After an accident, your insurance adjuster might mention using a 17c diminished value calculator to determine your car’s loss in value. It’s important to understand that this is an internal tool designed to minimize the insurance company’s payout, not to accurately reflect your vehicle’s true market loss.

Think of their calculation as the opening offer in a negotiation. Understanding how the 17c formula works is the first step toward challenging a lowball settlement and fighting for the compensation you deserve.

What Is the 17c Formula?

The “17c formula” is a calculation method used by many insurance companies to estimate a vehicle’s diminished value after an accident. It originated from a Georgia court case, Mabry v. State Farm, and has since been widely adopted by insurers for its simplicity and consistency.

However, the formula is not based on real-world market data. Instead, it’s a standardized shortcut that often produces a significantly lower diminished value figure than what an independent appraisal would find. Its primary purpose is to create a predictable, low payout for the insurer, not to make you whole.

The Problem with a Standardized Formula

The biggest flaw in the 17c method is its starting point: it automatically caps the maximum possible loss at just 10% of your car’s pre-accident value. Before any other factors are even considered, the formula has already put a low ceiling on your potential recovery.

An extensive analysis found this method consistently produces the lowest payouts among common formulas, often falling 15-25% below the actual loss determined by independent appraisers.

The core issue is simple: A rigid formula can’t capture the nuances of the open market. It ignores the real-world impact of a negative CarFax report, the stigma of structural damage, and what buyers in your area are actually willing to pay for a vehicle with an accident history.

A Quick Example of the 17c Calculation

Let’s walk through a common scenario to see how an adjuster uses the 17c formula to arrive at a low settlement offer.

- Vehicle Pre-Accident Value: $30,000 (based on a source like Kelley Blue Book).

- Step 1: Apply 10% Cap: $30,000 x 10% = $3,000. This is the absolute most the insurer will consider, regardless of the severity of the damage.

- Step 2: Apply Damage Multiplier: For “moderate” damage, they might apply a multiplier of 0.50, instantly cutting the potential payout in half to $1,500.

- Step 3: Apply Mileage Multiplier: If your car has 50,000 miles, they could apply another multiplier (e.g., 0.60), dropping the offer again to just $900.

The final $900 becomes the insurer’s initial offer. This example shows how arbitrary multipliers quickly diminish the real loss, creating a number that benefits the insurance company. To see what a more realistic figure looks like, you can learn how to calculate diminished value with our comprehensive guide.

