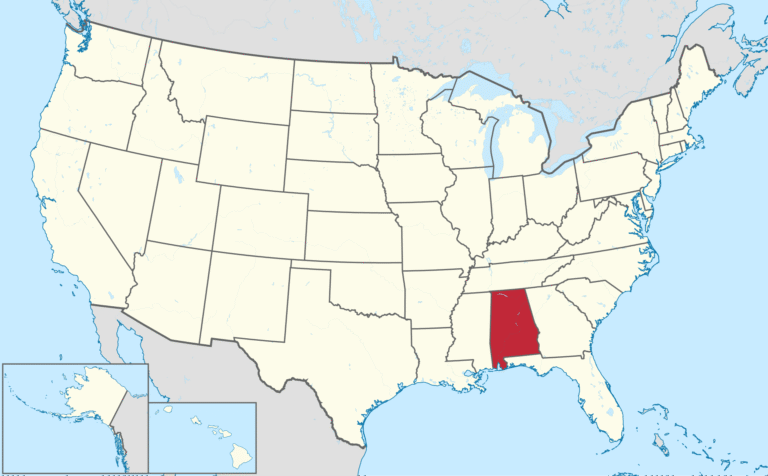

Diminished Value & Total Loss Appraisal in

Vermont

Get Your Free Estimate in a Minute!

Recover your car’s lost value after an accident with a certified Vermont appraisal. Our reports are fast, accurate, and court-ready — trusted by attorneys and insurers statewide.

No credit card required [Takes less than 30 second]

Last updated: August 18, 2025

Diminished Value & Total Loss Auto Appraisals in Vermont: What You Need to Know

Vermont drivers can recover losses for both diminished value (DV) and fair market value (FMV) claims after a car accident. Whether your vehicle was repaired or declared a total loss, state law allows you to pursue compensation for its true pre-accident value. This page explains how Vermont diminished value appraisals and total loss auto appraisals work, what laws apply, key filing steps, and how a professional SnapClaim report can help you negotiate a fair insurance settlement. For city-specific information, visit our Vermont Diminished Value Appraisal page.Does Vermont Allow Diminished Value and Total Loss Claims?

Diminished Value (DV)

Yes. Vermont recognizes diminished value claims when supported by credible market evidence. If your car was repaired after an accident and you were not at fault, you may be entitled to compensation for the reduction in market value between the vehicle’s pre-accident and post-repair condition. Although Vermont has no specific DV statute, courts have allowed recovery under property damage laws when proven with professional appraisal data and repair documentation.Fair Market Value / Total Loss (FMV)

Yes. When repair costs exceed your vehicle’s actual cash value, Vermont insurers must settle based on its fair market value before the accident. If the insurer’s offer is too low, you can request an independent Fair Market Value Appraisal using verified Vermont market data and dealer quotes.Key Vermont Laws & Regulations

- DV recognition: Allowed under Vermont case law when supported by evidence of market value loss.

- FMV requirement: Vermont Department of Financial Regulation requires insurers to use comparable vehicles to determine actual cash value.

- Statute of limitations: 12 V.S.A. § 512 — 3 years for property damage, including DV and FMV claims.

- Comparative negligence: Vermont follows a modified comparative fault rule — recovery is reduced by your percentage of fault.

- Small claims: Vermont Small Claims Courts handle claims up to $10,000 (Vermont Judiciary).

- Insurance complaints: File with the Vermont Department of Financial Regulation.

What You Should Document

- Accident or police report: Obtain from the Vermont Department of Motor Vehicles (DMV) or local police department.

- Repair invoices and supplements: Include all parts lists, calibration data, and photos.

- Vehicle photos: Before and after repairs, showing VIN and odometer.

- Comparable sales data: Vermont dealership and private listings from your area (Burlington, South Burlington, Rutland, Barre, etc.).

- Certified Diminished Value or FMV Appraisal from SnapClaim.

Step-by-Step Claim Process

- Confirm your claim type: Diminished Value (DV) for repaired vehicles or Fair Market Value (FMV) for total loss.

