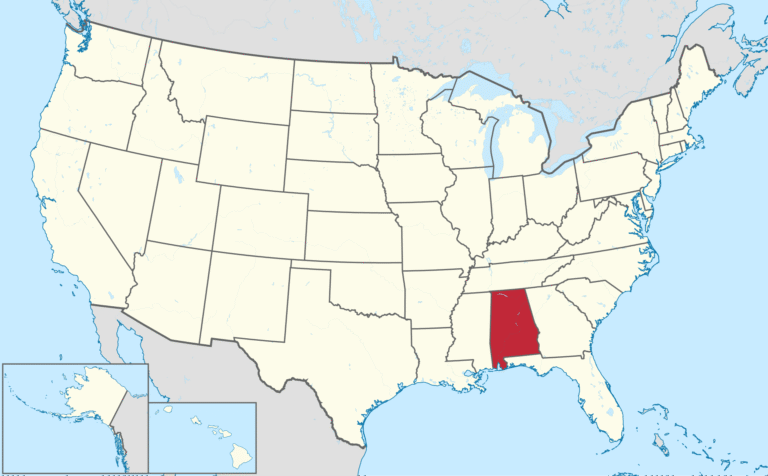

Diminished Value Appraisal in

Alabama

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified Alabama diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across Alabama.

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in Alabama: What You Need to Know

Alabama Diminished Value Appraisal — Get the True Value of Your Car After an Accident

Even after quality repairs, your vehicle can lose resale value once its accident history appears on Carfax or AutoCheck. If your accident happened anywhere in Alabama—including Birmingham, Montgomery, Mobile, Huntsville, and Tuscaloosa—an Alabama diminished value appraisal helps document that loss, often worth thousands depending on vehicle type and damage severity.

SnapClaim delivers data-driven, court-ready appraisal reports used by Alabama insurers, attorneys, and small-claims courts.

Why Diminished Value Matters in Alabama

Alabama law allows vehicle owners to pursue compensation for diminished value after an accident caused by another driver. Courts recognize that even properly repaired vehicles lose market value due to accident history. An accurate appraisal report strengthens your claim and provides the evidence insurers need to process fair settlements.

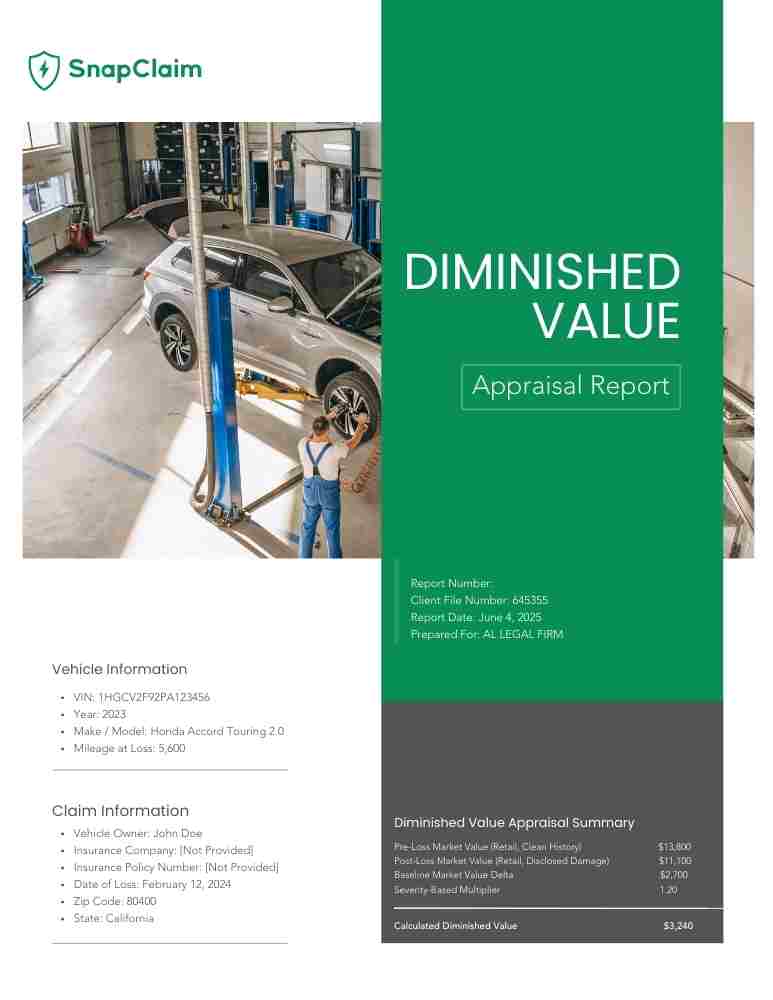

What Your Alabama Diminished Value Appraisal Report Includes

- Vehicle details (year, make, model, trim, mileage, options)

