Total Loss Appraisal in Minnesota

Get Your Free Estimate in minutes.

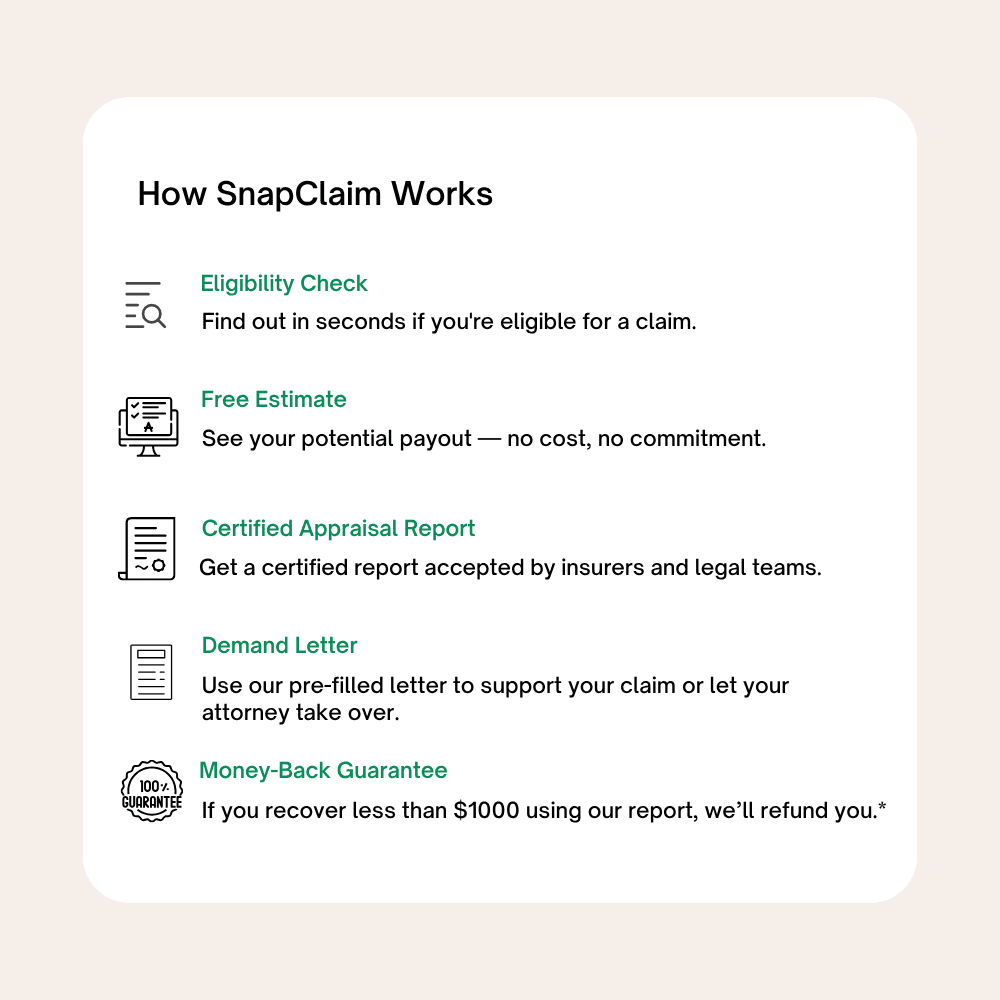

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Minnesota total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Minnesota: What You Need to Know

Minnesota Total Loss Appraisal — Challenge a Low ACV Offer & Get a Fair Settlement

If your vehicle was declared a total loss in Minnesota and the insurance payout feels too low, you do not have to accept the insurer’s valuation. You have the right to request an independent Minnesota total loss appraisal to determine your vehicle’s true Actual Cash Value (ACV) immediately before the accident.

From Minneapolis, Saint Paul, Bloomington to Rochester, Duluth, Maple Grove and cities across the state, SnapClaim helps Minnesota drivers and attorneys dispute inaccurate total loss offers using local, market-supported data.

Our certified total loss appraisal reports are data-driven, USPAP-aware, and insurer-ready — commonly used in appraisal clause disputes, negotiations, and small-claims matters throughout Minnesota.

Why Get a Total Loss Appraisal in Minnesota?

