Total Loss Appraisal in

Arkansas

Get Your Free Estimate in a Minute!

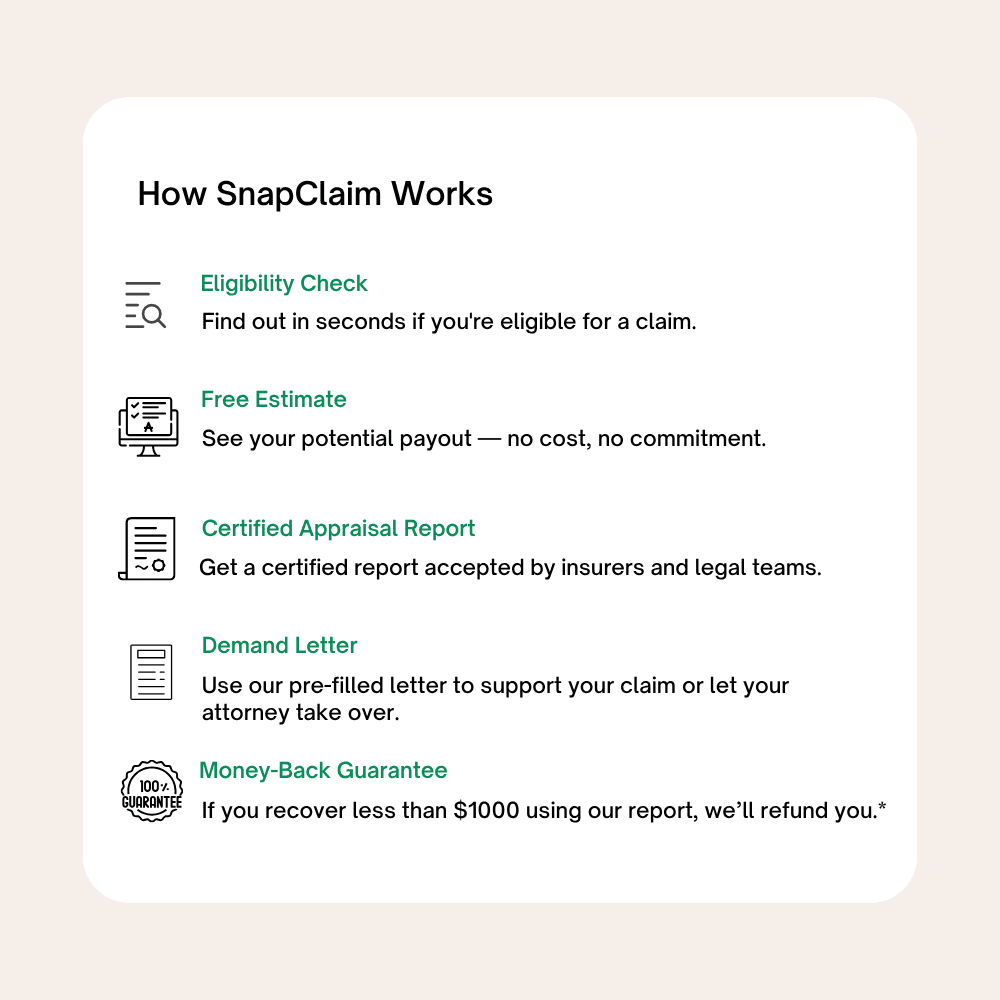

If your car was declared a total loss and you’re not happy with the insurance payout, you have the right to request a Arkansas total loss appraisal. SnapClaim helps you dispute unfair insurance valuations with certified, data-backed reports that show your vehicle’s true fair market value.

No credit card required [Takes less than 30 second]

Total Loss Appraisal in Arkansas: What You Need to Know

Arkansas Total Loss Appraisal — Get the True Value of Your Totaled Vehicle

If your car was declared a total loss and the insurance payout feels too low, you’re entitled to an independent Arkansas total loss appraisal. Whether your accident occurred in Little Rock, Fort Smith, Fayetteville, Springdale, Jonesboro, or anywhere across the state, SnapClaim helps you recover your vehicle’s fair market value (ACV) and secure the full settlement you deserve. Our certified total loss appraisal reports are data-driven, USPAP-aware, and court-ready — trusted by insurers, attorneys, and small-claims courts throughout Arkansas.Why Get a Total Loss Appraisal in Arkansas?

When your vehicle is totaled, insurers must pay its actual cash value (ACV). CCC or Mitchell valuations often undervalue Arkansas markets, especially along the I-49 and I-40 corridors where demand for used trucks, SUVs, and hybrids remains strong. An independent appraisal ensures your payout reflects true Arkansas resale prices.Common Reasons to Dispute a Total Loss Offer

- Incorrect trim, mileage, or options in the insurer’s report

- Comparables pulled from cheaper, out-of-state markets

- Improper deductions or unsupported condition adjustments

- Local demand premiums ignored (4×4 trucks, SUVs, hybrids, work vehicles)

What’s Included in Your Arkansas Total Loss Appraisal Report

- Full VIN-based vehicle analysis (make, model, trim, mileage, options)

- Verified local comparable listings (Little Rock, NWA, River Valley, Delta, and more)

- Accurate pre-loss fair-market-value calculation

- Transparent adjustment table for features, mileage, and regional trends

- Documentation to invoke your appraisal clause or use in small-claims court

- Optional expert witness support for arbitration or litigation

Arkansas Total Loss Laws & Appraisal Rights

Under Arkansas insurance law, you have the right to dispute a total loss valuation and request an independent appraisal under your policy’s appraisal clause. If appraisers disagree, a neutral umpire determines the vehicle’s fair value.- Arkansas Insurance Department — Official Site

- Arkansas Judiciary — Small Claims Court Information

- Arkansas Total Loss Threshold & Appraisal Laws

How to Dispute a Total Loss Offer in Arkansas

- Request the insurer’s valuation report and review it for errors.

