After a car accident, you’ll hear one term more than any other: Actual Cash Value. So, what is my car’s actual cash value? Think of it as the fair market price for your vehicle just moments before the collision occurred—not the original sticker price, but what a willing buyer would have paid for it right then and there. Understanding this number is the first step toward securing a fair insurance settlement.

Your Car’s Actual Cash Value Explained

When an insurer declares your car a total loss, its Actual Cash Value (ACV) becomes the single most important figure in your claim. This is the baseline they use to calculate your payout. Getting a firm grip on this concept empowers you to challenge a low offer and negotiate effectively.

Your car’s value is determined by a unique mix of factors, much like a house’s value depends on its condition, age, and location.

The Role of Depreciation

The main reason your car’s ACV is almost always lower than its original price is depreciation. This is the natural and unavoidable loss of value that happens as a vehicle ages, accumulates miles, and shows normal wear.

Unless you own a rare classic, cars are depreciating assets. A brand-new car can lose 20–30% of its value in the first year alone. After five years, that figure can climb to 50–60% depending on its make, model, and condition.

Key Differences in Valuation Terms

It’s easy to get tangled up in insurance jargon. While a comprehensive glossary of insurance terms can be a lifesaver, let’s simplify the key terms you’ll encounter during your claim.

Here’s a quick reference table to clarify the differences between Actual Cash Value and other common valuation terms.

Understanding Different Car Valuations

| Valuation Term | What It Represents | Primary Use Case |

|---|---|---|

| Actual Cash Value (ACV) | Your car’s fair market price before the accident, accounting for depreciation. | The standard for calculating a total loss payout. |

| Replacement Cost | The cost to buy a brand-new, identical vehicle today. | Rarely covered in standard auto policies; requires special coverage. |

| Fair Market Value | Often used interchangeably with ACV; what a buyer would willingly pay a seller. | General valuation for sales, taxes, or legal matters. |

| Diminished Value | The loss in resale value a car suffers after being repaired from an accident. | A separate claim filed after repairs are completed on a repairable vehicle. |

The insurance company’s settlement is based on ACV, which is designed to compensate you for the value you lost, not to buy you a brand-new car. This is why their first offer often feels surprisingly low and why understanding how to negotiate is crucial.

How Insurance Companies Calculate Your Car’s ACV

When you receive a settlement offer, you might wonder, “Where did they even get this number?” It’s not arbitrary. It’s the result of a data-driven process designed to answer one question: what is my car’s actual cash value?

