Wondering how much value your car lost after an accident, even with perfect repairs? A diminished car value calculator provides a quick estimate of that loss, which is a real and permanent hit to your car’s resale price. Understanding this number is the critical first step in recovering the money you’re rightfully owed from the at-fault party’s insurance.

What Is Diminished Value and Why It Matters

After a collision, the insurance company pays to fix the visible damage, but they can’t erase the accident from your vehicle’s history report. When you eventually sell or trade in the car, that accident record will make buyers wary and often forces you to accept a lower offer.

That financial gap—the difference between your car’s market value before the crash and its new, lower value with an accident history—is its diminished value. It’s a real loss you’re left with, not the insurer. The good news is that in most states, you have the right to file a diminished value claim against the at-fault driver’s policy to recover that loss.

The Role of a Diminished Car Value Calculator

So, where do you begin? A diminished car value calculator is your initial fact-finding tool. It offers a quick, no-cost estimate of your potential loss, helping you decide if filing a claim is worth your time.

This initial estimate is a game-changer for several reasons:

- It provides a baseline. You get an immediate, objective figure to understand the financial impact of the accident.

- It empowers your next move. A significant estimated loss confirms that pursuing a formal claim with a certified appraisal makes sense.

- It sets realistic expectations. The calculation gives you a concrete number to begin the conversation about your car value after accident.

Understanding How Damage Impacts Value

At its core, diminished value is tied directly to the physical damage your vehicle sustained. The severity and type of damage are major factors in any calculation. This isn’t just about major collisions; even seemingly minor issues, like the common types of windshield damage, contribute to a negative history report and can reduce its value.

This is why documenting everything is so important—it helps establish the true scope of your loss. To get the full picture, check out our complete guide on what a diminished value claim is and how the entire process works.

How a Diminished Car Value Calculator Works

A diminished car value calculator doesn’t just guess. It uses a specific, methodical process to estimate the hit your car’s value has taken since the accident.

You start by plugging in the basics: your car’s make, model, year, mileage, and its general condition before the crash. Then, you’ll add details about the damage. Was it a minor fender-bender, or was there serious frame damage? Every detail you provide helps sharpen the final number.

The Formula Behind the Estimate

Most free online calculators use a version of a long-standing industry formula to crunch the numbers. A common starting point is a method known as “Rule 17c,” which originated in a Georgia court case. While it’s not a universal standard, its logic is often used for these initial estimates.

Here’s a simplified breakdown of how it typically works:

- Find the Starting Value: The calculator pulls the fair market value of your vehicle just before the accident. This “before” picture often uses a benchmark like Kelley Blue Book or NADA Guides.

- Apply a Value Cap: It then takes a percentage of that value—often 10%—to set the maximum possible diminished value.

- Adjust for Damage Severity: Next, a multiplier is applied based on how bad the damage was. Minor cosmetic issues might get a low multiplier (e.g., 0.25), while major structural damage could get a 1.00.

- Factor in Mileage: Finally, another multiplier adjusts the figure for your car’s mileage. Lower-mileage vehicles tend to lose a larger percentage of their value after an accident.

Getting a handle on your diminished value is much easier when you know how insurance companies calculate settlements, as their methods are what you’ll be up against.

From Calculation to Clarity

Once all those inputs are processed, the calculator generates an estimated diminished value figure. This number represents the immediate drop in your car’s resale value due to its new accident history. For instance, a $30,000 car with moderate damage and low mileage could easily see an estimated loss of several thousand dollars.

It’s crucial to remember this is an estimate—it’s not a certified appraisal that will hold up in a serious negotiation. However, this initial figure is incredibly powerful. It gives you a sense of what’s at stake and helps you decide if it’s worth pursuing a formal claim with confidence.

Free Calculators Versus Certified Appraisals

An instant online estimate and a certified appraisal report serve two very different purposes. A free diminished car value calculator is an excellent first step, giving you a quick snapshot of your potential loss. Think of it as a compass pointing you in the right direction.

