Denver Total Loss Appraisal

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Denver total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Denver Total Loss Appraisal — Get the True Value of Your Totaled Vehicle

If your car was declared a total loss in Denver, Colorado Springs, or Aurora and the payout looks low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Denver total loss appraisal to establish your vehicle’s actual cash value (ACV) before the crash. SnapClaim delivers data-driven, USPAP-aware, court-ready total loss reports used by Denver insurers, attorneys, and small-claims courts.Why Total Loss Appraisals Matter in Denver

When a vehicle is totaled, insurers must pay its fair market value (ACV). Initial CCC/Mitchell valuations can miss Denver-area market premiums, options, or correct trim—leading to undervalued offers.Why Denver Vehicle Owners Are Affected Most

- Front Range demand and low inventory can increase ACV over book values.

- High resale interest for AWD/SUVs and EVs (Subaru, Toyota, Ford, Tesla, Chevrolet) pushes prices.

- Insurer comps sometimes pull from cheaper out-of-market regions, reducing your settlement.

What Your Denver Total Loss Appraisal Report Includes

- Full vehicle details (VIN, year, make, model, trim, mileage, options)

- Verified comparable listings in Denver, Aurora, Colorado Springs, and nearby markets

- Pre-loss fair market value analysis with transparent adjustments

- Documentation to invoke the appraisal clause or file in small claims

- Clear methodology (USPAP-aware) and optional expert-witness support in Denver

Denver and Surrounding Areas We Serve

- Denver

- Colorado Springs

- Aurora

- Fort Collins

- Lakewood

- Thornton

- Arvada

- Westminster

- Pueblo

- Centennial

- Boulder

- Greeley

- Longmont

- Loveland

How to Dispute a Denver Total Loss Offer

- Request the insurer’s valuation (CCC/Mitchell) and check options, trim, and mileage.

- Order your Denver total loss appraisal to establish true pre-loss ACV.

- Invoke the appraisal clause in writing if there’s a significant difference.

- Submit SnapClaim’s report and negotiate or proceed to umpire/arbitration if needed.

- Recover compensation — many Denver clients secure thousands more with proper documentation.

Local Insight: Common Denver Insurer Practices

- Comps sourced from AutoTrader, CarGurus, and Cars.com within Denver metro

- Dealer price checks within ~50 miles of the Front Range

- Localized adjustments for mileage, color, options, and seasonal demand

Example Denver Case Study

Vehicle: 2020 Toyota RAV4 XLE AWDInsurance Offer (CCC): $21,900

SnapClaim Appraisal: $25,400

Final Settlement: $24,950 after invoking the appraisal clause

Helpful Denver/Colorado Resources

- C.R.S. §10-4-618 — Total Loss Settlement Standards

- Colorado Division of Insurance — File a Complaint

- Colorado Judicial Branch — Small Claims

Ready to Get Your Denver Total Loss Appraisal?

- No credit card required

- Delivery in about 1 hour

- Includes fair-market-value report and appraisal-clause support

Related Colorado Locations

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Denver

How SnapClaim Helps Denver Drivers

- Eligibility Check: Find out in seconds if your total loss case qualifies for an independent appraisal.

- Free Estimate: Instantly see your vehicle’s fair market value based on verified Denver market data — no cost, no obligation.

- Certified Appraisal Report: Receive a detailed, data-backed report reflecting true resale prices across the Denver metro area.

- Appraisal Clause Support: Use our report to invoke your policy’s appraisal clause and challenge unfair insurer valuations.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal fee — no risk, full transparency.

My SUV was totaled during rush hour in Denver, and the insurance company’s initial offer didn’t make sense. SnapClaim’s appraisal showed the true market value, and I recovered $4,000 more than expected.”

— Jason P., Denver, CO

Delaware Total Loss – Frequently Asked Questions

How are total loss values determined for vehicles in Delaware, Colorado?

Delaware vehicle values are typically based on nearby regional sales, condition-specific data, and real market availability rather than generic statewide averages.

Can mileage differences significantly affect a Delaware total loss offer?

Yes. Mileage adjustments play a major role in valuations. Incorrect mileage assumptions can reduce payouts by thousands if not corrected.

What happens if comparable vehicles aren’t available near Delaware?

