Total Loss Appraisal in

Connecticut

Get Your Free Estimate in a Minute!

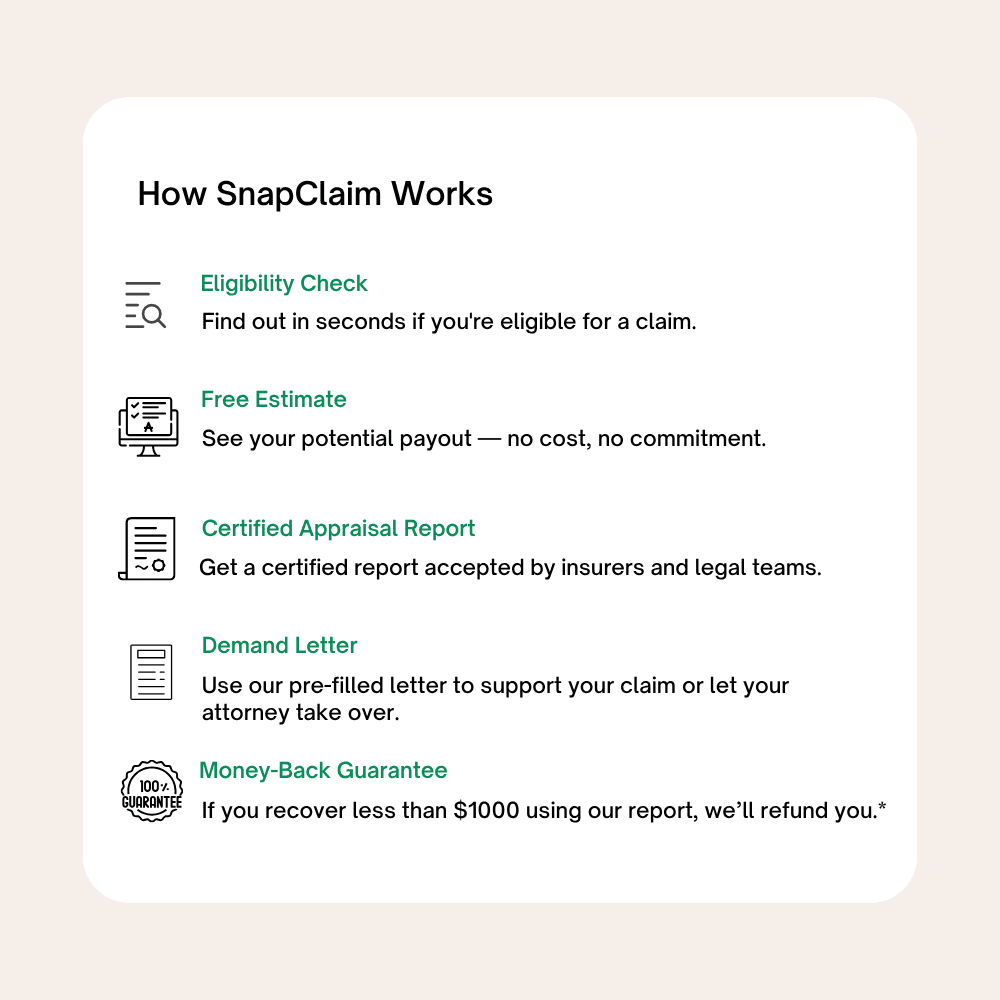

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Connecticut total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Connecticut: What You Need to Know

Connecticut Total Loss Appraisal — Get the Full Value of Your Totaled Vehicle

If your vehicle was declared a total loss and the insurance offer feels too low, you have the right to obtain an independent Connecticut total loss appraisal. Whether the accident happened in Bridgeport, New Haven, Stamford, Hartford, Waterbury, or anywhere across the state, SnapClaim helps you recover your vehicle’s true fair market value (ACV) and secure the full payout you’re owed. Our certified total loss appraisal reports are data-driven, USPAP-aware, and accepted by insurers and small-claims courts across Connecticut.Why Get a Total Loss Appraisal in Connecticut?

Insurance valuations like CCC and Mitchell frequently undervalue Connecticut markets, especially in metro regions along I-95 and I-84 where used vehicle demand is strong. An independent appraisal ensures your ACV reflects real, local resale prices—not averages pulled from cheaper out-of-state markets.Common Reasons to Dispute a Total Loss Offer

- Wrong trim, features, mileage, or equipment listed in CCC/Mitchell

- Comparables pulled from low-value markets outside Connecticut

- Unsupported deductions or incorrect condition adjustments

- Local demand premiums ignored (AWD, hybrid, EV, commuter vehicles)

What’s Included in Your Connecticut Total Loss Appraisal Report

- Full VIN-based analysis (trim, options, mileage, condition)

- Verified local comparable listings from CT cities and surrounding markets

- Accurate pre-loss fair market value calculation

- Transparent adjustment tables for features and mileage

- Documentation to invoke your appraisal clause or use in small-claims court

- Optional expert witness support for arbitration or litigation

Connecticut Total Loss Laws & Appraisal Rights

Connecticut policyholders are protected under state law and can dispute an insurer’s total loss value through the policy’s appraisal clause. If your appraiser and the insurer’s cannot reach agreement, a neutral umpire determines the final value.- Connecticut Insurance Department — Consumer Rights

- Connecticut Small Claims Court

- CT Insurance Statutes — Chapter 700c

How to Dispute a Total Loss Offer in Connecticut

- Request your insurer’s CCC, Mitchell, or internal valuation report.