How the 17c Diminished Value Calculator Works

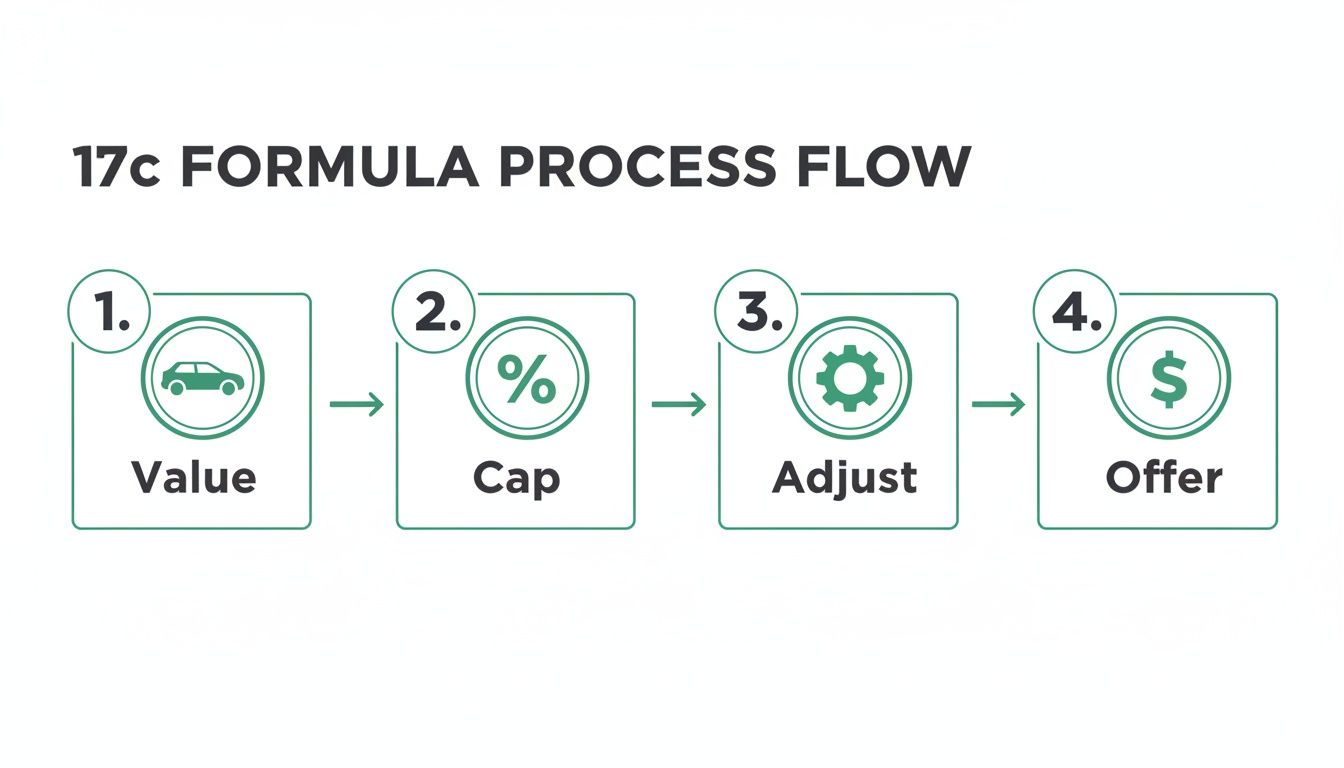

Using an online 17c diminished value calculator can be a good way to preview the insurer’s likely offer, but it’s crucial to understand the flawed logic behind it. The calculation starts with your vehicle’s pre-accident value and then applies a series of modifiers to systematically reduce the final number.

First, you need a reliable starting point for your vehicle’s pre-accident value. Sources like Kelley Blue Book or NADAguides are excellent resources. While the adjuster will use their preferred source, having your own data gives you a solid foundation for negotiation.

Once the pre-accident value is established, the formula applies multipliers for damage severity and mileage to arrive at its final, often disappointingly low, figure.

Breaking Down the Key Inputs

The 17c calculator uses three main levers to drive down your payout. Understanding these components reveals why the insurer’s offer is rarely fair.

- The 10% Cap: This is the formula’s most significant flaw. It arbitrarily limits the maximum diminished value to 10% of the car’s pre-accident worth, no matter how severe the damage.

- Damage Severity Multiplier: The calculator applies a multiplier based on the extent of repairs. Severe structural damage receives the highest multiplier (1.0), while minor cosmetic issues get a much lower one (e.g., 0.25), drastically cutting the payout.

- Mileage Adjustment: The formula penalizes vehicles with higher mileage. A car with 80,000 miles will see its diminished value reduced far more than a similar vehicle with only 20,000 miles.

This infographic illustrates how the 17c formula chips away at your vehicle’s value.

As you can see, the entire process is engineered to systematically reduce the initial value, resulting in a much smaller payout for you.

Understanding the 17c Formula Modifiers

Insurers use a standard set of multipliers to adjust the claim based on damage and mileage. While exact figures vary, they generally follow this structure.

| Modifier Type | Description | Example Multiplier (Varies by Insurer) |

|---|---|---|

| Damage Severity | Adjusts the payout based on the extent of repairs. Structural damage gets the highest multiplier, while cosmetic issues get the lowest. | • 1.00: Severe Structural Damage • 0.75: Major Panel Damage • 0.50: Moderate Panel Damage • 0.25: Minor Damage |

| Mileage | Reduces the final amount based on how many miles are on the vehicle. The higher the mileage, the larger the reduction. | • 1.00: 0–19,999 miles • 0.80: 20,000–39,999 miles • 0.60: 40,000–59,999 miles • 0.40: 60,000–79,999 miles |

By understanding these steps, the process becomes less of a mystery. An online 17c diminished value calculator can help you anticipate the insurance company’s opening offer, but remember: their number is just a starting point, not the final word on your car’s value after an accident.

Uncovering the Flaws in the 17c Formula

Now that you see how a 17c diminished value calculator works, let’s expose its greatest weakness: it’s an artificial formula completely disconnected from the real-world car market.

Insurance companies favor it because it’s a convenient shortcut that produces consistently low numbers. However, it fails to account for the factors that truly impact a vehicle’s resale value after a collision.

Think about what a savvy car buyer does first—they check the vehicle history report. An accident record is an immediate red flag that drives down what a buyer is willing to pay. The 17c formula completely ignores this reality.

The Real World vs. The Formula

The gap between a 17c calculation and your car’s actual loss in value can be massive. The formula has no way to factor in the powerful market forces that dictate what a car is truly worth.

It systematically ignores key details that matter to buyers:

- Accident History Stigma: Most buyers will choose a car with a clean record over an identical one that’s been in a wreck, even with flawless repairs. This stigma directly reduces market value.

- Specific Damage Types: There’s a huge difference in perceived value between a minor fender bender and a crash that involved frame damage or airbag deployment. The formula’s generic multipliers don’t account for this.

- Local Market Demand: The desirability of your specific make and model in your geographic area plays a huge role in its value. A one-size-fits-all formula can’t measure local market conditions.

