Has your car been in an accident? Even after perfect repairs make it look brand new, its accident history is now a permanent blemish on its record, dragging down its resale value. A what is diminished value claim is your legal path to recovering that financial loss from the at-fault driver’s insurance company. This isn’t just an idea—it’s a real, measurable loss, and you’re entitled to get that money back.

Your Car Is Repaired, but Its Value Is Still Damaged

After an accident, your top priority is getting your car fixed. The body shop does its magic—panels are replaced, the paint is perfectly matched, and it’s safe to drive again. But while the physical damage is gone, an invisible problem remains: a permanent stain on your vehicle’s history report from services like Carfax or AutoCheck.

This is what’s known as inherent diminished value. It’s the automatic drop in your car’s fair market value because of its newly acquired accident history.

Put yourself in a car buyer’s shoes. You find two identical used cars—same year, mileage, and features. The only difference? One has a major accident on its record. You would only consider buying the one with the accident history if it came with a steep discount. That price difference is the diminished value you’ve already lost.

Why Your Repaired Car Is Worth Less

An accident history creates doubt. Even with flawless repairs, a potential buyer will always wonder if there are hidden, long-term issues lurking beneath the surface. That stigma directly impacts your car’s market value. The entire point of a diminished value claim is to make the at-fault party’s insurance company pay for this very real loss they caused.

Of course, insurance adjusters often follow a script. They’ll argue that quality repairs made your car “whole” again, completely ignoring how the market actually works. You’ll likely hear things like:

- “The repairs restored your vehicle to its pre-accident condition.”

- “We only pay for the physical damage, not a potential loss in resale value.”

- “Diminished value isn’t covered under our policy.”

Don’t fall for it. These are common negotiation tactics, not legal facts. In most states, if you weren’t at fault, the other driver’s insurance is responsible for all the damages their insured caused, and that includes the hit to your car’s market value. To get what you’re owed, you need proof. A certified appraisal from SnapClaim provides the data-backed evidence needed to shut down the insurer’s weak arguments and strengthen your claim.

Understanding the Three Types of Diminished Value

When you file a diminished value claim, you’re not just asking for a lump sum for a generic “loss.” The concept is broken down into three distinct categories. Knowing the difference is key to building a strong case and clarifying exactly what you’re asking the insurance company to pay for.

While they all point to a drop in your car’s worth, only one is the real focus of nearly every successful claim. Getting the language right helps you negotiate from a much stronger position.

Inherent Diminished Value: The Focus of Most Claims

This is the big one. Inherent diminished value is the automatic, unavoidable loss in your car’s market value simply because it now has an accident on its record. Even if a top-tier body shop performs flawless repairs, the vehicle is permanently branded.

Think of it as a permanent “scar” on your vehicle’s history report. When a potential buyer runs a Carfax check, that accident will pop up, immediately making your car less desirable than an identical one with a clean record. This forces you to accept a lower price when you go to sell it, and that difference is the inherent diminished value.

Repair-Related Diminished Value

Next up is repair-related diminished value. This type of loss happens when the repairs themselves are shoddy, further dragging down your vehicle’s value beyond the accident stigma alone.

A few clear examples include:

- Mismatched paint colors that are easily noticeable.

- The shop used cheaper aftermarket parts instead of Original Equipment Manufacturer (OEM) parts.

- Body panels are poorly aligned, or the doors don’t close quite right.

- Lingering mechanical issues that weren’t there before the accident.

If your car is suffering from poor repair work, that’s a separate fight you have with the body shop. It’s usually handled through the shop’s warranty, not as the main part of your diminished value claim against the at-fault driver’s insurance.

Immediate Diminished Value

The third category, immediate diminished value, is the difference in your car’s worth right after the crash but before any repairs have been done. In practice, this is mostly a theoretical concept.

Immediate diminished value is rarely used in real-world claims because once the vehicle is repaired, its value is re-established. The actual, lasting financial damage is the inherent loss that remains post-repair, which is why appraisers and courts focus on that figure instead.

