When your insurance company says your car is “totaled,” it isn’t a comment on how bad the wreck looks—it’s pure economics. They’ve simply decided it will cost more to fix your car than what it was worth right before the accident. Understanding this key fact is the first step to navigating the claims process and getting the fair payout you deserve.

Understanding a Total Loss Declaration

Hearing the words “total loss” is never fun, but the logic behind it is straightforward. Your insurer is simply doing a cost-benefit analysis. Is it cheaper to pay for repairs, or is it cheaper to write you a check for the car’s pre-accident value and take possession of the damaged vehicle?

The decision comes down to one key concept: the Total Loss Threshold (TLT).

The Total Loss Threshold Explained

Every state—or sometimes the insurance company itself—sets a Total Loss Threshold. This is a percentage that acts as a tipping point. If the estimated repair cost (plus the car’s scrap or salvage value) exceeds this percentage of your car’s Actual Cash Value (ACV), it’s officially a total loss.

ACV is simply the fair market price for your car one minute before the crash happened.

For example, let’s say your car’s ACV is $15,000. Your state’s TLT is 75%. If the repair estimate is higher than $11,250 ($15,000 x 0.75), the insurance company will declare it a total loss.

This is why a car that looks fixable is often totaled. The math, not the visual damage, makes the final call.

Why Are More Cars Being Totaled Today?

If it seems like more cars are being totaled lately, you’re not wrong. Skyrocketing repair costs, driven by parts shortages and higher labor rates, have made fixing cars incredibly expensive. It’s now common for an insurer to total a vehicle once repair costs hit just 70-80% of its value because it’s the more economical option for them.

To help you understand the process, here are the key terms you’ll hear from your adjuster.

Key Terms in Your Total Loss Claim

| Term | What It Means for You |

|---|---|

| Total Loss Declaration | The insurer has decided it’s not cost-effective to repair your vehicle. They will pay you its value instead. |

| Actual Cash Value (ACV) | The fair market value of your vehicle right before the accident. This is the number your settlement is based on. |

| Total Loss Threshold (TLT) | A percentage (set by state law or the insurer) that triggers a total loss. If repair costs exceed this %, it’s totaled. |

| Salvage Value | The amount the insurer can get by selling the damaged vehicle for parts or scrap. This is factored into their calculation. |

When these factors align, a total loss is declared. This kicks off the process where the insurance company must compensate you for the loss of your property.

Of course, your insurance policy is the contract that spells out what’s covered. Different types of incidents fall under different coverages. For instance, if your car was totaled due to theft or a freak hailstorm, you’d need the right policy in place. A good starting point is understanding comprehensive car insurance.

Your goal is to get a settlement that truly reflects your car’s pre-accident worth. This is where knowing how to challenge the insurer’s valuation becomes critical.

How Insurers Calculate Your Car’s Value

The most important number in a car insurance totaled car claim is the Actual Cash Value (ACV). This figure is the foundation of the insurer’s settlement offer, but it often causes confusion. ACV isn’t what you paid for the car, and it’s not what it costs to buy a brand-new one.

Simply put, ACV is what your car was worth on the open market one minute before the crash. Think of it as the fair price a real person would have paid for your specific vehicle.

