Hearing that your car is a “total loss” after an accident can be confusing and stressful. What does that term really mean, and how does it affect your insurance payout? Understanding the total loss calculation for your vehicle is the first step toward ensuring you receive a fair settlement.

It’s not about how crumpled the metal looks—it’s a purely financial decision the insurance company makes based on a specific formula. If the cost to fix your car plus its scrap value is more than its value right before the accident, the insurer will declare it a total loss and issue a payout.

Why Your Car Was Declared a Total Loss

When an insurance adjuster declares your vehicle a total loss, they aren’t just making a gut call. They are running numbers through a strict process guided by their company’s policies and, importantly, state regulations. It’s all business.

At its core, the decision comes down to a simple comparison. The insurer weighs the cost of repairing your car back to its pre-accident condition against what that car was actually worth a moment before the crash. If the repair bill gets too high relative to the car’s value, it’s cheaper for them to pay you that value and sell the wrecked vehicle for salvage.

The Key Components of the Formula

To understand their decision, you need to know the three main ingredients in the total loss recipe. Each one plays a critical role in whether your car gets fixed or written off.

- Actual Cash Value (ACV): This is the most important number in the equation. It’s what your specific vehicle—with its exact mileage, condition, and options—was worth in your local market the second before the accident. Think of it as the fair market value.

- Cost of Repairs: This is the official estimate to fix everything, covering both parts and labor. With complex modern cars, repair costs are skyrocketing, pushing more vehicles into the “totaled” category.

- Salvage Value: This is the money the insurance company can get back by selling your damaged car at a salvage auction. A buyer will either fix it up or strip it for parts.

The Basic Rule: If the Cost of Repairs + the Salvage Value is greater than or equal to the Actual Cash Value, your vehicle will be declared a total loss.

This formula gives the insurer a clear financial reason for their decision. To learn more about the process, see our detailed guide on what a total loss vehicle means. Getting this foundation right is the first step to making sure you get a fair settlement.

Decoding Actual Cash Value (ACV)

When your car is declared a total loss, the Actual Cash Value, or ACV, becomes the single most important number in your settlement. It is also the most common point of dispute between vehicle owners and insurance companies.

It’s critical to understand what ACV is—and what it isn’t. ACV is not what you paid for your car or what a dealer is asking for a similar one today.

ACV is a snapshot of your vehicle’s true market value the exact moment before the accident happened. It’s what a real person would have reasonably paid for your specific car, in its exact pre-crash condition.

How Adjusters Calculate Your Car’s ACV

Insurance adjusters use valuation software that pulls data from different sources to produce a baseline figure. However, the quality of that data and the specific details they input can drastically change the offer you receive.

They start with your car’s make, model, year, and trim. From there, they apply adjustments, adding or subtracting value based on several key factors.

Here’s a look at what they review when determining your car’s pre-accident worth.

Key Factors Influencing Your Vehicle’s Actual Cash Value (ACV)

| Factor | How It Impacts Your Car’s Value |

|---|---|

| Mileage | A major factor. Lower mileage almost always means higher value, while high mileage brings it down. |

| Overall Condition | Adjusters look at the pre-accident state of your car. Any existing dings, scratches, or wear and tear will reduce the ACV. A pristine, garage-kept vehicle commands a higher value. |

| Optional Features & Upgrades | That premium sound system, sunroof, or advanced safety package adds real value and must be factored into the final number. |

| Recent Maintenance & Repairs | Did you just install a new set of tires or have major engine work done? Proof of significant, recent investments can increase the ACV. |

The Critical Role of “Comps”

After setting a baseline value, the adjuster must back it up with comparable vehicles, or “comps.” These should be real-world examples of cars just like yours that recently sold in your local area. Unfortunately, this is where many insurance valuations fall short.

Too often, an insurer will use comps that aren’t truly comparable. They might take your pristine, low-mileage SUV with premium features and compare it to a basic, high-mileage model in rough shape. This tactic is used to justify a lowball offer.