While industry pros recognize all three types, it’s the inherent diminished value that dominates insurance disputes. To learn more from an industry perspective, you can read about inherent diminished value claims from IRMI. A professional appraisal is specifically designed to calculate this inherent loss, giving you the hard evidence you need to prove your case.

How Diminished Value Is Calculated (The Right Way vs. The Insurer’s Way)

When it’s time to figure out what you’re owed, insurance companies and professional appraisers live in two completely different worlds. The insurer’s goal is simple: pay out as little as possible. To do this, they often use a flawed, self-serving formula designed to produce a low number.

On the other hand, a certified appraiser uses real-world market data to determine your actual financial loss. Understanding this difference is the key to getting fair compensation.

The Insurer’s Flawed Shortcut: The 17c Formula

Many insurance carriers lean on a controversial method known as the “17c formula.” This formula originated from a single court case and is widely criticized by auto appraisal experts because it’s built to produce the lowest possible payout, rarely matching what’s happening in the real-world market.

The 17c formula applies a series of arbitrary caps and modifiers that chip away at the final amount:

- Step 1: Caps the Maximum Value: It puts a ceiling on the diminished value at just 10% of your car’s pre-accident value, regardless of damage severity.

- Step 2: Applies a Damage Modifier: It multiplies that number based on damage severity, but the multipliers are often subjective and unfairly weighted to shrink the payout.

- Step 3: Applies a Mileage Modifier: Finally, it slashes the amount again based on mileage, which can reduce your claim to almost nothing on higher-mileage vehicles.

The biggest problem with Formula 17c is that it’s a cookie-cutter equation. It completely ignores your local used car market, your vehicle’s specific condition, its trim level, and its desirability to buyers—all factors that have a massive impact on the car value after an accident.

The Professional Approach: Market-Driven Analysis

A credible, independent appraisal throws flawed shortcuts like the 17c formula in the trash. Instead, a certified appraiser performs a comprehensive market analysis to find the true loss. This method gives you the hard proof you need to negotiate on a level playing field.

This professional approach is all about real-world data and looks at several key factors:

- Pre-Accident Fair Market Value: First, the appraiser determines your vehicle’s value right before the crash by looking at actual sales data for similar cars in your local market.

- Severity and Nature of Damage: The analysis gets specific. Was there structural or frame damage? Did the airbags deploy? These are huge red flags for buyers and dramatically increase the loss in value.

- Quality of Repairs: The appraisal considers how well the car was fixed. Were factory (OEM) parts used? Are there any small cosmetic issues still visible?

- Market Stigma: Most importantly, the appraiser analyzes how the accident history will deter potential buyers in your specific area. This “stigma” is where the real value is lost.

By comparing your repaired car to similar ones with clean histories, an appraiser can calculate your financial loss. While there is no single, official diminished value calculator that every state recognizes, a professional report provides the detailed analysis you need to prove your claim. A SnapClaim report, for example, gives you the verifiable evidence to push back against a lowball offer and demand the compensation you rightfully deserve.

Your Step-by-Step Guide to Filing a Diminished Value Claim

Knowing you’re owed money is one thing; actually getting it requires a clear, strategic plan. Filing a diminished value claim is about building a professional, well-documented case that an insurance adjuster simply can’t ignore. This roadmap will walk you through each step, taking the guesswork out of the process.

Step 1: Confirm Your Eligibility

Before you invest time and effort, make sure you can file a claim. The rules can vary by state, but a few key criteria usually need to be met.

Most successful diminished value claims are third-party claims, meaning you file against the at-fault driver’s insurance policy. Filing a first-party claim (against your own insurance) is almost always a non-starter, as most policies exclude it. You also generally need to be the legal owner of the vehicle.

Step 2: Gather All Essential Documents

Your claim is only as strong as your evidence. You need to build a case file with every piece of paper related to the accident and repairs.

Start compiling these key documents:

- The Police Report: Official proof establishing the other driver was at fault.

- Photos and Videos: Gather pictures from the accident scene and detailed photos of the completed repairs.

- Repair Invoices: The final, itemized bill from the body shop proves the extent of the damage.

