Your car is back from the shop and looks as good as new. But there’s a problem you can’t see: a permanent black mark on its vehicle history report. This hidden loss is called diminished value, and it means your car is worth less now, even if the repairs were perfect.

When you realize the at-fault driver’s insurance company isn’t going to simply hand over a check for this lost value, searching for a “diminished value lawyer near me” is often the right next step. This guide explains when you need a lawyer and how to find the right one for your claim.

Why You Might Need a Diminished Value Lawyer

After an accident, you just want your car fixed. But the repair bill is only one part of your financial loss. The moment an accident appears on a vehicle history report, your car’s market value can drop by thousands of dollars. This is the entire basis of a diminished value claim, and it’s something insurance adjusters prefer not to discuss.

Insurance companies are in the business of minimizing payouts. They often argue that quality repairs restore your car’s pre-accident value, but any potential buyer knows that isn’t true. A car with an accident history will almost always sell for less than an identical one with a clean record.

The Insurance Company’s Playbook

Insurers use a standard set of tactics to downplay or deny diminished value claims. Knowing what to expect is the first step in protecting your financial interests.

- The Flat-Out Denial: An adjuster might incorrectly claim that your state doesn’t recognize diminished value or that their policy doesn’t cover it.

- The “Formula” Offer: They often use a generic, internal formula (like the infamous 17c formula) that produces a ridiculously low number. This approach ignores your vehicle’s unique features and the actual local market conditions.

- Delay and Defend: By dragging their feet, insurers hope you’ll get frustrated and either give up or accept a lowball offer just to be done with it.

Imagine a nearly new SUV sustains significant frame damage. Even after repairs at a certified shop, its resale value could easily drop by $5,000 to $10,000. The insurer might offer $500, citing their internal calculations. This is exactly where you need to push back with solid proof.

A good diminished value lawyer has seen these tactics hundreds of times and knows how to counter them. They build a solid case backed by hard evidence, usually starting with a professional, independent appraisal. This legal pressure signals to the insurance company that you’re serious and won’t be pushed around, forcing them to negotiate fairly.

Do I Really Need a Lawyer for a Diminished Value Claim?

