Total Loss Appraisal in

Delaware

Get Your Free Estimate in a Minute!

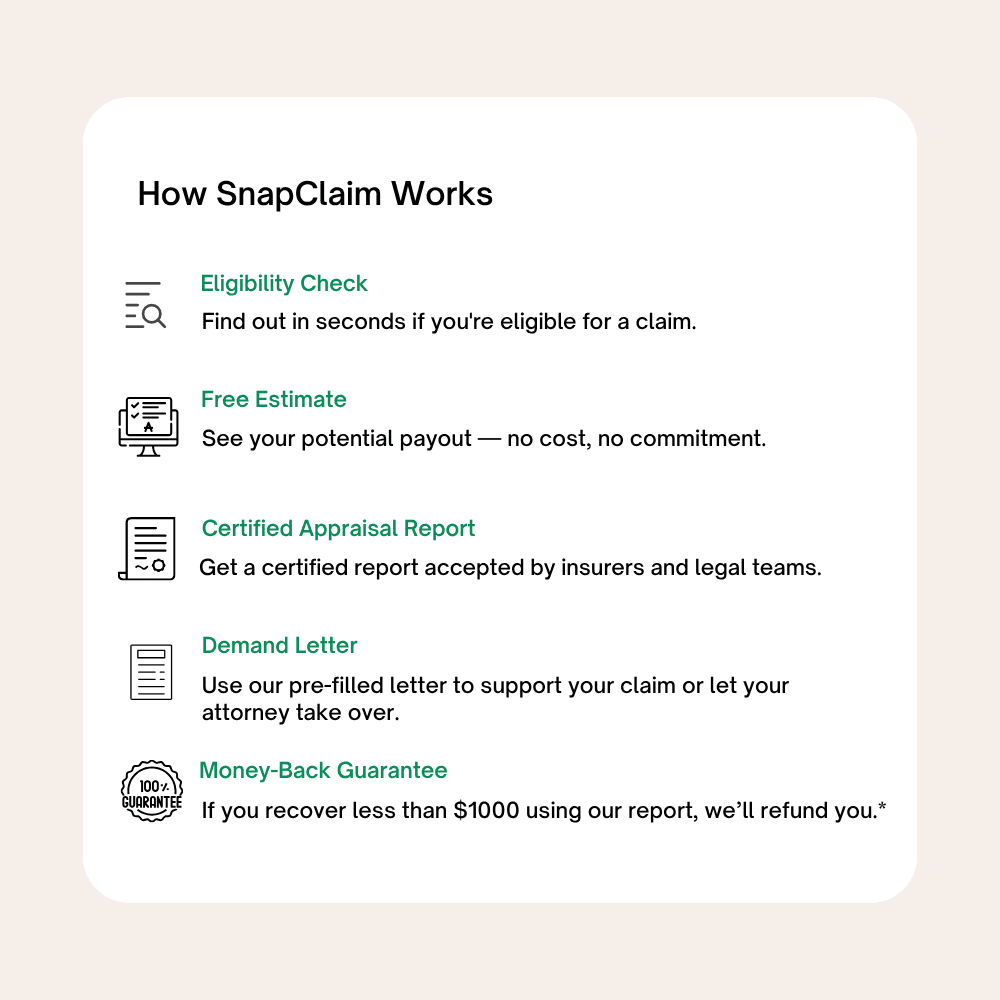

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Delaware total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Delaware: What You Need to Know

Delaware Total Loss Appraisal — Get the Full Value of Your Totaled Vehicle

If your vehicle was declared a total loss and the insurance offer feels too low, you have the right to obtain an independent Delaware total loss appraisal. Whether the accident happened in Wilmington, Dover, Newark, Middletown, Smyrna, or anywhere across the state, SnapClaim helps you recover your vehicle’s true fair market value (ACV) and secure the full payout you’re owed. Our certified total loss appraisal reports are data-driven, USPAP-aware, and accepted by insurers and small-claims courts across Delaware.Why Get a Total Loss Appraisal in Delaware?

