Milford Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Milford total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Milford Total Loss Appraisal — Get What Your Vehicle Is Truly Worth

If your vehicle was declared a total loss in Milford, Wilmington, or Dover and the payout seems too low, you don’t have to accept it. Delaware drivers have the right under their insurance policy’s appraisal clause to request an independent Milford total loss appraisal that determines the car’s actual cash value (ACV) before the accident.

SnapClaim provides USPAP-compliant, data-driven total loss reports trusted by insurers, attorneys, and appraisers throughout Delaware to resolve valuation disputes quickly.

Why Total Loss Appraisals Matter in Milford

Insurance valuations (CCC or Mitchell) often use data that doesn’t fully reflect the local market trends in Delaware’s coastal and urban regions. SnapClaim ensures your vehicle’s valuation includes accurate dealer and retail pricing from the Milford metro area.

Why Milford Vehicle Owners Often See Undervalued Offers

- Milford’s used car market remains strong, especially for sedans and SUVs like Honda CR-V, Toyota Camry, Ford Escape, and Subaru Forester.

- Insurance valuations frequently rely on listings from lower-cost neighboring states.

- Local demand around Wilmington, Dover, and Newark raises vehicle resale prices.

What Your Milford Total Loss Appraisal Report Includes

- Verified VIN, year, make, model, trim, mileage, and options

- Comparable listings from Milford, Wilmington, Dover, and Newark markets

- Transparent pre-loss fair market value analysis

- Documentation to invoke your appraisal clause or use in small claims court

- Optional expert-witness support within Delaware

Milford and Surrounding Areas We Serve

- Wilmington

- Dover

- Newark

- Middletown

- Smyrna

- Milford

- Seaford

- Georgetown

- Elsmere

- New Castle

- Laurel

- Harrington

- Claymont

- Milton

How to Dispute a Milford Total Loss Offer

- Get a copy of your insurer’s CCC or Mitchell valuation report.

- Order your Milford total loss appraisal to verify pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a large difference.

- Use SnapClaim’s report to negotiate or proceed to arbitration.

- Recover your loss — many Delaware clients gain $2,000–$6,000 more with accurate documentation.

Local Insight: Milford Market Trends

- High demand for commuter vehicles and SUVs in northern Delaware and coastal areas.

- Dealerships in Wilmington and Dover influence pricing statewide.

- Insurers may use comps from less competitive markets, lowering payout values.

Example Milford Case Study

Vehicle: 2021 Toyota RAV4 XLE

Insurance Offer (CCC): $26,200

SnapClaim Appraisal: $29,000

Final Settlement: $28,700 after invoking the appraisal clause

Helpful Delaware Resources

- Delaware Department of Insurance — File a Complaint

- Delaware General Assembly — Insurance Statutes

- Delaware Courts — Small Claims Court

Ready to Get Your Milford Total Loss Appraisal?

- Delivered same day — usually within an hour

- Money-back guarantee if your claim isn’t paid

- Report valid for insurance, legal, and small-claims use

Related Delaware Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Milford

How SnapClaim Helps Milford Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Milford market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Milford metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

“After my SUV was totaled in Milford, I felt stuck with a low payout. SnapClaim’s appraisal brought clarity to the process and helped the insurer reconsider their numbers.”

— Laura L., Milford, DE

Milford Total Loss – Frequently Asked Questions

When is a vehicle considered a total loss in Milford, Delaware?

In Milford, insurers may declare a vehicle a total loss when repair costs approach 70–75% of its pre-accident value.

Local market comparisons within both Kent and Sussex Counties are used to determine fair compensation.

Reference:

Delaware Total Loss Laws.

How is ACV calculated for Milford-area vehicles?

Actual Cash Value (ACV) is based on recent sales of similar vehicles in Milford and surrounding towns.

Adjustments are made for mileage, condition, and installed factory or aftermarket options.

Learn more:

Understanding ACV.

What payout should I expect for a totaled car in Milford?

Insurance pays the vehicle’s ACV at the time of loss. Deductibles may apply if the claim is filed under your own policy, whereas claims against the at-fault driver typically do not.

Why might Milford total loss offers be lower than expected?

Low offers can result from:

• Using comps from outside Kent or Sussex Counties

• Incorrect mileage or trim information

• Ignoring aftermarket or factory-installed features

A Milford-specific appraisal ensures accurate market valuation:

Milford Total Loss Appraisal.

Can I dispute a total loss valuation in Milford?

Yes. Reviewing the insurer’s report and submitting an independent appraisal based on Milford market data can help challenge a low settlement offer.