But when it’s time to file a claim, insurance companies demand verifiable proof, not just a preliminary number. This is where a certified appraisal provides the hard evidence you need to strengthen your case.

When To Use A Free Calculator

A free online calculator is the perfect tool for that initial “what if” phase right after an accident. It’s designed to give you a fast, no-cost baseline so you can figure out if pursuing a diminished value claim is worth your time.

Use a free calculator when you want to:

- Get an immediate estimate: Understand the potential loss within minutes.

- Decide your next steps: Use the number to determine if the potential recovery justifies filing a formal claim.

- Gather initial information: Equip yourself with a data-backed starting point before diving deeper.

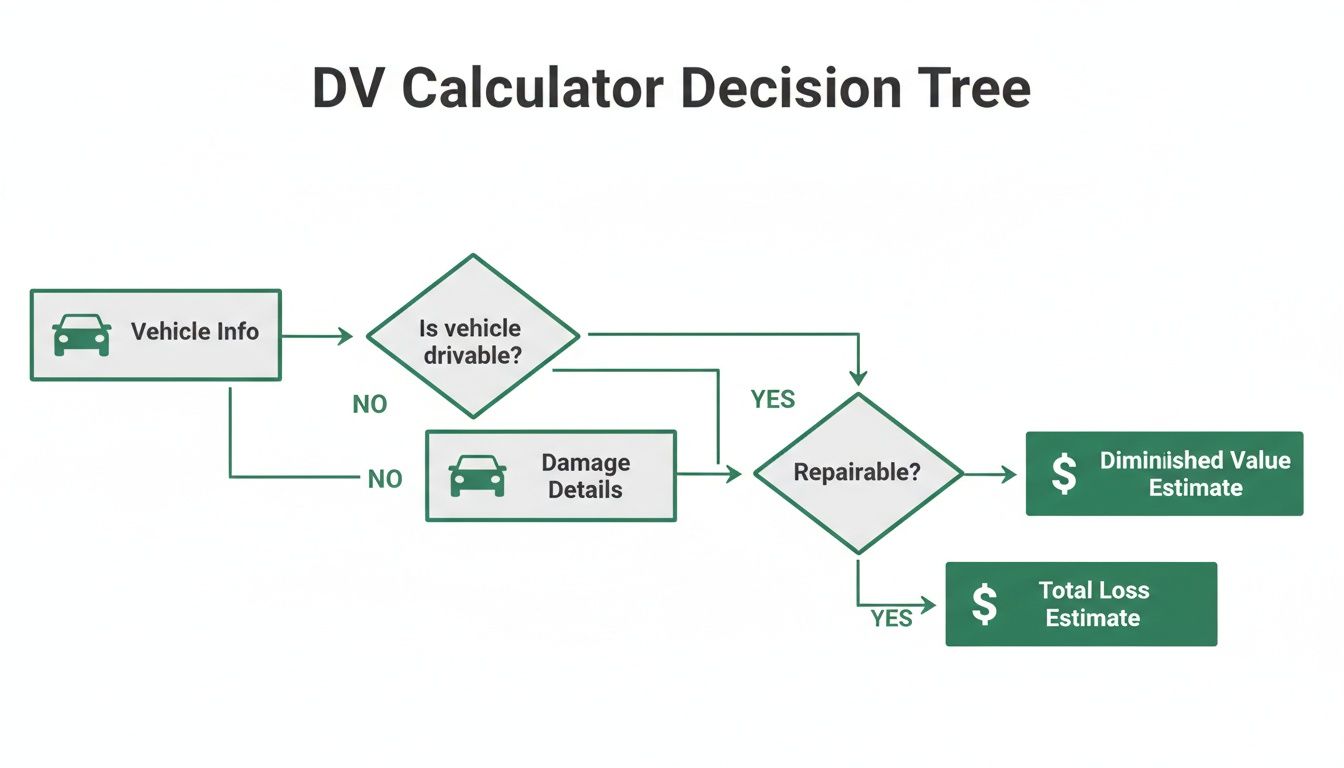

The flowchart below shows the simple steps a calculator takes to generate your initial estimate.

