Trying to find a Mitchell total loss phone number after your insurer hands you a low settlement offer? Here’s a critical piece of information many vehicle owners miss: your direct line of communication isn’t with Mitchell International. Your negotiation is with your own insurance company’s claims adjuster.

Mitchell is the company that creates the valuation software, but your insurer manages the claim, makes the final payout decision, and negotiates the settlement. They simply use Mitchell’s report as a tool to justify their offer. This guide explains who to contact and how to prepare for a fair negotiation.

Your Guide To Total Loss Claim Contacts

When your vehicle is declared a total loss, it’s easy to get confused about who to call. Although Mitchell provides the valuation report, think of them as a third-party data provider. Any questions, disputes, or arguments about your vehicle’s value must go through your insurance adjuster. They are the decision-maker in your claim.

To clear things up, here’s a quick-reference table outlining who does what. Understanding these roles helps you put your energy where it will make a difference—with your insurer.

Your Total Loss Claim Contacts At A Glance

This table breaks down the key contacts for your total loss valuation questions and disputes.

| Contact Point | Contact Detail | Primary Purpose |

|---|---|---|

| Your Insurance Adjuster | Found in your claim documents or insurer's app. | Your primary contact for all questions, disputes, and negotiations regarding your total loss settlement offer. |

| Mitchell International | N/A (Contact is through your insurer). | Provides the valuation software and market data used by your insurance company. They do not handle individual claims. |

| SnapClaim Appraisal | Available through our appraisal service page. | An independent, certified appraiser who provides a data-backed report proving your vehicle's true fair market value. |

Knowing who to contact saves time and frustration. Focus on building your case with your adjuster, and if you hit a wall, remember that an independent appraisal is your most powerful tool for proving your vehicle’s actual worth.

What Is Mitchell and Why Does It Matter for Your Claim?

When your insurance adjuster says they used “Mitchell,” they’re referring to Mitchell International, a major company providing software that insurance carriers use to value vehicles declared a total loss.

It’s a common point of confusion, so let’s be clear: Mitchell doesn’t decide your final payout. Your insurance company does. Mitchell’s system simply generates a detailed valuation report that your adjuster uses to calculate their settlement offer.

This report is designed to pinpoint your car’s Actual Cash Value (ACV)—its fair market worth right before the accident. Here’s how it generally works:

- The software scans the local market for similar vehicles for sale, often called “comparables” or “comps.”

- It then applies adjustments (positive or negative) based on your car’s specific mileage, condition, and optional features.

Understanding this process is key to protecting yourself. Insurers often treat these automated reports as final, but they can—and often do—contain errors that lead to a lowball offer. By learning how to read a similar report, like the one we break down in our guide to the CCC One Market Valuation Report, you can spot inaccuracies and fight for the fair settlement you deserve.

How to Prepare for a Call About Your Total Loss Value

Going into a conversation with your insurance adjuster prepared is non-negotiable. When you’re organized and informed, you shift from being a passive recipient of their offer to an active participant in your claim. Before you pick up the phone, get a firm grasp of what actual cash value (ACV) really means—it’s the entire basis for their settlement number.

Showing up with the right documents and smart questions signals to the adjuster that you’re serious. This prep work is your best tool, especially since you can’t just call a Mitchell total loss phone number to argue with the report directly.

Your Pre-Call Checklist

Get these items together before you dial the adjuster:

- Your Claim Number: Have it handy so they can pull up your file instantly.

- The Mitchell Valuation Report: You have a right to the full report, not just the summary. Review every line item.

- Your Vehicle’s VIN: For accurate identification and cross-referencing.

- Photos and Records: Gather pictures showing your car’s excellent pre-accident condition, plus receipts for recent maintenance or upgrades.

With these documents, you’re ready to ask pointed questions about unfair deductions, incorrect condition ratings, or “comparable” vehicles that aren’t truly comparable.

