St. Albans Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a St. Albans total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

St. Albans Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in St. Albans, Burlington, or South Burlington and the payout seems too low, you don’t have to accept it. Vermont drivers have the right under their insurance policy’s appraisal clause to request an independent St. Albans total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout Vermont to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in St. Albans

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in Vermont. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the St. Albans metro area.Why St. Albans Vehicle Owners Often See Undervalued Offers

- St. Albans’s used car market is consistently strong, especially for AWD vehicles, trucks, and SUVs like Toyota RAV4, Subaru Outback, Ford F-150, and Honda CR-V.

- Insurance valuations often rely on comps from cheaper nearby states.

- High demand around Burlington, South Burlington, and Rutland results in higher resale pricing.

What Your St. Albans Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from St. Albans, Burlington, Rutland, Brattleboro, and Montpelier markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within Vermont

St. Albans and Surrounding Areas We Serve

- Burlington

- South Burlington

- Rutland

- Essex Junction

- Bennington

- Brattleboro

- Colchester

- Montpelier

- St. Albans

- Barre

- Middlebury

- Milton

- Williston

- Hartford

How to Dispute a St. Albans Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your St. Albans total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many Vermont clients gain $2,000–$6,000+ more with accurate documentation.

Local Insight: St. Albans Market Trends

- Vermont has very high demand for AWD and winter-ready vehicles.

- Burlington and South Burlington show higher dealer pricing compared to rural Vermont.

- Insurers often use comps from cheaper rural towns, lowering payouts unfairly.

Example St. Albans Case Study

Vehicle: 2018 Subaru Outback PremiumInsurance Offer (CCC): $17,900

SnapClaim Appraisal: $20,600

Final Settlement: $20,300 after invoking the appraisal clause

Helpful Vermont Resources

Ready to Get Your St. Albans Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related Vermont Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in St. Albans

How SnapClaim Helps St. Albans Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified St. Albans market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the St. Albans metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“After my SUV was totaled in St. Albans, the insurance payout was thousands below what my Nissan Rogue was worth. I ordered a Vermont total loss appraisal from SnapClaim, and they sent the report the same day. With their documentation, I recovered $4,300 more.”

— Justin T., St. Albans, VT

St. Albans Total Loss – Frequently Asked Questions

How is a total loss calculated for vehicles in St. Albans?

In St. Albans, a car is deemed a total loss when the estimated repair costs exceed what similar vehicles are currently selling for in the area. Vermont Total Loss Guidelines.

Why do St. Albans residents often challenge the initial payout?

Insurance companies sometimes use broad data that overlooks St. Albans-specific demand for certain vehicle models.

Does St. Albans’ climate impact vehicle valuations?

Yes. Cars with winter-ready features or all-wheel drive often have higher local resale value in St. Albans’ snowy conditions. Market Value Insights.

Are trucks and SUVs more valuable in St. Albans claims?

Vehicles capable of handling rural roads, snow, and utility tasks generally retain stronger resale value locally.

Can maintenance records influence total loss settlements in St. Albans?

Yes. Cars with detailed service histories often receive higher settlements than similar vehicles without documentation.

Do aftermarket upgrades affect total loss payouts?

Practical modifications such as tow hitches, roof racks, or winter tires may increase the vehicle’s claimed value when documented.

Does accident fault influence total loss valuations in St. Albans?

No. The determination is based on fair market value rather than who caused the accident.

Why choose a St. Albans-specific appraisal?

Local appraisals provide a realistic valuation using St. Albans market data rather than statewide averages. St. Albans Total Loss Appraisal.

What factors can delay a total loss claim in St. Albans?

Incomplete records, missing maintenance documentation, and outdated local market data can slow settlement processing.

How does SnapClaim help St. Albans vehicle owners?

SnapClaim generates St. Albans-specific valuation reports using verified local sales to help secure fair compensation. Start a St. Albans Claim.

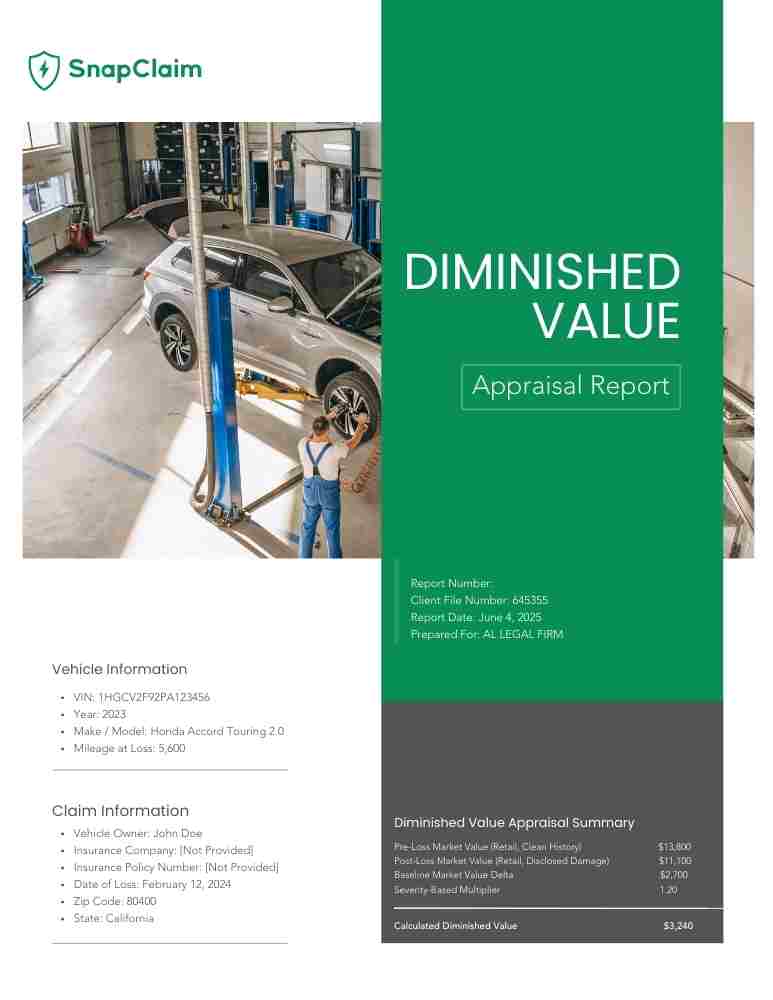

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.