Devils Lake Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Devils Lake total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Devils Lake Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Devils Lake, Fargo, or Bismarck and the payout seems too low, you don’t have to accept it. North Dakota drivers have the right under their insurance policy’s appraisal clause to request an independent Devils Lake total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout North Dakota to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in Devils Lake

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in the Fargo and Bismarck metro areas. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Devils Lake region.Why Devils Lake Vehicle Owners Often See Undervalued Offers

- Devils Lake’s used car market remains strong, especially for trucks and SUVs like Ford F-150, Chevy Silverado, GMC Sierra, and Toyota 4Runner.

- Insurance valuations often rely on cheaper listings from smaller rural towns.

- Local demand around Fargo, Bismarck, Minot, and Grand Forks raises vehicle resale prices.

What Your Devils Lake Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Devils Lake, Fargo, Bismarck, Minot, and Grand Forks markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within North Dakota

Devils Lake and Surrounding Areas We Serve

- Fargo

- Bismarck

- Minot

- Grand Forks

- Williston

- Wahpeton

- Jamestown

- West Fargo

- Dickinson

- Mandan

- Devils Lake

- Valley City

- Beulah

- Horace

How to Dispute a Devils Lake Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Devils Lake total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many North Dakota clients gain $2,000–$6,000 more with proper documentation.

Local Insight: Devils Lake Market Trends

- High demand for trucks, SUVs, and 4×4 vehicles across North Dakota.

- Dealerships in Fargo and Bismarck set the state’s pricing benchmarks.

- Insurers often pull comps from lower-priced rural markets, reducing valuations.

Example Devils Lake Case Study

Vehicle: 2020 Toyota Tacoma TRDInsurance Offer (CCC): $27,800

SnapClaim Appraisal: $31,100

Final Settlement: $30,750 after invoking the appraisal clause

Helpful North Dakota Resources

- North Dakota Department of Insurance — File a Complaint

- North Dakota Century Code — Insurance Laws

- North Dakota Courts — Small Claims

Ready to Get Your Devils Lake Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related North Dakota Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in {Devils Lake}

How SnapClaim Helps Devils Lake Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Devils Lake market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Devils Lake metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“After my SUV was totaled in Devils Lake, the insurance company undervalued my Hyundai Tucson. I ordered a North Dakota total loss appraisal from SnapClaim, and they got the report back the same day. With their documentation, I recovered $4,050 more.”

— Jack P., Devils Lake, ND

Devils Lake Total Loss – Frequently Asked Questions

How is a vehicle declared a total loss in Devils Lake, North Dakota?

In Devils Lake, a vehicle is typically considered a total loss when repair expenses approach or exceed its actual cash value. Insurers evaluate Ramsey County market pricing, mileage, prior condition, and local resale demand. North Dakota total loss standards.

Why can vehicle values in Devils Lake differ from larger North Dakota cities?

Devils Lake has a smaller, more utility-focused vehicle market. Local buyers often prioritize durability and winter reliability over luxury features, which can shift values compared to metro areas.

Does rural driving around Devils Lake affect total loss valuations?

Yes. Frequent travel on county roads and rural highways can add wear to suspension and driveline components, which appraisers consider during valuation.

What types of vehicles hold value best in Devils Lake?

Four-wheel-drive trucks, practical SUVs, and well-maintained sedans with proven winter performance tend to retain stronger value in the Devils Lake area.

Can lake-area use or outdoor features impact a total loss settlement?

Yes. Vehicles equipped with towing packages, roof racks, or corrosion protection may see valuation adjustments if these features are documented and in good condition.

What common oversight do Devils Lake drivers make after a total loss?

Many owners rely on insurer comparisons from distant cities, overlooking local Devils Lake listings that better reflect true market value.

How does seasonal use affect vehicle valuations in Devils Lake?

Vehicles used year-round, especially through harsh winters, are evaluated for wear, while well-documented maintenance can help offset seasonal impact.

Why do Devils Lake residents seek independent total loss appraisals?

Independent appraisals focus on Devils Lake–specific demand and Ramsey County pricing instead of generalized state or regional averages. Devils Lake total loss help.

Can disagreements over condition delay a Devils Lake total loss claim?

Yes. Differences in opinion about condition, mileage, or features can extend negotiations, but clear photos and service records usually speed resolution.

How does SnapClaim support Devils Lake vehicle owners?

SnapClaim prepares Devils Lake–focused valuation reports using verified local listings, vehicle-specific features, and real Ramsey County market data. Start a Devils Lake claim.

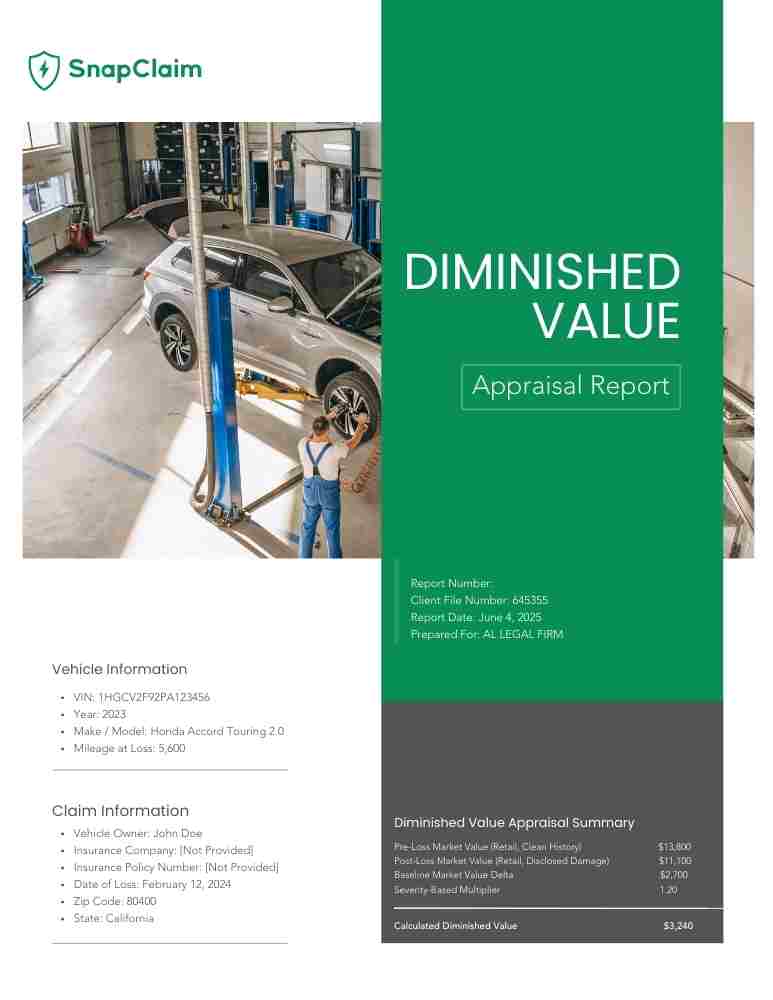

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.