- Order an independent SnapClaim appraisal to establish the true pre-loss market value.

- Invoke your appraisal clause if there’s a value disagreement.

- Submit SnapClaim’s report to your adjuster or attorney.

- Negotiate or escalate — many Arkansas clients recover thousands more with proper documentation.

Local Insight: Arkansas Market Trends

- Trucks and SUVs (F-150, Silverado, Tacoma, 4Runner) retain value across the Ozarks, River Valley, and Delta.

- Rural demand and work-vehicle use keep 4×4 and towing packages at a premium.

- Hybrids and fuel-efficient models have seen strong resale interest since 2021.

Example Arkansas Case Study

Vehicle: 2020 Toyota Tacoma SR5 4×4Insurance Offer (CCC): $29,400

SnapClaim Appraisal: $32,900

Final Settlement: $32,300 after invoking the appraisal clause

Helpful Arkansas Resources

- Arkansas Insurance Department — File a Complaint

- Arkansas Judiciary — Small Claims

- NHTSA — Vehicle History Lookup

Ready to Get Your Arkansas Total Loss Appraisal?

- No upfront payment required

- Report delivered in about 1 hour

- Fair-market-value and insurer-ready documentation included

Related Arkansas Locations

Click a pin to open the city’s total loss page.

Find your Arkansas city below to order your Total Loss Appraisal.

Order Your Total Loss Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Dispute an Unfair Total Loss Offer in Arkansas

If your car was declared a total loss in Colorado but the insurance payout seems too low, you don’t have to accept it. Under your policy’s appraisal clause, you can request an independent Arkansas total loss appraisal to verify your vehicle’s true fair market value. SnapClaim makes it simple — get a certified total loss report, invoke your appraisal rights, and negotiate a higher settlement — all within minutes.

“After my truck was totaled in Little Rock, the insurance company’s offer barely covered half of what local listings showed. SnapClaim took over the Arkansas total loss appraisal right away — their data-driven report proved the real market value in Central Arkansas. Thanks to them, I got an extra $3,600 on my settlement.”

James W.,

Little Rock, AR

Frequently Asked Questions

What makes a car a total loss in Arkansas?

In Arkansas, a vehicle is considered a total loss when repair costs are 70% or more of its Actual Cash Value (ACV) before the crash. Learn more: state-by-state rules.

What does Actual Cash Value (ACV) mean?

ACV is your car’s fair market value immediately before the accident—based on make, model, mileage, condition, and local Arkansas market data (Little Rock, Fayetteville, Fort Smith, Bentonville, Jonesboro). Learn more: Fair Market Value.

How much will insurance pay if my car is totaled in Arkansas?

Insurers owe your vehicle’s fair market value at the time of loss. If you file under your own policy, your deductible applies. If the at-fault driver’s insurer pays, you usually owe no deductible.

Can I dispute the insurance company’s total loss valuation?

Yes. You can request the full valuation report (CCC/Mitchell), verify comparable listings, and order an independent report from SnapClaim: Arkansas Total Loss Appraisal.

What happens to my title after a total loss in Arkansas?

Your vehicle will receive a Salvage title. After repairs, you can apply for a rebuilt title through the Arkansas Office of Motor Vehicle once it passes inspection.

Can I keep my totaled vehicle in Arkansas?

Yes. If you choose to retain the vehicle, your settlement will be reduced by the salvage value. You must obtain a rebuilt title before driving it again.

Are taxes and fees included in my total loss settlement?

Yes—Arkansas law generally requires insurers to include sales tax, title, and registration fees in total loss payouts. Request an itemized breakdown to confirm.

How long do I have to file a total loss claim in Arkansas?

The statute of limitations for property damage in Arkansas is generally three years from the date of the accident.

Why does local market data matter in Arkansas?

Vehicle prices vary by city—pickup trucks often sell for higher values in Northwest Arkansas, while SUVs and hybrids are popular in Little Rock and Conway. Using local comps ensures your payout reflects the true Arkansas market.

What is an appraisal clause, and how does it help?

Most Arkansas insurance policies include an appraisal clause. It allows each party to hire an appraiser, and if they disagree, a neutral umpire decides the final value—protecting your right to a fair settlement.

Can I use an independent appraisal in arbitration or court?

Yes. SnapClaim’s certified appraisal reports are accepted for disputes, arbitration, or small claims court. Learn more.

How fast can I get a total loss appraisal in Arkansas?

Most Arkansas appraisals are completed the same day—often within one hour—so you can negotiate quickly with your insurer.

How does SnapClaim help Arkansas drivers?

SnapClaim builds Arkansas-specific valuation files using verified comps from Little Rock, Fayetteville, Fort Smith, Bentonville, Jonesboro, and Conway. Many clients recover thousands more than the initial insurance offer. Start now.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.