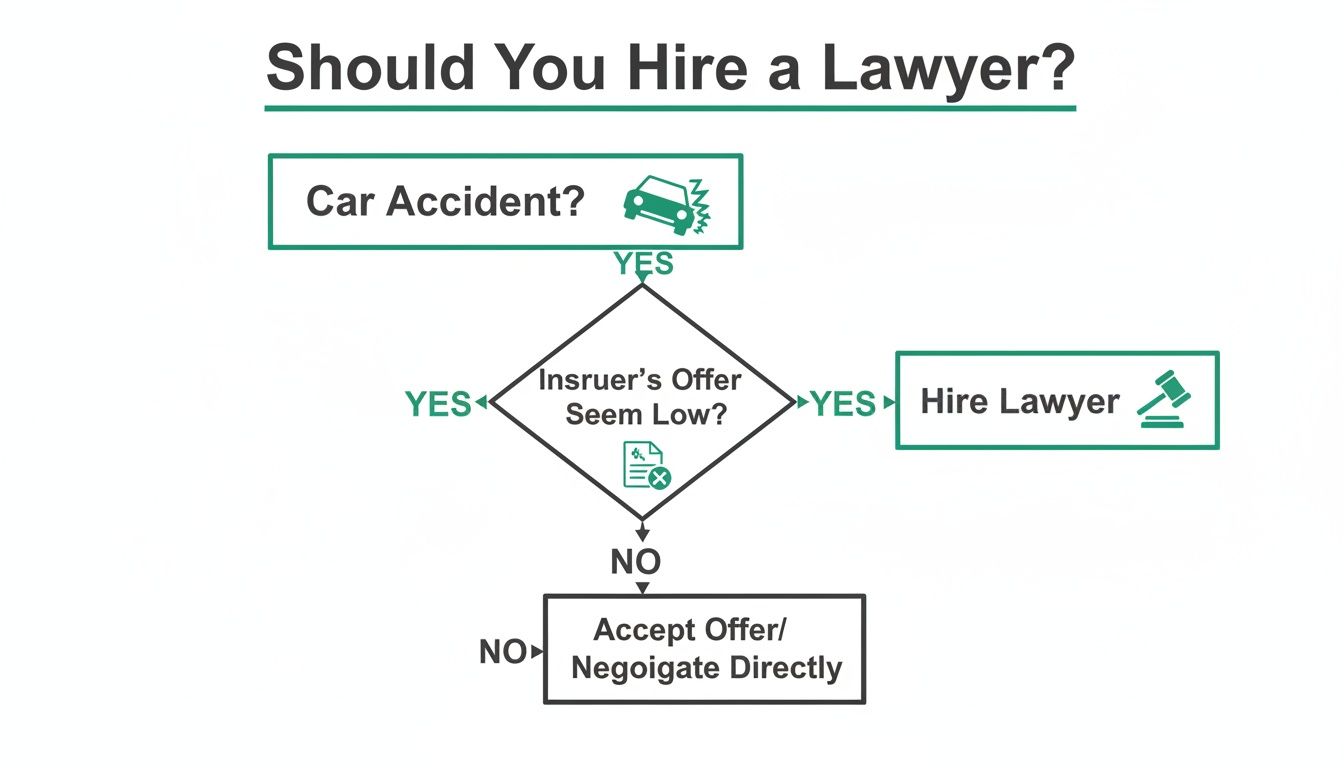

So, your car is repaired, but you know its value has plummeted. The big question is: do you handle the diminished value claim yourself, or is it time to call a lawyer? Not every minor scuff requires legal firepower, but in some situations, going it alone is a losing battle.

Many people try negotiating on their own first. Unfortunately, they often face denials, delays, and insultingly low offers. If the at-fault driver’s insurance adjuster offers you pocket change based on a bogus formula, or just flat-out denies your claim, that’s your cue. You need backup.

This flowchart breaks down the typical journey from accident to realizing you need professional help.

As you can see, the insurance company’s resistance is almost always the trigger. When they won’t play fair, it’s time to find an expert who can make them.

Key Signs You Need to Hire a Lawyer

Some situations are too complex or high-stakes to handle yourself. If any of these apply to your accident, your next search should be for a “diminished value lawyer near me.”

- Serious Structural Damage: If there was frame damage or other major structural work, the diminished value will be significant. Insurers fight these high-dollar claims tooth and nail.

- Luxury, Exotic, or Brand-New Cars: A newer Mercedes or a classic Porsche loses a huge chunk of its value after a collision. An attorney knows how to calculate and defend these massive losses.

- You Were Also Injured: If you have a personal injury claim from the same accident, it’s almost always best to bundle the diminished value claim with it. Your lawyer can manage everything at once.

- The Insurer Is Unresponsive: When an adjuster stops returning calls, it’s a classic delay tactic. A letter from an attorney gets their attention again—fast.

Insurance companies have entire teams dedicated to minimizing payouts. A claimant with a certified appraisal from a service like SnapClaim can secure a significantly higher payout than someone going in unprepared. The right evidence is powerful.

How to Find the Best Local Diminished Value Lawyers

Finding the right legal expert is crucial. Start by searching online for attorneys who specifically mention “diminished value” or “auto property damage” on their websites. Look at their reviews and case results to see if they have a track record of success in this specific area. Your goal is to find a partner who understands the law and knows how to use evidence, like a certified appraisal report from SnapClaim, to win your case.

Key Questions to Ask Before Hiring an Attorney

Once you have a shortlist of potential lawyers, the initial consultation is your chance to interview them. You need to separate the genuine specialists from the generalists. Going in prepared with the right questions will quickly reveal who has the experience to win your claim.

Experience with Diminished Value Claims

Not all auto accident lawyers are the same. Many focus on personal injury (PI) and treat property damage as an afterthought. You need someone who understands the nuances of proving lost market value.

Start with these direct questions:

- “What percentage of your practice is dedicated to diminished value claims?” You want to hear that it’s a core part of their work, not just a rare side case.

- “Can you walk me through a recent diminished value case you handled and its outcome?” A real-world example demonstrates a proven process.