- Proof of Pre-Accident Value: Maintenance records or listings for comparable vehicles help establish your car’s condition before the crash.

Your Diminished Value Claim Checklist

| Step | Action Item | Why It’s Important |

|---|---|---|

| 1. Eligibility | Confirm you were not at-fault and own the vehicle. | Establishes your legal right to file a third-party claim. |

| 2. Documentation | Collect the police report, photos, and repair invoices. | Creates an undeniable paper trail of the accident and damages. |

| 3. Appraisal | Obtain a certified, independent diminished value appraisal. | Provides objective, expert proof of your financial loss. |

| 4. Demand | Draft and send a formal demand letter with all documents. | Officially presents your case and the specific amount you are seeking. |

| 5. Negotiation | Follow up with the adjuster and use your appraisal as leverage. | Puts you in control of the conversation, ready to counter lowball offers. |

Step 3: Obtain a Certified Independent Appraisal

This is the most important step in the process. An adjuster’s opinion on your car’s lost value is not objective evidence. You need a professional, data-driven report from an independent appraiser to scientifically prove your financial loss.

A certified appraisal report is your expert witness. It uses verifiable market data, repair analysis, and industry-standard methods to systematically dismantle an insurer’s lowball offer and prove your vehicle’s true loss in value.

A report from a trusted provider like SnapClaim gives you the firepower you need to shut down weak arguments and negotiate from a place of authority.