This process quickly turns your vehicle’s info and damage specifics into a clear, actionable estimate of your loss.

When You Need A Certified Appraisal

While a calculator is great for getting started, it won’t hold up under the scrutiny of an insurance adjuster. Adjusters are trained to challenge and dismiss claims that lack professional, verifiable documentation. A certified appraisal report is the official proof you need to be taken seriously.

A certified appraisal, like those from SnapClaim, is a comprehensive valuation built on detailed market analysis and expert review. It goes far beyond a simple formula by analyzing real-time sales data for comparable vehicles—with and without accident histories. That level of detail makes it a defensible document that can stand up to adjuster pushback.

A certified appraisal isn’t just an opinion; it’s a meticulously researched document that provides the evidence an insurance company requires to justify a diminished value payout. It transforms your request from a simple inquiry into a formal, documented demand.

A SnapClaim report provides:

- Verifiable market data from multiple industry sources.

- Expert analysis consistent with court-accepted valuation standards.

- A professional, defensible document to submit with your claim.

Here’s a simple way to think about it: the free calculator tells you that you have a case, but the certified appraisal is what helps you prove it. Understanding how to get a diminished value appraisal is the critical next step in securing the compensation you deserve.

Free Online Calculator vs SnapClaim Certified Report

A side-by-side comparison to help you choose the right tool for your situation.

| Feature | Free Online Calculator | SnapClaim Certified Report |

|---|---|---|

| Primary Use Case | Initial estimate to see if a claim is worthwhile | Official evidence for an insurance claim or legal case |

| Cost | Free | Paid professional service |

| Credibility with Insurers | Low; often dismissed as an unverified estimate | High; accepted as a court-ready, defensible document |

| Data Sources | General algorithms, publicly available data | Multiple dealer-only sources, market analysis, expert review |

| Supporting Documentation | None; provides a single number | Full report with methodology and comparable vehicle data |

| Best For | Getting a quick baseline understanding of your potential loss | Proving your loss and negotiating a fair settlement |

Ultimately, that professional report gives your claim the credibility it needs to be taken seriously, providing the leverage required to negotiate a fair settlement with the insurance company.

Common Mistakes to Avoid in Your Claim

Navigating a diminished value claim can be tricky. One wrong step could mean leaving thousands of dollars on the table. Knowing what not to do is just as important as knowing what to do.

One of the biggest blunders is accepting the insurance adjuster’s first offer. Insurers are businesses, and their initial settlement is almost always a lowball figure designed to close your claim quickly and cheaply. Accepting it without negotiating means you are likely leaving money behind.

Another common pitfall is assuming a perfect repair job erases the problem. Your car might look and drive like new, but its vehicle history report now has a permanent black mark. When you sell, services like CarFax will broadcast that accident history to every potential buyer, who will then demand a discount. That discount is your diminished value.

Relying on the Wrong Proof

Many people mistakenly believe a generic online formula is all they need. While a diminished car value calculator is a fantastic starting point, adjusters are trained to dismiss claims based on those numbers alone. They require documented, market-based proof of your loss.

This is why an independent, certified appraisal is a game-changer. It elevates your claim from a simple request to a formal, evidence-backed demand they cannot easily ignore.

Your consumer rights are protected by state and national regulations. Knowing these rights empowers you to push back against unfair settlement offers and fight for what you’re owed.

A great resource for understanding these protections is the National Association of Insurance Commissioners (NAIC).

The NAIC consumer page offers tools and guides to help you understand your rights. It also provides direct access to your state’s insurance department, so you can learn the exact rules that apply to your claim and even file a complaint if an insurer acts in bad faith.

Other Costly Errors to Sidestep

To build the strongest case possible, be mindful of these other common errors:

- Waiting Too Long: Every state has a statute of limitations for filing property damage claims. If you delay, you could lose your right to compensation.

- Signing a Release Too Soon: Never sign a final release of liability until you are 100% satisfied with the entire settlement, including your diminished value payment. Once signed, the case is closed for good.