- Comparable listings pulled statewide (Birmingham, Montgomery, Mobile, and surrounding ZIP codes)

- Pre- and post-accident market value estimates using verified market data

- DV calculation incorporating repair severity and dealer feedback

- Transparent methodology aligned with appraisal best practices (USPAP-aware)

- Optional expert-witness support for court or arbitration

Most reports are completed and delivered in about 1 hour, ready for insurance submission.

Alabama Areas We Serve

We provide DV and Total Loss appraisals statewide across Alabama, including:

- Birmingham

- Montgomery

- Mobile

- Huntsville

- Tuscaloosa

- Hoover

- Dothan

- Auburn

- Decatur

- Madison

- Florence

- Phenix City

- Prattville

- Gadsden

How to File a Diminished Value Claim in Alabama

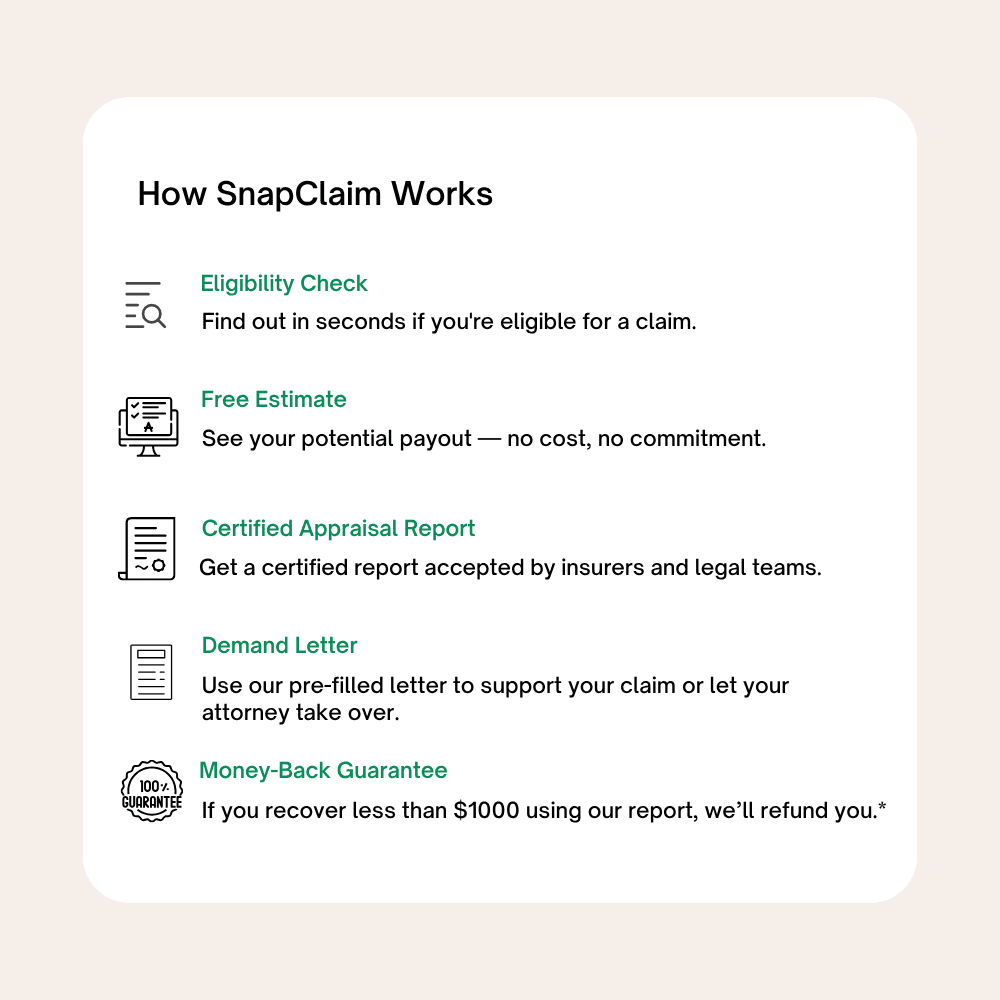

- Order your appraisal to document the loss with clear market evidence.

- Submit a DV demand letter to the at-fault driver’s insurer.

- Negotiate or escalate — our reports are formatted for attorney and arbitration review.

