If you’ve received a low settlement, it’s important to dispute the diminished value offer before accepting it. Insurance companies often start with a figure far below your car’s true post-accident loss in value. Understanding how they calculate diminished value—and how to challenge it—can help you recover thousands more from your claim.

Why You Need to Dispute Your Diminished Value Offer if Is a Lowball

Insurance companies don’t calculate your car’s lost value based on what a real buyer would pay for a vehicle with an accident history. Instead, they use internal formulas designed to keep their payouts as low as possible.

One common tool is the notorious “17c formula.” This calculation is known for producing unfairly low numbers. It starts by capping the maximum diminished value at 10% of the car’s pre-accident value, then cuts that amount even more with harsh deductions for mileage and damage. In simple terms, it’s a system built to undervalue your claim from the start.

Understanding the Insurer’s Playbook

That first offer isn’t an objective assessment; it’s a business tactic. Insurers count on you accepting their initial number without questioning it, because many people do. But the gap between their offer and what you’re truly owed can be thousands of dollars.

For example, a 2023 Maryland case involved an insurer offering just $1,300 for diminished value on a car with $15,000 in repairs. After the owner disputed the offer with an independent appraisal, the final settlement was $3,800—nearly three times the original amount.

The table below shows how an insurer’s math differs from reality.

Insurer’s Formula vs. Real-World Value: A Comparison

| Metric | Insurer’s Initial Offer | Independent Appraisal Value |

|---|---|---|

| Formula Used | 17c or proprietary internal calculation | Real-world market data and comparables |

| Typical Offer | $1,300 (based on a real case) | $3,800 (actual settlement) |

| Goal | Minimize insurer payout | Accurately reflect market value loss |

| Basis | Arbitrary caps and deductions | Evidence-based market analysis |

This isn’t a rare occurrence. The numbers consistently show that a well-supported dispute can help you recover significantly more than the insurance company’s initial offer.

