When an insurance company declares your vehicle a total loss, your first question is often about the money: who gets the insurance check when a car is totaled? The answer depends on one key factor: who owns the vehicle.

If you own your car outright, the check comes directly to you. However, if you have an auto loan or lease, the insurance payout first goes to the lender or leasing company to cover your outstanding balance. Understanding this process is the first step toward securing the fair compensation you deserve.

Who Gets the Insurance Check When a Car Is Totaled

After the shock of an accident, financial questions quickly follow. The most common one we hear is, “Who gets the insurance check when a car is totaled?” While the question is simple, the answer depends entirely on who holds the title and has a financial stake in your vehicle.

The starting point for any total loss payout is your vehicle’s Actual Cash Value (ACV). This isn’t the cost of a new car; it’s what the insurer determines your car was worth the moment before the crash. They analyze its depreciation, mileage, and condition to arrive at this figure, which forms the basis of their settlement offer.

Ownership Determines the Payee

Your ownership status is the single most important factor that decides where the insurance money goes. It typically falls into one of these three scenarios:

- You Own the Car Outright: If you’ve paid off your vehicle and hold the title, the process is simple. The full settlement check is made out to you.

- You Have an Auto Loan: If you’re still making payments, your lender is the lienholder, giving them a legal claim to the vehicle. The insurer must pay them first to satisfy your loan balance. Any leftover money comes to you.

- You Lease the Vehicle: When you lease, the leasing company owns the car. Therefore, the insurance check goes directly to them to cover the loss of their asset.

Let’s break this down further.

Quick Guide to Payout Recipients

This table provides a simple overview of who gets paid based on car ownership.

| Ownership Status | Primary Recipient of the Check | Key Consideration |

|---|---|---|

| Owned Outright | You (the vehicle owner) | The full settlement is yours. |

| Financed (Loan) | The Lender (Lienholder) | The lender is paid first; you receive any remaining amount. |

| Leased | The Leasing Company (Lessor) | The leasing company owns the vehicle and receives the payment. |

Navigating these rules can be overwhelming. This guide will walk you through each scenario, explain how insurers determine your car value after accident, and show you what to do if their offer is too low.