Minnesota’s vehicle market is shaped by harsh winters, strong demand for AWD and SUVs, and pricing differences between Twin Cities metro areas and outstate markets. Automated valuation tools often fail to capture these realities.

- Higher demand for AWD, SUVs, and winter-capable vehicles

- Pricing differences between Twin Cities suburbs and greater Minnesota

- Mileage adjustments that don’t reflect long suburban commutes

- Trim packages and safety options frequently miscoded by valuation software

CCC, Mitchell, or Audatex reports may undervalue Minnesota vehicles by pulling comps from cheaper regions, misidentifying trim or drivetrain, or applying unsupported condition deductions. A SnapClaim appraisal focuses on Minnesota-relevant comparables and transparent adjustments.

Common Reasons to Question a Minnesota Total Loss Offer

- Incorrect trim, AWD/FWD designation, or factory options

- Comparable vehicles sourced outside the Twin Cities market

- Excessive condition deductions without documentation

- Improper mileage assumptions for suburban driving patterns

- Higher trims or winter packages valued as base models

What’s Included in Your Minnesota Total Loss Appraisal Report

- Full VIN-decoded analysis confirming trim, drivetrain, and installed features

- Comparable listings sourced from Minnesota and nearby regional markets

- A clearly supported pre-loss fair market value (ACV)

- Adjustments for mileage, options, upgrades, and overall condition

- Documentation to support invoking the appraisal clause under your policy

- Optional expert support if the dispute escalates or involves legal counsel

Most Minnesota total loss appraisals are completed in about 1 hour and are ready to send directly to the insurance adjuster.

Minnesota Total Loss Disputes & Appraisal Rights

Many Minnesota auto insurance policies include an appraisal clause allowing either party to dispute a vehicle’s value using independent appraisers. If the appraisers cannot agree, a neutral umpire may determine the final value.

- Minnesota Department of Commerce — Insurance

- Minnesota DVS — Titles & Registration

- Minnesota Courts — Conciliation Court

How to Dispute a Total Loss Offer in Minnesota

- Request the insurer’s valuation report (CCC, Mitchell, or Audatex).

- Review the report carefully for errors in trim, mileage, or condition.

- Order a SnapClaim total loss appraisal to establish true ACV.

- Invoke the appraisal clause if the insurer’s offer is unsupported.

- Negotiate using documented market evidence to support a higher payout.

Minnesota Market Insights

- AWD and winter packages often command above-average pricing.

- Suburban Twin Cities markets can exceed statewide averages.

- High-mileage vehicles may be undervalued by generic formulas.

- Limited availability of certain trims increases replacement cost.

Example Minnesota Case Study

Vehicle: 2021 Subaru Outback Limited AWD

Insurance Offer: $28,200

SnapClaim Appraisal: $33,100

Outcome: Settlement increased after submitting the independent appraisal

Helpful Minnesota Resources

- Minnesota Insurance — Consumer Help

- Minnesota Courts — Self-Help

- Minnesota Department of Public Safety

- NHTSA — Vehicle History Search

Ready to Get Your Minnesota Total Loss Appraisal?

- No upfront payment required

- Most reports completed in about 1 hour

- Insurer-ready documentation with market-backed ACV

Related Minnesota Locations

Click a pin to open the city’s total loss page.

Find your Minnesota city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Minnesota

If your car was declared a total loss in Minnesota but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Minnesota total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my SUV was declared a total loss following a winter collision in Maple Grove, the insurance company’s offer came in well below what similar vehicles were selling for across Minnesota. I ordered a SnapClaim appraisal, and their report clearly documented the true market value using regional comps. Once I submitted it, the insurer increased my settlement by more than $3,150.”

Olivia N.,

Maple Grove, MN

Minnesota Total Loss – Frequently Asked Questions

When is a vehicle considered a total loss in Minnesota?

Minnesota total loss decisions are commonly handled using a Total Loss Formula (TLF) approach. A vehicle is generally treated as a total loss when the insurer decides it is not economical to repair because the cost of repairs plus salvage value approaches or exceeds the vehicle’s Actual Cash Value (ACV) immediately before the crash. See how Minnesota compares to other states here: total loss laws by state.

What does Actual Cash Value (ACV) mean on a Minnesota total loss claim?