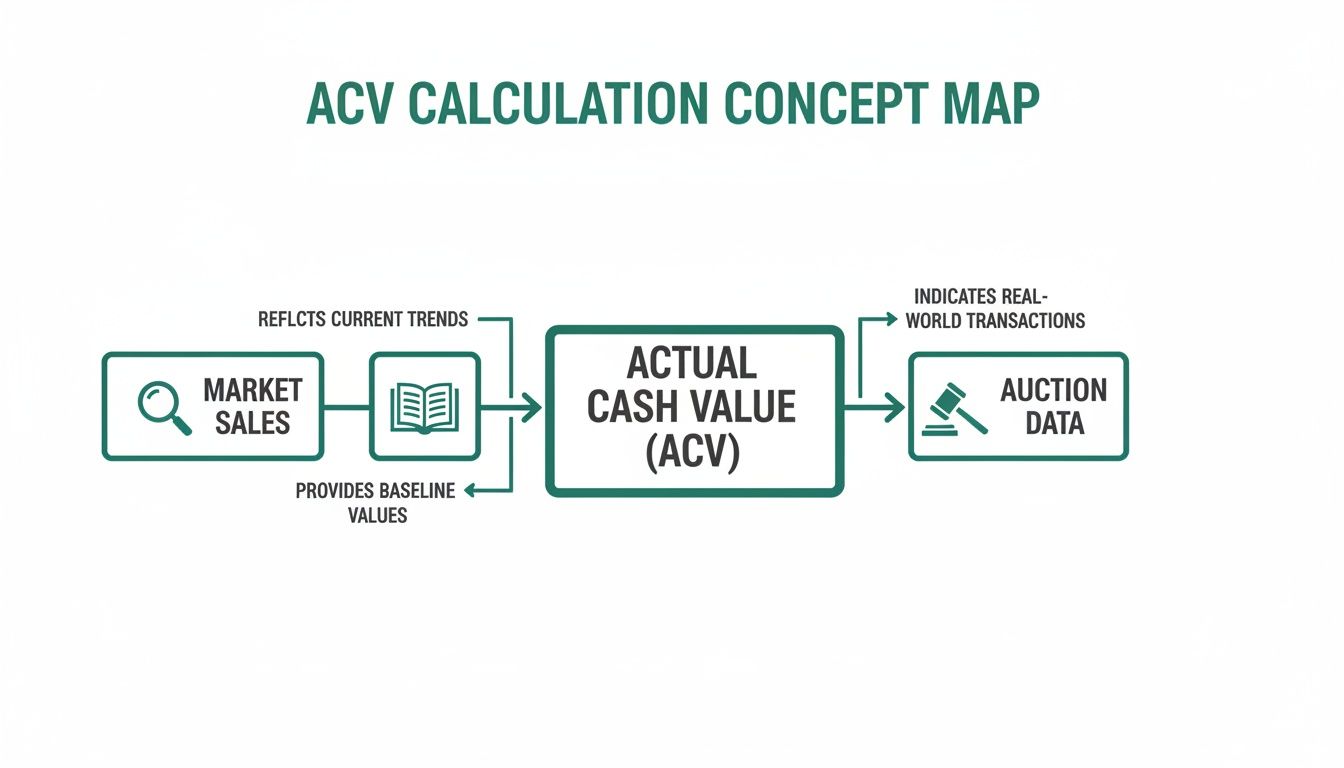

Insurance companies use proprietary software that combines data from multiple sources to generate a valuation report. This allows them to support their offer with what appears to be solid market evidence, but the type of data they prioritize can significantly impact the final number.

The Three Pillars of an Insurer’s Valuation

An insurer’s ACV calculation relies on three main data sources to determine a vehicle’s value.

- Comparable Vehicle Sales: Adjusters search for vehicles similar to yours—same make, model, year, and trim—that have recently sold in your local market. The goal is to match mileage and options as closely as possible.

- Valuation Guides: Sources like Kelley Blue Book (KBB) and NADAguides offer standardized vehicle values. While useful, insurers treat these as just one piece of the puzzle, not the final word.

- Auction Data: This is often where your valuation takes a hit. Insurers frequently use data from wholesale auctions where dealers buy cars at lower prices. Relying on this data can drag down your vehicle’s valuation significantly compared to its retail worth.

An insurer’s goal is to find the “fair market value.” When they lean too heavily on wholesale auction data, the valuation no longer reflects what it would have actually cost you to buy a comparable car from a retail dealer.

Fine-Tuning the Value with Adjustments

After pulling market data, the software applies adjustments specific to your vehicle. These can either increase or decrease the final value.

- Positive Adjustments: Features like a premium sound system, sunroof, top-tier trim package, or exceptionally low mileage will add value.

- Negative Adjustments: High mileage, pre-existing cosmetic damage, or interior wear and tear can reduce the value. The condition rating assigned by the adjuster (“fair,” “good,” or “excellent”) plays a major role.

This process is highly automated. The adjuster inputs your car’s details, and the system generates a valuation. Many insurers use platforms like the CCC ONE Market Valuation Report, but the report is only as accurate as the data used.

Why the Data They Use Is Everything

Answering “What is my car’s actual cash value?” is all about big data. Insurers and independent appraisers determine ACV using recent sales, auction results, and market trends. For example, if a five-year-old sedan was worth $18,000 last year but the market for that model dropped 8%, its ACV might start around $16,560before accounting for its specific mileage or condition. You can read more on these trends in global auto market reports.

If the insurer’s report uses “comps” that are base models when yours was fully loaded, or if it pulls data from a cheaper market, the ACV offer will be unfairly low. Your job is to analyze their report and counter with better evidence.

Key Factors That Determine Your Car’s Value

When you ask, “what is my car actual cash value,” the answer is in the details—and insurers often overlook them. While make, model, year, and mileage set the baseline, numerous other factors shape your car’s true worth. Knowing these is your best defense against a lowball settlement.

An insurer’s automated system can’t see the unique qualities of your vehicle. It’s up to you to highlight them and provide proof.

The Core Valuation Factors

Every valuation starts with the same basic checklist to establish a baseline value.

- Make, Model, and Year: A 2022 Honda Accord has a different starting value than a 2018 Ford Focus. This is the primary identifier.

- Mileage: This is one of the biggest drivers of depreciation. Lower mileage suggests less wear and tear and almost always means a higher value.

- Overall Condition: The pre-accident condition is critical. An adjuster will classify your car’s state (e.g., fair, good, excellent) based on visible wear, interior cleanliness, and any pre-existing damage.

Details Insurers Often Overlook

This is where you can significantly impact your settlement. Insurance companies, aiming to close claims quickly, often fail to account for valuable additions and recent investments.