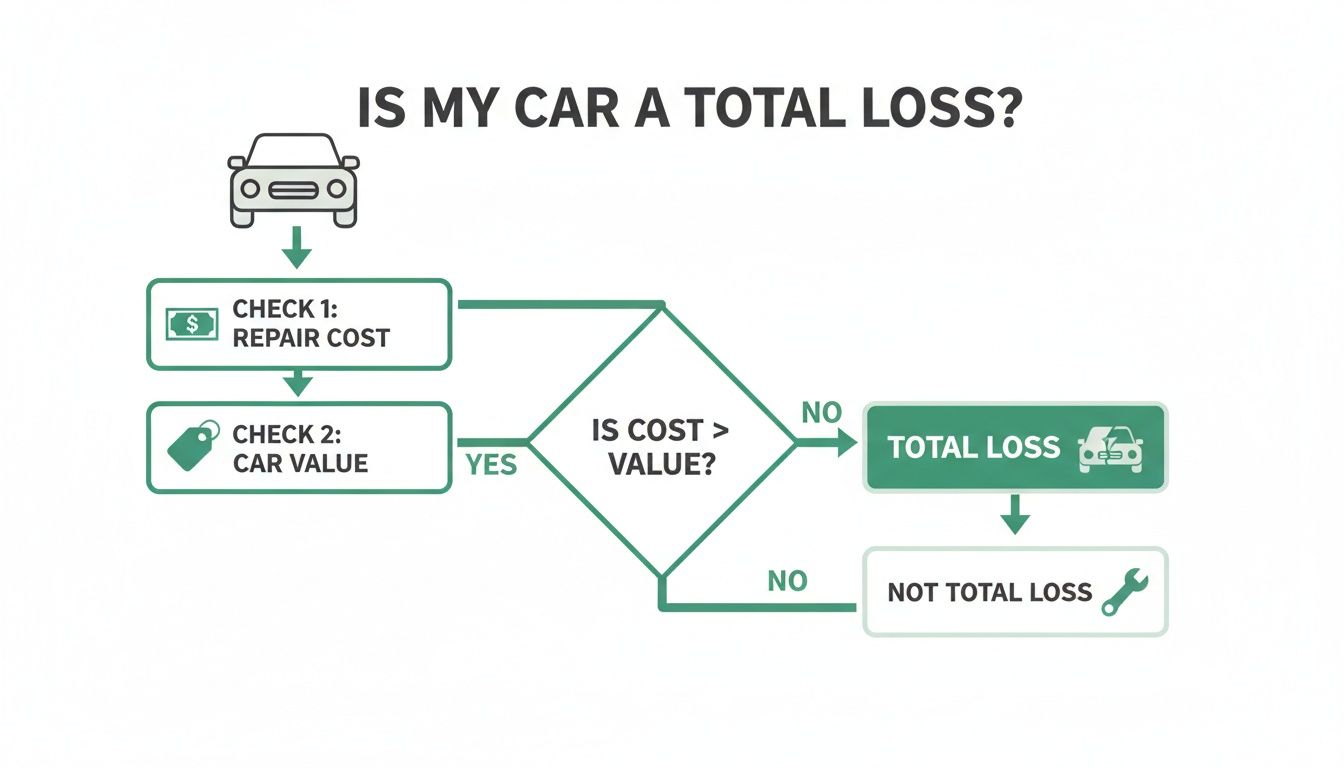

How Insurance Companies Decide Your Car Is a Total Loss

Before anyone can figure out who gets the insurance check when a car is totaled, an adjuster must declare your vehicle a “total loss.” This isn’t a subjective judgment; it’s based on a specific calculation.

Insurers compare the estimated cost of repairs to your car’s Actual Cash Value (ACV)—what it was worth right before the accident. If the repair costs approach the car’s value, it reaches a point where fixing it is no longer financially practical for them. That’s when it’s totaled.

The Total Loss Threshold

Every state has a total loss threshold (TLT), which is a specific percentage set by law. If repair costs exceed this percentage of the car’s ACV, the vehicle must be declared a total loss. These thresholds vary by state, typically ranging from 70% to 100%.

- In a state like Texas, the threshold is 100%. Repair costs must exceed the car’s full value for it to be legally totaled.

- Other states set the bar around 75%. So, if your car is worth $10,000 and repairs are estimated at $7,500 or more, it’s a total loss.

However, an insurer can still total your car even if repairs are below the state’s legal threshold. Their internal policies may flag a vehicle for total loss if repairs approach 70% of its value to avoid the risk of hidden damages causing costs to spiral. For a deeper dive, check this guide on understanding the actual cash value (ACV) of a totaled car.

Why More Cars Are Being Totaled

It’s a common sight: cars with seemingly minor damage being written off by insurers. This is happening more frequently due to the skyrocketing cost of repairs.

Modern vehicles are filled with advanced safety features like sensors, cameras, and specialized materials that are very expensive to fix. A minor fender-bender can now damage complex electronic systems, sending repair estimates through the roof.

The data confirms this trend. Total loss claims now account for 27% of all collision claims, driven by high repair costs. The Insurance Institute for Highway Safety tracks these trends, highlighting how much more expensive it is to fix today’s cars. Ultimately, it all comes down to the insurer’s ACV calculation. If they undervalue your car, it’s more likely to be totaled, leaving you with an inadequate settlement. Our guide on total loss calculation shows you how to fight for a fair valuation.

Mapping the Payout Path for Different Ownership Scenarios

The path an insurance check takes can be complex, depending on who has a financial stake in your vehicle. The critical question—who gets the insurance check when a car is totaled—has a different answer for each situation. Let’s trace the money through the three most common ownership scenarios.

