Clearwater Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Clearwater total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Clearwater Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Clearwater, Miami, or Orlando and the payout seems too low, you don’t have to accept it. Florida drivers have the right under their insurance policy’s appraisal clause to request an independent Clearwater total loss appraisal that determines the car’s actual cash value (ACV) before the accident. SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout Florida to resolve valuation disputes quickly.Why Total Loss Appraisals Matter in Clearwater

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in Florida. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Clearwater metro area.Why Clearwater Vehicle Owners Often See Undervalued Offers

- Clearwater’s used car market is consistently strong, especially for hybrids, EVs, trucks, and SUVs like Toyota RAV4, Tesla Model 3, Ford F-150, and Honda CR-V.

- Insurance valuations often rely on comps from cheaper nearby states.

- High demand around Miami, Orlando, Tampa, and Jacksonville results in higher resale pricing.

What Your Clearwater Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Clearwater, Miami, Orlando, Tampa, Jacksonville, and St. Petersburg markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within Florida

Clearwater and Surrounding Areas We Serve

- Miami

- Orlando

- Tampa

- Jacksonville

- St. Petersburg

- Hialeah

- Port St. Lucie

- Cape Coral

- Tallahassee

- Fort Lauderdale

- Pembroke Pines

- Hollywood

- Gainesville

- Miramar

How to Dispute a Clearwater Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Clearwater total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many Florida clients gain $2,000–$6,000+ more with accurate documentation.

Local Insight: Clearwater Market Trends

- Florida has high demand for EVs, hybrids, trucks, and SUVs.

- Miami and Orlando show higher dealer pricing compared to inland Florida.

- Insurers often use comps from rural areas, lowering payouts unfairly.

Example Clearwater Case Study

Vehicle: 2018 Honda Accord EXInsurance Offer (CCC): $14,800

SnapClaim Appraisal: $17,900

Final Settlement: $17,700 after invoking the appraisal clause

Helpful Florida Resources

- Florida Department of Financial Services

- Florida Highway Safety & Motor Vehicles

- Florida Courts — Small Claims

Ready to Get Your Clearwater Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related Florida Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Clearwater

How SnapClaim Helps Clearwater Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Clearwater market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Clearwater metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“When my sedan was totaled in Clearwater, the insurance company tried to settle with a number that didn’t reflect what cars were actually going for in Pinellas County. I decided to order a SnapClaim total loss appraisal, and their report laid out the real local market value with solid, undeniable data. The insurer ended up raising the payout by a huge margin, which made replacing my car surprisingly smooth.”

— Megan T., Clearwater, FL

Clearwater Total Loss – Frequently Asked Questions

How is a total loss determined in Clearwater?

A vehicle in Clearwater is considered a total loss when the repair cost plus salvage value reaches or exceeds its Actual Cash Value (ACV). Learn more about Florida guidelines here: Total Loss State Laws.

What affects ACV for Clearwater vehicles?

ACV is based on recent Clearwater & Pinellas County market listings, mileage, condition, trim level, and optional features. Guide: Fair Market Value Guide.

Does insurance pay full value for a totaled vehicle in Clearwater?

Insurance companies typically pay your vehicle’s current market value. If the other driver is at fault, your deductible usually does not apply.

How can I dispute a low total loss offer in Clearwater?

You can compare the offer with Clearwater local comps or order an independent appraisal: Clearwater Total Loss Appraisal.

What happens to my title after a total loss in Clearwater?

After a total loss, your vehicle receives a Florida Salvage Title. Once repaired and inspected, you may apply for a Rebuilt Title.

Can I keep my totaled car in Clearwater?

Yes, you can keep it, but your payout will be reduced by the vehicle’s salvage value. You must complete the Florida rebuilt title process before driving it again.

Are taxes and fees reimbursed in Clearwater total loss settlements?

Many insurance policies reimburse sales tax, registration fees, and title charges. Always request a line-item breakdown: ACV Line Items.

How long do I have to file a total loss claim in Clearwater?

Florida law allows you up to 5 years to file a property damage claim.

Why is Clearwater market data important for ACV?

Local Clearwater & Pinellas County market data reflects true resale value, which is more accurate than statewide averages.

What is an appraisal clause for Clearwater total loss claims?

An appraisal clause allows both sides to hire their own appraisers. If the valuations don't match, a neutral umpire makes the final decision.

Are SnapClaim reports accepted in Clearwater courts?

Yes — SnapClaim reports are accepted in Pinellas County small claims court, mediation, and arbitration.

How fast can I get a Clearwater total loss appraisal?

Most Clearwater appraisals are completed the same day — often within one hour.

What if I owe more than my car’s value in Clearwater?

GAP insurance may cover any negative equity. An independent appraisal can also support a higher ACV during your claim.

How does SnapClaim help Clearwater drivers?

SnapClaim uses Clearwater & Pinellas County market data to produce court-ready total loss valuations. Start your appraisal.

Daytona Beach Total Loss – Frequently Asked Questions

How is a total loss determined in Daytona Beach?

In Daytona Beach, a vehicle is considered a total loss when the repair cost plus salvage value equals or exceeds its Actual Cash Value (ACV). Florida law sets the framework for these calculations. Learn more: state-by-state rules.