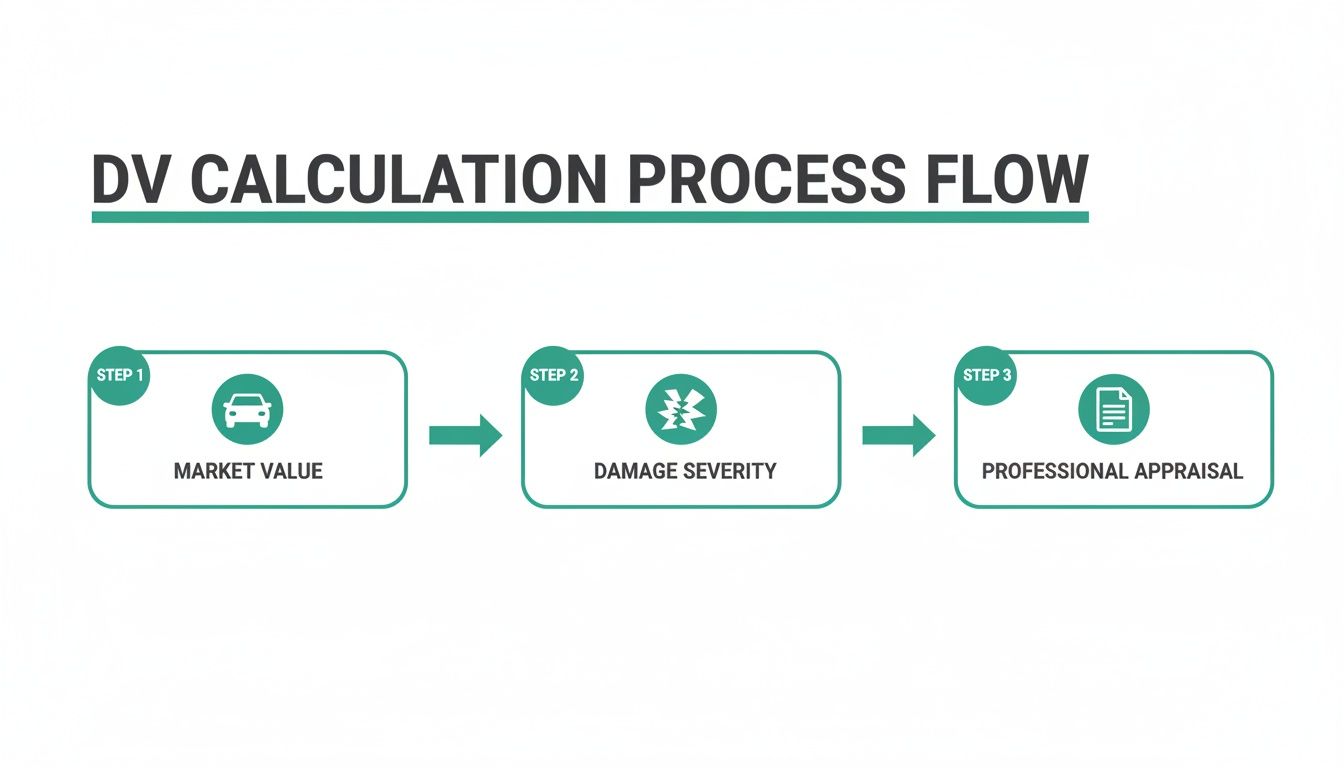

This is exactly how a professional appraisal determines your car’s diminished value.

As you can see, a proper calculation always starts with the vehicle’s pre-accident market value, factors in the severity of the damage, and finishes with a professional appraisal to certify the final loss amount.

Step 4: Submit a Formal Demand Letter

Once you have your appraisal and all your supporting documents, it’s time to officially present your claim. This is done by sending a formal demand letter to the at-fault driver’s insurance adjuster.

Keep your letter professional, clear, and to the point. It must include:

- Your contact information and the claim number.

- A clear statement that you are seeking compensation for your vehicle’s diminished value.

- A brief summary of the accident facts.

- The exact dollar amount you are demanding, as stated in your certified appraisal.

Attach a copy of your appraisal report, the police report, and the final repair bill. This complete package presents an undeniable case and kicks off the negotiation process with your appraisal as the foundation.

Navigating State Laws and Common Insurer Tactics

Knowing your rights is half the battle. The rules for diminished value claims can change dramatically from one state to the next, and insurance companies have a playbook of tactics designed to deny, delay, or underpay your claim. To get what you’re owed, you need to be ready for both the legal fine print and the adjuster’s predictable objections.

First-Party vs. Third-Party Claims: What You Need to Know

Who was at fault for the accident? This one question changes everything. It determines whether you’re filing a first-party claim with your own insurer or a third-party claim against the other driver’s policy.

First-Party Claim: This is a claim with your own insurance company. The bad news? In almost every state, standard auto policies explicitly exclude coverage for diminished value. Your policy is written to pay for repairs, not the hit your car’s market value takes.

Third-Party Claim: This is a claim against the at-fault driver’s insurance. This is where you have a real shot. The other driver’s liability coverage is responsible for making you “whole” again, which includes paying for the financial damage to your car’s resale value.

Takeaway: If the accident wasn’t your fault, you have a legal right in most states to pursue a diminished value claim from the responsible party’s insurer. Don’t let an adjuster convince you otherwise.

Recognizing and Countering Common Insurer Objections

Insurance adjusters are trained to minimize payouts. You’re almost guaranteed to hear one of these common objections. Here’s what to expect and how to shut it down.

1. “We Don’t Pay for Diminished Value.”

This is a common company policy, not a state law. Your response should be firm: “State law makes your insured liable for all property damages they caused, including my vehicle’s loss in market value.”

2. “The Repairs Restored Your Car to Pre-Accident Condition.”

This argument ignores reality. A car with an accident history is worth less than one without it. A professional appraisal provides hard data showing how buyers penalize vehicles with accident records.

3. “You Haven’t Sold the Car, So You Haven’t Lost Anything.”

This is a logical fallacy. The financial loss happens the moment the crash is recorded on your vehicle’s history, not when you sell it. Your car is an asset, and its value was permanently damaged.

4. “Our Formula Shows You’re Owed a Much Lower Amount.”

Adjusters often hide behind internal formulas like the flawed 17c formula. Challenge their math by presenting your own certified appraisal. Our guide on the diminished value 17c calculator can help you pick their argument apart.

A professional appraisal from SnapClaim is the most powerful tool you have to dismantle these objections. It replaces opinions and flawed formulas with objective proof, giving you the leverage to negotiate for the compensation you rightfully deserve.

