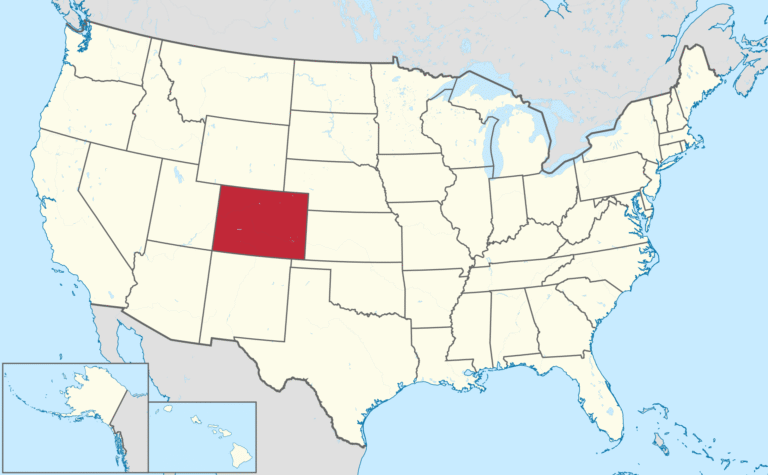

Total Loss Appraisal in

Colorado

Get Your Free Estimate in a Minute!

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Colorado total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Colorado: What You Need to Know

Colorado Total Loss Appraisal — Get the True Value of Your Totaled Vehicle

If your vehicle was declared a total loss and you’re not satisfied with the insurance company’s offer, you have the right to request an independent Colorado total loss appraisal. Whether your car was totaled in Denver, Colorado Springs, Aurora, Fort Collins, or anywhere in the state, SnapClaim helps determine its fair market value (ACV) before the accident and negotiate a higher payout.

Our certified total loss appraisal reports are data-driven, USPAP-aware, and court-ready—trusted by insurance adjusters, attorneys, and small-claims courts across Colorado.

Why Get a Total Loss Appraisal in Colorado?

When your vehicle is deemed a total loss, the insurer must pay the actual cash value. Initial offers often rely on CCC/Mitchell models that undervalue Colorado markets. An independent appraisal protects your payout.

Common Reasons to Dispute a Total Loss Offer

- Incorrect options, trim, or mileage used in the insurer valuation

- Comparables pulled from cheaper or distant markets

- Excessive condition deductions not supported by evidence

- Special packages/upgrades (technology, safety, towing, premium wheels) omitted

What’s Included in Your Colorado Total Loss Appraisal Report

- Full vehicle details (VIN, year, make, model, trim, mileage, options)

- Verified comparable listings from Colorado markets (Denver, Boulder, Colorado Springs, Fort Collins, Aurora)

- Fair-market-value analysis immediately before the loss

- Transparent adjustment matrix for mileage, options, and regional pricing

- Documentation to invoke the appraisal clause or file in small claims

- Optional expert-witness support for arbitration or litigation

Most total loss reports are completed in about 1 hour and are formatted for direct insurer submission.

Colorado Total Loss Laws & Appraisal Rights

If you disagree with the insurer’s valuation, you can invoke your policy’s appraisal clause—each side hires an appraiser; if they disagree, an umpire sets the value.

- Colorado Revised Statutes §10-4-618 — total loss settlement standards

- Colorado Division of Insurance fair claims guidance for total loss settlements

- Appraisal clause is present in most collision/comprehensive policies

How to Dispute a Total Loss Offer in Colorado

- Request the insurer’s valuation report (CCC/Mitchell) and review line by line.

- Order your independent appraisal to establish true pre-loss fair market value.

- Invoke the appraisal clause in writing if values differ significantly.

- Submit SnapClaim’s report to the adjuster or your attorney.

- Negotiate or escalate—most clients recover substantially more with proper documentation.

Local Insight: Colorado Total Loss Trends

- Front Range markets (Denver–Aurora–Boulder–Colorado Springs) retain higher resale values

- High-demand models (Subaru, Toyota, Ford, Tesla, Jeep, Lexus) push ACV upward

- Used-car price inflation since 2021 has widened gaps in insurer valuations

Example Colorado Case Study

Vehicle: 2020 Subaru Outback Touring XT

Insurance Offer (CCC): $22,800

SnapClaim Appraisal: $26,200

Final Settlement: $25,700 after appraisal-clause process

Helpful Colorado Resources

- C.R.S. §10-4-618 — Total Loss Settlement Standards

- Colorado Division of Insurance — File a Complaint

- Colorado Small Claims Court (limit $7,500)

- NHTSA — Vehicle History & VIN Lookup

Ready to Get Your Colorado Total Loss Appraisal?

- No upfront payment required

- Delivery in about 1 hour

- Includes fair-market-value analysis and dispute-ready report

Related Colorado Locations

Click a pin to open the city’s total loss page.