What factors affect Actual Cash Value (ACV) in Daytona Beach?

ACV considers your car's make, model, year, mileage, options, condition, and recent sales of similar vehicles in Daytona Beach & Volusia County. Local market data ensures your ACV reflects realistic resale value. See how ACV is calculated: Fair Market Value.

Will my insurance cover a totaled car in Daytona Beach?

Yes. Your insurer pays the vehicle’s fair market value at the time of loss. If using your own policy, a deductible may apply; if the at-fault driver’s insurer pays, usually no deductible is required.

How can I dispute a low total loss offer in Daytona Beach?

Review the insurer's valuation report, check if local Daytona Beach comps were used, and highlight missing options. You can also order an independent Daytona Beach total loss appraisal from SnapClaim: Daytona Beach Total Loss Appraisals.

What happens to my car title after a total loss in Daytona Beach?

The Florida DMV issues a Salvage title for totaled vehicles. Once repairs are completed and inspected, you may apply for a rebuilt title before driving the vehicle legally.

Can I keep my totaled vehicle in Daytona Beach?

Yes, but your settlement will decrease by the salvage value. Florida’s rebuilt title process must be completed before you can legally drive it again.

Are fees and taxes included in Daytona Beach total loss settlements?

Total loss settlements may cover sales tax, title, and registration fees under Florida law. Always request an itemized breakdown from your adjuster. More info: ACV & line items.

How long do I have to file a total loss claim in Daytona Beach?

Daytona Beach total loss claims follow Florida's statute of limitations for property damage, generally five years from the accident date. Submit claims promptly while evidence is current.

Why is local Daytona Beach market data important for ACV?

Daytona Beach vehicle prices differ from other Florida areas. Using local Daytona Beach comparable vehicles ensures your ACV reflects the real resale conditions in your area.

What is an appraisal clause in Daytona Beach insurance policies?

Many auto policies include an appraisal clause. If you and the insurer disagree on your car’s value, each side hires an appraiser and a neutral umpire decides the final valuation.

Can independent appraisals be used in court or arbitration in Daytona Beach?

Yes. SnapClaim’s certified Daytona Beach total loss appraisals can be used in small claims court, mediation, or arbitration.

How quickly can I get a Daytona Beach total loss appraisal?

Most Daytona Beach appraisals are completed same day, often within an hour, allowing you to respond quickly to insurance offers.

What if I owe more than my car is worth in Daytona Beach?

Any negative equity is your responsibility. If you have GAP insurance, it may cover the difference between your loan and the ACV. An independent appraisal can help document value.

How does SnapClaim assist Daytona Beach drivers?

SnapClaim uses verified Daytona Beach comps to provide accurate, court-ready total loss valuations, helping drivers secure fair settlements. Start now.

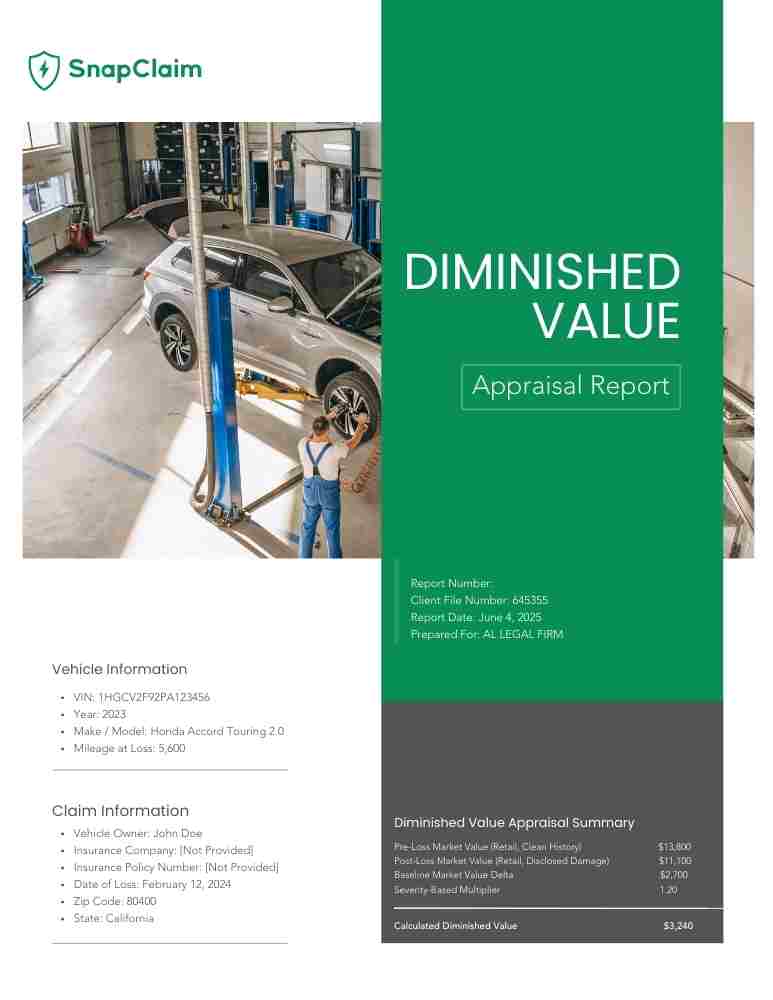

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.