Key Takeaway: The quality of the “comps” used in a valuation report is everything. A fair settlement is built on a foundation of accurate comparable vehicles.

This is why an independent, third-party appraisal is a game-changer. At SnapClaim, our certified appraisers use hyper-local, market-verified data to find comps that genuinely mirror your vehicle’s pre-accident condition, mileage, and features. This provides the proof you need to negotiate fairly for the full insurance total loss payout you deserve.

The Formula Insurers Use to Total a Vehicle

Insurance companies don’t decide to total a car based on how bad the damage looks. It’s a cold, hard financial decision based on a simple formula.

Understanding this calculation is the first step to making sure they’re playing by the rules. It all boils down to comparing the cost of repairs to the car’s value right before the accident.

The Official Total Loss Formula

At its core, the math is a cost-benefit analysis. An adjuster will declare a vehicle a total loss when this equation is true:

Cost of Repair + Salvage Value ≥ Actual Cash Value (ACV)

Let’s quickly review each piece of that puzzle.

- Cost of Repair: The total estimated price for all parts and labor to restore your car to its pre-accident condition.

- Salvage Value: What the insurer can get for your wrecked car by selling it at a salvage auction.

- Actual Cash Value (ACV): As we’ve covered, this is what your car was worth on the open market a moment before the crash. This is the single most argued-over number in the entire total loss calculation vehicle process.

If the cost to fix the car plus the money they can get for selling the wreck is greater than what the car was worth, it’s a financial no-brainer for them.

Understanding the Total Loss Threshold (TLT)

While that formula is the industry standard, state laws add another factor: the Total Loss Threshold (TLT). This is a specific percentage set by state regulators that legally forces an insurer to declare a vehicle a total loss if repair costs reach that level.

The TLT is based on the repair cost as a percentage of the vehicle’s ACV.

For example, a state like Texas has a TLT of 100%, meaning the repair estimate must meet or exceed the car’s full ACV. But in Colorado, the TLT is just 75%. If your car in Colorado had an ACV of $20,000, it must be totaled once the repair bill hits $15,000 (75% of $20,000). You can usually find your state’s TLT on its DMV or Department of Insurance website, such as this resource from the Texas Department of Insurance.

How These Components Come Together

Let’s walk through a quick example. Imagine your car’s ACV is determined to be $18,000. The body shop estimates repairs at $14,000, and the insurer figures it can get $5,000 for the car at a salvage auction.

Plugging those numbers into the formula:

- $14,000 (Repair Cost) + $5,000 (Salvage Value) = $19,000

Since $19,000 is more than the $18,000 ACV, the insurance company will declare it a total loss.