How a Certified Appraisal Strengthens Your Claim

An insurance adjuster’s opinion is not objective evidence. Their job is to protect their company’s bottom line, meaning their initial offer will almost always be the lowest number they can justify. To successfully counter a lowball offer, you need undeniable, data-driven proof. This is where a certified, independent appraisal becomes your most powerful tool.

Turning Opinions into Verifiable Facts

A professional appraisal systematically dismantles an insurer’s weak arguments by replacing their claims with objective market analysis. A SnapClaim report is built on a foundation of real-world, verifiable data, analyzing key factors like:

- Real-Time Market Data: We evaluate your vehicle’s specific make, model, and condition against actual sales data for comparable cars in your local area.

- Damage Severity Analysis: The report documents the extent of the damage, noting critical issues like frame damage or airbag deployment that heavily impact resale value.

- Repair Quality Assessment: We consider the quality of repairs, including whether OEM parts were used, to present a complete picture of the vehicle’s post-repair state.

This expert-reviewed methodology provides the proof you need to negotiate confidently. To learn more, read our guide on getting a car appraisal after an accident.

The Power of Data in Negotiations

When you hand a certified appraisal to an adjuster, the entire dynamic of the negotiation changes. You are no longer just asking for more money; you are providing a detailed, professional analysis that justifies your demand. The burden of proof shifts to them. They have to explain why their valuation is more accurate than a report based on concrete market evidence.

A professional appraisal report is your expert witness on paper. It provides the court-ready documentation and verifiable proof needed to support your claim with confidence.

Our Risk-Free Money-Back Guarantee

We believe so strongly in the power of our data-backed reports that we stand behind them with a simple guarantee. Our commitment to you is a risk-free path toward the compensation you deserve.

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed. This promise ensures that you can pursue your claim with confidence, knowing you have a professional partner dedicated to helping you achieve a fair outcome.

FAQ: Common Questions About Diminished Value Claims

Can I claim diminished value if the accident wasn’t my fault?

Yes, absolutely. In fact, this is the primary scenario where you can file a successful claim. A diminished value claim is a type of third-party claim made against the at-fault driver’s insurance company to compensate you for the loss in your vehicle’s market value.

How long do I have to file my claim?

Every state sets a deadline for filing property damage claims, known as the statute of limitations. This window is typically between two and six years from the date of the accident. It is always best to act quickly while the evidence is fresh. Be sure to check your specific state laws to confirm the deadline.

Is a claim worth it for an older car?

It depends on the car’s market value before the crash, not just its age. While newer, more expensive cars often have larger claims, a well-maintained older vehicle, a classic car, or a model with very low mileage can still lose significant value. The only way to know for sure is with a professional appraisal.

What should I do if the insurance company denies my claim?

Don’t panic. An initial denial is a common tactic. Politely ask for the reason for the denial in writing. Often, the rejection is based on an internal company policy, not state law. A denial is an invitation to negotiate from a stronger position, and your certified appraisal is the perfect tool to counter their arguments with objective, data-backed evidence.

Here are answers to some of the most common questions vehicle owners ask about what a diminished value claim is and how it works.

Can I claim diminished value if the accident wasn’t my fault?

Yes, absolutely. In fact, this is the primary scenario where you can file a successful claim. A diminished value claim is a type of third-party claim made against the at-fault driver’s insurance company to compensate you for the loss in your vehicle’s market value.

How long do I have to file my claim?

Every state sets a deadline for filing property damage claims, known as the statute of limitations. This window is typically between two and six years from the date of the accident. It is always best to act quickly while the evidence is fresh. Be sure to check your specific state laws to confirm the deadline.

Is a claim worth it for an older car?

It depends on the car’s market value before the crash, not just its age. While newer, more expensive cars often have larger claims, a well-maintained older vehicle, a classic car, or a model with very low mileage can still lose significant value. The only way to know for sure is with a professional appraisal.

What should I do if the insurance company denies my claim?

Don’t panic. An initial denial is a common tactic. Politely ask for the reason for the denial in writing. Often, the rejection is based on an internal company policy, not state law. A denial is an invitation to negotiate from a stronger position, and your certified appraisal is the perfect tool to counter their arguments with objective, data-backed evidence.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.