Research from industry bodies like the National Association of Insurance Commissioners highlights that post-accident vehicles can lose 10-25% of their market value. For a $25,000 car, the 17c formula might suggest a loss of only $375, while real-world data could show a true value drop closer to $3,750.

A rigid, insurer-friendly formula can never capture what a real buyer would pay for a car with an accident history. It’s designed for consistency, not accuracy, which is why you need real market data to prove your claim.

Building Your Case Beyond the Calculator

So, how do you fight a lowball offer from a 17c diminished value calculator? You don’t argue with their flawed formula. Instead, you counter it with undeniable, market-based evidence that proves your vehicle’s actual loss in value. This is how you shift from reacting to their number to proactively building a powerful diminished value claim.

The foundation of a strong claim is a professional, data-driven appraisal report. A SnapClaim certified report replaces the insurer’s self-serving formula with cold, hard facts based on real-world data, providing the proof you need to negotiate fairly.

This professional analysis gives you the leverage to negotiate for the compensation you rightfully deserve.

What a Professional Appraisal Provides

A comprehensive appraisal report is much more than just a number; it’s a detailed evidence package documenting your car’s loss in value on the open market.

A credible appraisal from SnapClaim always includes:

- Comparable Vehicle Sales: An analysis of recent sales of similar vehicles in your area—some with clean histories and some with accident records—to establish a clear value gap.

- Dealership Insights: Direct quotes from local sales managers confirming how much less they would offer for your vehicle now compared to before the accident.

- Auction Data: Hard numbers from wholesale auctions showing the financial impact of accident histories on vehicle prices.

This market-driven evidence is what truly matters. It shifts the conversation away from the insurer’s abstract formula and grounds it in the reality of what real buyers are willing to pay.

Once you have this report, you present it to the insurer with a formal demand letter. You can reference a personal injury demand letter template to help structure your argument. This approach transforms your claim into a well-supported, data-backed case that strengthens your negotiating position.

How to Negotiate With Your Insurance Adjuster

With a certified appraisal in hand, you are no longer just a claimant—you are an informed party with documented proof.

Your first step is to send the insurance company a formal demand letter that includes your appraisal report. This presents a documented, evidence-based counteroffer that commands their attention.

When the adjuster responds, they will likely fall back on their 17c diminished value calculator. You might hear, “Our formula shows the diminished value is $850.” Your job is to remain calm and pivot the conversation back to your evidence.

Talking Points for Your Negotiation

Don’t waste time arguing the flaws in their formula. Your appraisal is based on objective market facts, making their calculation irrelevant.

Use clear, confident language to keep the focus on your report. Here are a few phrases that can help:

- “I understand your worksheet produced that number, but my certified appraisal is based on actual market data from our local area, which is what determines a vehicle’s true value.”

- “Could you please provide a written rebuttal explaining which specific comparable sales or dealership quotes in my report you believe are inaccurate?”

- “The 17c formula is an internal tool for your company. My claim is based on the real-world loss in value, which is fully documented in this appraisal.”

This approach puts the burden of proof back on the adjuster. By consistently referencing the verifiable data in your report, you make it very difficult for them to justify their lowball offer.

To make your claim process even smoother, SnapClaim offers a Money-Back Guarantee. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed. This ensures you can pursue fair compensation with confidence.

Frequently Asked Questions (FAQ)

Navigating a diminished value claim can be confusing. Here are answers to some of the most common questions we receive from vehicle owners.

Can I file a diminished value claim if I was at fault?

Generally, you can only file a diminished value claim against the at-fault driver’s insurance company. This is known as a third-party claim. Your own insurance policy (a first-party claim) typically does not cover diminished value if you caused the accident. Laws vary by state, so it’s always wise to check your local regulations.

Do I have to accept the 17c formula calculation?

Absolutely not. The 17c formula originated from a Georgia court case and is not a legally mandated calculation in any state. Insurers use it because it’s a convenient tool that saves them money. You have the right to challenge their offer with independent evidence of your vehicle’s actual loss in value.

What if the insurer rejects my professional appraisal?

This is a common tactic. If an adjuster dismisses your independent appraisal, remain professional and ask them for a specific, written explanation detailing why they are disputing your market data. A certified report from a provider like SnapClaim is built on verifiable evidence, which shifts the burden of proof to the insurer to disprove the facts.

Why shouldn’t I just use a free 17c calculator for my claim?

A free online 17c diminished value calculator is useful for one thing: getting a sneak peek at the lowball number the insurance adjuster will likely offer you. It uses the same flawed, insurer-friendly logic and holds no weight in a negotiation. To secure the compensation you’re actually owed, you need a credible, independent report that provides objective data to prove your car’s true loss in market value.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.