Has your vehicle’s value dropped after an accident caused by a Progressive-insured driver? Even with flawless repairs, an accident history can significantly lower your car’s resale price. This guide explains how to file a diminished value Progressive claim to recover the money you’re rightfully owed.

Understanding Diminished Value and Your Rights

After an accident, your immediate concern is getting your car repaired. However, the financial impact doesn’t stop there. Your vehicle now has a permanent accident record on services like CARFAX and AutoCheck, making it less attractive to future buyers.

When you eventually sell or trade in your car, you’ll have to accept a lower price simply because of its accident history. This difference between your car’s pre-accident value and its post-repair value is called inherent diminished value. It’s a real financial loss, and when a Progressive driver is at fault, their insurance should cover it.

First-Party vs. Third-Party Claims: A Critical Distinction

Your ability to file a successful diminished value claim with Progressive depends entirely on whether it is a third-party claim.

- Third-Party Claim: This is when you file against the at-fault driver’s insurance—in this case, Progressive. Most states recognize your right to be “made whole,” which includes being compensated for your car’s lost market value. This is where you have the power to negotiate.

- First-Party Claim: This is a claim against your own Progressive policy. These claims are almost always denied. Your policy is a contract to repair your vehicle, not to insure its market value against depreciation.

This isn’t just an opinion; it’s supported by legal history. The court case Siegle v. Progressive (2002) established that an insurer’s duty to “repair or replace” a vehicle under a first-party policy doesn’t automatically include paying for its diminished value. Your focus must be on the at-fault driver’s policy.

Key Takeaway: You are not asking your insurer for a favor. You are legally pursuing the at-fault driver’s Progressive policy to compensate you for the financial damage their client caused. Understanding this is the first step toward a successful negotiation. To learn more, check out our guide on what a diminished value claim is.

Building an Airtight Case with Strong Evidence

Before contacting a Progressive adjuster, you must gather all your proof. Filing a diminished value Progressive claim without solid evidence is like going into a negotiation unprepared—it simply won’t work.

Your goal is to present a well-documented, undeniable case for fair compensation. An organized approach shows the adjuster you are serious, informed, and ready to support your claim.

Your Pre-Negotiation Checklist

This checklist covers the essential documents needed to build your case file. Having these items ready will make your conversation with the adjuster far more effective.

| Document or Evidence | Why It’s Critical | Where to Find It |

|---|---|---|

| Final Itemized Repair Bill | This proves the extent of the damage by listing every part replaced and all labor performed, making it difficult for an adjuster to downplay the repairs. | The body shop that repaired your vehicle. Request the detailed invoice, not just the insurance summary. |

| Pre-Accident Service Records | Maintenance records establish your vehicle’s excellent pre-accident condition, which supports a higher pre-accident value. | Your dealership, mechanic, or personal files. |

| Before-and-After Photos | Visuals are powerful. Photos of your car before the accident, immediately after, and post-repair create a clear, compelling timeline of the damage. | Your phone’s camera roll or cloud storage. |

| Police Accident Report | This official report confirms who was at fault—a non-negotiable for any third-party claim. It removes any doubt about liability. | The police department that responded to the scene. |

While these documents are a great start, they only prove the accident happened and repairs were made. They do not prove the specific dollar amount your vehicle lost in market value.

A common mistake is assuming the insurance company will calculate this loss fairly. Their goal is to settle for the lowest amount possible. Your goal is to get what you’re owed, and that requires independent proof.

The Most Powerful Tool for Your Claim

The single most important piece of evidence is a certified, independent diminished value appraisal report. This document is your ultimate leverage.

A professional appraisal shifts the conversation from opinion (“I feel my car is worth less”) to fact (“Here is the market data proving my car is worth less”).

An independent report from a trusted expert like SnapClaim provides an unbiased valuation of your car value after accident. The report analyzes local market data, recent sales of similar vehicles (with and without accident histories), and the specifics of your repairs to deliver a data-backed figure. To see what makes a report so effective, learn how to read an appraisal report.

How Progressive Calculates Diminished Value (and How to Respond)

When you submit your evidence, Progressive won’t just accept your number. They use their own methods to calculate a vehicle’s loss in value, and understanding their strategy is key to a successful negotiation.

Insurance companies rely on standardized formulas to produce quick, low settlement offers for your diminished value Progressive claim.

The Notorious “17c” Formula

One of the most common tools they use is the 17c formula. This calculation is widely criticized as a massive oversimplification that fails to reflect real-world loss. It starts with a cap—usually 10% of the vehicle’s pre-accident Kelley Blue Book value—and then reduces that number with various “modifiers.”

Here’s a simplified look at how their math works:

- Base Loss: The formula takes your car’s pre-accident value (e.g., $30,000) and immediately caps the potential diminished value at 10%, for a starting maximum of $3,000.

- Damage Modifier: It then applies a multiplier based on damage severity. Minor cosmetic damage might reduce the payout by 75%, while severe structural damage might not get a reduction.

