When your insurance adjuster declares your car a total loss, the settlement offer that follows can feel like a punch to the gut. It’s often thousands less than you expected, sparking one of the most common total loss appraisal insurance claim disputes. If you’re wondering whether you can fight back, the answer is yes.

Challenging an unfair insurance total loss payout isn’t just possible—it’s your right. Armed with the right information and evidence, you can successfully negotiate for the compensation you deserve.

Why Your Insurer’s First Offer Is Often Too Low

Many vehicle owners mistakenly believe an insurer’s first settlement offer is final. In reality, it’s just their opening bid. That number represents their calculation of your vehicle’s Actual Cash Value (ACV)—what it was worth the moment before the accident.

The problem is, their version of ACV often doesn’t match reality. This gap is what sparks most total loss appraisal insurance claim disputes. Here’s why their number is so often off the mark.

Common Flaws in Insurer Valuations

- Reliance on Flawed Valuation Software: Most insurers use automated tools like CCC ONE or Audatex. These platforms pull data from huge databases, often missing the unique details of your local market where prices could be much higher.

- Poorly Chosen “Comps”: The comparable vehicles (“comps”) they use to justify their offer are often inaccurate. Insurers may cherry-pick comps with higher mileage, fewer options, or from a dealership hundreds of miles away in a cheaper market.

- Ignoring Your Vehicle’s Real Condition: Did you keep your car in pristine condition? Their report will likely default to “average” or “fair” condition, ignoring its excellent service history and accident-free past.

- Overlooking Recent Upgrades: Those brand-new tires you just bought or the premium sound system you installed are rarely included. Insurers often miss these value-adding features unless you provide receipts.

This isn’t an occasional problem; it’s a systemic issue designed to minimize payouts. An insurer’s goal is to close your claim quickly and inexpensively. Your goal is to be made whole. These two objectives are naturally at odds.

To see a full breakdown of how these payouts are calculated, you can explore our guide on total loss car appraisals. Understanding their methods is the first step toward successfully pushing back on a lowball offer.

Insurer Valuation vs. Reality: A Common Breakdown

This table shows the most common areas where insurer valuations fall short.

| Valuation Factor | Typical Insurer Approach | Fair Market Reality |

|---|---|---|

| Condition Rating | Defaults to “average” or “fair” based on age/mileage. | A well-maintained vehicle in “excellent” condition is worth significantly more. |

| Comparable Vehicles | Uses comps from a wide radius with different options or higher mileage. | True comps are local, have similar features, and are closely matched in mileage. |

| Recent Upgrades | Ignores new tires, brakes, or aftermarket parts unless proven with receipts. | Recent investments directly add to the vehicle’s resale value and appeal. |

| Local Market Adjustments | Relies on broad regional data that smooths out local price spikes. | Your local market dictates the true replacement cost, which can be much higher. |

Building Your Case with the Right Evidence

Before arguing with an adjuster, you must build an evidence-based case. Winning total loss appraisal insurance claim disputes is not about who complains the loudest; it’s about who has the better proof.

Your first step is to request a copy of the insurance company’s valuation report. This document is the basis for their low offer, and your job is to find its mistakes.

Scrutinize The Insurer’s Valuation Report

Think of the insurer’s report as a puzzle with missing pieces. You’re looking for specific errors that undervalue your car. Even small mistakes can add up to thousands of dollars missing from your insurance total loss payout.

Look for these common red flags:

- Wrong Trim and Options: Did they list your fully-loaded Limited model as a basic SE? Did they forget your sunroof or premium sound system? Every omission costs you money.

- Bad “Comparable” Vehicles: Insurers love using comps that aren’t comparable. Check their examples—are they from a different state? Do they have far more miles? Do they lack your car’s options?

- Unfair Condition Adjustments: Adjusters often apply negative adjustments for minor “pre-existing damage.” A tiny door ding should not result in a $500 deduction. Question every adjustment and demand photographic proof.

Once you’ve found the weak spots in their report, it’s time to build your own with much stronger evidence.

Gather Your Own Powerful Evidence

Your goal is to paint a clear picture of what your vehicle was worth right before the accident. The more documentation you have, the stronger your position becomes.

Key Takeaway: The person with the most detailed and verifiable evidence almost always wins. Your records are far more accurate than an insurer’s generic data.