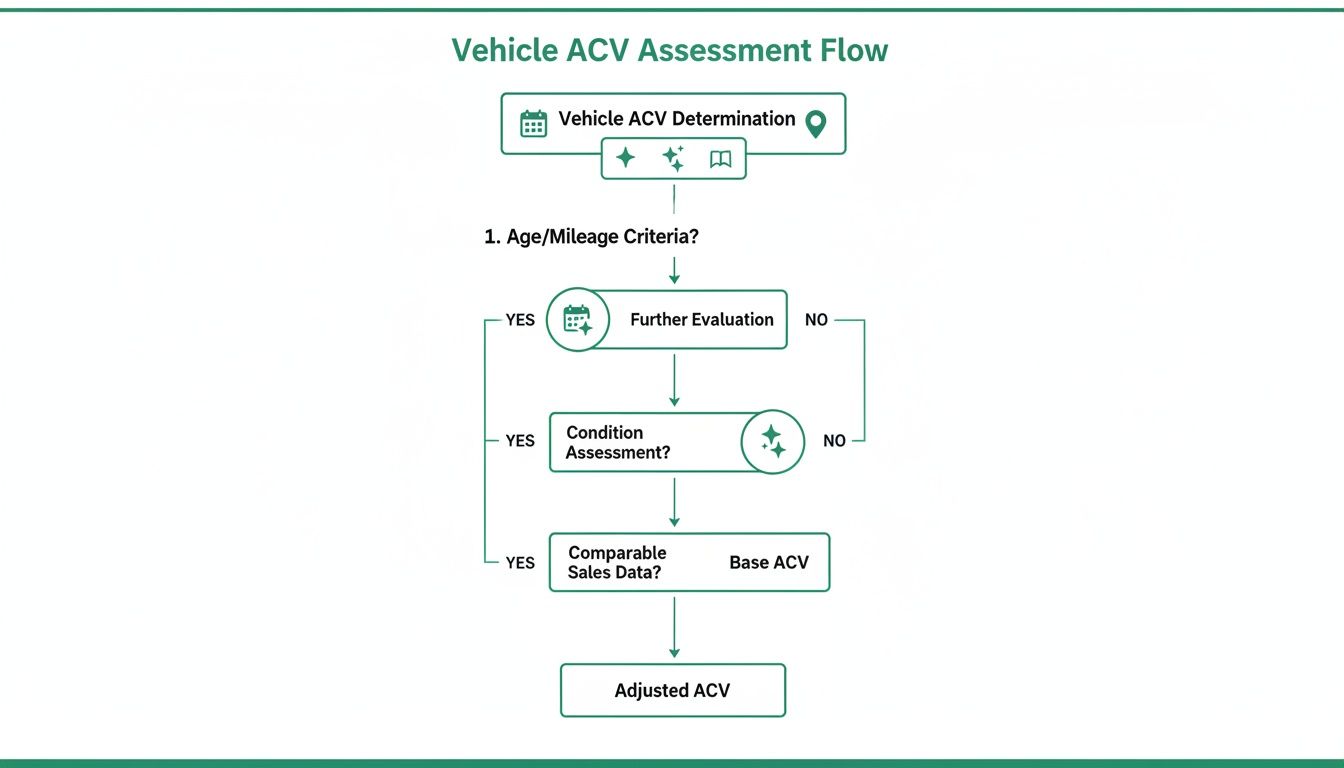

The flowchart below shows the factors that go into calculating that all-important ACV figure.

A correct ACV isn’t just a number from a database; it depends on a deep dive into your vehicle’s specific history and features. Since the ACV is the bedrock of your settlement, making sure it’s accurate is your number one priority. You can learn more about how a professional appraisal establishes this value in our guide to total loss car valuation.

Common Tactics That Lead to Low Settlement Offers

Did the insurance company’s first offer for your totaled car seem insultingly low? You’re not alone. It’s a common part of the claims process, and it’s usually not an accident.

That lowball number is often the result of automated systems and tactics designed to work in the insurer’s favor. An insurer’s total loss calculation for a vehicle is their opening bid in a negotiation, not the final word. Understanding how they arrive at that number is your first step toward fighting for the settlement you actually deserve.

Flawed Automated Valuation Software

Most large insurers rely on third-party valuation software to produce an initial ACV. While fast and efficient for them, these systems are far from perfect.

These reports often use outdated data or completely miss the nuances of your local market. They also tend to ignore recent upgrades—like new premium tires or an upgraded stereo—unless you fight to get them included.

The Problem of Poor “Comparable” Vehicles

This is the biggest offender. The most common reason for a low offer is the insurer’s choice of “comparable” vehicles, or “comps.” Your car’s ACV should be based on what similar vehicles have recently sold for in your area. But “similar” can be stretched.

An insurer might justify a low number by comparing your well-kept car to comps with:

- Significantly higher mileage

- A basic trim level lacking your car’s premium features

- A history of accidents or poor condition

- Listings from distant geographic areas where cars sell for less

This is a classic apples-to-oranges game used to drive down your car value after an accident, and it’s a massive red flag.

Rising Repair Costs and Market Pressures

The auto industry is facing major headwinds. Supply chain issues and increasingly complex cars have sent repair costs through the roof.

This puts immense pressure on insurers. It’s often cheaper for them to total a car than to pay for a mountain of expensive repairs. The total loss rate has climbed dramatically, a trend driven by repair costs eclipsing a car’s value. You can read more about how technology and costs are reshaping auto insurance on solera.com.