What to Do When You Disagree With the Valuation

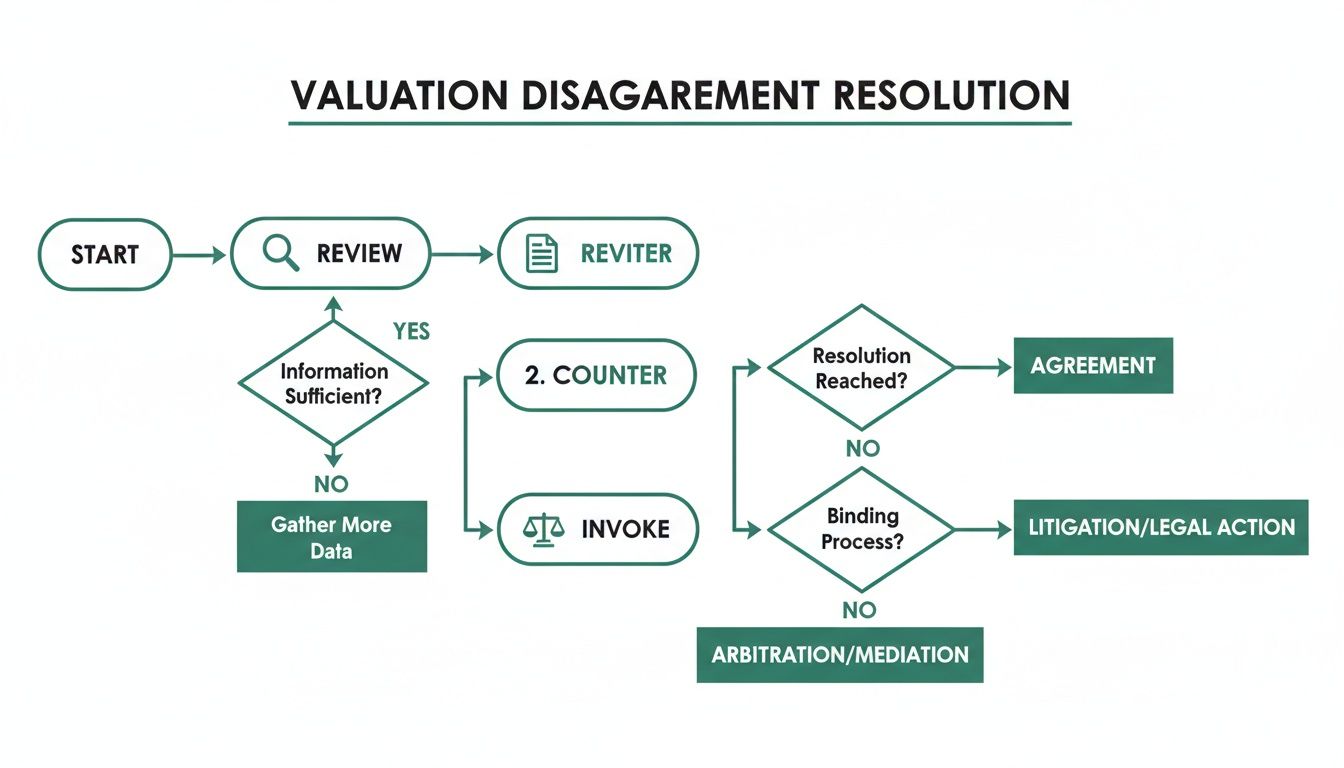

Receiving a lowball total loss offer can feel final, but it’s not. You have the right to challenge their number. The key is to counter with credible, data-driven evidence, not just your opinion.

Simply telling an adjuster your car was worth more won’t move the needle. You need to come prepared with proof that their valuation is flawed. Your most effective tool is an independent, third-party appraisal. While the insurer’s report is generated by an automated system, a certified appraisal is a detailed, human-reviewed analysis of your vehicle’s specific condition and local market value.

Your Right to an Independent Review

Presenting a report from a trusted source like SnapClaim levels the playing field. This counter-evidence formally signals that you are disputing the insurance total loss payout and opens the door for a real negotiation. In many cases, this is all it takes to secure a revised, higher offer.

If the insurer still refuses to negotiate, your policy almost certainly contains an “Appraisal Clause.” Invoking this clause is a formal step that can compel your insurer to consider evidence from a competent, independent appraiser. You can learn more in our complete guide to disputing a total loss offer.

Using An Independent Appraisal to Get a Fair Settlement

When an insurer’s valuation is too low, the most effective way to secure a fair settlement is with hard evidence. While there’s no Mitchell total loss phone number to call, you can challenge your insurer’s offer with a certified, independent appraisal. This immediately shifts the conversation from a subjective disagreement to a fact-based negotiation.

A professional appraisal from SnapClaim provides the court-ready, data-driven report you need to prove your vehicle’s true actual cash value. Our expert-reviewed process analyzes your local market, meticulously documents your vehicle’s condition, and accounts for unique features to build a solid, defensible valuation. This is what empowers you to negotiate confidently and secure a higher insurance total loss payout.

This flowchart breaks down the typical steps for resolving a valuation disagreement, from reviewing the initial offer to invoking your policy’s appraisal clause if negotiations stall.

The key takeaway is that you are not stuck. There is a structured path forward. In complex cases, you might also consider specialized legal consultant firms for expert guidance. To see how our reports are built, check out our guide on the total loss appraisal process.

Best of all, our service is risk-free. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed. This is our Money-Back Guarantee.

Total Loss Claims: Your Questions Answered

Dealing with a total loss can feel overwhelming. Here are straightforward answers to common questions from vehicle owners navigating valuations from systems like Mitchell.

Can I call Mitchell directly to change my vehicle’s value?

No. While it seems logical to search for a Mitchell total loss phone number to argue a lowball offer, Mitchell only provides the software. Your insurance company is the one using it. Your claim, evidence, and negotiation are all with your insurance adjuster, who holds the final authority on your insurance total loss payout.

What if the adjuster rejects my independent appraisal?

This is where your insurance policy’s “Appraisal Clause” is useful. Most standard auto policies include this clause, which is a formal process for resolving valuation disagreements. When you invoke it, your insurer is obligated to consider a report from a competent, independent appraiser, significantly strengthening your position.

How can I speed up my total loss dispute?

The fastest way to resolve a dispute is to present undeniable proof from the start. A certified appraisal report gives your adjuster everything needed to justify a higher, more accurate settlement. It turns a frustrating argument into a simple review, often leading to a much faster and fairer outcome for your car value after accident.

What are the most common errors in a Mitchell report?

Automated reports are a good starting point but often contain errors. The most common mistakes we see are:

– Bad “Comps”: Using “comparable” vehicles from distant markets that don’t match local pricing.

– Wrong Condition Rating: Marking a car as “average” when it was clearly “excellent” or “very good.”

– Missing Features: Overlooking valuable add-ons, trim packages, or recent upgrades like new tires.

– Unfair Adjustments: Applying vague deductions that drag the value down without clear justification.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.