- “How familiar are you with our state’s specific laws on diminished value?” An expert can confidently reference relevant state laws or recent court cases.

- “How do you use appraisal reports to build your cases?” The best lawyers know that a data-driven, certified appraisal is the most powerful tool in their negotiation arsenal.

A strong candidate won’t just say they handle these cases; they’ll explain how they do it, emphasizing that a certified appraisal is the foundation of every demand letter they send.

Understanding Their Fee Structure

The cost of hiring a lawyer shouldn’t be a secret. A reputable attorney will be transparent about their fees from day one, so there are no surprises later. As demand in the U.S. legal market has shifted, many clients prefer the specialized expertise and better value of smaller, niche practices. You can discover more about this legal market shift and what it means for consumers.

Nearly all diminished value lawyers work on a contingency fee basis. This means they only get paid if they win money for you, typically taking a percentage of the final settlement (usually 25-40%). Their interests are aligned with yours—if you don’t win, they don’t get paid. Always get this agreement in writing.

How Your Lawyer and Appraiser Work Together

A winning diminished value claim is built on two pillars: an expert legal strategy and undeniable evidence. Your lawyer brings the legal pressure, while a certified appraiser delivers the hard data that makes your claim impossible to ignore. This partnership turns a disputed claim into a successful settlement.

Insurance adjusters demand “proof.” Without it, your claim is just your opinion against theirs. A good lawyer knows the most effective way to counter an insurer’s lowball offer is with a data-driven appraisal that methodically calculates your car’s lost value.

The Legal Power of an Appraisal Report

A certified appraisal from a trusted source like SnapClaim isn’t just another document; it’s the cornerstone of your lawyer’s argument. It provides objective, third-party validation of your financial loss using real-world market data, not an insurer-friendly formula.

This report becomes the central piece of evidence your attorney uses to build a powerful demand letter. Instead of just stating your car lost value, they can point to specific market comparisons and a detailed analysis that supports the exact dollar amount you’re claiming. This immediately shifts the negotiation from a subjective debate to a factual, evidence-based discussion.

The process is straightforward but effective:

- Secure the Appraisal: Order a certified appraisal report detailing your vehicle’s pre-accident value, post-repair value, and the resulting diminished value.

- Share it with Your Lawyer: Your attorney reviews the report to understand its methodology and conclusions.

- Your Lawyer Takes Action: Armed with this proof, they draft a demand package that compels the insurer to pay what you’re owed.

This one-two punch is highly effective. The lawyer provides the legal threat, while the appraisal provides the factual justification. Together, they leave little room for an insurer to argue. When you’re searching for a diminished value lawyer near me, ask them how they use professional appraisals in their strategy.

Frequently Asked Questions (FAQ)

Can I claim diminished value if the accident wasn’t my fault?

Yes. In most states, you can only file a diminished value claim against the at-fault driver’s insurance company. You typically cannot claim it under your own collision policy, as that coverage is designed to pay for repairs, not the loss in market value.

What does a diminished value lawyer cost?

Most diminished value lawyers work on a contingency fee, meaning they only get paid if they win your case. Their fee is a percentage of the settlement, usually between 25% and 40%. You pay nothing upfront, so there is no financial risk to you.

Is it worth hiring a lawyer for a smaller claim?

It depends on the numbers. For minor damage to an older car, the diminished value might only be a few hundred dollars, and a lawyer’s fee could consume most of the settlement. However, for newer vehicles, luxury cars, or cars with significant structural damage, the loss can be thousands of dollars. A car’s diminished value can be significant, making legal help a smart investment.

How does a SnapClaim report help my case?

A SnapClaim report provides the certified, data-driven proof your lawyer needs to negotiate effectively. It replaces opinion with fact, showing the insurance company the precise amount your car’s value has dropped based on real market data. This strengthens your claim and supports your case for fair compensation.

A SnapClaim report provides the proof you need to negotiate from a position of strength. And with our Money-Back Guarantee, you can invest in this crucial evidence with total confidence. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim. You can learn more about how to order a diminished value appraisal near you and get started.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your diminished value appraisal today