What happens to my Delaware title after a total loss in Milford?

Delaware issues a Salvage Certificate. To drive the vehicle again, it must pass a Delaware Enhanced Vehicle Inspection and receive a rebuilt title.

Can I keep my totaled vehicle in Milford?

Yes. You may retain your vehicle, but the insurer will subtract the salvage value from your payout. Rebuilt-title rules must be followed before driving it again.

Does a Milford total loss settlement include fees?

Delaware has no standard sales tax, but title, registration, and document fees may apply depending on the insurance policy. Always request a full settlement breakdown.

How long do I have to resolve a total loss claim in Milford?

Delaware generally allows two years from the accident date to file a property damage claim. Early filing ensures accurate access to Milford and regional market data.

Why is Milford-specific market data important?

Vehicle demand and resale trends in Milford can differ from other towns in Sussex and Kent Counties. Sedans, trucks, and SUVs often maintain stronger resale value locally due to commuting and regional usage patterns.

Does Delaware allow appraisal clauses in total loss disputes?

Yes. Many Delaware auto policies include an appraisal clause that allows both parties to submit appraisers, with a neutral umpire deciding the final vehicle value.

Can a SnapClaim appraisal be used in Milford small claims court?

Yes. Certified SnapClaim appraisals can be used in Kent or Sussex County Small Claims Court, mediation, or arbitration.

More info:

Milford Total Loss Help.

How quickly can I get a Milford total loss appraisal?

Most Milford appraisals are completed same-day, often within an hour, so you can respond promptly to insurance offers.

What if my auto loan exceeds the vehicle’s value in Milford?

If your loan balance exceeds ACV, you are responsible for the difference unless you have GAP insurance, which may cover the shortfall.

How does SnapClaim assist Milford drivers with total loss claims?

SnapClaim leverages Milford and regional market data to produce precise ACV reports.

Many drivers recover higher payouts by submitting an independent appraisal instead of accepting the initial offer.

Start here:

Start Your Milford Appraisal.

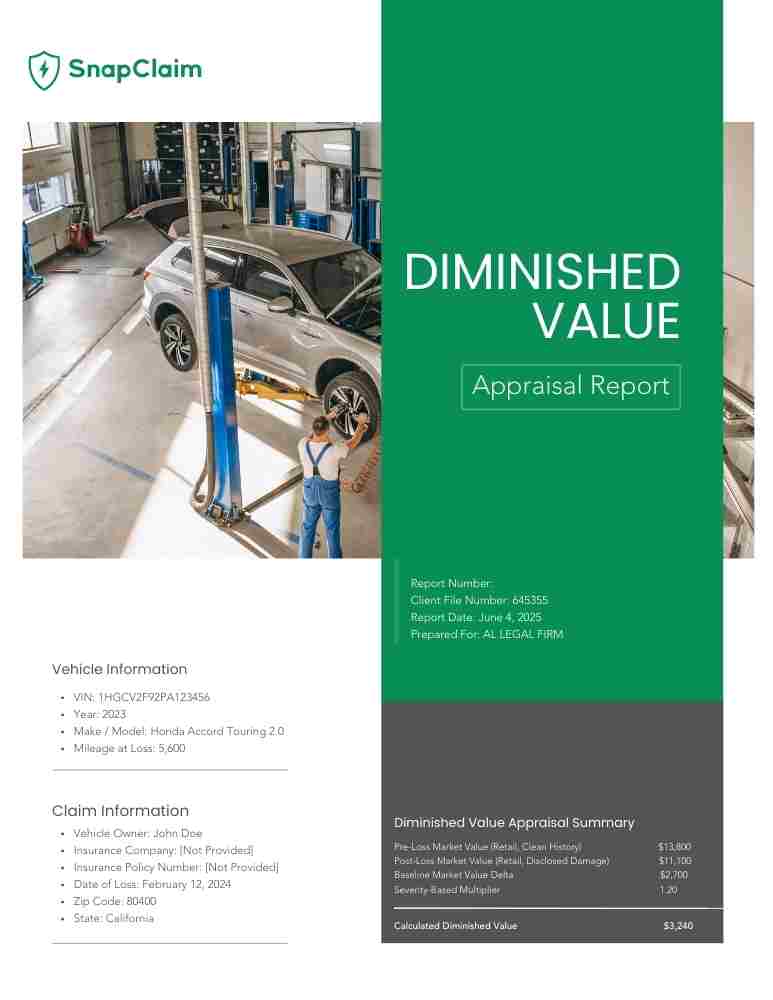

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.