Diminished Value Appraisal in

Utah

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified Utah diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across Utah

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in Utah: What You Need to Know

Utah Diminished Value Appraisal — Recover What Your Vehicle Lost After an Accident

Even after quality repairs, your vehicle can lose market value once its accident history appears on Carfax or AutoCheck. If your crash happened anywhere in Utah—including Salt Lake City, West Valley City, West Jordan, Provo, and Orem—a Utah diminished value appraisal helps document that loss and strengthen your insurance claim.

SnapClaim provides court-ready, data-driven appraisal reports trusted by Utah insurers, personal-injury attorneys, and Justice Courts statewide.

Does Utah Allow Diminished Value Claims?

Third-party (at-fault driver’s insurer)

Yes. Utah recognizes diminished value (DV) as recoverable property damage when another driver is at fault—the measurable reduction in market value after an accident, even when repairs are properly completed.

First-party (your own insurer)

Usually no, unless your policy specifically provides DV coverage. Most collision/comprehensive policies exclude it.

Key Utah Law & Claim Authority

- Statute of limitations: 3 years to file property-damage/DV claims (Utah Code § 78B-2-305).

- Consumer protection: The Utah Insurance Department regulates insurers and handles consumer complaints.

- Small claims court: DV disputes up to $15,000 may be filed in Utah Justice Court — Small Claims.

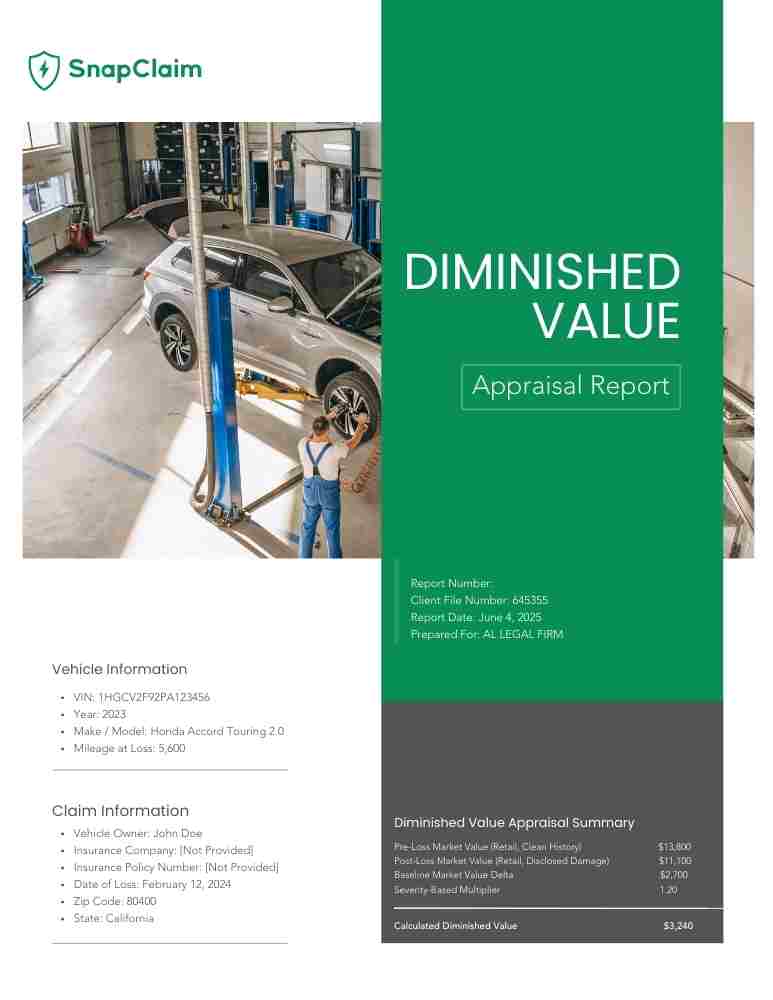

What Your Utah Diminished Value Appraisal Report Includes

- Vehicle specs: year, make, model, trim, mileage, options, and condition

- Comparable listings filtered by Utah ZIP codes (e.g., SLC, Provo, Ogden)

- Pre-accident vs. post-repair valuation using verified market data

- DV calculation reflecting repair severity and regional demand

- Transparent methodology aligned with USPAP and insurer standards

- Optional expert-witness testimony support for arbitration or court

Most reports are completed and delivered in about 1 hour, ready for insurance submission.