The Core Components of an ACV Calculation

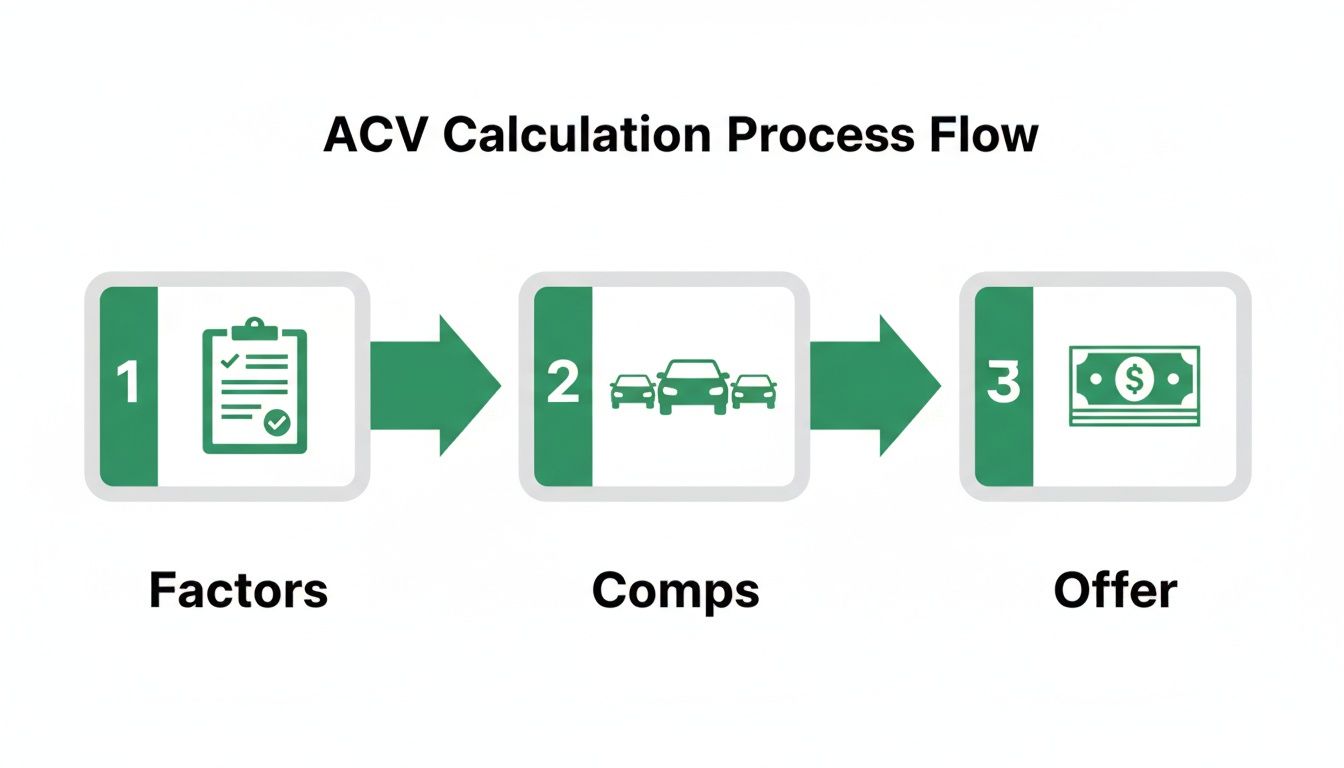

Insurance companies use a specific formula and market data to arrive at a valuation. While their process can seem complex, it generally boils down to a few key factors:

- Base Value: The starting point is your car’s year, make, and model.

- Mileage: Lower mileage generally means higher value, while higher mileage brings it down.

- Condition: They assess the pre-accident condition of the interior and exterior, looking for wear and tear or any old damage.

- Features & Options: Upgraded sound systems, sunroofs, or advanced safety features can add real value.

- Local Market Data: The value is adjusted based on what similar cars are actually selling for in your area.

Once the adjuster has this information, they build a profile of your vehicle. The next step is where they find “proof” to back up their number.

The Role of “Comparable” Vehicles

To justify their ACV offer, insurers generate a report using what they call “comparable” vehicles, or “comps.” In theory, these are similar cars recently sold or currently for sale in your local market.

The goal is to find vehicles that are a close match to yours in make, model, year, and condition to establish a fair price range. Unfortunately, this is where many valuations start to go wrong for the vehicle owner.

Key Insight: The “comparable” vehicles an insurer picks are often anything but. It’s common for them to use cars with higher mileage, fewer options, or worse pre-accident condition than yours. This tactic artificially drags down the average value and your settlement offer.

