After an accident caused by a USAA member, your car’s resale value can drop—even after perfect repairs. In this guide, you’ll learn how to file a diminished value claim with USAA to recover that lost value and ensure you’re fairly compensated.

Understanding the Process

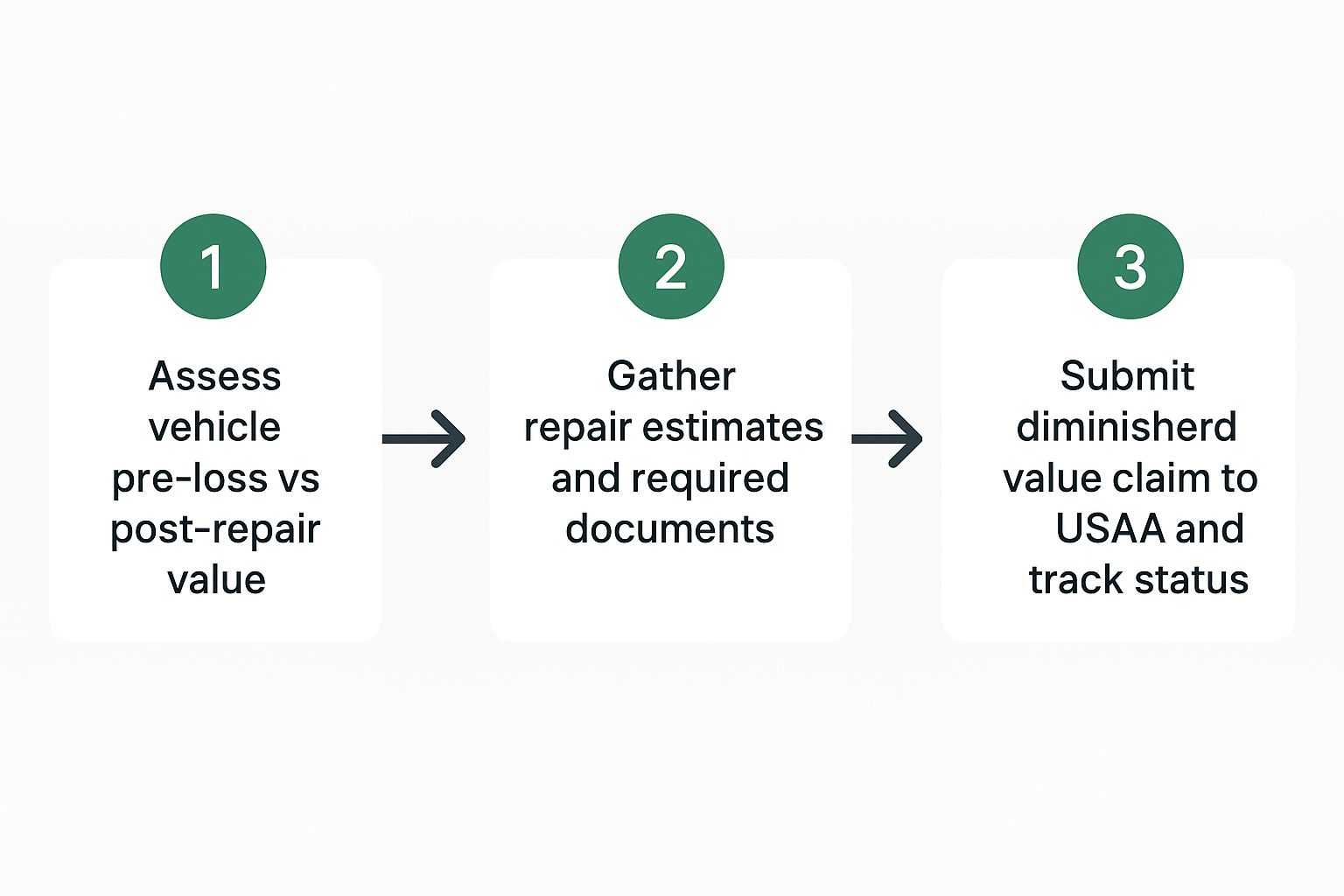

If you’re new to this, it’s worth taking a moment to understand the basics. Our detailed guide on what a diminished value claim is explains why this compensation is so critical for vehicle owners. To file a claim with USAA, the process boils down to proving your loss with solid evidence and formally demanding the compensation you are owed. You can learn more about Step-by-Step Guide to Filing Auto Insurance Claims.

The Burden of Proof Is on You

Here’s the hard truth: an insurance adjuster’s job is to protect their company’s finances, not to voluntarily pay the full amount your vehicle has lost in value. You have to prove your loss with credible evidence.