Utah Areas We Serve

- Salt Lake City, UT

- West Valley City, UT

- West Jordan, UT

- Provo, UT

- Orem, UT

- Sandy, UT

- St. George, UT

- Ogden, UT

- Layton, UT

- South Jordan, UT

- Lehi, UT

- Millcreek, UT

- Taylorsville, UT

- Logan, UT

- Murray, UT

How to File a Diminished Value Claim in Utah

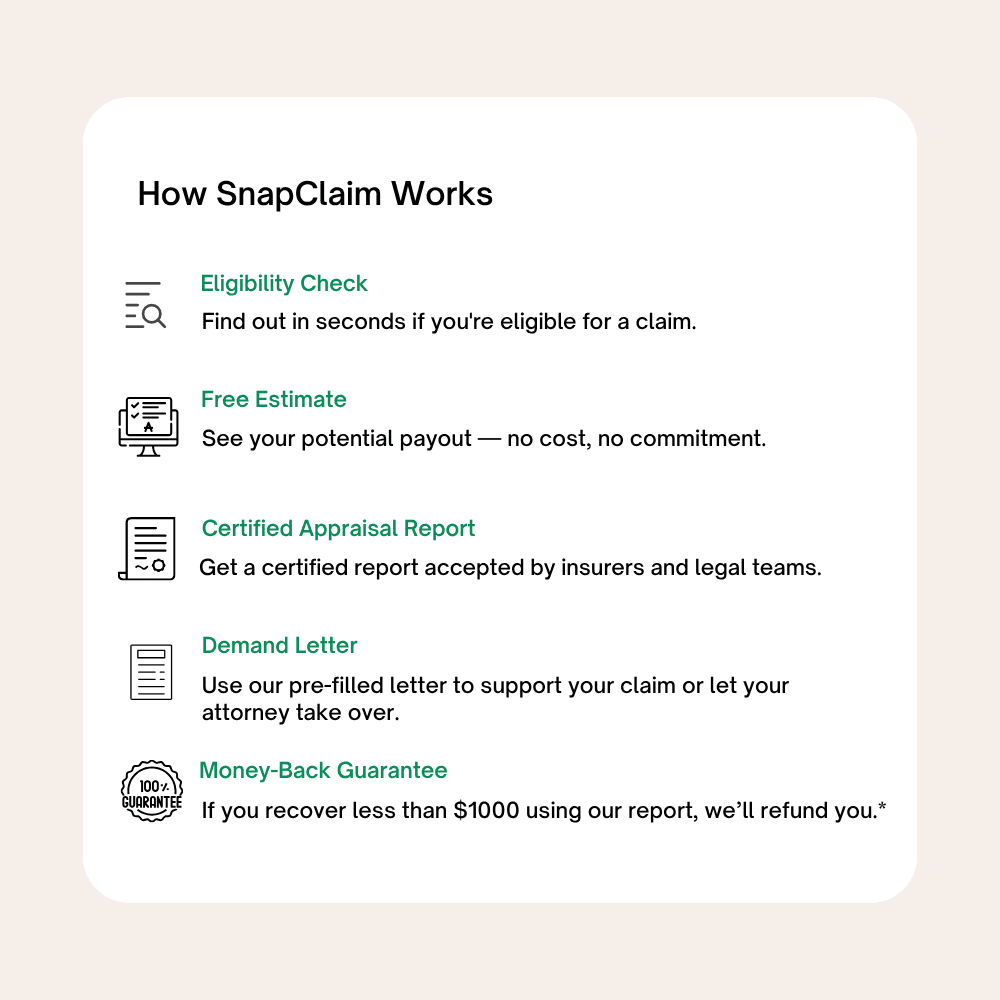

- Order your appraisal — get a certified report quantifying your loss in value.

- Send a DV demand letter to the at-fault insurer with the appraisal attached.

- Negotiate or escalate — our reports are formatted for attorney use and Justice Court filing.

- Recover compensation — many Utah drivers recover thousands, depending on damage and vehicle type.

Utah Insurance Practices to Know

Some insurers use simplified formulas that undervalue DV. SnapClaim uses:

- Verified listings from AutoTrader, CarGurus, and Cars.com filtered to Utah markets

- Dealer input from along the Wasatch Front and Southern Utah

- Localized adjustments for mileage, trim, color, features, and condition

Example Utah Case Study

Vehicle: 2021 Subaru Outback Premium

Repair Cost: $6,400 (rear quarter & liftgate)

Initial Insurer Offer: $750 (formula-based)

SnapClaim DV Result: $4,500

Final Settlement: $4,200 after submitting our report and demand letter

Helpful Utah Resources

- Utah Code § 78B-2-305 — 3-year limit for property damage

- Utah Insurance Department — complaints & insurer regulation

- Utah Courts — Small Claims — filing info and forms

Ready to Get Your Utah Diminished Value Appraisal?

- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Click a pin to open the city’s diminished value page.

Find your Utah city below to order your Diminished Value Appraisal.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Utah

If your vehicle was damaged in a Utah car accident, it may lose resale value even after high-quality repairs. This is called diminished value. With a Utah diminished value appraisal, you can prove your vehicle’s loss in value and recover it under v state law. In fact, Utah is one of the most favorable states for pursuing diminished value claims.

SnapClaim makes filing a Utah diminished value claim fast and stress-free. We provide a free diminished value estimate, a certified Utah diminished value appraisal report, and an insurer-ready demand letter you can submit immediately. No waiting. No confusion. Just accurate, court-ready documentation trusted by attorneys and insurance adjusters across Utah

“After my SUV was rear-ended in Salt Lake City, I thought the repairs had made it good as new. Later, I learned the accident record had still lowered its market value. SnapClaim’s Utah diminished value appraisal gave me clear, data-backed proof of the loss. My attorney sent the report to the insurer, and they paid the difference quickly. It turned what could’ve been a stressful dispute into a smooth, fair outcome.”

Emily W.,

Salt Lake City, UT

Utah Diminished Value – Frequently Asked Questions

What is a diminished value claim in Utah?

In Utah, a diminished value (DV) claim seeks compensation for the loss in your vehicle’s market value after an accident. Even after quality repairs, your car is usually worth less because it now carries an accident history that will show up on Carfax and similar reports. A DV claim aims to recover that difference between pre-accident value and post-repair value. Learn how DV works nationwide: Diminished Value Guide.

Does Utah recognize diminished value claims?

Yes. Utah courts have long recognized that vehicle owners can recover for diminished value, not just the cost of repairs. Utah case law allows recovery for the difference in market value immediately before and after the collision, including:

- Metcalf v. Mellen (1920) – allows recovery for cost of repair plus any remaining loss in market value.

- Hill v. Varner (1955) and Sevy v. Utah Farm Bureau – confirm that depreciation after repairs can be recoverable.

In practical terms, that means you can often pursue a DV claim against the at-fault driver’s insurer in Utah when your car is worth less after the accident. Start with a free estimate: Utah Diminished Value Appraisals.

Do I have a diminished value claim if my vehicle was fully repaired?

Yes. Utah law recognizes that even when a vehicle is restored to its pre-accident condition, it can still suffer inherent diminished value because buyers and dealers discount vehicles with an accident history. Courts have allowed diminution-in-value damages when repairs do not return an item to its original market value due to lingering negative public perception.

In other words, “fully repaired” does not mean “no diminished value.” A Utah diminished value appraisal from SnapClaim can document this loss: How diminished value is calculated.

If my vehicle is more than five years old, can I still make a diminished value claim?

It depends. Newer vehicles are the strongest candidates for diminished value, but older vehicles can still qualify:

- New or late-model vehicles (< 5 years, no prior damage) – very strong DV candidates.

- 5+ year-old vehicles – may still have DV depending on make, model, mileage, and the severity of damage.

- Vintage / collector vehicles – often have significant diminished value after a serious crash.

If you’re unsure, use SnapClaim’s free screening and we’ll tell you if a Utah DV claim is likely worth pursuing: Check your Utah DV eligibility.

How do I make a diminished value claim in Utah?

The basic steps are:

- Repair your vehicle at a reputable, preferably OEM-focused body shop.

- Document everything – repair order, photos, estimates, supplements.

- Obtain an independent appraisal quantifying diminished value (that’s what SnapClaim provides).

- Submit a written DV demand with the appraisal to the at-fault insurer.

SnapClaim can handle steps 2–3 and provide a Utah-specific DV report your attorney or you can use in negotiations: See our report process.

What factors determine if my car has diminished value after an accident?

Utah diminished value is case-specific. Key factors include:

- Make, model, and year – newer, high-demand, luxury, or specialty vehicles typically suffer more DV.

- Pre-accident condition – pristine vehicles with no cosmetic/structural issues see higher DV than cars already in rough shape.

- Mileage – lower mileage generally means higher DV; high mileage can blunt the impact.

- Type and severity of damage – structural, frame, or airbag deployment usually produces substantial DV even after proper repair.

- Quality of repairs – poor repairs create additional repair-related diminished value on top of inherent DV.