Find your Colorado city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

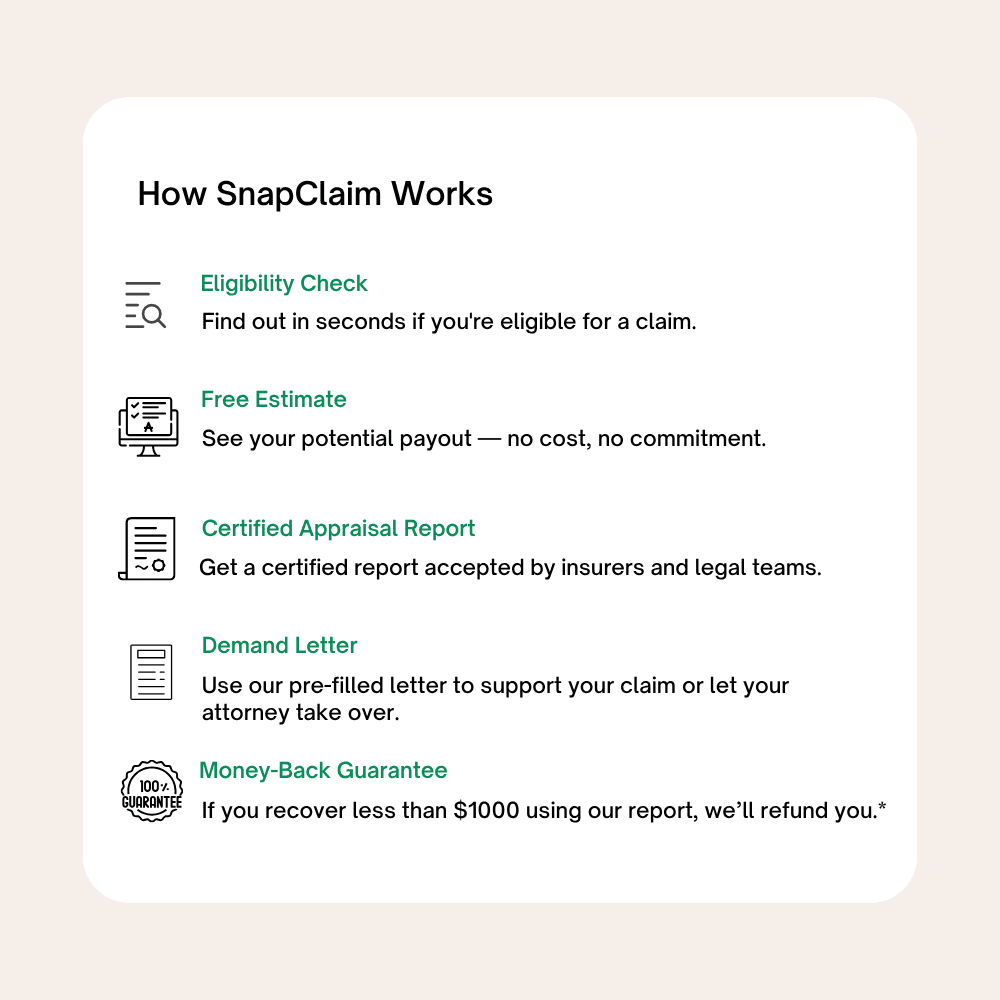

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Colorado

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Colorado total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“When my car was totaled in Aurora, my insurance company offered way less than it was worth. SnapClaim handled everything — I got my Colorado total loss appraisal the same day and recovered $3,900 more than the insurer’s offer.”

Daniel S.

Aurora, CO

Frequently Asked Questions:

- What qualifies a vehicle as a total loss in Colorado?

In Colorado, a car is typically declared a total loss when the cost of repairs plus the salvage value equals or exceeds 100 % of the vehicle’s actual cash value (ACV) immediately before the accident.

- What does “actual cash value” (ACV) mean in a total loss claim?

ACV is the market value of your vehicle right before the damage occurred — factoring in make, model, mileage, condition, options, and local market trends. Insurers use ACV as the base for your payout.

- How much will the insurance company pay me if my car is totaled?

The insurer will pay you the fair market value of the vehicle (ACV) at the time of loss, minus any deductible if you’re using your own policy. If you were not at fault, the at-fault driver’s insurer pays—usually no deductible applies.

- Can I contest the insurance company’s settlement offer for a totaled vehicle?

Yes — in Colorado you can dispute the insurer’s valuation if you believe your vehicle was undervalued. You can request documentation, provide comparables, or use an independent appraisal to support your claim.

- Does Colorado require the insurer to use a fair method for valuing total losses?

Yes — under C.R.S. §10-4-639, insurers in Colorado must establish a fair and consistent method for determining total loss values that considers unique characteristics of the vehicle and uses credible valuation sources.

- What fees and costs must be included in a total loss settlement in Colorado?

When your vehicle is declared a total loss, the insurer must also pay title fees, sales tax, and registration/transfer fees where applicable.

- Can I keep my totaled vehicle after settlement in Colorado?

Yes — you can choose to keep the totaled vehicle, but it will need to be retitled as a salvage or “rebuilt from salvage” vehicle and repaired to roadworthy condition before being driven legally.

- What happens to the vehicle title once it’s a total loss?

When declared a total loss, the title may be branded accordingly. A salvage certificate of title may be required if the vehicle is later rebuilt or kept.

- What should I do if the insurance company values my vehicle too low?

Steps you can take: Request the insurer’s valuation breakdown Provide documentation of upgrades or perfect maintenance Obtain an independent appraisal report that includes market comparables Submit your report and negotiate or invoke the appraisal clause if available

- How long do I have to file a total loss claim in Colorado?

For property damage claims including total loss, Colorado’s statute of limitations is generally 3 years for damages to personal property (see C.R.S. §13-80-101).

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.