Insurance valuations like CCC and Mitchell frequently undervalue Delaware markets, especially along the I-95 corridor and in fast-growing communities near the beaches where used vehicle demand is strong. An independent appraisal ensures your ACV reflects real, local resale prices—not averages pulled from cheaper out-of-state markets.Common Reasons to Dispute a Total Loss Offer

- Wrong trim, features, mileage, or equipment listed in CCC/Mitchell

- Comparables pulled from low-value markets outside Delaware

- Unsupported deductions or incorrect condition adjustments

- Local demand premiums ignored (commuter vehicles, SUVs, EVs, and trucks)

What’s Included in Your Delaware Total Loss Appraisal Report

- Full VIN-based analysis (trim, options, mileage, condition)

- Verified local comparable listings from DE cities and surrounding markets

- Accurate pre-loss fair market value calculation

- Transparent adjustment tables for features and mileage

- Documentation to invoke your appraisal clause or use in small-claims court

- Optional expert witness support for arbitration or litigation

Delaware Total Loss Laws & Appraisal Rights

Delaware policyholders are protected under state law and can dispute an insurer’s total loss value through the policy’s appraisal clause. If your appraiser and the insurer’s cannot reach agreement, a neutral umpire determines the final value.- Delaware Department of Insurance — Consumer Services

- Justice of the Peace Court — Small Claims Information

- Delaware Code Title 18 — Unfair Insurance Practices

How to Dispute a Total Loss Offer in Delaware

- Request your insurer’s CCC, Mitchell, or internal valuation report.

- Order a SnapClaim independent appraisal to establish your true pre-loss ACV.

- Invoke your appraisal clause if the insurer will not match the real value.

- Submit SnapClaim’s appraisal report to your adjuster or attorney.

- Negotiate or escalate—many DE drivers recover thousands more with proper documentation.

Delaware Market Trends & Local Insight

- Delaware used-car prices remain higher than some nearby states due to limited supply and commuter demand.

- SUVs, pickups, and crossovers used for commuting to larger metro areas and beaches often command strong resale premiums.

- EVs and hybrids are increasing in resale demand in Wilmington, Newark, and growing suburban corridors.

Example Delaware Case Study

Vehicle: 2019 Honda CR-V EX AWDInsurance Offer (CCC): $17,400

SnapClaim Appraisal: $21,050

Final Settlement: $20,600 after invoking the appraisal clause

Helpful Delaware Resources

- Delaware Department of Insurance — File a Complaint

- Delaware Courts — Official Site

- NHTSA Vehicle History Lookup

Ready to Get Your Delaware Total Loss Appraisal?

- No upfront payment required

- Report delivered in about 1 hour

- Fair-market-value and insurer-ready documentation included

Related Delaware Locations

Click a pin to open the city’s total loss page.

Find your Delaware city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Delaware

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Delaware total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my accident in Newark, the insurance company low-balled my total loss claim. SnapClaim stepped in fast and used real Delaware comps to determine the actual value. I ended up getting $3,700 more than their first offer.”

Anthony S.,

Newark, DE

Frequently Asked Questions

When is a car considered a total loss in Delaware?

An insurer may declare a total loss when it’s no longer economical or safe to repair the vehicle. They compare your repair costs and salvage value to your car’s Actual Cash Value (ACV) before the crash. Learn more about state rules: total loss state laws.

What does Actual Cash Value (ACV) mean in Delaware?

ACV is your car’s fair market value immediately before the accident—based on year, make, model, trim, options, mileage, condition, and local Delaware comparables (Wilmington, Dover, Newark, Middletown, Smyrna). See how ACV is calculated here: Fair Market Value.

My car is “totaled” but still drives. Do I have options?

