Total Loss Appraisal in

California

Get Your Free Estimate in a Minute!

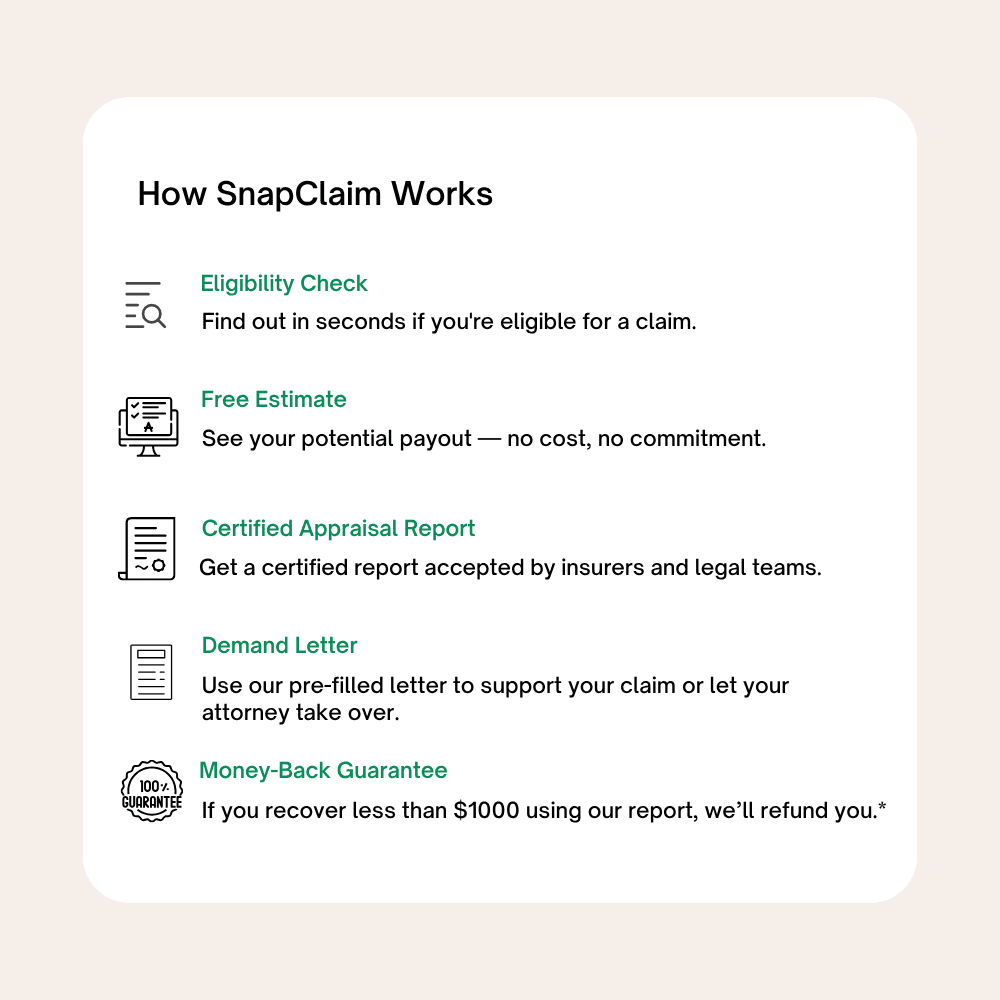

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a California total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in California: What You Need to Know

California Total Loss Appraisal — Get the True Market Value of Your Totaled Vehicle

If your vehicle was declared a total loss anywhere in California and the insurance offer feels too low, you are entitled to request an independent California total loss appraisal to verify your vehicle’s true market value. Whether your accident happened in Los Angeles, San Diego, San Francisco, Sacramento, San Jose, Fresno, or any other California city, SnapClaim helps drivers challenge low valuations and recover their car’s real fair market value (ACV). Our certified California total loss appraisal reports are market-driven, USPAP-aware, and insurer-ready — accepted by adjusters, attorneys, and small-claims courts across the state.Why Get a Total Loss Appraisal in California?