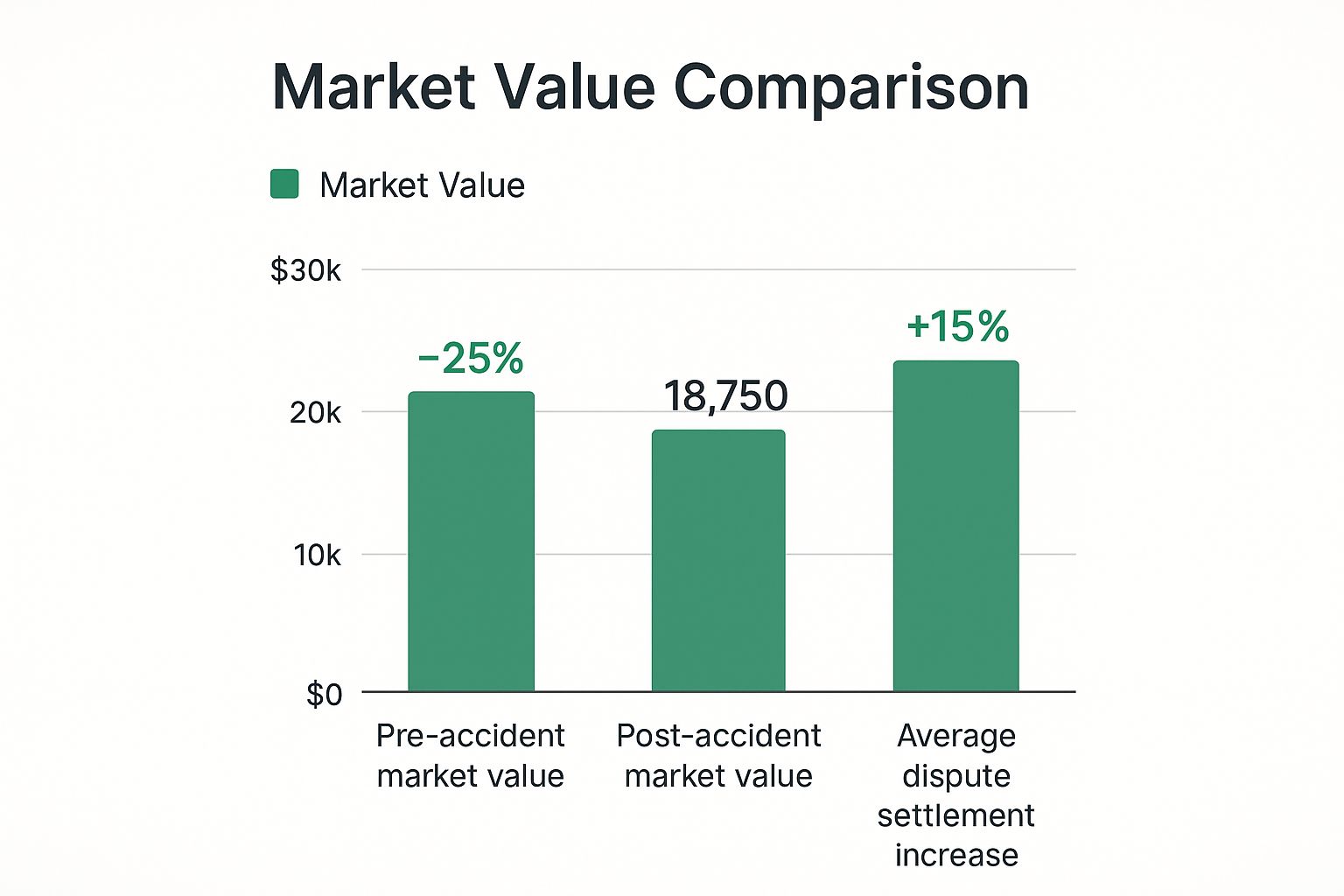

The data is clear: an accident hurts your car’s market value, but successfully disputing the insurance company’s low offer can help you recover a large portion of that loss. The first step is understanding how much an accident can devalue a car.

Building Your Evidence File for a Strong Dispute

If you’re going to dispute a diminished value offer, your opinion alone isn’t enough. You need solid proof. Insurance adjusters respond to data and documents, not just arguments. The most important step you can take is to build a comprehensive evidence file that supports your claim.

Think of it like building a case. Every piece of documentation strengthens your position and makes it harder for the insurer to defend their lowball offer.

You can learn more about how to dispute a lowball diminished value offer.

Your Essential Document Checklist

An organized file shows the adjuster you are serious. A messy, incomplete submission is easy to dismiss, but a professional package demands attention.

Here’s what you need to include in your file:

- The Official Accident Report: This is essential. It establishes the facts of the crash and who was at fault.

- Detailed Repair Invoices: The final bill isn’t enough. Get the itemized invoice that lists every part, hour of labor, and all materials used. This shows the true extent of the repairs.

- Before-and-After Photos: Visuals are powerful. Include clear photos of the damage right after the accident and high-quality pictures of the car after repairs are complete.

Pro Tip: Visit a few local car dealerships and ask for a written statement explaining how an accident history would lower your vehicle’s trade-in value. This is real-world proof from market experts that is difficult for an adjuster to ignore.

The Centerpiece of Your Dispute

While these documents are important, one piece of evidence is the most critical: a certified, independent appraisal.

This isn’t just another opinion. It’s a professional valuation from an unbiased expert who provides a credible, market-based assessment of your car’s lost value. A professional report shows you’ve done your homework and are serious about getting fair compensation.

An independent appraisal provides the solid proof needed to anchor your claim and confidently dispute diminished value offer. A great next step is to learn more about a professional car appraisal after an accident.

SnapClaim reports provide the proof needed to negotiate fair compensation. And with our money-back guarantee, if the insurance recovery from the claim is less than $1,000, the appraisal fee is fully refunded.

How to Write a Demand Letter That Gets Results

Once you have your evidence gathered, it’s time to draft a formal demand letter to dispute diminished value offer.

Think of this letter as a professional, structured argument, not a complaint. It’s your opportunity to show the insurance adjuster that you are organized, well-informed, and negotiating from a position of strength.

The key is to keep it professional—be firm, factual, and logical. Leave emotion out of it. Your goal is to systematically explain why their offer is too low and present your counter-offer, backing it up with the proof you’ve gathered. This letter can shift the entire negotiation away from their flawed formula and toward your real-world financial loss.

Structuring Your Letter for Maximum Impact

A strong demand letter should be clear and easy to read. Don’t make the adjuster search for information. Lay out your case with precision.

Your letter should include these essential points:

- A Clear Statement of Intent: Start by stating that you are formally dispute diminished value offer and presenting a counter-demand.

- Brief Accident Summary: Quickly recap the accident details, including the date, location, and the fact that their insured was at fault.

- The Inadequacy of Their Offer: Explain why their offer is unacceptable. State their offer amount and contrast it with your own documented findings.

- Presentation of Evidence: This is where you introduce your proof. Reference your repair invoice, dealership statements, and most importantly, your SnapClaim certified appraisal report.

- Your Formal Demand: Clearly state the exact dollar amount you are demanding based on your appraisal. Be specific.