Start by gathering these critical pieces of proof:

- Find Your Own Real Comps: Search local dealership sites, AutoTrader, and Cars.com for vehicles that are a true match—same year, make, model, trim, and similar mileage. Save screenshots of the listings, capturing the VIN and asking price to establish the true car value after accident in your local market.

- Compile Maintenance and Upgrade Records: Gather every service record you have. Receipts for new tires, brakes, or a battery prove your vehicle was well-maintained and justify a higher condition rating.

- Dig Up the Original Window Sticker: The original “Monroney sticker” is an itemized list of every factory feature and option, making it impossible for the insurer to claim they didn’t exist.

This collection of evidence becomes the backbone of your rebuttal. You’re no longer arguing opinions; you’re presenting facts that replace the insurer’s flawed assumptions. For targeted information, check our state-specific law pages to see how local laws might influence your claim.

How an Independent Appraisal Strengthens Your Position

While your own evidence is a great start, a certified independent appraisal is your ace in the hole. This professional report changes the dynamic of your negotiation and is your most effective tool in total loss appraisal insurance claim disputes.

An independent appraisal provides an objective assessment from a third party with no stake in your payout. An insurer’s valuation comes from an adjuster who works for them, using software designed to find the lowest defensible number. That distinction is critical.

The Power of Objective Valuation

An independent appraiser’s sole job is to determine the true Fair Market Value (FMV) of your vehicle. FMV is what a willing buyer would have paid a willing seller in your local market right before the accident.

Unlike the generic data insurers use, a professional appraiser digs into specifics:

- Hyper-Local Market Analysis: They pinpoint recently sold comparable vehicles in your area to establish a real-world replacement cost.

- Vehicle-Specific Details: Every upgrade, from a premium sound system to your car’s impeccable condition, is properly valued.

- Industry-Standard Methodology: Their process is transparent, defensible, and follows recognized appraisal practices that hold up under scrutiny.

The moment you provide a certified appraisal, the conversation shifts. You are now a prepared claimant armed with credible, third-party proof.

An independent appraisal report moves the burden of proof. The insurer must now explain why their internal valuation is more accurate than an objective, market-based assessment from a certified professional.

This shift in leverage is often enough to break the stalemate and lead to a much fairer settlement. When you search for an expert, look for a service providing a total loss appraisal near me to ensure the valuation reflects your local market.

Negotiating a Fair Settlement With Your Insurer

Armed with your evidence and a certified independent appraisal, you are ready to negotiate. Effective negotiation in total loss appraisal insurance claim disputes isn’t about emotion; it’s about clear, confident communication backed by undeniable proof.

The goal is to move the adjuster from their lowball number to a fair settlement that reflects your vehicle’s true worth. It all starts with a professional counteroffer.

Crafting a Professional Rebuttal

Your first move should be a written counteroffer, usually via email. This creates a clear record of your dispute. Keep it concise, logical, and professional.

Your rebuttal email needs three key things:

- A Clear Statement of Disagreement: Politely state that you are rejecting their offer because it does not reflect your vehicle’s Actual Cash Value (ACV).

- A Point-by-Point Takedown of Their Report: Systematically list every error you found in their valuation. Use direct, factual language. For example, “Your report lists my vehicle’s trim as the base ‘LX’ model, but my attached window sticker confirms it is the ‘EX-L’ trim.”

- Presentation of Your Evidence: Attach everything: your independent appraisal, local comparable vehicle listings, maintenance records, and photos.

Pro Tip: Reference your attachments directly in your email. For example: “Please see the attached SnapClaim Certified Appraisal, which establishes a Fair Market Value of $24,500. This is supported by the three local dealer listings also attached.”

This methodical approach forces the adjuster to address your specific points instead of giving a generic response. It shows them you’re serious and prepared.

Mastering Communication with the Adjuster

Once your email is sent, the real negotiation begins. Be firm and persistent, but always stay professional.

- Stick to the Facts: Every conversation should circle back to one thing: the vehicle’s valuation. Instead of, “My car was worth more,” try, “Your valuation used comps from 200 miles away; my attached certified appraisal demonstrates a local market value of $24,500.”

- Take Detailed Notes: After every call, write down the date, time, the adjuster’s name, and a summary of the discussion. Follow up with a short email confirming the key points to create a paper trail.