California’s insurance market frequently relies on CCC, Mitchell, and Audatex reports, which often undervalue vehicles — especially in high-demand metro areas where used-car prices trend significantly higher than national averages. A SnapClaim appraisal ensures your payout reflects actual California resale pricing, not artificially low comparables pulled from cheaper out-of-state markets.Common Reasons to Challenge a California Total Loss Offer

- Incorrect trim, equipment, or mileage listed in the insurer’s report

- Comps pulled from rural or out-of-state markets that don’t match Bay Area / LA prices

- Unsupported deductions for prior use, condition, or after-market equipment

- EV and hybrid premiums ignored (especially in SoCal and Silicon Valley)

- Incorrect adjustments related to California emissions packages

What’s Included in Your California Total Loss Appraisal Report

- Full VIN breakdown with verified trim, options, and mileage

- Local comparable listings from Los Angeles, San Diego, San Jose, Sacramento, Fresno, and beyond

- Accurate fair-market-value calculation based on California market trends

- Transparent adjustments for features, mileage, upgrades, and condition

- Documentation to invoke the appraisal clause under your California auto policy

- Optional expert negotiation support if your case escalates

California Total Loss Laws & Your Appraisal Rights

California drivers may dispute a total loss valuation and request an independent appraisal under their auto policy’s appraisal clause. If the two appraisers cannot agree, a neutral umpire reviews both reports and decides the final value.- California DMV — Total Loss & Salvage Guidelines

- California Department of Insurance

- California Small Claims Court

How to Dispute a Total Loss Offer in California

- Request the insurer’s valuation report (CCC, Mitchell, or Audatex).

- Get a SnapClaim total loss appraisal for a verified ACV.

- Invoke the appraisal clause if you disagree with the insurer’s valuation.

- Send the independent appraisal to your adjuster or attorney.

- Negotiate using documented evidence — many California drivers recover thousands more.

California Market Insights

- EVs and hybrids (Tesla, Prius, Bolt, Ioniq) command strong premiums statewide.

- Bay Area resale values remain among the highest in the country.

- Trucks and SUVs are highly demanded in inland regions (Fresno, Bakersfield, Riverside).

- Wildfire-impacted inventory shortages often increase resale values.

California Case Study

Vehicle: 2020 Toyota Tacoma TRD Off-RoadInsurance Offer (CCC): $29,400

SnapClaim Appraisal: $34,150

Final Settlement: $33,700 after invoking the appraisal clause

Helpful California Resources

- California Department of Insurance — File a Complaint

- California DMV — Vehicle Guides

- Small Claims Filing Steps

- NHTSA — Vehicle History Lookup

Ready to Get Your California Total Loss Appraisal?

- No upfront payment required

- Report ready in about 1 hour

- Fair-market-value + insurer-ready documentation included

Related California Locations

Click a pin to open the city’s total loss page.

Find your California city below to order your Total Loss Appraisal.

- Los Angeles, CA

- San Diego, CA

- San Jose, CA

- San Francisco, CA

- Fresno, CA

- Sacramento, CA

- Long Beach, CA

- Oakland, CA

- Bakersfield, CA

- Anaheim, CA

- Riverside, CA

- Stockton, CA

- Irvine, CA

- Santa Ana, CA

- Chula Vista, CA

- Fremont, CA

- San Bernardino, CA

- Modesto, CA

- Fontana, CA

- Moreno Valley, CA

- Oxnard, CA

- Huntington Beach, CA

- Glendale, CA

- Santa Clarita, CA

- Garden Grove, CA

- Santa Rosa, CA

- Oceanside, CA

- Rancho Cucamonga, CA

- Ontario, CA

- Elk Grove, CA

- Corona, CA

- Lancaster, CA

- Palmdale, CA

- Salinas, CA

- Hayward, CA

- Pomona, CA

- Escondido, CA

- Sunnyvale, CA

- Torrance, CA

- Pasadena, CA

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in California

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent California total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my hybrid was totaled in a pile-up near Pasadena, the insurance valuation came in far below what California cars are actually selling for. I used SnapClaim for a California total loss appraisal, and their report pulled real comps from across Los Angeles County. With it, I was able to negotiate an extra $3,600 on my settlement.”

Jordan K.,

Pasadena, CA

California Total Loss – Frequently Asked Questions

How do insurers decide if my car is a total loss in California?

In California, most insurers use a Total Loss Formula (TLF): they compare your vehicle’s Actual Cash Value (ACV) before the crash with the estimated cost to repair and the salvage value. If it’s not reasonably economical to repair under that formula, the car is treated as a total loss. You can see how California compares to other states in our total loss state law overview.

What is Actual Cash Value (ACV) in a California claim?

