ons.

- Recent Major Repairs: Invoices for a new transmission or brand-new tires.

Step 3: The Total Loss Declaration and Settlement Offer

If the numbers meet your state’s criteria, the insurer will declare your car a total loss and send you a settlement offer. This offer is usually their calculated ACV minus your policy’s deductible.

Don’t rush to accept it. Review their valuation report and compare it to your own research. If the offer seems low, it’s time to push back with facts. This is where a certified appraisal report from SnapClaim becomes your most valuable asset. It provides an unbiased, evidence-based valuation that reflects your car’s true market worth. Presenting a professional appraisal changes the conversation from an argument to a negotiation based on proof.

FAQ: Your Top Total Loss Questions Answered

Navigating a total loss claim is stressful, and it’s normal to have questions. Here are clear, simple answers to some of the most common ones we hear from vehicle owners.

Can I keep my car if it’s a total loss?

In most states, yes. This is called “owner retention.” The insurance company will pay you the car’s ACV minus its salvage value. For example, if the ACV is $10,000 and the salvage value is $1,500, you would receive a check for $8,500. Be aware that the state will issue a “salvage title” for your car, which makes it very difficult to insure and sell in the future. You will also be responsible for all repair costs.

What if I owe more on my loan than the settlement offer?

This situation is called being “upside down” on your loan. The insurance company is only responsible for paying the car’s ACV, not your loan balance. If you owe $20,000 but the ACV is $18,000, you are responsible for the remaining $2,000. Guaranteed Asset Protection (GAP) insurance is designed for this exact scenario. If you purchased GAP coverage when you bought your car, it will cover the difference.

How do I prove my car was worth more?

You need to provide evidence to support a higher valuation. Your opinion alone is not enough. To build a strong case, gather documents like:

- Detailed maintenance records.

- Receipts for recent major repairs (e.g., new tires, transmission).

- Proof of valuable upgrades (e.g., premium sound system, tow package).

The single most effective tool is a certified independent appraisal. A SnapClaim report provides a detailed, objective analysis of your vehicle and its local market, shifting negotiations from opinion to fact.

Does the settlement include sales tax and fees?

In many states, yes. The goal of a total loss settlement is to “make you whole,” which means providing enough money to buy a comparable replacement vehicle. This includes sales tax, title, and registration fees. Always ask for a line-item breakdown of the settlement offer. If taxes and fees are not included, you can and should request them. You can check your state’s Department of Insurance website to confirm the rules.

About SnapClaim

SnapClaim is a leading provider of independent vehicle appraisals for diminished value and total loss dispute claims. Our team utilizes cutting-edge technology and extensive market knowledge to deliver accurate and defensible valuations. We are dedicated to empowering vehicle owners and personal injury attorneys with the information and expertise needed to negotiate fair settlements with insurance companies. With a commitment to transparency and customer satisfaction, SnapClaim ensures you receive the true value of your vehicle.

At SnapClaim, we believe you shouldn’t have to fight for a fair settlement alone. Our certified appraisal reports provide the undeniable proof needed to challenge lowball offers and support negotiations for your vehicle’s true value. With our money-back guarantee, you can pursue the compensation you’re owed with confidence.

Ready to get a fair settlement?