Yes. A car can be structurally or economically totaled and still run. You can:

• Negotiate the payout if the ACV looks low

• Ask to retain the salvage (keep the car) and have the payout reduced by the salvage value

• Get an independent total loss appraisal from SnapClaim before you accept the offer:

Delaware Total Loss Appraisals.

Do insurers have to use local Delaware comparables?

Valuation companies sometimes pull comps from outside Delaware or from lower-value markets. If your report relies on distant or outdated listings, you can challenge it and present stronger local data from Wilmington, Dover, Newark, or your actual market. SnapClaim builds Delaware-focused valuation files using verified in-state comps to support a more accurate ACV.

Can I get a second opinion before accepting a total loss offer?

Absolutely. You don’t have to accept the first number the insurer gives you. You can request the full valuation report (CCC/Mitchell/audatex), review the comps and mileage adjustments, and order an independent appraisal from SnapClaim to see what your vehicle is really worth in Delaware.

How much should insurance pay if my car is totaled in Delaware?

In a total loss, insurers generally owe your vehicle’s fair market value at the time of loss (its ACV), plus applicable taxes and fees. If you’re using your own policy, your deductible may apply. If the at-fault driver’s insurer is paying, there’s typically no deductible.

How does a total loss affect my loan or lease in Delaware?

The insurer pays your vehicle’s ACV to you or directly to your lender/lease company. If the payoff amount is higher than the settlement, you’re responsible for the difference unless you have GAP coverage or certain lease protections. A higher, more accurate ACV from an independent appraisal can reduce or eliminate that negative equity.

What happens to my title after a total loss in Delaware?

Totaled vehicles generally receive a salvage title. If you or a buyer repair the vehicle, you’ll need to complete Delaware’s DMV salvage/rebuilt process and pass inspection before getting a rebuilt/restored title and returning the car to the road.

Can I keep my totaled vehicle in Delaware?

Yes. Many Delaware drivers choose to retain the salvage. Your settlement is reduced by the agreed salvage value, and you must follow the DMV’s rebuilt-title process if you plan to repair and drive the vehicle again.

Are taxes and fees included in my Delaware total loss settlement?

Total loss settlements may include sales tax, title, and registration fees based on Delaware rules and the terms of your policy. Ask your adjuster for an itemized breakdown of ACV, taxes, and fees. Learn more about line items here: ACV & line items.

What if my Delaware total loss offer feels too low?

Start by reviewing the valuation report. Look for:

• Comps from cheaper markets or outside Delaware

• Missing packages, options, or mileage adjustments

• Incorrect accident or condition notes

If the number still looks low, a certified Delaware appraisal from SnapClaim can give you a stronger,

market-supported value to negotiate with:

Start your appraisal.

How long do I have to deal with a total loss claim in Delaware?

Delaware law sets deadlines (called statutes of limitations) for bringing property damage claims after a crash. These limits can depend on your situation and who you are making a claim against. Because missing a deadline can seriously affect your rights, it’s wise to talk with a Delaware attorney about the specific time limits that apply to your case.

What is an appraisal clause and can it help me in Delaware?

Many auto policies include an appraisal clause. If you and the insurer disagree on value, each side hires an appraiser. If they still can’t agree, a neutral umpire reviews both and sets the value. A strong, data-driven appraisal from SnapClaim can help you make the most of this process.

Can I use a SnapClaim appraisal in court or arbitration in Delaware?

Yes. SnapClaim’s certified, USPAP-aware reports are designed to be used in small claims court, arbitration, or mediation to support your position on value. We also work closely with attorneys handling total loss and property damage disputes.

How does SnapClaim help Delaware drivers with total loss claims?

We build Delaware-specific valuation files using verified listings from Wilmington, Dover, Newark, Middletown, Smyrna, and surrounding markets. Our total loss appraisals are:

• Based on real market data, not generic averages

• Designed to be understood by adjusters, appraisers, and courts

• Often used to help drivers recover thousands more than the insurer’s first offer

Start your Delaware total loss appraisal.