- Don’t Jump at the First New Offer: If the adjuster comes back with a slightly higher number, thank them and ask for time to review it. Compare it against your appraisal to ensure it’s genuinely fair.

Preparing for Common Pushback Tactics

Adjusters use common tactics to keep payouts low. Being prepared for their arguments will help you stand your ground.

- “We don’t accept third-party appraisals.” This is a classic bluff. Respond calmly: “My policy doesn’t exclude using a certified, independent appraiser to establish fair market value. Could you point me to the specific policy language that states that?”

- “Those online listings are just asking prices.” A fair point, but you have a counter: “I understand they’re asking prices, but they represent the current replacement cost in my local market, which is the basis for ACV. Your report used dissimilar vehicles from a different market.”

- “We have to use the comps from our system.” A logical rebuttal: “If your system is producing a value that is thousands below the verifiable local market price, then the system’s data is flawed and needs to be manually corrected with the real-world evidence I’ve provided.”

Insurers often get it wrong. One review of 46 appraisal clause cases found that insurers undervalued claims by an average of $5,312—an error rate of nearly 46%. You can learn more about these findings and see how final awards often doubled initial offers after an appraisal. This is why pushing back with solid evidence is so important.

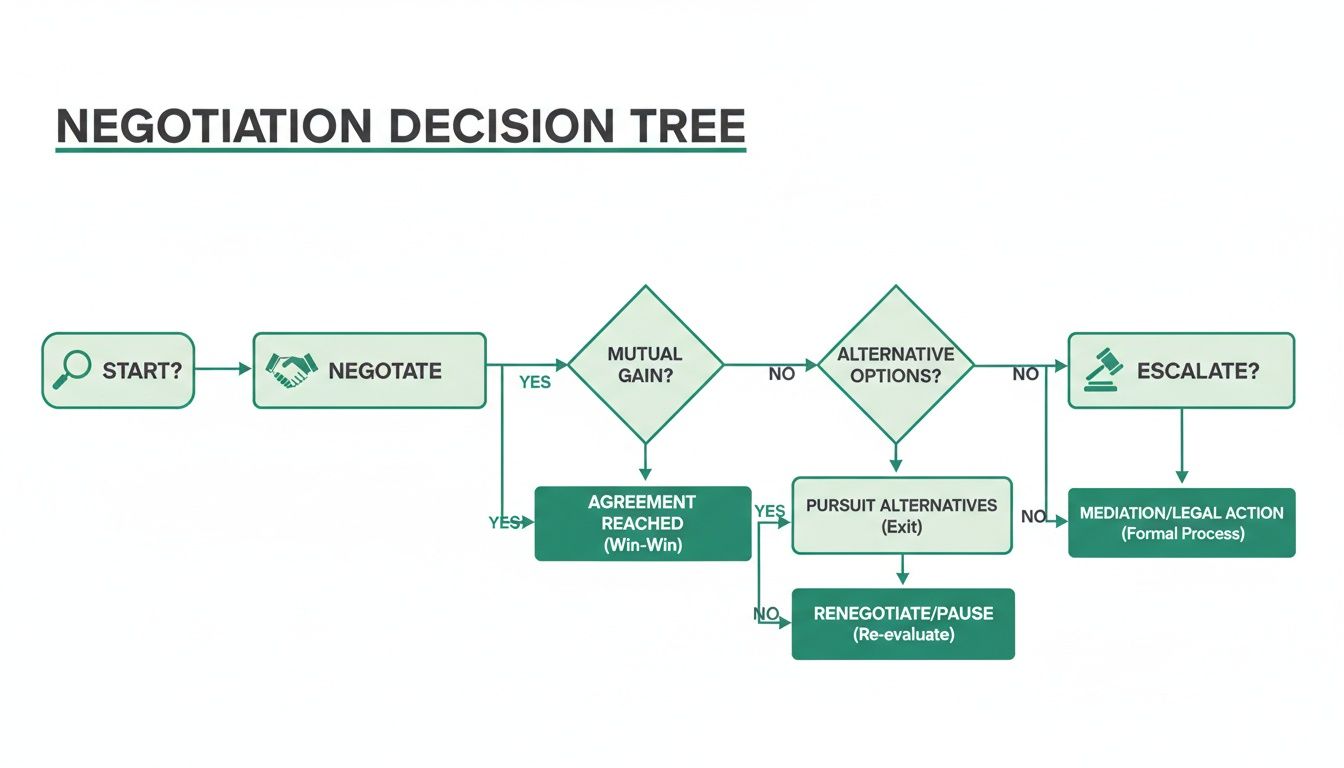

Understanding Your Escalation Options When Talks Stall

So, you’ve presented your evidence and tried to negotiate in good faith, but the adjuster won’t budge. This frustrating stalemate is common in total loss appraisal insurance claim disputes, but it’s not the end of the road.