Knowing these tactics isn’t about picking a fight—it’s about being prepared. An independent, certified appraisal from SnapClaim gives you the hard data needed to counter these moves and demand a fair settlement.

How to Effectively Dispute a Lowball Offer

Getting a low settlement offer is frustrating, but remember this key fact: you do not have to accept the insurance company’s first offer.

You have the right to question their math and negotiate for what you’re rightfully owed. The secret is to approach it calmly, armed with solid proof. This isn’t an argument; it’s a fact-based business discussion.

Step 1: Request the Valuation Report

Before you do anything else, ask the adjuster for a complete copy of their valuation report. This document shows how they came up with their offer and is your roadmap for the dispute.

Inside, you’ll find the “comparable” vehicles they used, any adjustments they made, and—most importantly—what they missed. Go over this report line by line.

Step 2: Gather Your Own Evidence

With their report in hand, it’s time to build your case. Your mission is to prove their total loss calculation for your vehicle is flawed.

Start building an evidence file that includes:

- Maintenance and Repair Records: Receipts for every oil change, brake job, or other major service prove you took great care of your vehicle.

- Receipts for Recent Upgrades: Did you add new tires, a stereo, or a remote start? These upgrades add value.

- Pre-Accident Photos: Pictures showing your car in great condition are powerful proof against an adjuster’s claim that its condition was merely “average.”

- Original Window Sticker: If you have it, this sticker lists every factory-installed option that made your vehicle unique.

Step 3: Get an Independent Appraisal

Collecting records is a great start, but the single most powerful tool in a negotiation is a certified, independent appraisal. The insurance company has its report; you need to counter it with a stronger one.

Key Takeaway: An independent appraisal from a trusted third party like SnapClaim levels the playing field. It replaces the insurer’s biased valuation with an objective, data-driven report.

A professional appraisal from SnapClaim uses verifiable sales data and industry-standard methods to establish a rock-solid ACV, giving you the ammunition to negotiate with confidence. For a full breakdown of the process, see our step-by-step guide to disputing a total loss offer.

Step 4: Present Your Case Professionally

Once you have your evidence and independent appraisal, contact the adjuster. Frame your counteroffer in a clear, professional email. Attach copies of everything—receipts, photos, and especially your certified appraisal report.

State the value you believe is fair and walk them through why, referencing data from your appraisal. This shifts the conversation from an emotional plea to a factual negotiation they can’t easily ignore.

Frequently Asked Questions (FAQ)

Can I keep my car if it is declared a total loss?

Yes, in most states, you can choose to keep your vehicle through a process called “owner-retained salvage.” The insurance company will pay you the car’s Actual Cash Value (ACV) minus its salvage value. Your car will be issued a salvage title, and you will need to complete all necessary repairs and pass a state inspection before it can be legally driven or insured again.

What happens if I owe more on my loan than the car is worth?

If your auto loan balance is higher than the settlement from the total loss calculation for your vehicle, you are responsible for paying the difference. This is often called being “upside down.” If you have GAP (Guaranteed Asset Protection) insurance, it is designed to cover this gap. Without it, you will need to arrange to pay the remaining balance to your lender.

Does the settlement include sales tax and fees?

This depends on your state’s laws. Many states, including Florida, require insurers to include sales tax, title, and transfer fees in the total loss payout. The logic is that the settlement should make you whole, allowing you to purchase a replacement vehicle without paying these costs out of pocket. Always ask for a detailed breakdown of your settlement offer.

Can I also make a diminished value claim on a total loss?

No, you cannot. A diminished value claim is for vehicles that have been repaired after an accident and have lost market value as a result. Since a total loss vehicle is not repaired, it is ineligible for this type of claim. The total loss settlement is intended to compensate you for the vehicle’s entire pre-accident value.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

SnapClaim provides the proof you need to negotiate fairly. Our data-backed reports strengthen your claim, and our process is risk-free. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.