Total Loss Appraisal in

Florida

Get Your Free Estimate in a Minute!

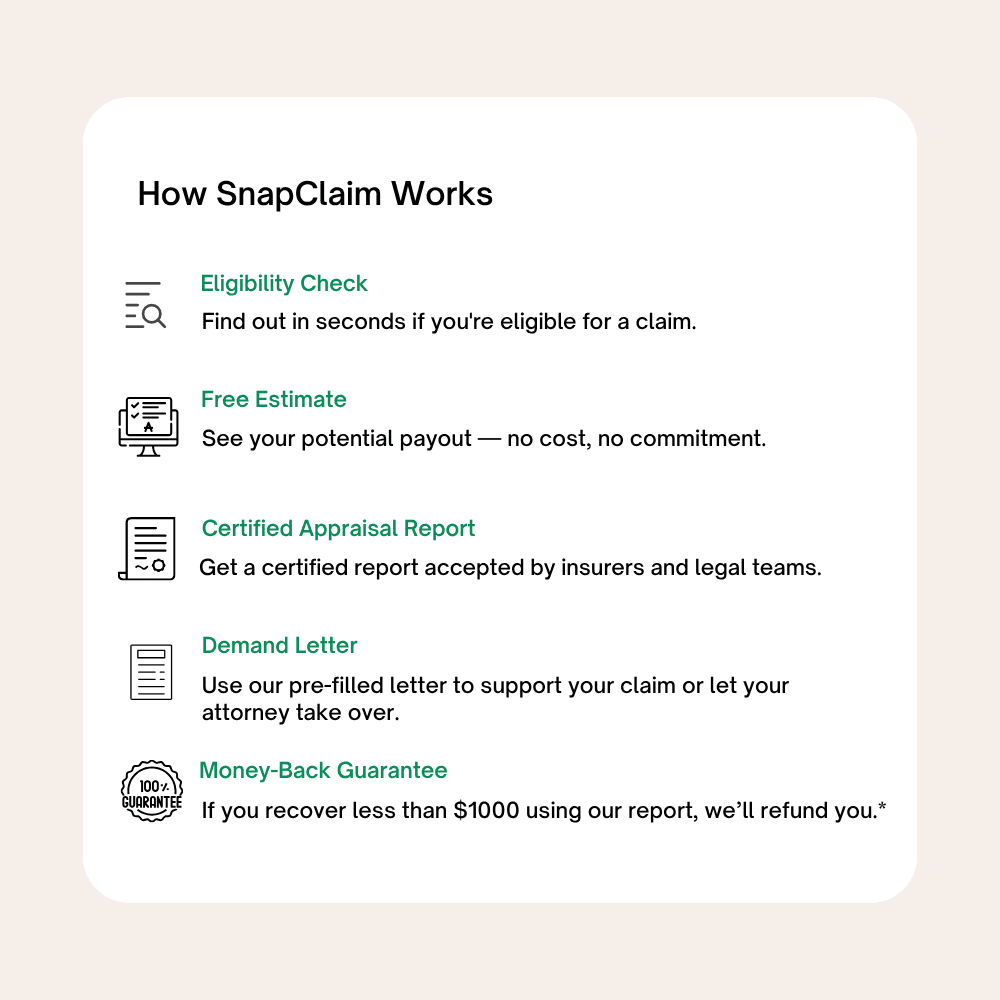

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Florida total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Florida: What You Need to Know

Florida Total Loss Appraisal — Get the True Value of Your Totaled Vehicle

If your vehicle was declared a total loss in Florida and the insurance payout seems too low, you have the right to request an independent Florida total loss appraisal. Whether the loss occurred in Miami, Orlando, Tampa, Jacksonville, Fort Lauderdale, or any other part of the state, SnapClaim helps you recover your vehicle’s fair market value (ACV) and secure the settlement you’re owed. Our certified total loss appraisal reports are data-driven, USPAP-aware, and insurer-ready — trusted by adjusters, attorneys, and small-claims courts across Florida.Why Get a Total Loss Appraisal in Florida?