ACV is your car’s fair market value in California immediately before the accident. It takes into account the year, make, model, trim, mileage, options, condition, and local California market data (for example, Los Angeles, San Diego, San Jose, Sacramento, Fresno). To understand how ACV should be calculated, check our Fair Market Value guide.

What if the CCC or Mitchell valuation looks too low for my area?

You don’t have to accept a valuation that doesn’t match the real California market. Ask for a copy of the full report, verify the comparable vehicles, and look for issues like out-of-area listings, missing options, incorrect mileage, or condition errors. Many drivers use a SnapClaim California total loss appraisal to present a higher, data-backed number: get a California total loss appraisal.

Does California have a specific percentage threshold for total loss?

California focuses more on whether it is economical to repair the vehicle rather than a single fixed percentage. Insurers typically compare repair costs and salvage value against ACV to decide if your car is a total loss. For context on how this fits into national rules, see our state-by-state total loss rules, then use a California-specific appraisal if you think the call was wrong: California total loss help.

What happens to my title after a total loss in California?

When a vehicle is determined to be a total loss in California, the original title is usually surrendered and the car is issued a salvage certificate. If the vehicle is later repaired and passes the required California DMV inspections, it may qualify for a revived salvage (rebuilt) title. Always check how the title will be branded before signing any total loss paperwork, especially if you plan to keep the car.

Can I keep and repair my totaled car in California?

Often, yes. If you choose to retain the salvage, the insurance company will usually reduce your cash settlement by the vehicle’s estimated salvage value. You’ll then need to follow California’s process for salvage and revived salvage vehicles, including repairs and inspections, before the car can legally return to the road. A SnapClaim appraisal can help you confirm that both the ACV and salvage value are being calculated fairly: speak with our California appraisal team.

Are sales tax and DMV fees included in my California total loss payout?

Many California total loss settlements include applicable sales tax and certain DMV-related fees (like title or registration costs) so that you can replace your vehicle, but it’s not guaranteed. Ask your adjuster for a line-by-line breakdown of ACV, tax, and fees. Our valuation guide explains these components in more detail: Fair Market Value & ACV breakdown.

What if I still owe more on my auto loan than the insurance pays in California?

If your loan payoff is higher than the total loss settlement, you have negative equity. You’re responsible for that difference unless you have GAP coverage or similar protection. Ensuring your ACV is correct can drastically shrink that gap. California drivers often use a SnapClaim appraisal to show that the car was worth more than the insurer’s number: request a California total loss appraisal.

How long do I have to deal with a property damage claim in California?

California has specific statutes of limitations for property damage and injury claims from auto accidents. Those deadlines can be a few years, but the exact timing depends on your situation and can change if laws are updated. Because missing a deadline can hurt your rights, it’s important to consult a California attorney about timing. SnapClaim focuses on providing accurate, data-driven valuations that your attorney or adjuster can use: learn how our California reports fit into your claim.

What is an appraisal clause and how does it work in California policies?

Many California auto policies include an appraisal clause to resolve disputes about your car’s value. Typically, you and the insurer each select an appraiser; if the appraisers cannot agree, they submit the dispute to a neutral umpire who helps set the value. This process usually applies when you’re making a claim under your own policy. A detailed, USPAP-aware SnapClaim report can support you if you decide to invoke appraisal: see how our California appraisals are used.

Can I use SnapClaim if my accident happened in a different part of California?

Yes. SnapClaim works across all of California—from major metros like Los Angeles, San Diego, the Bay Area, and Sacramento to smaller cities and rural regions. We pull hyper-local comparable listings that match your specific market instead of generic national values. You can start from our California landing page: California diminished value & total loss hub or go straight to the total loss form: order a California total loss appraisal.

How fast can I get a California total loss appraisal from SnapClaim?

Most California total loss appraisals are completed the same business day after you upload your claim information and documents—often within about an hour. That speed helps you respond quickly when an adjuster is pressuring you to accept a low offer. Get started here: start your California total loss appraisal.

How does a SnapClaim report help California drivers negotiate a better payout?

SnapClaim builds a California-specific valuation file using verified comparables, condition adjustments, mileage, options, and local market corrections. The report clearly shows how your ACV should be calculated, making it easier to challenge any unfair insurer valuation. Many California clients recover thousands more after presenting a SnapClaim appraisal: see how our California appraisals work.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.