- Prior accident history – previous crashes can complicate, but not always eliminate, DV claims.

- Pre-accident market value – DV is measured as a drop from your actual pre-accident fair market value.

SnapClaim builds Utah DV reports using real market comps and these factors: How we determine fair market value.

What evidence should I collect to support my diminished value claim?

Strong documentation makes or breaks a Utah DV claim. Helpful evidence includes:

- Clear photos of the damage and repair process.

- Body shop repair estimates, final invoices, and supplements.

- Any trade-in or cash offers you’ve received after the accident.

- Evidence of unsuccessful attempts to sell or only receiving lowball offers.

- A professional diminished value appraisal report (SnapClaim’s role).

You can upload most of this directly to SnapClaim and we’ll incorporate it into your Utah DV appraisal: Upload your documents securely.

Do I need to hire an expert for a diminished value claim?

Realistically, yes. Insurance companies rarely accept “because I say so” as proof of diminished value. You need:

- An independent, data-driven appraisal quantifying the loss in value.

- A report that can be used by your attorney in negotiation, appraisal clause, or small claims.

SnapClaim functions as that independent expert by providing certified, Utah-aware diminished value reports that PI attorneys and adjusters can work with: See Utah DV report features.

Does an expert need to inspect my vehicle in person for a Utah diminished value claim?

Not always. Many Utah DV claims can be supported with:

- High-quality photos and videos of the damage.

- Complete repair orders, supplements, and parts lists.

- VIN, mileage, and feature list for accurate valuation.

For complex or high-dollar claims (severe structural damage, luxury vehicles), an in-person inspection may be helpful, but is not strictly required in every case. SnapClaim’s process is designed to work 100% online for most Utah diminished value appraisals: How our remote appraisals work.

Do all Utah personal injury attorneys handle diminished value claims?

No. Many Utah PI firms focus on bodily injury and do not handle property damage or diminished value claims due to:

- Limited experience with DV or property damage.

- Time demands compared to injury cases.

- Belief that DV claims are “too small” for their practice model.

That’s exactly why tools like SnapClaim exist—to make Utah diminished value simple and scalable for firms that choose to offer this service: SnapClaim for law firms.

When should I contact an attorney about my diminished value claim in Utah?

Ideally, you should talk to a Utah attorney as early as possible—often before repairs are complete—so they can:

- Help preserve evidence and documentation for both injury and DV.

- Coordinate timing so your DV claim is supported by a professional appraisal.

- Ensure you don’t miss key deadlines or policy requirements.

If you already have counsel, SnapClaim can work directly with your attorney by providing plug-and-play DV appraisals and demand letter language: Pair our report with your attorney.

How much will it cost to hire an attorney for my diminished value claim?

Many Utah attorneys who do accept diminished value cases work on a contingency fee basis for injury claims and may bundle DV in as part of the overall property damage package. Others may charge a flat fee for handling DV only.

SnapClaim is not a law firm, but we keep our appraisal pricing simple and transparent so your attorney can justify fees on top of a clear, data-backed DV report: See SnapClaim pricing.

How long do I have to submit a diminished value claim in Utah?

Under Utah law, diminished value is treated as property damage. The statute of limitations for most property damage claims, including vehicle damage, is generally around three years from the date of the accident. However, policy deadlines and special situations can shorten or complicate this.

Because deadlines are critical and fact-specific, you should confirm timing with a Utah attorney. From a practical standpoint, it’s best to start your DV claim as soon as repairs are complete while market data and documentation are fresh. SnapClaim can provide a Utah DV appraisal quickly so you don’t lose leverage: Get your appraisal started.

What if the person who caused the accident does not have insurance?

If the at-fault driver is uninsured, your options may include:

- Uninsured motorist property damage (UMPD) coverage, if purchased, which can sometimes cover DV in Utah subject to limits and deductibles.

- Collision coverage to repair the vehicle (though many policies exclude DV for first-party claims).

- Pursuing the driver personally, which is often difficult in practice.

A Utah attorney can explain how your specific coverages apply. SnapClaim can still quantify your lost value so you understand what is at stake when negotiating with your insurer: Understand your diminished value.

Is it worth pursuing a diminished value claim in Utah?

It often is—especially for:

- Newer vehicles (< 5 years old) with clean history before the crash.

- Cars with structural damage, airbag deployment, or high-quality repairs that still show on Carfax.

- Higher-value, luxury, or specialty vehicles where even a modest percentage drop equals thousands of dollars.

SnapClaim offers a quick, free diminished value estimate so you can decide if it’s worth pushing a Utah DV claim: Get a free DV estimate.