- Mileage Modifier: Finally, they apply another cut based on your car’s mileage. A vehicle with over 100,000 miles could see its payout cut in half again.

With this flawed logic, a potential $3,000 claim can be reduced to a frustratingly low offer of just a few hundred dollars.

Why the 17c Formula Fails

The biggest issue with formulas like 17c is that they are completely disconnected from reality. This method ignores physical inspections and relies on generic data instead of what’s happening in your local market.

The 17c formula ignores critical factors like local market demand, your vehicle’s specific desirability, repair quality, and the significant negative stigma of structural damage on a vehicle history report.

This is why an independent appraisal from SnapClaim is so powerful. It dismantles their generic approach by focusing on the only thing that truly matters: verifiable market data.

How to Counter Progressive’s Calculation

When the adjuster presents their low offer—which will almost certainly be based on a formula like 17c—your job is to show them why their number is irrelevant. Don’t argue about the formula itself; just pivot the conversation back to your evidence.

Use these talking points to steer the conversation:

- “Your formula doesn’t reflect my local market.” Then, direct them to the comparable vehicle sales in your SnapClaim report showing the price difference between clean cars and those with an accident history.

- “This calculation ignores the severity of the structural repairs.” Refer to your repair invoice and highlight the specific parts that were replaced and the labor involved.

- “My certified appraisal provides a market-driven valuation, not a theoretical one.” Emphasize that your report is based on actual sales data and professional analysis. You can see the difference yourself by using our diminished value 17c calculator.

By keeping the focus on your data-backed evidence, you remove their flawed formula from the equation and move the negotiation onto solid ground.

Submitting Your Claim and Negotiating Like a Pro

With your evidence gathered and a rock-solid SnapClaim appraisal in hand, it’s time to formally submit your diminished value Progressive claim. This is about presenting a professional, data-backed case that an adjuster cannot easily dismiss.

Your first step is to write a clear, concise demand letter. This document officially informs Progressive that you are seeking compensation for your car’s lost value.

Crafting an Effective Demand Letter

Keep your letter brief and factual to set a professional tone from the start.

Be sure to include this key information:

- Your Claim Number: Always reference the existing property damage claim number.

- A Clear Statement: State directly that you are making a claim for your vehicle’s inherent diminished value.

- Your Evidence: Attach all supporting documents, including your SnapClaim appraisal and the final repair invoice.

- Your Demand Amount: Clearly state the diminished value figure from your appraisal report as your settlement demand.