- Order a SnapClaim independent appraisal to establish your true pre-loss ACV.

- Invoke your appraisal clause if the insurer will not match the real value.

- Submit SnapClaim’s appraisal report to your adjuster or attorney.

- Negotiate or escalate—many CT drivers recover thousands more with proper documentation.

Connecticut Market Trends & Local Insight

- CT used-car prices remain higher than national averages due to supply shortages and commuter demand.

- AWD/4WD vehicles (Subaru, Toyota, Honda) command strong resale value in winter months.

- EVs and hybrids are increasing in resale demand around New Haven, Stamford, and West Hartford.

Example Connecticut Case Study

Vehicle: 2019 Honda CR-V EX AWD Insurance Offer (CCC): $17,400 SnapClaim Appraisal: $21,050 Final Settlement: $20,600 after invoking the appraisal clauseHelpful Connecticut Resources

- Connecticut Insurance Department — File a Complaint

- State of Connecticut Judicial Branch

- NHTSA Vehicle History Lookup

Ready to Get Your Connecticut Total Loss Appraisal?

- No upfront payment required

- Report delivered in about 1 hour

- Fair-market-value and insurer-ready documentation included

Related Connecticut Locations

Click a pin to open the city’s total loss page.

Find your Connecticut city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Connecticut

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Connecticut total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

After my car was totaled on I-84 near Hartford, the insurance offer came in thousands below what similar cars were selling for in Connecticut. SnapClaim stepped in fast. Their Connecticut total loss appraisal used real market data from across the state — from Hartford to New Haven to Stamford. Because of their report, I secured an extra $3,700 above the insurer’s first offer. Absolutely worth it.

Michael R.,

Hartford, CT

Frequently Asked Questions

What makes a car a total loss in Connecticut?

Connecticut uses a Total Loss Formula (TLF): if repair costs plus salvage value are greater than or equal to your car’s Actual Cash Value (ACV) before the crash, it’s a total loss. Learn more: state-by-state rules.

What does Actual Cash Value (ACV) mean?

ACV is your car’s fair market value immediately before the accident—based on make, model, trim, options, mileage, condition, and local Connecticut comps (Hartford, New Haven, Bridgeport, Stamford, Norwalk). See how ACV is calculated: Fair Market Value.

How much does insurance pay if my car is totaled in Connecticut?

Insurers owe your vehicle’s fair market value at the time of loss. If you claim under your policy, your deductible may apply. If the at-fault driver’s insurer pays, there’s typically no deductible.

Can I challenge the insurer’s total loss valuation?

Yes—request the full valuation (CCC/Mitchell), verify the comps, and present stronger Connecticut listings. You can also order an independent appraisal from SnapClaim: Connecticut Total Loss Appraisals.

What happens to my title after a total loss in Connecticut?

Totaled vehicles usually receive a Salvage title. After repairs, you must pass the Connecticut DMV salvage inspection to obtain a rebuilt/restored title before driving again.

Can I keep my totaled vehicle?

Yes. Your settlement will be reduced by the salvage value. You must follow Connecticut’s rebuilt title process with the DMV to return it to the road.

Are taxes and fees included in my settlement?

Connecticut settlements may include sales tax, title, and registration fees. Ask for an itemized breakdown. More info: ACV & line items.

What if my insurance offer seems too low?

Review the comps for out-of-state pricing or missing options. If undervalued, order a certified Connecticut appraisal: Start your appraisal.

How long do I have to file a total loss claim in Connecticut?

Connecticut’s statute of limitations for property damage is generally two years from the accident date. Act quickly while evidence and market data are current. This is general information, not legal advice—consult an attorney about your specific situation.

Why does Connecticut market data matter?

Prices vary by city—trucks/SUVs may command premiums in some suburban markets, while hybrids/EVs are strong in urban areas like Hartford and New Haven. Local comps ensure your ACV reflects real Connecticut resale conditions.

What is an appraisal clause and how does it help?

Many Connecticut auto policies include an appraisal clause: each side hires an appraiser; if they disagree, a neutral umpire sets value—protecting you from undervaluation when used properly.

Can I use an independent appraisal in court or arbitration?

Yes. SnapClaim’s certified, USPAP-aware report can be used in small claims, arbitration, or mediation. Details: Connecticut Total Loss.

How fast can I get a total loss appraisal?

Most Connecticut appraisals are completed the same day—often in about an hour—so you can negotiate quickly.

What if I owe more than my car’s value?

You’re responsible for any negative equity. GAP insurance can cover the difference between ACV and your loan balance if you have it.

How does SnapClaim help Connecticut drivers?

We build Connecticut-specific valuation files using verified comps from Hartford, New Haven, Bridgeport, Stamford, and Norwalk. Many clients recover thousands more with a SnapClaim appraisal. Start now.