When a vehicle is totaled, insurers must pay its true actual cash value (ACV). Florida often sees undervalued CCC/Mitchell reports, especially in high-demand markets like Miami, Tampa, and Orlando where used-car prices remain elevated due to tourism, population growth, and supply shortages. A SnapClaim independent appraisal ensures your payout reflects real Florida resale values — not artificially low comps from other states.Common Reasons to Dispute a Total Loss Offer

- Incorrect trim, mileage, or equipment in the insurer’s report

- Comparables pulled from cheaper out-of-state markets

- Unjustified mileage, condition, or prior-use deductions

- Florida-specific demand premiums ignored (SUVs, hybrids, EVs)

- Flood-zone adjustments misapplied or unsupported

What’s Included in Your Florida Total Loss Appraisal Report

- Full VIN-based evaluation with trim, options, and mileage verification

- Local comparable listings from Miami, Tampa, Orlando, Jacksonville, and beyond

- Accurate pre-loss fair-market-value calculation

- Transparent adjustments for features, mileage, and market trends

- Documentation to invoke the appraisal clause under your Florida policy

- Optional expert support for arbitration or litigation

Florida Total Loss Laws & Appraisal Rights

Florida insurance law allows policyholders to dispute a total loss valuation and demand an independent appraisal through the policy’s appraisal clause. If both appraisers disagree, a neutral umpire makes the final value determination.- Florida Administrative Code 69B-220 — Claims Adjusting

- Florida Department of Financial Services — Consumer Help

- Florida Small Claims Court

How to Dispute a Total Loss Offer in Florida

- Request the insurer’s valuation report (CCC, Mitchell, or Audatex).

- Order a SnapClaim total loss appraisal to determine true ACV.

- Invoke the appraisal clause in your policy if values differ.

- Submit the independent appraisal to your adjuster or attorney.

- Negotiate using documented evidence — many Florida drivers recover thousands more.

Local Insight: Florida Market Trends

- Miami, Tampa, and Orlando remain among the strongest resale markets in the Southeast.

- Trucks and SUVs (F-150, Tacoma, CR-V, RAV4) command premium pricing.

- Hurricane seasons impact inventory, increasing resale values for clean-title vehicles.

- EVs and hybrids are rapidly gaining demand in metro areas.

Example Florida Case Study

Vehicle: 2019 Honda Accord EX-L Insurance Offer (CCC): $17,950 SnapClaim Appraisal: $21,300 Final Settlement: $20,900 after appraisal clause invocationHelpful Florida Resources

- Florida Department of Financial Services — File a Complaint

- Claims Adjusting Rules (69B-220)

- Small Claims Court Filing Guide

- NHTSA — Vehicle History Lookup

Ready to Get Your Florida Total Loss Appraisal?

- No upfront payment required

- Report delivered in about 1 hour

- Fair-market-value and insurer-ready report included

Related Florida Locations

- Jacksonville

- Miami

- Tampa

- Orlando

- St. Petersburg

- Hialeah

- Tallahassee

- Port St. Lucie

- Cape Coral

- Fort Lauderdale

- Pembroke Pines

- Hollywood

- Miramar

- Gainesville

- Coral Springs

- Clearwater

- Palm Bay

- Pompano Beach

- West Palm Beach

- Lakeland

- Davie

- Miami Gardens

- Boca Raton

- Deltona

- Plantation

- Sunrise

- Palm Coast

- Largo

- Deerfield Beach

- Melbourne

- Boynton Beach

- Lauderhill

- Kissimmee

- Homestead

- Tamarac

- Delray Beach

- Daytona Beach

- North Miami

- Wellington

- North Port

Click a pin to open the city’s total loss page.

Find your Florida city below to order your Total Loss Appraisal.

- Jacksonville, FL

- Miami, FL

- Tampa, FL

- Orlando, FL

- St. Petersburg, FL

- Hialeah, FL

- Tallahassee, FL

- Port St. Lucie, FL

- Cape Coral, FL

- Fort Lauderdale, FL

- Pembroke Pines, FL

- Hollywood, FL

- Miramar, FL

- Gainesville, FL

- Coral Springs, FL

- Clearwater, FL

- Palm Bay, FL

- Pompano Beach, FL

- West Palm Beach, FL

- Lakeland, FL

- Davie, FL

- Miami Gardens, FL

- Boca Raton, FL

- Deltona, FL

- Plantation, FL

- Sunrise, FL

- Palm Coast, FL

- Largo, FL

- Deerfield Beach, FL

- Melbourne, FL

- Boynton Beach, FL

- Lauderhill, FL

- Kissimmee, FL

- Homestead, FL

- Tamarac, FL

- Delray Beach, FL

- Daytona Beach, FL

- North Miami, FL

- Wellington, FL

- North Port, FL

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Florida

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Florida total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my minivan was totaled on I-95 near Fort Lauderdale, the insurer tried to settle for an amount that didn’t even cover a comparable replacement. SnapClaim’s Florida total loss appraisal spelled out the real market value using South Florida comps, and it completely shifted the negotiation. I ended up recovering $4,250 more than the original offer.”

Mike N.

Fort Lauderdale, FL

Florida Total Loss – Frequently Asked Questions

How is a car declared a total loss in Florida?