This isn’t an accident; it’s a common strategy to minimize the insurance total loss payout. An adjuster might pull comps from a different area where prices are lower or select cars that lack your vehicle’s premium packages.

Why the First Offer Is Often Too Low

Insurance companies are businesses, and their goal is to close claims for as little as possible. The initial ACV offer they send is a starting point for negotiation—not a final number. They are banking on you accepting it without question.

Insurers often rely on third-party valuation services that can produce reports skewed toward lower values. These reports might ignore the new tires you just bought or use a flawed set of “comparable” vehicles. An undervalued offer isn’t personal; it’s business as usual.

That’s why you must do your own homework. For a deeper dive, our guide on total loss car valuation gives you the knowledge to analyze their report. Armed with the right information, you can challenge their assessment and negotiate for the payout you deserve.

Your Action Plan After a Total Loss Diagnosis

Once the insurance company labels your car a “total loss,” the clock starts ticking. The moves you make next are critical to ensuring you get a fair payout. This isn’t a time to panic—it’s time to get organized.

Before diving into the total loss claim, remember the critical steps immediately following a vehicle accident. Those initial actions can influence how your claim plays out. Once the total loss diagnosis is official, however, your mission shifts to managing the claim.

Step 1: Secure Your Belongings

First things first: get all your personal items out of your car. If it was towed from the scene, find out where it is and schedule a time to clean it out.

Don’t forget to check the glove box, center console, and trunk. The moment you sign the vehicle over to the insurer, you might never get access to it again.

Step 2: Do Not Sign Anything Immediately

Your adjuster will eventually send over documents to sign, including a release of title. Read every word, but do not sign anything until you’ve reviewed and agreed to their settlement offer.

Signing the title over too early removes your negotiating power. Remember, you are under no obligation to accept their first offer.

Step 3: Gather All Your Documentation

Now it’s time to build your case. The more proof you have of your car’s value and condition before the crash, the stronger your negotiating position will be.

Your goal is to prove what your car was worth moments before the accident. Start collecting:

- Maintenance Records: Dig up receipts for recent work. New tires, a brake job, or major service shows you kept the vehicle in great shape.

- Photos: Find any pictures of your car before the wreck that show off its excellent condition.

- Bill of Sale: Your original purchase document helps establish the car’s specific features and trim level.

- List of Upgrades: Did you add a remote starter or aftermarket sound system? List every custom part.

This documentation helps you challenge the insurer’s initial offer, which is often based on a simplified process.

As you can see, the final offer hinges on the “comps” they choose. This is where most valuations go wrong and where you have the power to push back.

Step 4: Review Your Insurance Policy

It’s time to read the fine print in your auto insurance policy regarding total loss claims. You need to know your exact coverage, your deductible amount, and any specific procedures your insurer requires.

Pay special attention to whether you have GAP (Guaranteed Asset Protection) coverage. If you owe more on your car loan than its ACV, this coverage helps pay off the difference. To get a handle on that all-important ACV figure, it helps to understand how to determine your vehicle’s actual cash value.

Negotiating a Fair Settlement for Your Totaled Car

Here’s a critical piece of advice: the insurance company’s first settlement offer is almost never their final offer. Think of it as the start of a conversation. Insurers are businesses aiming to close claims as efficiently and inexpensively as possible.

They are banking on you accepting their first number without a fight. But if you come prepared with evidence, you can challenge a lowball offer and get the full amount you’re owed. The key is to stop talking about opinions and start showing them facts about your car’s real value.

Building Your Counteroffer with Evidence

Data is your best friend when talking to an adjuster. Before you call them back, build a solid case for why your car is worth more than their offer.

Your mission is to paint a clear picture of your car’s pre-accident condition and prove its market value. Organize the following items:

- Maintenance Records: Proof of regular service shows your car was well-cared-for, which adds to its value.