When true local matches are limited, insurers may widen the search area. However, pricing should still reflect realistic replacement options, not distant or inflated listings.

Does seasonal demand impact Delaware vehicle valuations?

Seasonal trends can influence prices, especially for trucks, SUVs, and AWD vehicles. These demand shifts are sometimes missed in automated reports.

Is documentation important for Delaware total loss disputes?

Absolutely. Service records, recent repairs, and ownership history help support higher valuations and clarify vehicle condition.

Can an insurer overlook features specific to my Delaware vehicle?

Yes. Trim packages, safety technology, and factory options are sometimes omitted, which can lead to undervaluation if not reviewed carefully.

Are taxes and fees included in Delaware total loss settlements?

Many policies allow reimbursement for sales tax and registration costs, but these are not always automatically included in the initial offer.

What if I believe the market report used outdated prices?

Outdated or expired listings can skew results. Challenging the data with current market examples is often effective.

How does salvage retention work for Delaware drivers?

Keeping the vehicle reduces the payout by its salvage value. That value should reflect realistic local auction demand, not inflated estimates.

When should a Delaware policyholder seek an independent appraisal?

Independent appraisals are commonly used when offers seem low, data appears inaccurate, or negotiations stall.

Learn more:

Delaware Total Loss Support.

How long does a Delaware total loss appraisal usually take?

Most independent reviews are completed quickly, often within one business day once vehicle details are provided.

Why do Delaware drivers work with SnapClaim?

SnapClaim focuses on accurate, data-backed valuations tailored to local Colorado markets, helping drivers pursue fair settlements.

Get started:

Understand Fair Market Value.

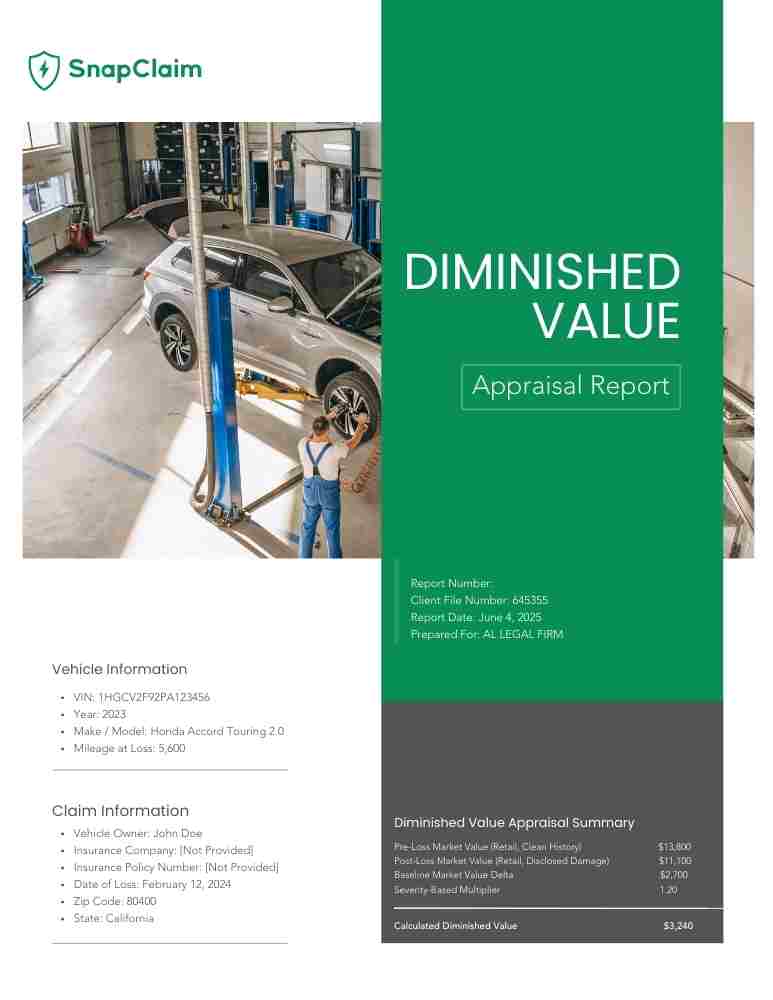

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.