Frankfort Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Frankfort total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Frankfort Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Frankfort, Louisville, or Lexington and the payout seems too low, you don’t have to accept it. Kentucky drivers have the right under their insurance policy’s appraisal clause to request an independent Frankfort total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout Kentucky to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in Frankfort

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in Kentucky’s urban and rural regions. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Frankfort metro area.Why Frankfort Vehicle Owners Often See Undervalued Offers

- Frankfort’s used car market remains strong, especially for trucks and SUVs like Toyota Tacoma, Honda CR-V, Ford F-150, and Subaru Outback.

- Insurance valuations frequently rely on listings from other states or lower-cost regions.

- Local demand around Louisville, Lexington, and Bowling Green raises vehicle resale prices.

What Your Frankfort Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Frankfort, Louisville, Lexington, and Bowling Green markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within Kentucky

Frankfort and Surrounding Areas We Serve

- Louisville

- Lexington

- Bowling Green

- Owensboro

- Covington

- Richmond

- Georgetown

- Florence

- Hopkinsville

- Elizabethtown

- Henderson

- Nicholasville

- Frankfort

- Paducah

How to Dispute a Frankfort Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Frankfort total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many Kentucky clients gain $2,000–$6,000 more with accurate documentation.

Local Insight: Frankfort Market Trends

- High demand for reliable trucks, SUVs, and sedans across urban and rural areas.

- Dealerships in Louisville and Lexington influence statewide pricing.

- Insurers may use comps from out-of-state regions, lowering payouts.

Example Frankfort Case Study

Vehicle: 2021 Toyota Tacoma SR5Insurance Offer (CCC): $29,800

SnapClaim Appraisal: $33,200

Final Settlement: $32,900 after invoking the appraisal clause

Helpful Kentucky Resources

Ready to Get Your Frankfort Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related Kentucky Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Frankfort

How SnapClaim Helps Frankfort Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Frankfort market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Frankfort metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“After my Volkswagen Passat was totaled in Frankfort, the insurance payout didn’t reflect local market prices. SnapClaim’s same-day appraisal helped increase my settlement by $3,900.”

— EmilyT., Frankfort, KY

Frankfort Total Loss – Frequently Asked Questions

When is a vehicle considered a total loss in Frankfort, Kentucky?

In Frankfort, a car is labeled a total loss when the estimated repair costs outweigh the vehicle’s pre-accident value under Kentucky loss standards. Kentucky Total Loss Guide.

Does Frankfort’s smaller market affect vehicle valuations?

Yes. Limited local inventory can cause insurers to rely on distant pricing, which may not accurately reflect Frankfort-area demand.

Can government or fleet use impact a Frankfort total loss value?

Vehicles previously used for official or fleet purposes may be valued differently. Clear documentation helps ensure accurate classification. Vehicle Value Factors.

Do recent repairs matter for total loss claims in Frankfort?

Recent mechanical or cosmetic repairs can raise a vehicle’s market value if properly documented and submitted.

What documents should Frankfort drivers prepare after a total loss?

Owners should gather the title, payoff statements, maintenance records, and photos showing the vehicle’s pre-accident condition.

Is retaining a totaled vehicle an option in Frankfort?

Yes. Keeping the vehicle reduces the settlement by salvage value and may require additional inspections under Kentucky law.

How are outstanding loans handled after a Frankfort total loss?

Insurance payments go to the lender first, with any remaining balance issued to the vehicle owner.

Why do Frankfort drivers seek independent total loss appraisals?

Independent appraisals use verified Frankfort-area listings rather than generalized pricing models. Frankfort Total Loss Appraisal.

Does who caused the accident affect Frankfort total loss value?

Liability determines which insurer pays, but the vehicle’s fair market value remains the same.

How does SnapClaim support Frankfort vehicle owners?

SnapClaim provides Frankfort-specific valuation reports backed by current market data to help owners challenge low insurance offers. Start Your Frankfort Appraisal.

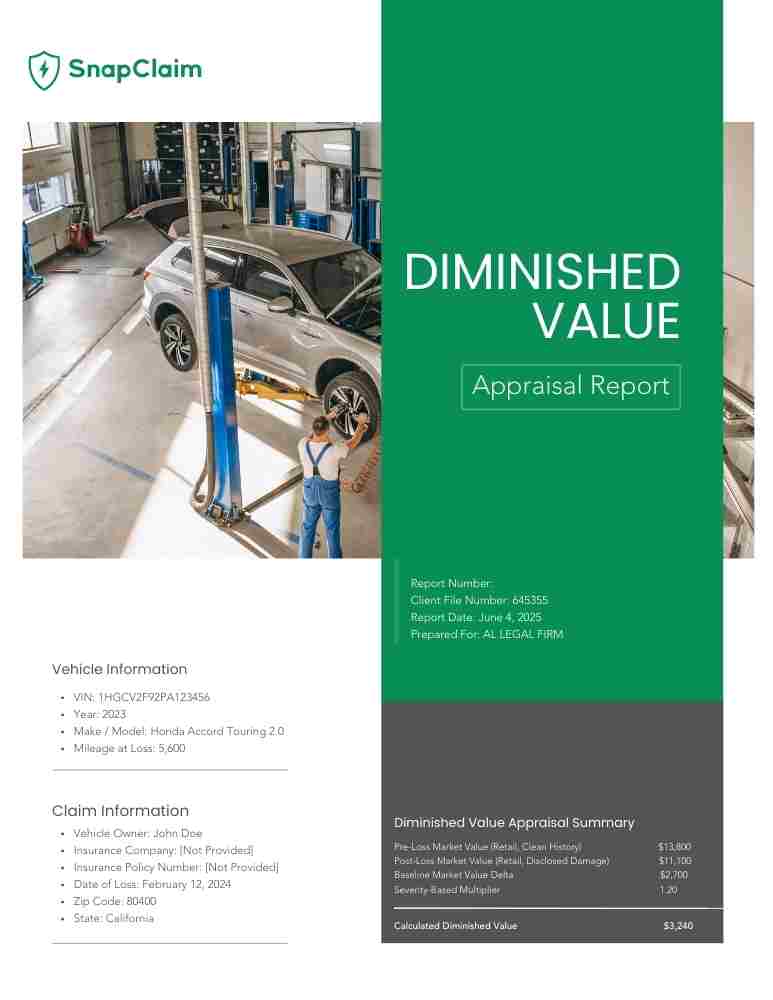

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.