This is where a certified appraisal report from an independent expert comes in. An objective, data-driven SnapClaim report provides the proof you need to counter their lowball offer and negotiate from a position of strength.

| Key Stages of a USAA Diminished Value Claim | | :— | :— | :— | | Stage | Key Action | Goal | | Assessment | Gather all accident and repair documents. | Organize your initial evidence to understand the scope of the damage and repairs. | | Valuation | Obtain a certified, independent diminished value appraisal. | Establish the true monetary loss your vehicle has suffered with an expert report. | | Demand | Submit a formal demand letter to the USAA adjuster. | Clearly state the amount you are claiming and provide the appraisal as proof. | | Negotiation | Respond to USAA’s initial offer with facts and data. | Counter their low offer and negotiate a fair settlement based on your evidence. |

With these stages in mind, you can approach the claim process methodically and avoid leaving money on the table.

How USAA Calculates Diminished Value

When you get an offer from USAA, the number can seem surprisingly low. It’s not random; it’s the result of a specific internal formula they use to standardize these payouts. Understanding their starting point is key to building a strong counter-negotiation.

USAA, like many insurers, often uses a calculation known as the “17c formula” to determine its initial offer. The process starts with your vehicle’s pre-accident value, or Fair Market Value, using guides like NADA or Kelley Blue Book. You can learn How to File a USAA Car Insurance Claim.

The 17c Formula in Action

The 17c formula immediately caps the maximum possible diminished value at 10% of the car’s pre-accident value.

For example, if your car was worth $30,000 before the accident, USAA’s starting point for your entire claim would be capped at just $3,000.

From that initial 10% figure, USAA applies two major deductions, or “modifiers,” that shrink the payout even further:

- Damage Modifier: This adjusts the amount based on the severity of the damage. Minor cosmetic issues result in a larger reduction than significant structural or frame damage.

- Mileage Modifier: The payout is cut again based on your car’s mileage at the time of the accident. Higher mileage means a bigger deduction.

Why Their Formula Falls Short

This cookie-cutter approach rarely reflects what’s actually happening in the used car market. The final number they offer is based on their internal math, not on how real buyers will react to a car with an accident on its history report.

A vehicle’s true loss in value is determined by what a willing buyer will pay for it, not by a generic insurance company formula. This gap is precisely where your opportunity to negotiate lies.

This is why their first offer can feel so disconnected from your car’s real-world loss. You can get a much better sense of your car’s situation by using a professional diminished value claim calculator to find a more realistic starting point. An independent appraisal gives you the hard evidence needed to push back against their internal numbers and fight for what you’re truly owed.

Building an Evidence-Based Claim They Can’t Ignore

When filing a diminished value claim, your opinion on your car’s lost value doesn’t carry much weight with an adjuster. What they can’t ignore, however, is cold, hard proof. You must present a professional demand backed by undeniable evidence, showing them—not just telling them—that your vehicle has lost real market value.

Your Essential Evidence Checklist

Before contacting the adjuster, organize your paperwork. This documentation is the foundation of your entire claim.

Make sure you have these key items ready:

- The Official Accident Report: This document establishes what happened and who was at fault.

- Photos and Videos: Take pictures of the damage from every angle before repairs begin, as well as photos showing the completed work.

- The Final Itemized Repair Invoice: This critical document lists every part replaced and all labor performed, proving the collision’s severity and creating a permanent record future buyers will see.

While this paperwork is essential, your single most powerful tool is a certified, independent appraisal. An insurer’s internal valuation is designed to serve their interests. A SnapClaim report delivers an unbiased, data-backed assessment of your car’s specific loss in value, which helps strengthen your claim.

You can learn more by reading about a professional car appraisal after an accident. It’s how you level the playing field.

A certified appraisal isn’t just a suggestion; it’s professional evidence. It forces the negotiation to shift from their internal formula to a discussion based on real-world market data.

If pulling all this together feels overwhelming, resources like affordable paralegal services can provide assistance to help get your case organized. And remember, every SnapClaim appraisal comes with our money-back guarantee. If your insurance recovery is less than $1,000, we refund your appraisal fee completely.

How to Negotiate Your USAA Claim Like a Pro

With your evidence organized and a certified appraisal report in hand, it’s time to engage with the USAA adjuster. This is where your preparation pays off.

Start by sending a professional demand letter. This formal document clearly states your claim for diminished value. Attach your certified appraisal as the primary piece of evidence to shift the conversation away from their internal formula and onto the real-world market data your report provides.

Presenting Your Case Effectively

Don’t be surprised when USAA’s first offer comes in low; this is a standard opening move. Respond calmly and professionally, using your appraisal report as the anchor for every point you make.