How much money am I likely to recover for diminished value in Utah?

There’s no fixed table, but Utah DV recoveries commonly range from a few hundred dollars on older, higher-mileage vehicles to several thousand dollars on newer or higher-value vehicles. The key drivers are:

- Your vehicle’s pre-accident fair market value.

- Severity and type of damage (especially frame/structural).

- Market reaction—how buyers and dealers treat similar damaged vehicles.

SnapClaim’s appraisal uses real Utah and regional comps to estimate a market-supported DV number, which often becomes the foundation for settlement negotiations: Learn how we value vehicles.

Can I submit a diminished value claim to my own insurance company?

It depends on your policy. In Utah:

- Third-party DV claims (against the at-fault driver’s insurer) are commonly allowed.

- First-party DV claims (against your own insurer) are often excluded unless your policy specifically covers DV.

- Some uninsured motorist property coverage may provide limited DV benefits under strict conditions.

Always review your declarations page and speak with a Utah attorney about your rights. Regardless of who you file with, you’ll need a clear, independent appraisal—which is where SnapClaim comes in: Use our report with any insurer.

How can I increase the value of my diminished value claim in Utah?

You can’t “inflate” your claim, but you can maximize legitimate value by:

- Using a quality shop that documents repairs clearly.

- Preserving all photos, invoices, and supplements.

- Obtaining an independent DV appraisal based on real market data, not generic formulas.

- Responding promptly to insurer requests while holding firm on well-supported numbers.

SnapClaim appraisals are designed to give you that solid, evidence-based starting point: Strengthen your Utah DV claim.

What if the insurance company refuses to pay fair value for my diminished value claim?

If an insurer lowballs or denies your Utah DV claim, options may include:

- Having your attorney send a formal demand letter with your SnapClaim appraisal attached.

- Escalating to a supervisor, appraisal clause, or mediation where available.

- Filing a lawsuit within Utah’s property damage statute of limitations if warranted (discuss with your attorney).

SnapClaim reports are structured to be court- and arbitration-ready so your lawyer has credible valuation evidence if negotiations stall: Order a Utah DV appraisal.

What are the most common defenses to a diminished value claim in Utah?

Insurers frequently argue that:

- The damage was minor and did not materially affect value.

- Your vehicle was old, high-mileage, or already in poor condition.

- There is prior accident history making it hard to isolate current DV.

- Your appraisal is unsupported or based on unrealistic comparables.

A professional Utah diminished value report that uses clear methodology and transparent comps makes these defenses much harder to sustain: See what’s in our reports.

What if my expert determines that poor repair work was done on my vehicle?

Poor repairs create repair-related diminished value on top of inherent DV. In that case:

- You may need to have the vehicle repaired correctly to industry standards first.

- Your claim could include both the cost to correct bad repairs and the resulting additional DV.

- Your expert’s report should clearly separate inherent DV vs. repair-related DV.

SnapClaim’s reports highlight structural damage, aftermarket parts, and any issues that can support a request for proper repairs and compensation: Get a detailed DV report.

What if I want to keep my vehicle—can I still make a diminished value claim?

Yes. In fact, most Utah diminished value claims are for vehicles you keep and continue driving. DV is about:

- The loss in what your car would sell or trade for today, not whether you actually sell it.

- The stigma and lower resale price caused by a recorded accident history.

A SnapClaim appraisal quantifies that loss so you’re compensated for the real-world impact on your vehicle’s value—even if you never sell it: Start your Utah DV appraisal.

What is a buyback offer and should I accept one?

A buyback offer usually comes up in a total loss situation, not a typical diminished value scenario. The insurer pays you your vehicle’s value minus salvage, and you “buy back” the salvage vehicle to keep it.

If you are dealing with a borderline total loss and are considering a buyback, make sure you understand:

- Whether DV still applies (often it’s either total loss or DV, not both).

- Future title branding (salvage/rebuilt) and how that affects value.

A fair fair market value and DV analysis from SnapClaim can help you and your attorney decide whether a buyback makes sense: Total loss & DV valuation help.

What if I cannot get a buyback offer or the numbers don’t make sense?

If the insurer won’t offer a buyback or the salvage value seems unreasonable, focus on:

- Ensuring the pre-accident fair market value is correct.

- Making sure you understand whether your case is truly a total loss or better approached as a DV claim.

Either way, you need accurate valuation. SnapClaim’s Utah-specific fair market value and diminished value appraisals can help you and your attorney decide the best path: Compare DV vs. total loss options.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.