Preparing for the Adjuster’s Call

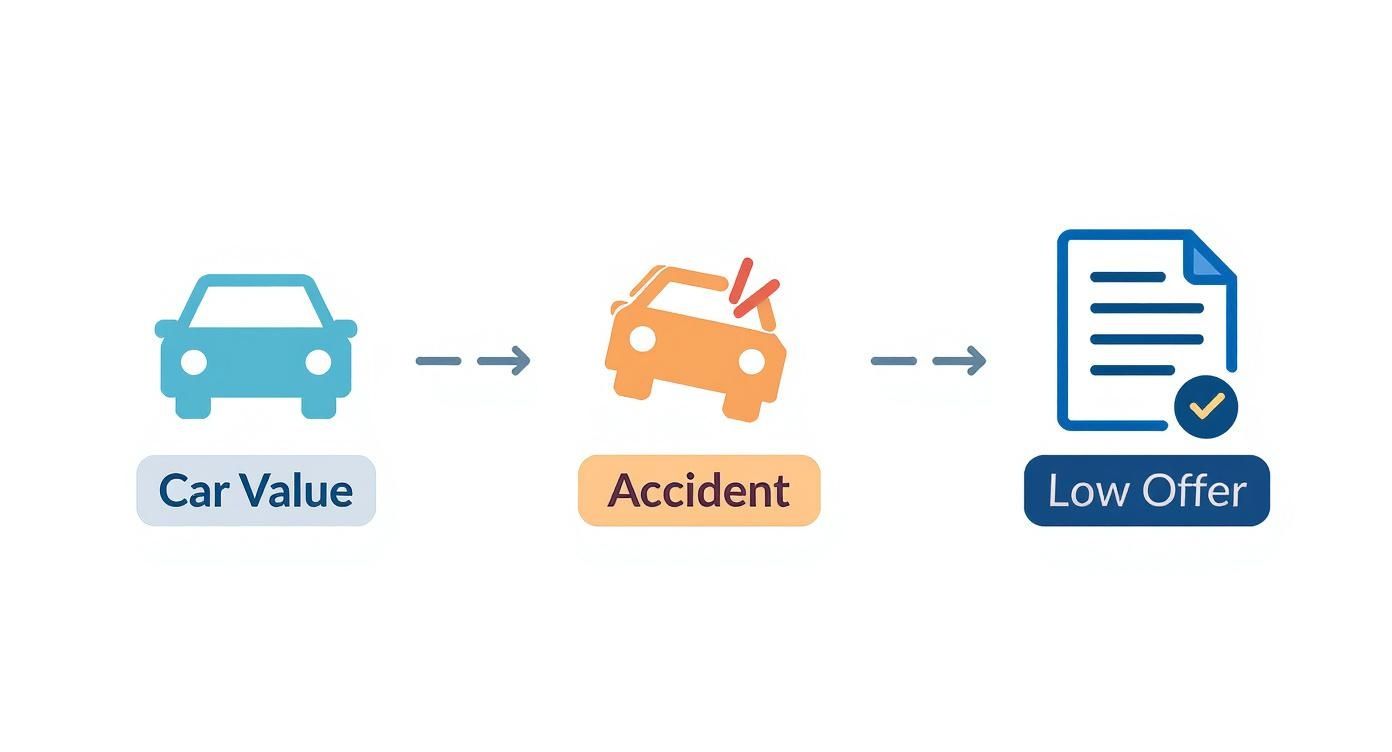

After Progressive receives your demand, an adjuster will contact you. Stay calm, be firm, and keep redirecting the conversation back to your evidence.

This visual illustrates the insurance playbook: they start with your car’s high pre-accident value and counter with a low offer. Your independent appraisal is the only way to prove the true loss and negotiate a fair settlement.

When the adjuster makes a low offer, expect to hear common objections like, “We don’t pay for that,” or “Your car was repaired to pre-accident condition.” Don’t argue. Just point them back to the facts in your appraisal.

Pro Tip: Ask the adjuster, “Can you please provide the market data you used to arrive at your offer?” This simple question often exposes the weakness in their position, as their valuation is typically based on a generic formula, not real-world sales data.

Submitting Your Claim Online

Progressive, like many insurers, has an online portal for managing claims. Use it to upload your demand letter and supporting documents. This creates a digital record of your submission, which can be useful if you need to escalate the claim later.

Persistence is key. Your certified SnapClaim appraisal provides the proof you need to negotiate confidently. And with our Money-Back Guarantee, there’s no risk. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

What to Do When Progressive Pushes Back

Receiving a low offer or an outright denial on your diminished value Progressive claim can be frustrating, but it’s rarely the final word. It’s often just an opening negotiation tactic.

Think of the initial response as a test. Adjusters want to see if you will simply give up. Your persistence, backed by solid proof like an independent appraisal, is the key to a fair outcome. A low offer isn’t the end; it’s your signal to start negotiating seriously.

Professionally Countering a Low Offer

When an adjuster gives you a low number, stay calm and professional. Put the responsibility back on them.

I recommend asking one simple question:

“Could you please email me the written documentation and market data you used to justify that offer?”

This question is effective for two reasons:

- It forces them to document their valuation method, which is often a flawed formula like 17c.

- It signals that you expect a negotiation based on facts, not a quick dismissal.

Most of the time, they cannot provide real-world market data to support their low offer. This is your opportunity to re-emphasize the strength of your independent appraisal, which is based on verifiable local market sales.

Escalating Your Claim Effectively

If the adjuster won’t negotiate fairly, your next step isn’t always a lawsuit. A powerful and underutilized tool is filing a formal complaint with your state’s Department of Insurance (DOI).

The DOI is a government agency that regulates insurers and investigates consumer complaints. Filing a complaint is free and often gets an insurer’s attention, leading to a review by a manager or an internal team motivated to resolve the issue. Sometimes, just informing the adjuster of your intent to file a complaint is enough to bring them back to the table.

Knowing When to Consider Legal Action

Unfortunately, some claims require more pressure. A 2023 survey found that only 15% of diminished value claims filed with Progressive were approved on the first attempt. The vast majority required more evidence or escalation. You can learn more about the challenges consumers face when filing insurance claims.

If all else fails, small claims court is a final option. The process is designed for you to represent yourself, and the filing fees are generally low. A judge is more likely to be persuaded by a certified, data-driven appraisal than an insurance company’s self-serving formula.

FAQ: Common Questions About Diminished Value Progressive Claims

Here are answers to some of the most common questions we hear from vehicle owners about filing a diminished value claim against Progressive.

Can I claim diminished value if the accident wasn’t my fault?

Yes. Diminished value is recovered from the at-fault party’s insurance. If a Progressive-insured driver caused the accident, you have the right to file a third-party claim against their policy for your car’s loss in value.

Can I file a diminished value claim if I was at fault?

Almost always, the answer is no. Your own insurance policy is designed to cover repairs to your vehicle, not to compensate you for its loss in market value. This is an industry-standard practice, and first-party diminished value claims are nearly impossible to win (with a few rare exceptions, such as in Georgia).

How long do I have to file my claim with Progressive?

The deadline, known as the ‘statute of limitations’ for property damage, varies by state. It can be as short as one year or as long as six. It is critical to know your state’s deadline. The best time to start your claim is right after your vehicle repairs are complete. You can learn more by checking our guide on state-specific laws.

Does it matter if my car is leased or financed?

Yes, and it makes your claim even more important. An accident history will reduce your vehicle’s value, and you are responsible for that financial gap when you trade in your car or return your lease. The money from a successful diminished value claim helps cover that loss so you don’t pay for someone else’s mistake.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.