By attaching your SnapClaim appraisal, you’re not just sharing your opinion—you’re providing an expert, data-driven valuation that helps strengthen your claim. It becomes the anchor for your entire argument.

Remember, a strong letter can often prevent a long, drawn-out fight. It shows the insurer that your claim is valid and that you are prepared to defend it.

Negotiating With The Insurance Adjuster

After you send your demand letter, expect a call from the insurance adjuster. This is where the real negotiation begins as you formally dispute the diminished value offer. Preparation is key.

To succeed in your negotiation, stay calm, professional, and stick to the facts. Your independent appraisal report is your most powerful tool. When the adjuster pushes back—and they will—your job is to steer the conversation back to the evidence you’ve provided. They are trained negotiators, but you have the data on your side.

Countering Common Adjuster Tactics

Insurance adjusters often use a script. They might tell you their formula is an “industry standard” or that your appraisal isn’t valid. Don’t let these tactics distract you. Your response should be simple and direct.

Here’s a common scenario:

Adjuster: “Our offer is based on the 17c formula, which is what we use for all claims.”

Your Response: “I understand you have your methods, but that formula doesn’t reflect the actual market in our area. My certified appraisal is based on real-time sales data for comparable vehicles, and it supports a loss in value of $X,XXX.”

Always document every conversation. After a phone call, send a brief follow-up email summarizing what you discussed. This creates a paper trail and holds the adjuster accountable.

Having a professional report removes the guesswork and gives you the proof needed to stand your ground. Our SnapClaim reports provide the proof needed to support negotiations with insurers.

With SnapClaim, you can negotiate with confidence. Our money-back guarantee ensures that if your insurance recovery is less than $1,000, your appraisal fee is fully refunded. You have nothing to lose by fighting for the fair compensation you deserve.

What to Do When the Insurer Won’t Cooperate

You’ve built a solid case with all the right evidence, but the insurance company still won’t offer a fair amount. This is a common tactic: they hope you’ll get frustrated and give up.

Don’t fall for it. Hitting a roadblock isn’t the end—it’s just a sign that it’s time to escalate. You are never forced to accept a lowball settlement when you dispute diminished value offer. You have options, and knowing what to do next is how you get paid fairly.

File a Complaint With Your State’s Department of Insurance

Your first official step should be filing a complaint with your state’s Department of Insurance (DOI). The DOI is the government agency that regulates insurance companies and investigates consumer complaints.

Filing a complaint is free and usually gets a quick response. Insurers are legally required to respond to the state, which forces them to take your claim seriously instead of giving you the runaround.

To get started, you’ll need to find your state’s agency. A trusted directory like USA.gov is the best way to ensure you’re filing with the correct regulatory body.

Consider Small Claims Court

If a DOI complaint doesn’t resolve the issue, small claims court is your next option. The process is designed for individuals to resolve disputes without needing a lawyer, making it a practical and low-cost choice.

Your certified appraisal report becomes your expert evidence in court. Presenting your professional documentation provides a powerful, fact-based argument. Many insurers will settle before the court date to avoid the time and expense. Your willingness to go to court shows them you’re not backing down.

This strategy is similar to disputing a total loss offer—it all comes down to having solid, undeniable proof.

These two steps can provide the leverage needed for most diminished value disputes. They turn the tables and put the pressure back on the insurer to pay what you’re owed.

FAQ: Disputing a Diminished Value Offer

Here are answers to a few common questions vehicle owners have when preparing to dispute a diminished value offer.

Can I dispute a diminished value offer without a lawyer?

Yes, absolutely. Many vehicle owners successfully negotiate a higher settlement on their own by building a strong, evidence-based case. The key is to stay organized and provide solid proof to back up your claim. A certified independent appraisal from a service like SnapClaim gives you the expert validation needed to effectively counter their low offer and dispute their diminished value offer.

How long do I have to file a diminished value claim?

The time you have to file, known as the statute of limitations, varies by state. It is typically between two and five years from the date of the accident. However, you shouldn’t wait. It’s best to start the process as soon as your vehicle’s repairs are complete. Acting quickly ensures all details are fresh and makes gathering documents easier. Always check your specific state’s laws to confirm the filing deadline.

Does it matter if my car is leased or has a loan?

Yes, and you should absolutely still pursue a claim. An accident on your vehicle’s history can cause significant financial penalties, regardless of who holds the title.

For Leased Vehicles: The damage can lead to penalties for “excessive wear and tear” when you return the car.

For Financed Vehicles: The loss in value can leave you with negative equity, meaning you owe more on your auto loan than the car is worth.

A diminished value settlement helps offset these financial losses, protecting you from future out-of-pocket costs.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today