First, it’s helpful to see what triggers a total loss payout. Insurance companies use a simple formula.

If the cost to repair your car exceeds its value, it is generally declared a total loss. This is when the payout process begins.

Scenario 1: You Own the Car Outright

This is the most straightforward scenario. If you have paid off your vehicle and hold the title, the insurance company writes the check directly to you.

As the sole owner, the full Actual Cash Value (ACV) settlement belongs to you. After agreeing on a settlement amount, you will need to:

- Sign the vehicle’s title over to the insurance company.

- Provide a signed power of attorney form, allowing them to take possession.

- Hand over the keys.

Once the paperwork is complete, the check is issued in your name, and you can use the funds as you see fit.

Scenario 2: You Have an Auto Loan

When you are still making car payments, your lender is the lienholder. This means they have a legal claim on the vehicle until the loan is paid off. Because of this lien, the insurance company is legally required to pay them first.

Here’s how the payment is processed:

- Lender Gets Paid First: The insurer sends the settlement check directly to your lender to pay off your remaining loan balance.

- You Get What’s Left: If the settlement is more than what you owe, you receive a check for the difference. For example, if your car’s ACV is $15,000 and you owe $12,000, your lender gets $12,000, and you get the remaining $3,000.

- The Potential Shortfall: If you owe more than the car is worth (known as being “upside down”), you are responsible for paying the difference to the lender.

Scenario 3: You Lease the Vehicle

In a lease agreement, you do not own the car—the leasing company does. They hold the title and are the legal owner. Consequently, when a leased car is totaled, the entire insurance settlement goes directly to them.

The payout covers your remaining lease payments and the vehicle’s residual value. In almost all cases, you will not receive any part of the insurance total loss payout. As the experts at Kelley Blue Book note, the check goes to the insured party only if there are no outstanding liens or leases. You can find more details in their guide on totaled cars.

How Your Auto Loan and GAP Insurance Affect Your Payout

When you finance a vehicle, the answer to “who gets the insurance check when a car is totaled?” involves your lender. Also known as the lienholder, your lender has a direct financial stake in the car until the loan is fully paid. This legally puts them first in line for any insurance payout.

The insurance company will issue the settlement check directly to your lender to pay off your loan. Only after the loan is satisfied will you receive any leftover funds. This process protects the lender’s investment, ensuring they are paid back before you are.

The Risk of Being “Upside Down”

A common problem for vehicle owners is being “upside down” on their auto loan, which means you owe more on your car than its Actual Cash Value (ACV). This happens because cars often depreciate faster than we pay down the loan.

This creates a financial gap that can be a major headache. For example, if your car’s ACV is determined to be $18,000, but your loan balance is $21,000, the insurance payout won’t cover your debt. The lender receives the full $18,000, but you are still responsible for the remaining $3,000, even though you no longer have the car.

It’s vital to understand how insurers calculate ACV. Learning more about what determines the actual cash value can help you prepare for negotiations.

How GAP Insurance Saves the Day

This scenario is precisely where Guaranteed Asset Protection (GAP) insurance is invaluable. GAP is optional coverage designed to cover the difference—or “gap”—between the insurance payout and what you still owe your lender.

Here’s how it works using our example:

- Remaining Loan Balance: $21,000

- Insurer’s ACV Payout: $18,000

- The Financial Gap: $3,000

Without GAP insurance, you would have to pay the $3,000 out of pocket. With GAP coverage, the policy pays the $3,000 difference directly to the lender, clearing your loan. It bridges that financial gap so you can walk away from a total loss without debt for a car that no longer exists.

Key Takeaway: GAP insurance is essential protection if you have a significant auto loan, especially in the first few years of ownership when depreciation is steepest. It ensures you can move on from a total loss without a lingering financial burden.