Florida generally uses an 80% total loss threshold. If the reasonable cost to repair your vehicle (and in some cases its salvage value) reaches around 80% or more of the car’s Actual Cash Value (ACV) before the crash, the insurer may declare it a total loss under state rules. Learn more in our guide to state-by-state total loss laws.

What does Actual Cash Value (ACV) mean on a Florida claim?

ACV is your car’s fair market value in Florida just before the accident. It’s based on year, make, model, trim, mileage, options, condition, and local Florida listings (Miami, Orlando, Tampa, Jacksonville, Fort Lauderdale, and nearby markets). See how ACV is calculated in our Fair Market Value guide.

Do I have to accept the first total loss offer from the insurance company?

No. You can request the full valuation report (CCC, Mitchell, etc.), review every comparable, and push back if Florida comps, options, mileage, or condition are missing or undervalued. Many drivers use a SnapClaim Florida total loss appraisal to show a higher, data-backed value: Florida total loss appraisals.

Does Florida being a “no-fault” (PIP) state change my total loss claim?

Florida’s no-fault rules mainly affect injury (PIP) benefits, not whether your car is a total loss. Vehicle damage is usually handled under the at-fault driver’s property damage liability coverage or your own collision coverage. The total loss value is still based on ACV and Florida market data. For a deeper overview, visit our Florida total loss & diminished value hub.

What happens to my title after a total loss in Florida?

When a vehicle meets Florida’s total loss rules, the insurer or owner usually surrenders the title and the state issues a salvage title or, for severely damaged vehicles, a certificate of destruction. If the vehicle is properly repaired and inspected, it may later qualify for a rebuilt title before going back on the road. Always review title branding carefully before agreeing to a settlement.

Can I keep my totaled car in Florida?

Often, yes. If you choose to retain the salvage, the insurer typically reduces your cash settlement by the vehicle’s estimated salvage value, and your Florida title will be branded accordingly (salvage or rebuilt after repairs). SnapClaim can help you understand whether the proposed salvage value and ACV are in line with the Florida market: talk to our Florida total loss team.

Are taxes, tag, and title fees included when my car is totaled in Florida?

Many Florida total loss settlements include state sales tax and certain tag and title fees needed to replace your vehicle, but it’s not automatic. Ask your adjuster for an itemized breakdown of ACV, taxes, and all fees. Our valuation guide explains these line items in more detail: Fair Market Value & ACV breakdown.

What if I still owe more on my auto loan than the insurance pays?

If your payoff is higher than the total loss settlement, you may have negative equity. You’re still responsible for that balance unless you have GAP insurance or loan/lease payoff coverage. Getting an accurate, Florida-specific ACV from SnapClaim can reduce or eliminate that gap by making sure your payout reflects real market value: get a Florida total loss appraisal.

How long do I have to deal with a Florida total loss or property damage claim?

Florida law sets strict statutes of limitations for car accident claims, and recent changes have shortened some deadlines. Property-damage-only lawsuits are often limited to just a few years, and injury claims may have even shorter timeframes. Because deadlines can change and depend on your situation, talk with a Florida attorney as soon as possible if you’re unsure about timing. SnapClaim focuses on the valuation side of your total loss and provides appraisals that support those discussions: see how our Florida reports are used.

What is an appraisal clause in a Florida auto policy and can it help me?

Many Florida auto policies have an appraisal clause for disputes over total loss value. It usually allows you (as the insured) and the insurer to each hire an appraiser; if they disagree, a neutral umpire helps set the value. This process is normally available only under your own policy, not when you’re making a purely third-party claim against the other driver’s insurer. A SnapClaim report can support you if you invoke appraisal: learn how our Florida appraisals are used.

Can I use SnapClaim if the accident happened in a different Florida city?

Yes. SnapClaim works statewide. Whether your crash happened in Miami, Orlando, Tampa, Jacksonville, Tallahassee, or a smaller Florida city, we pull hyper-local comps that reflect your actual market. You can start from our Florida landing page: Florida total loss & DV overview or go straight to the appraisal order form: order a Florida total loss appraisal.

How fast can I get a Florida total loss appraisal from SnapClaim?

Most Florida total loss appraisals are completed the same business day after we receive your claim info and documents—often in about an hour. That speed lets you counter low offers quickly before the claim drags on. Get started here: start your Florida total loss appraisal.

How does a SnapClaim report help Florida drivers negotiate a better payout?

SnapClaim builds a Florida-specific valuation file using verified listings, condition adjustments, options, mileage, and market corrections for your city. The report clearly shows how your ACV was calculated and where the insurer’s number may fall short. Many clients recover thousands more after presenting a SnapClaim appraisal: see examples of Florida total loss results.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.