As the visual shows, your car’s value is a mix of real-world market sales, standard guides, and wholesale auction data. Your job is to ensure every high-value item is included.

- Trim Level and Optional Packages: Was your car the base model or the fully loaded version? Factory-installed packages for technology, safety, or performance can add thousands of dollars to the ACV.

- Significant Recent Maintenance: Did you recently spend $1,200 on new premium tires or replace the timing belt? Provide receipts for major service done in the last 6-12 months to prove your car was in top mechanical condition.

- Quality Aftermarket Additions: High-quality, professionally installed upgrades can add value. A premium sound system, brand-name wheels, or a spray-in bed liner for a truck should always be documented.

The Power of Local Market Demand

Geography plays a surprisingly large role in a car’s value. A 4×4 truck or an all-wheel-drive SUV will command a higher ACV in a snowy state like Colorado than it will in sunny Florida. Conversely, a convertible is more valuable in Miami than in Anchorage.

Your insurer is required to use comparable vehicles from your local market. If their report pulls comps from a different city or state where values are lower, you have a legitimate reason to challenge their offer.

While ACV is an objective measure, understanding how dealerships optimize presentation for market value offers perspective on factors influencing a car’s worth. For insights into how dealers present value, consider these strategies for selling cars online. By documenting your car’s specific features and condition, you can effectively audit the insurer’s report and pinpoint where they missed the mark.

Understanding ACV vs. Diminished Value

It’s easy to confuse two critical terms in an auto claim: Actual Cash Value (ACV) and Diminished Value. However, they represent two completely different financial losses, and each requires a separate claim.

A simple way to remember the difference is: ACV is about the past, while Diminished Value is about the future.

What Actual Cash Value Covers

Actual Cash Value is what your car was worth on the open market in the split second before the accident. When an insurer declares your car a total loss, their settlement is based on its ACV. Their goal is to provide a payout that reflects the pre-accident value of the asset you lost, accounting for depreciation.

What Diminished Value Covers

Diminished Value, on the other hand, is the drop in resale value your car experiences after it’s been wrecked and repaired. A vehicle with an accident on its record is simply worth less than an identical one with a clean history.

That loss of market appeal is the “diminished value.” You file a diminished value claim to recover that specific loss, but only after the car has been repaired—not when it has been totaled.

Imagine two identical used cars. Same year, make, model, and mileage. One has a clean vehicle history, while the other shows a major collision. The difference in their selling prices is the diminished value.

Here’s a quick breakdown to keep them straight:

- ACV Claim (Total Loss): Your car is not worth fixing. You receive a check for its pre-accident value.

- Diminished Value Claim: Your car is repairable. After repairs, you file a claim for the resale value it lost due to the accident history.

Both concepts are central to being made financially whole. ACV compensates you for losing your vehicle entirely, while a diminished value claim helps you recover its lost market value.

Common Reasons Insurers Offer a Low ACV

Receiving the first settlement offer can be jarring. You know what your car was worth, but the number on the paper often feels disconnected from reality. This isn’t personal; it’s a standard business process designed to manage costs.

Understanding why these offers come in low is key. Once you spot the weak points in their valuation, you gain the power to negotiate for what you’re rightfully owed and ask, “what is my car actual cash value,” with evidence to back you up.

Using Outdated or Irrelevant Comparable Vehicles

A solid ACV calculation depends on the value of similar cars recently sold in your area. Insurers often use valuation reports that pull comps from the wrong places or compare your car to different models.

Here’s where it goes wrong:

- Wrong Trim Level: Your fully loaded Limited model is compared to a basic SE, ignoring thousands in options.

- Geographic Mismatch: They pull comps from a rural town where cars sell for less than in your city.

- Poor Condition: The report uses vehicles with prior accidents or rough histories to set the value for your well-maintained car.

Relying on Wholesale Data Instead of Retail Value

This common shortcut leads to a lowball offer. An insurer’s report often leans heavily on wholesale auction data—the price a dealer pays, not the price you’d pay on a retail lot.

The legal standard in most states requires insurers to pay you enough to buy a similar vehicle in your local retail market. By using wholesale prices, they are not calculating a true replacement value.

This gap between wholesale and retail can easily slash 10-20% off the offer. You must counter with real-world retail prices from local dealers and classifieds.

Applying Unfair Condition Adjustments

Every valuation includes adjustments for your car’s pre-accident condition. This is a prime area for adjusters to be overly critical to reduce the payout, such as docking value for “normal wear and tear” with no real impact on market value. If you have photos proving your vehicle’s great condition, you can shut these deductions down.