ACV is your vehicle’s fair market value right before the accident. It should be supported by real Minnesota listings and local pricing—Twin Cities and statewide markets (for example Minneapolis, Saint Paul, Rochester, Duluth, Bloomington, Maple Grove, Woodbury, Plymouth, and nearby areas)—then adjusted for year, trim, mileage, options, and condition. Learn how ACV should be calculated: Fair Market Value & ACV.

The Minnesota total loss offer seems low — what should I review in the valuation?

Ask for the insurer’s full valuation report (CCC, Mitchell, Audatex, etc.) and check for: incorrect trim, missing packages/options, mileage errors, condition deductions that don’t match photos, or comps pulled from non-comparable regions that don’t reflect Minnesota demand. Many drivers and law firms use an independent SnapClaim Minnesota total loss appraisal to support a higher, data-backed ACV: order a Minnesota total loss appraisal.

The valuation deducted for “rust” or “winter wear” — is that normal in Minnesota?

Minnesota vehicles can be subject to winter-related wear, but deductions should still be evidence-based. If the report applies a rust/wear adjustment, ask for the inspection notes and photos supporting it. If your vehicle was well-maintained (garage kept, undercoating, recent service), provide documentation to correct an overstated condition deduction.

Does Minnesota use a fixed percentage threshold to total a car?

Minnesota is often handled using the Total Loss Formula rather than a single published percentage. That means the decision often turns on whether repair costs plus salvage value are close to or greater than the vehicle’s ACV. Insurers may also declare an economic total loss based on safety and repair feasibility.

What happens to my title if my car is totaled in Minnesota?

When a vehicle is processed as a total loss in Minnesota, it is typically issued a salvage/branded title (or salvage documentation). If the vehicle is repaired, Minnesota may require inspections and documentation before it can be titled and registered again. Salvage history can affect resale value and insurance options.

Can I keep my totaled vehicle in Minnesota and repair it?

Often, yes. If you choose to retain the salvage, the insurer typically reduces your payout by the vehicle’s estimated salvage value. You keep the vehicle and then follow Minnesota’s rebuild and inspection requirements before it can be legally driven again. A proper appraisal helps confirm ACV and salvage deductions are fair: talk to our Minnesota appraisal team.

What if the salvage value deduction is too high?

Salvage value can vary depending on demand and how the insurer estimates it (auction bids, vendor tools, or generic tables). If you’re keeping the vehicle, ask for the supporting documentation behind the salvage number. An inflated salvage deduction can shrink your settlement, and an independent appraisal can help you dispute it: Minnesota total loss appraisals.

Will my Minnesota total loss payout include sales tax and registration fees?

Some total loss settlements include applicable taxes and certain title/registration fees needed to replace the vehicle, but practices vary by insurer and policy. Always request an itemized breakdown showing ACV, taxes, fees, and deductions so you can verify accuracy.

How long do I have to pursue a property damage or total loss claim in Minnesota?

Minnesota has statutes of limitations that set deadlines for property damage and injury claims. The applicable deadline depends on your facts and can change over time. Missing a deadline can affect your rights, so consult a Minnesota attorney if timing may be an issue. SnapClaim supports negotiations with valuation reports: see how our Minnesota reports are used.

Does my Minnesota auto policy have an appraisal clause for ACV disputes?

Many auto policies used in Minnesota include an appraisal clause for disputes over vehicle value (ACV). Typically, each side selects an appraiser; if they can’t agree, a neutral umpire helps decide the amount. This process is most commonly used when the claim is under your own coverage. A detailed valuation can strengthen your position: Minnesota total loss appraisals.

Does SnapClaim work statewide in Minnesota, including smaller cities and rural areas?

Yes. SnapClaim supports valuations across all of Minnesota—Twin Cities metro, regional hubs, and rural communities. Our reports use hyper-local comparable vehicles so the valuation reflects real Minnesota pricing instead of generic national averages. Start here: SnapClaim Minnesota hub.

How fast can I get a Minnesota total loss appraisal from SnapClaim?

Most Minnesota total loss appraisals are completed the same business day after we receive your claim details and supporting documents—often within about an hour. That speed helps you respond quickly to low offers: request a Minnesota total loss appraisal.