When direct negotiation fails, you have powerful consumer rights and formal escalation tools at your disposal.

The Appraisal Clause: Your Policy’s Secret Weapon

Buried in the fine print of most auto insurance policies is the “Appraisal Clause.” This is a built-in dispute resolution tool you can activate when you and your insurer are at a standstill over your vehicle’s value.

When you invoke the clause:

- You hire your appraiser: You choose and pay for an independent appraiser to represent your valuation.

- The insurer hires their appraiser: Your insurance company hires its own appraiser.

- The appraisers try to agree: If they agree on a value, the dispute is over.

- An Umpire makes the call: If they can’t agree, they select a neutral umpire. A value agreed to by any two of the three becomes the final, binding payout.

The appraisal clause takes the decision out of the adjuster’s hands and moves it to a more structured, unbiased arena.

Filing a Complaint With Your State’s Department of Insurance

Every state has a Department of Insurance (DOI) that oversees insurance companies and protects consumers. If you believe your insurer is acting in bad faith—stalling, refusing to communicate, or using deceptive tactics—filing a formal complaint is an effective step. A formal inquiry from a state regulator often motivates insurers to resolve disputes fairly.

Considering Mediation or Legal Counsel

For complex or high-value total loss disputes, you might need more firepower. Mediation involves a neutral third party to help you and the insurer find a middle ground. If you’re hitting a brick wall with an outright denial, it’s worth exploring strategies to fight insurance claim denial. Knowing these escalation paths exist means you don’t have to take “no” for an answer.

FAQ: Common Questions About Total Loss Disputes

Navigating total loss appraisal insurance claim disputes is less stressful when you have clear answers to common questions.

Can I reject the insurance company’s first offer?

Yes, and you probably should. An insurer’s first offer is a starting point for negotiation, not a final command. You have the right to reject it if you believe your vehicle was worth more. Politely inform the adjuster in writing that you do not accept their valuation and will be providing your own evidence.

How long do I have to settle a total loss claim?

The deadline is set by your state’s statute of limitations for property damage, which is typically two to six years. You can find details on our state-specific law pages. However, you shouldn’t wait. The market data you need to win your case, like comparable vehicle listings, gets stale quickly. Act as soon as you receive a low offer.

What if my loan balance is higher than the settlement?

This is called being “upside-down” on your loan. If you owe more than the final Actual Cash Value (ACV) settlement, you are responsible for the difference. This is why GAP (Guaranteed Asset Protection) insurance is so valuable, as it covers that remaining balance. Fighting for a fair ACV is critical, as a higher payout can shrink or eliminate that gap.

Is an independent appraisal worth the cost?

Yes. For most people, a professional appraisal from a service like SnapClaim is a smart investment. It provides data-backed proof that adjusters and umpires take seriously, turning an emotional argument into a factual discussion. The settlement increase often far exceeds the appraisal’s cost. SnapClaim also offers a Money-Back Guarantee: if your insurance recovery from the claim is less than $1,000, we refund the full appraisal fee.

Don’t Let the Insurance Company Have the Final Say

Dealing with a total loss is stressful, but you never have to accept an insurer’s lowball settlement. By understanding the process, gathering strong evidence, and using a certified independent appraisal, you can confidently handle total loss appraisal insurance claim disputes.

Remember, the insurer’s first offer is just a starting point. A professional appraisal from SnapClaim gives you the objective proof needed to level the playing field and transforms the conversation from opinions to facts. This move strengthens your claim and signals that you’re serious about getting a fair payout.

With SnapClaim’s Money-Back Guarantee, it’s a risk-free investment. If your insurance recovery is less than $1,000, we refund the full appraisal fee—guaranteed.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.