- Recover compensation — many Alabama clients recover several thousand dollars depending on damage severity and vehicle type.

Alabama Insurance Practices to Know

Insurers such as State Farm, Allstate, GEICO, and Progressive often use simplified formulas that undervalue claims. SnapClaim counters with:

- Real-world listings from AutoTrader, CarGurus, and Cars.com filtered to Alabama markets

- Dealer quotes within ~50 miles of the owner’s ZIP

- Localized adjustments for mileage, color, options, and trim demand

Example Alabama Case Study

Vehicle: 2020 Honda Accord EX-L

Repair Cost: $6,800 (rear-end collision)

Initial Insurer Offer: $900 (formula-based)

SnapClaim DV Result: $4,400

Final Settlement: $4,000 after submitting our report and demand letter

Helpful Alabama Resources

- Alabama Department of Insurance — file an insurance complaint

- Alabama Attorney General — Consumer Protection

- Alabama Courts — Small Claims Self-Help

Ready to Get Your Alabama Diminished Value Appraisal?

Start now — fast turnaround, clear evidence, and strong market comparables tailored to Alabama.

- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Related Alabama Locations

Click a pin to open the city’s diminished value page.

Find your Alabama city or metro area below to see local examples and order your Diminished Value Appraisal report.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Alabama

If your vehicle was damaged in an Alabama car accident, it may lose resale value even after high-quality repairs. This is called diminished value. With an Arizona diminished value appraisal, you can document the loss and seek recovery from the at-fault driver’s insurer under Arizona law.

SnapClaim makes filing an Alabama diminished value claim fast and stress-free. We provide a free diminished value estimate, a certified Alabama diminished value appraisal report, and an insurer-ready demand letter you can submit immediately. No waiting. No confusion. Just accurate, court-ready documentation trusted by attorneys and insurance adjusters across Alabama.

"After another driver rear-ended my SUV in Birmingham, the repairs looked flawless — but every dealership I visited offered me thousands less because of the accident record. I ordered an Alabama diminished value appraisal from SnapClaim, and within a day, I received a professional report that clearly documented the loss. My attorney submitted it to the insurance company, and they increased their offer by nearly $3,800. The process was fast, transparent, and made it easy to get what my vehicle was really worth."

Mike R.

Birmingham Al

Frequently Asked Questions:

- Can I file a diminished value claim in Alabama?

Yes. If another driver caused the crash, Alabama law allows you to recover compensation for your vehicle’s loss in value after repairs. Even if your car looks perfect, buyers and dealers will typically pay less once its accident record appears on Carfax — a valid diminished value claim helps you recover that difference.

- What’s the purpose of getting a diminished value appraisal in Alabama?

A professional Alabama diminished value appraisal documents exactly how much market value your car lost after an accident. Insurers often rely on outdated or generic formulas; an independent report from SnapClaim provides real market comparables and strengthens your negotiation or legal case.

- How much does an Alabama diminished value report cost?

A typical Alabama diminished value appraisal is about $350. You can request a free estimate online and review sample reports before ordering. For complete details, visit our SnapClaim Pricing page.

- Do insurance companies accept SnapClaim appraisals in Alabama?

They do. SnapClaim’s Alabama reports use verified listings, dealer input, and USPAP-aligned methodology — the same standards trusted by State Farm, GEICO, Allstate, Progressive, and other major insurers.

- How long does it take to receive my appraisal report?

Most SnapClaim appraisals are finished within about one hour once you upload your repair documents and photos. You’ll receive a polished, court-ready report by email, ready to send to your insurer or attorney the same day.

- Can I still claim diminished value if I was the one at fault?

Unfortunately, no. Alabama law only allows diminished value recovery when another party is responsible for the accident. Your own insurer typically won’t compensate for that loss unless you have optional coverage that specifically includes diminished value.

- What documents will help my Alabama diminished value claim?

Gather your repair estimate or final invoice, photos of the damage and repairs, and a copy of the police or accident report. These materials ensure your SnapClaim appraisal accurately reflects the real market impact of the crash.

- How long do I have to pursue a diminished value claim in Alabama?

You typically have up to two years from the date of the accident to file a property damage claim in Alabama, including diminished value. However, starting early gives you stronger leverage with insurers and ensures evidence like repair records and photos are still available.

- Where can I get a certified Alabama diminished value appraisal?

Order online through SnapClaim’s free estimate tool. Select your Alabama city — for example, Birmingham, Montgomery, or Mobile — and get your appraisal within hours.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.