Missing Valuable Features and Recent Upgrades

Automated systems are terrible at recognizing recent investments. That software doesn’t know you just spent $1,500 on new tires and brakes or that your truck had a premium bed liner. You must provide receipts for any upgrades, packages, or major maintenance to build your case for a higher settlement.

Decoding Low ACV Offers and Your Countermoves

This table shows common tactics insurers use to undervalue your vehicle and gives you actionable counter-strategies.

| Insurer’s Tactic | Why It Lowers Your Offer | Your Counter-Strategy |

|---|---|---|

| Using Distant Comps | Pulls cars from cheaper markets to lower the average value. | Provide comparable listings from local dealerships within a 50-75 mile radius. |

| Comparing to Base Models | Compares your high-end trim to a base model. | Submit your original window sticker to prove your car’s features. |

| Relying on Wholesale Data | Uses auction prices (dealer cost) instead of retail prices (consumer cost). | Find similar vehicles for sale on sites like AutoTrader to show true retail value. |

| Excessive Condition Deductions | Docks value for “normal wear and tear.” | Use pre-accident photos and maintenance records to prove excellent condition. |

| Ignoring Recent Upgrades | Fails to account for new tires, recent major repairs, or add-ons. | Provide all receipts for parts and labor from the last 6-12 months. |

A professional appraisal from SnapClaim can compile this evidence into a powerful, defensible report that provides the proof you need to negotiate fairly.

How to Dispute a Low Settlement and Get Fair Value

A lowball settlement offer is frustrating, but it’s rarely the final number. It’s an opening bid, and you have the right to negotiate for your vehicle’s actual worth. This isn’t about being confrontational; it’s about presenting better evidence.

Your Step-by-Step Negotiation Roadmap

Don’t accept an offer that feels wrong. Follow these steps to build a strong case for a higher settlement.

- Request Their Report: Ask the adjuster for a complete copy of their valuation report (e.g., from CCC ONE or Mitchell). This document shows the comparable vehicles and adjustments they used.

- Gather Your Evidence: Collect everything that proves your car’s true pre-accident condition and value, including recent photos, service records, receipts for major work, and the original window sticker.

- Find Better Comps: Search for the same year, make, model, and trim for sale at dealerships within a 50-75 mile radius. Screenshot these listings to show realistic retail asking prices.

- Make Your Case: Organize your proof into a clear email to the adjuster. Politely point out flaws in their report, attach your documentation, and state the value you believe is fair, backed by your evidence.

The Ultimate Tool for Proving Fair Value

While building your own case is a great start, a certified, independent appraisal report is the most powerful tool you can have. It replaces your opinion with a data-backed valuation from a neutral expert.

A SnapClaim report uses data-driven methods, reviewed by licensed appraisers, to determine a vehicle’s fair market value. This gives you a professional, documented basis to prove your car’s ACV is higher than the insurer’s offer and supports your case with certified data. You can read more about recognized appraisal practices in global and EU auto market reports.

An independent appraisal from a trusted source like SnapClaim levels the playing field, forcing the insurer to justify their lowball offer against a professional, market-based valuation. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

If the adjuster still won’t negotiate, you can use your policy’s “appraisal clause.” This is a dispute resolution tool where both parties hire independent appraisers to settle the disagreement. Learn more in our guide on invoking the appraisal clause in your insurance policy.

Frequently Asked Questions (FAQ)

Does my car loan balance affect its Actual Cash Value?

No. The amount you owe on your car loan has zero impact on its ACV. An insurer’s valuation is based on market factors like age, mileage, and condition—not your personal financing. If your loan balance is higher than the settlement, this is known as being “upside down,” and the difference is what GAP insurance is designed to cover.

Can I keep my car if it’s a total loss?

Yes, in most states, you can choose to keep your vehicle through “owner retention.” The insurer will pay you the ACV minus its salvage value (what they would get from selling it to a salvage yard). However, your vehicle will be issued a “salvage title,” which can make it difficult to insure and significantly harms its future resale value.

What if the insurance company and I can’t agree on the ACV?

If you’re at a stalemate over what your car’s actual cash value is, don’t accept a lowball offer. Your policy likely includes an “appraisal clause,” a formal process to resolve valuation disputes. This typically involves each side hiring an appraiser, who then negotiate a value or bring in a neutral third party to decide. However, presenting a data-backed report from SnapClaim often resolves the dispute without needing to take this formal step.

How do I prove my car was in excellent condition before the accident?

Documentation is key. Use recent, dated photos of the interior and exterior to show it was clean and well-maintained. Provide service records for regular oil changes, tire rotations, and other maintenance. Receipts for recent repairs, new tires, or detailing also serve as powerful proof of its superior pre-accident condition.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your appraisal report today