What to Do When the Insurance Payout Is Too Low

It’s a frustrating moment: the insurance company’s settlement offer arrives, and the number is far too low to replace your vehicle. You don’t have to accept an unfair offer. You have the right to challenge it.

Insurance companies often use automated valuation systems that produce generic values. These systems can easily miss what made your car valuable—its excellent condition, low mileage, recent upgrades, or high demand in your local market. Their first offer is just a starting point for negotiation, not the final word.

Building Your Case for a Higher Payout

To get the compensation you’re owed, you must prove your vehicle’s higher value with evidence. Your goal is to build a strong counteroffer based on facts.

Here’s what to collect:

- Comparable Listings: Find at least three vehicles for sale in your area that are a close match in make, model, year, trim, mileage, and features.

- Maintenance Records: Gather receipts for recent major work or valuable upgrades, like new tires, a new transmission, or custom additions.

- Original Window Sticker: If you have it, this document lists all optional features and packages that standard valuation tools often miss.

This evidence helps establish a more accurate baseline for your car’s pre-accident value. For a complete walkthrough, see our step-by-step guide to disputing a total loss offer.

The Power of an Independent Appraisal

While your own research is a great start, an independent, certified appraisal is your most powerful tool. It provides unbiased, data-backed proof of your vehicle’s fair market value, shifting the negotiation from opinions to facts.

A professional total loss report from SnapClaim strengthens your claim with certified data. Our reports provide the leverage you need to negotiate confidently and recover the fair compensation you deserve, helping you get a fair insurance total loss payout.

Take Control of Your Total Loss Claim and Get Paid Fairly

A total loss claim can feel like an uphill battle, but you have more power than you realize. While the first step is knowing who gets the insurance check when a car is totaled, the key to protecting yourself financially is remembering that the insurer’s valuation is negotiable.

Their initial settlement offer is just that—an offer. You do not have to accept a lowball number, whether the check is made out to you or your lender.

By gathering your own evidence and presenting a strong, data-backed counteroffer, you can challenge their valuation and fight for the money you are rightfully owed. An independent appraisal provides the objective proof needed to level the playing field and support your case. For a broader view of the process, it’s helpful to read about understanding claims processing and how to do it right.

At SnapClaim, our certified appraisal reports provide the hard data you need to negotiate confidently. We also stand behind our work with a straightforward promise.

SnapClaim’s Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Don’t leave money on the table. Take control of your claim and ensure you get the full, fair market value your vehicle was worth.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

FAQ: Your Top Questions About Total Loss Payouts

Here are answers to some common questions vehicle owners have during a total loss claim.

Can I Keep My Totaled Car?

Yes, in many cases, you can choose to keep your vehicle through an option called “owner retention.” If you do, the insurer will subtract the car’s salvage value (what it’s worth in its damaged state) from your settlement check. Be aware that the state will issue the car a “salvage title,” and it cannot be driven legally until it’s repaired and passes a rigorous safety inspection.

What if I Disagree with the Insurance Company’s Valuation?

You never have to accept the insurer’s first offer. If their valuation seems too low, you have the right to dispute it by providing evidence that your car was worth more. An independent, unbiased appraisal from a source like SnapClaim is the most effective way to do this. A certified, data-driven report provides the proof you need to negotiate for a fair insurance total loss payout.

How Long Does It Take to Get the Insurance Check?

Once you and the insurer agree on a settlement amount, it typically takes 7 to 30 days to receive the check. However, delays can occur due to incomplete paperwork, disputes over the vehicle’s value, or prolonged negotiations. Submitting all your documents promptly can help speed up the process.

Does a Total Loss Affect My Insurance Rates?

Whether a total loss impacts your rates depends on who was at fault for the accident. If you were the at-fault driver, you should anticipate a premium increase at your next policy renewal. If the accident was not your fault, your rates should not go up. However, insurance rules vary by state and company, so it’s always best to confirm with your agent.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your Fair Market Value Appraisal Report Now