- Proof of Upgrades: If you have receipts for a premium sound system or custom wheels, include them.

- Comparable Vehicle Listings: Find what cars just like yours (same year, make, model, trim, and similar mileage) are selling for in your local area. Good places to look are Kelley Blue Book, Edmunds, and local dealership websites.

When you present this information clearly, it signals to the adjuster that you’ve done your homework and puts pressure on them to justify their low number.

The Power of an Independent Appraisal

Your research is a fantastic start, but a certified, independent appraisal provides the strongest proof. An independent appraiser is a neutral expert whose only job is to determine your vehicle’s true Fair Market Value using industry-standard methods.

This is the single most effective way to level the playing field. An independent report replaces the insurer’s hand-picked “comparable” vehicles with a defensible, data-backed valuation that is very difficult for them to ignore.

A professional total loss car appraisal gives you the solid evidence needed to challenge an unfair settlement with confidence. It shifts the entire conversation from their opinion to a clear, fact-based value, giving you serious leverage.

Why Insurer Valuations Often Fall Short

It’s also helpful to understand the big picture. Economic pressures are making it tougher for car owners to get fair settlements. For example, global trade policies are reshaping the auto insurance market on solera.com, driving up the cost of auto parts and repairs. This incentivizes insurers to total vehicles and lowball the ACV they pay you.

This is why getting a second opinion from an independent expert is more important now than ever.

Insurer Valuation vs. an Independent Appraisal

An insurer’s report is designed to serve their interests. A certified appraisal, on the other hand, is built on objective, verifiable data.

| Factor | Typical Insurer Report | SnapClaim Certified Appraisal |

|---|---|---|

| Source | Generated by the insurer or a biased third-party vendor. | Prepared by a neutral, certified valuation expert. |

| “Comps” | Often uses vehicles with higher mileage or fewer options to lower the value. | Selects true, apples-to-apples comparable vehicles from your local market. |

| Condition | May use a generic “average” condition rating without specific proof. | Accounts for your vehicle’s actual pre-accident condition, backed by your evidence. |

| Adjustments | Frequently misses or ignores custom parts, recent upgrades, and maintenance. | Methodically adds value for documented upgrades and superior maintenance history. |

| Credibility | A starting point for negotiation, easily challenged with data. | A court-accepted, defensible document that provides powerful negotiating leverage. |

When you present a certified appraisal, you’re not just asking for more money—you’re proving your car insurance totaled car is worth more with a professional, evidence-based report. With a SnapClaim report, our certified methodology provides the data-backed proof you need to negotiate fairly.

Understanding Salvage Titles and Your Options

So, your car insurance company has declared your car totaled. What happens to the vehicle now? Its legal status is about to change permanently.

Once an insurer pays a total loss claim, they work with the DMV to replace the car’s clean title with a salvage title. This is a permanent brand on the vehicle’s record, signaling to all future buyers that it was once so damaged it was considered a complete loss. This brand hurts its value, safety, and reliability.

You have two main paths forward, and your choice will determine the final amount of your insurance check.

Option 1: Surrendering the Vehicle

The most common choice is to surrender the vehicle to the insurance company. You sign over the title, they take the wrecked car, and you receive the full Actual Cash Value (ACV) you agreed upon.

They then haul the car to a salvage auction to sell it for parts or scrap. For most people, this is the cleanest way to close the claim and move on.

Option 2: Keeping the Vehicle (Owner Retention)

Your other option is owner retention, which means you choose to keep your totaled car. This has some major financial strings attached.

If you go this route, the insurance company pays you the car’s ACV, but they first subtract its salvage value.

The salvage value is what the insurer estimates they would get for your wrecked car at auction. If your car’s ACV is $18,000 and its salvage value is $4,000, the insurer will pay you $14,000, and you get to keep the car.

This might be tempting if you’re a skilled mechanic, but don’t make this decision lightly. Making a salvage car road-legal again is almost always harder and more expensive than people think.