- Gather documentation: Collect your police report, repair invoices, and vehicle photos.

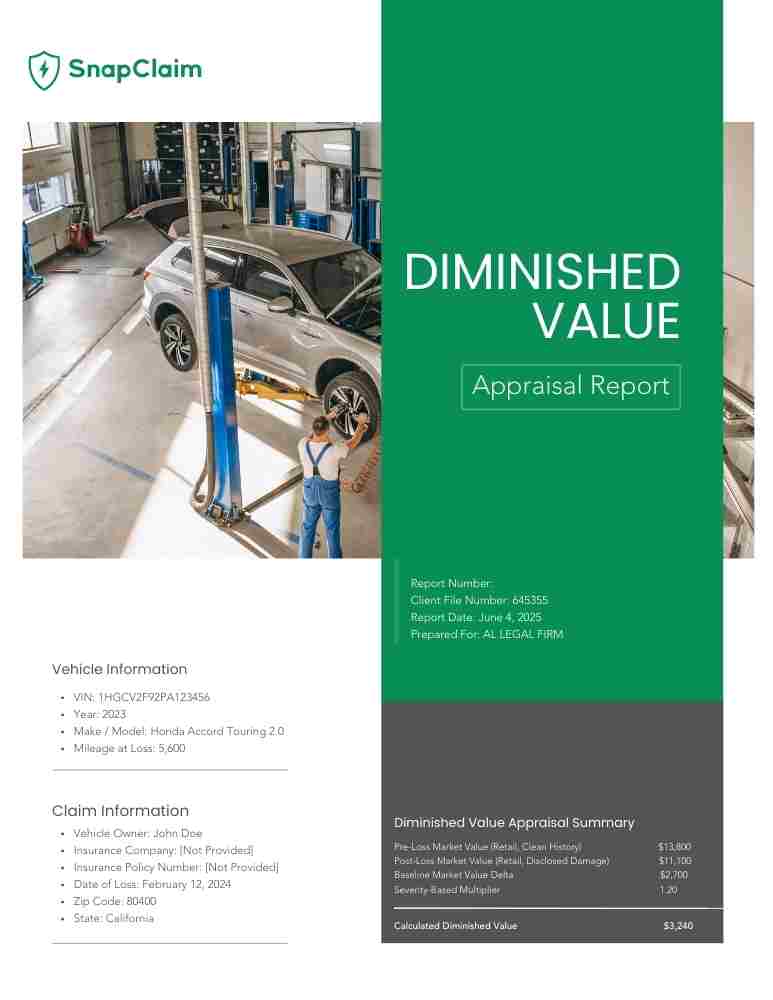

- Order a professional appraisal:SnapClaim reports use verified Vermont comparables and USPAP-compliant valuation methods.

- Submit a demand letter: Include your appraisal and cite 12 V.S.A. § 512 (3-year property damage statute) to support your claim.

- Negotiate or escalate: If the insurer undervalues your claim, use your report to pursue arbitration or file in small claims court.

Why a Professional Vermont Auto Appraisal Matters

Insurers often rely on outdated or incomplete valuation systems. A SnapClaim Diminished Value Appraisal or Fair Market Value Appraisal uses verified Vermont market data, local comparables, and certified methodologies accepted by courts and insurers. Every report is insurer-ready, court-defensible, and backed by our Money-Back Guarantee.Ready to Claim Your Vehicle’s True Value?

Start with a free estimate — no credit card required. SnapClaim is Vermont’s trusted auto appraisal company for diminished value and total loss claims — combining certified appraisers, real-time market data, and AI-driven valuation tools to help you secure the settlement you deserve. Get My Free Estimate →Learn More About Vermont Diminished Value Claims

For more details on eligibility, local laws, and sample reports, visit our Vermont Diminished Value page to explore regional guides and city-specific resources. For other states, visit Diminished Value State Laws.Order Your Auto Appraisal Report

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.