- Lacking Proper Documentation: Keep detailed records of everything: repair estimates, final invoices, photos of the damage, and all correspondence with the insurer. A solid paper trail is your best friend in a dispute.

By avoiding these mistakes, you can negotiate from a position of strength, fully backed by hard evidence and a clear understanding of your rights.

Putting Your Diminished Value Report to Work

A diminished car value calculator gives you a starting point. A certified appraisal report from SnapClaim is the tool that helps you get paid. Once you have this powerful document, it’s time to take action and formally pursue the compensation you’re owed.

Your next step is preparing a formal demand letter. This isn’t an emotional plea—it’s a professional, fact-based document that clearly outlines your financial loss. You’ll send this letter, along with your complete SnapClaim appraisal report, to the at-fault driver’s insurance company.

Crafting a Winning Demand Letter

Your demand letter should be clear, concise, and focused on the facts. It is your official opening statement in the negotiation with the insurance adjuster.

Here’s what your demand package should include:

- A clear statement of your claim: State that you are filing a third-party diminished value claim for the loss in your vehicle’s fair market value.

- The specific amount you are claiming: This number should come directly from your certified appraisal report.

- Your SnapClaim report as evidence: Attach the full report as the centerpiece and proof of your claim.

- Supporting documents: Include copies of the final repair invoice and the police report to provide a complete picture.

This organized approach immediately tells the adjuster you’re serious and well-prepared.

By presenting a data-backed claim, you shift the conversation from opinion to evidence. The burden is now on the insurer to refute the detailed market analysis in your certified report, which is much harder than dismissing a number from a free online calculator.

Navigating the Negotiation Process

After submitting your demand, the insurance adjuster will review it. Expect some pushback—it’s part of their job. They might return with a low offer or question the methodology.

This is where your SnapClaim report really shines. It’s filled with the specific, defensible data you need to counter their arguments. For example, if they challenge the amount, you can point directly to the comparable vehicle sales data in the report. Understanding how to read an appraisal report will give you even more confidence.

Stay firm but polite, and always bring the conversation back to the evidence. Remind them that your claim is based on a certified, independent valuation, not a random estimate.

Frequently Asked Questions (FAQ)

Can I claim diminished value if the accident wasn’t my fault?

Yes, absolutely. Diminished value claims are typically filed against the at-fault driver’s insurance policy, known as a third-party claim. If another driver was responsible for the accident, you have the right in most states to seek compensation for your vehicle’s loss in market value. Our state-specific law pages can provide more details on your local regulations.

When is the best time to file a diminished value claim?

The best time to file your formal diminished value claim is immediately after your vehicle’s repairs have been completed. While you can use a diminished car value calculator anytime to get an initial estimate, submitting your certified appraisal report after repairs are finished ensures the assessment reflects the car’s final, post-repair condition. This strengthens your claim and makes it harder for an insurer to dispute.

Is a free calculator enough to get a fair settlement?

A free calculator is a great starting point to see if a claim is worth pursuing, but it is rarely enough to secure a fair settlement. Insurance adjusters require documented proof of loss, not just an online estimate. A certified appraisal report from SnapClaim provides the data-backed evidence and expert analysis needed to strengthen your claim and negotiate effectively for the compensation you deserve.

What if the insurer denies my diminished value claim?

Don’t panic—initial denials are common. First, ask the adjuster for the specific reason for the denial in writing. Then, you can counter their position with a certified appraisal report from SnapClaim, which is designed to stand up to insurer scrutiny. Our reports provide the verifiable evidence needed to challenge an unfair denial. Plus, our Money-Back Guarantee makes it risk-free: “If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.”

Get the Proof You Need to Negotiate a Fair Payout

Using a diminished car value calculator is the perfect first step to understanding your financial loss after an accident. It empowers you with a data-driven estimate, clarifying whether pursuing a formal claim is the right move for you. When you’re ready to demand fair compensation for your car’s lost value, a certified appraisal report from SnapClaim provides the professional, evidence-backed proof you need to negotiate confidently.

Don’t let the insurance company undervalue your loss. Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your diminished value appraisal today