Avoid getting emotional. Instead, point to specific facts in your report. For example, you could say, “Your offer doesn’t seem to account for the structural damage listed on the repair invoice, which my appraisal shows has a major impact on resale value.”

A real-world example from North Carolina shows how effective this is. After a collision caused $20,000 in repairs, USAA’s initial diminished value offer was only $417. The owner presented a professional appraisal and stuck to the facts, and USAA’s offer jumped to nearly $6,000. You can read about this driver’s successful negotiation to see how a credible appraisal can support negotiations with insurers.

Negotiation is a process. Keep all communication in writing to create a paper trail, and patiently refer back to your evidence with each counteroffer.

This documented, evidence-based approach makes it much harder for an adjuster to dismiss your claim. If you’re not sure where to start, get a free diminished value estimate to get a ballpark idea of your potential claim. And remember, SnapClaim’s money-back guarantee has your back: if you recover less than $1,000 from the insurance company, your appraisal fee is fully refunded.

Getting Ready for USAA’s Negotiation Tactics

Insurance adjusters are professional negotiators whose job is to minimize claim payouts. When you file a diminished value claim with USAA, you will likely encounter predictable strategies designed to protect the company’s bottom line. Knowing their playbook is the best way to prepare your countermoves.

One common tactic is delay. An adjuster might take days to return a call or let your claim sit unprocessed. The goal is to frustrate you into accepting a low settlement. The key is to be polite but persistent with your follow-ups.

Common Objections and How to Push Back

You’ll likely hear specific arguments designed to shut down your claim. Being prepared helps you stay in control of the conversation.

Here are a few common objections:

- “Our offer is final.” An adjuster often presents their first lowball number as if it’s non-negotiable. Calmly ask for a complete, written copy of their valuation report so you can compare it directly against your independent appraisal.

- “You don’t need your own appraisal.” This is a red flag. An independent appraisal is your most powerful tool. It shifts the negotiation from their biased numbers to objective, real-world market data. Wondering if it’s worth it? You can learn more about the cost and value of a diminished value appraisal and see why it’s a smart investment.

- “We don’t pay for that in your state.” This is sometimes a bluff. Adjusters may incorrectly claim that diminished value isn’t recognized for third-party claims in your state. Know your rights ahead of time by checking your state’s laws.

Remember, the first offer from an insurer is just their opening bid in a negotiation, not the final word. Your certified appraisal is what forces them to address the actual market facts.

And don’t forget, every SnapClaim report comes with our money-back guarantee. If you recover less than $1,000 on your claim, we’ll refund your appraisal fee in full.

Finalizing Your Settlement and Receiving Payment

Once you and the USAA adjuster have agreed on a settlement amount, you’re on the home stretch. But don’t rush this final step—the details are critical.

Next, USAA will send a settlement offer and a release form.

It’s tempting to sign quickly, but you must review the release form carefully. Your signature formally closes the claim for good.

Understanding the Release Form

This document legally releases USAA and their insured driver from any future claims related to this accident.

By signing, you confirm that the agreed-upon amount is the final compensation you will receive. Once it’s signed, you cannot go back and ask for more money.

Take a few minutes to read the fine print. Make sure the settlement amount matches what you agreed to verbally. Once you’re confident everything is correct, you can sign and return the release. USAA will then process your payment, and you will have successfully navigated how to file a diminished value claim with USAA.

Frequently Asked Questions (FAQ)

Navigating a diminished value claim with USAA can bring up a lot of questions. Here are answers to some of the most common ones.

Can I file for diminished value if I was at fault?

Almost never. Diminished value is pursued against the at-fault driver’s insurance, which is known as a third-party claim. Your own policy’s collision coverage is a first-party benefit designed to repair your car, not to compensate you for its lost market value. The general rule is you can only file a DV claim when another driver is liable for the accident.

What is the time limit for filing my claim?

This depends on your state’s statute of limitations for property damage. Each state sets its own deadline, but most are between two to three years from the date of the accident. It’s your responsibility to know the deadline in your state and file your claim after repairs are complete. Waiting too long could cause you to lose your right to file completely.

What if USAA denies my claim?

First, insist that they provide the denial—and their specific reason for it—in writing. This gives you an official record to argue against. Armed with a professional appraisal report, you can submit a rebuttal that systematically addresses their reasoning. If they still won’t offer a fair settlement, your next steps could include filing a complaint with your state’s Department of Insurance or pursuing the matter in small claims court.

Is an independent appraisal really worth the cost?

Yes. An insurance company’s valuation protects its own bottom line. An independent appraisal from a certified service like SnapClaim levels the playing field. You are no longer arguing opinions; you are presenting a fact-based, market-driven analysis that provides the proof needed to support your negotiations for a fair settlement.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today