The Reality of a Rebuilt Title

If you decide to keep the car, you can’t just fix it up and drive it. To legally operate it again, you must navigate a strict state process to get a rebuilt title.

This usually involves:

- Extensive Repairs: You’re responsible for fixing everything to meet state safety standards.

- A Mountain of Paperwork: You’ll need to submit receipts for every part and all labor to prove the repairs were done properly.

- A Rigorous State Inspection: A certified inspector will comb over the vehicle to verify it’s structurally sound and safe. As the Texas Department of Insurance notes, this is a non-negotiable step.

Even with a rebuilt title, the car’s history is forever branded. A rebuilt title crushes its resale value, and finding full coverage insurance can be a real challenge.

Common Mistakes to Avoid in a Total Loss Claim

Navigating a car insurance totaled car claim can be tricky. One wrong step can cost you thousands. Knowing the common pitfalls ahead of time is your best defense against a lowball settlement.

Accepting the First Offer Blindly

The single biggest mistake is accepting the insurance company’s initial offer without question. Think of that first number as a starting point for negotiations, not the final word. You have every right to see their valuation report and present your own evidence for a higher payout.

Failing to Document Your Car’s Value

Many owners leave money on the table because they don’t prove what their vehicle was worth before the accident. The adjuster won’t know about that new set of tires or premium sound system unless you show them the receipts.

Take a few minutes to gather this crucial evidence:

- Recent Maintenance: Receipts for oil changes, new brakes, or major services prove the car was well-maintained.

- Upgrades and Features: Document any aftermarket parts or high-end factory options that add value.

- Pre-Accident Photos: Pictures showing your car in great condition can counter a low condition rating from the insurer.

Not Understanding Your Policy

It’s vital to know what your insurance policy covers before you agree to anything. Forgetting about your deductible can lead to a surprise when you see the final check.

Recent J.D. Power data shows that 26% of customers now face deductibles of $1,000 or more, which can put a huge dent in your payout. To see how this affects claims nationwide, you can discover more insights about auto claims satisfaction on claimsjournal.com.

You also need to confirm if you have GAP (Guaranteed Asset Protection) coverage, especially if you have a loan. Without it, you could be stuck paying off a car you no longer own.

Frequently Asked Questions (FAQ)

1. What if I owe more on my car loan than the insurance payout?

If the insurance settlement (your car’s Actual Cash Value minus your deductible) is less than what you owe, you are responsible for paying the remaining balance to your lender. This situation is where Guaranteed Asset Protection (GAP) insurance helps. If you have GAP coverage, it pays the difference between the insurance total loss payout and your remaining loan amount.

2. Can I dispute the insurance company’s valuation of my totaled car?

Absolutely. You have the right to challenge the insurer’s ACV offer. The best way to do this is by providing your own evidence, such as maintenance records, proof of upgrades, and comparable vehicle listings from your local market. For the strongest case, a certified appraisal from an independent expert provides data-backed proof to support your claim for fair compensation.

3. How long does a total loss claim take?

While it varies, most total loss claims are resolved within a few weeks to a month. The timeline depends on how quickly the vehicle is inspected, how long it takes for you and the adjuster to negotiate and agree on a value, and how fast the final paperwork is processed. Staying organized and responding promptly can help speed up the process.

4. Do I need an attorney for a total loss claim?

For most straightforward total loss claims, you likely don’t need an attorney. You can often negotiate a fair settlement on your own by presenting solid evidence, such as an independent appraisal. However, if your claim involves serious injuries, a dispute over who was at fault, or you feel the insurer is negotiating in bad faith, consulting a lawyer is a wise decision.

A lowball offer on your totaled car can leave you thousands of dollars short. A SnapClaim certified appraisal provides the data-backed proof you need to negotiate fairly and recover the full value of your vehicle.

We’re so confident in our reports that we offer a Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉Get your fair market value (total loss) appraisal