When your insurance adjuster declares your car a “total loss,” their first settlement offer is just the beginning of a conversation. The most important question becomes: what was your car actually worth right before the accident? Getting the right answer is the key to receiving a fair payout.

This guide will show you how to determine the value of a totaled car, why initial insurance offers are often too low, and how to negotiate for the compensation you rightfully deserve.

Your Car Is Totaled—What Happens Next?

Hearing the words “it’s a total loss” can be stressful and confusing. How is the value of a totaled car even decided? It’s more complicated than a quick online search, and the insurer’s first number is rarely their final offer.

We’re pulling back the curtain on how insurance companies calculate your vehicle’s worth and providing a clear, step-by-step plan to help you secure a fair settlement.

Understanding the Total Loss Declaration

A car is declared a “total loss” when the cost to repair it exceeds a certain percentage of its pre-accident value. This limit, known as the total loss threshold, varies by state and insurance policy. Once your vehicle crosses that threshold, the insurer’s responsibility is to pay you for its value, not to fix it.

The process typically includes these steps:

- Damage Assessment: An adjuster inspects your vehicle to estimate the cost of all necessary repairs.

- Valuation: The insurer calculates your car’s Actual Cash Value (ACV) from the moment before the crash occurred.

- Comparison: If the repair cost is higher than the state’s total loss threshold (e.g., 75% of the ACV), it’s officially totaled.

- Settlement Offer: You receive an offer based on that ACV, minus any applicable deductible.

Why the Initial Offer Is Just a Starting Point

Many vehicle owners mistakenly believe the insurer’s first offer is a take-it-or-leave-it deal. It’s not. Think of it as their opening bid in a negotiation.

Initial offers are often generated by automated systems that can easily miss what made your car unique. Did you just install new tires? Was it garage-kept with very low mileage? Did it have a premium trim package? Automated valuations often overlook these details, leading to a lowball offer on your car value after an accident.

You have more power in this process than you realize. The key is understanding how your car’s value is calculated and being prepared with evidence that supports a higher, more accurate figure.

Understanding Actual Cash Value (ACV)

Let’s define the most important term in a total loss claim: Actual Cash Value (ACV).

ACV is the fair market price for your vehicle the moment before the accident happened. It’s what a willing buyer would have reasonably paid for your specific car, in your local area, on that day. It’s supposed to be a concrete calculation reflecting the true value of a totaled car, but it’s also where disputes with insurance companies often begin.

Understanding how they calculate this number is your best defense against an unfair offer.

What Goes Into the ACV Calculation?

An insurer’s ACV calculation combines hard data with subjective assessments. They look at several key data points to determine your car’s pre-accident condition and its desirability in the current market.

To arrive at the final ACV, insurers weigh several factors. We’ve summarized the most important ones below.

Key Factors Influencing Your Car’s ACV

This table breaks down the primary elements insurance companies analyze to determine the Actual Cash Value of a totaled vehicle.

| Factor | Why It Matters |

|---|---|

| Base Value | This is the starting point, determined by your car's year, make, and model. It sets the foundational value before any adjustments. |

| Mileage | A straightforward factor. Lower mileage almost always means a higher value, while high mileage will bring the number down. |

| Overall Condition | This is where things get subjective. Adjusters rate the car’s interior, exterior, and mechanical state (e.g., excellent, good, fair, poor). |

| Options & Trim | Factory-installed upgrades like a sunroof, premium sound system, or advanced safety features add real, measurable value. |

| Recent Upgrades | This is huge. A brand-new set of tires, a recently replaced transmission, or other major work should be included. |

It’s essential to document every feature and recent upgrade. An adjuster relying on a standard database won’t know about that rare tech package or that you spent $1,200 on new brakes last month. If you don’t provide proof, that value disappears from your settlement.

ACV vs. Book Value vs. Salvage Value

It’s easy to confuse these terms, but they represent very different figures. Knowing the distinction is critical when reviewing your settlement offer.

- Actual Cash Value (ACV): As we covered, this is the insurer’s calculated market value of your car right before the crash. Your settlement is based on this number.

- Book Value (e.g., KBB): This is a retail-focused estimate from sources like Kelley Blue Book. It’s a helpful reference, but insurers don’t use it to calculate your payout.

- Salvage Value: This is what the wrecked car is worth now, primarily for its usable parts and scrap metal. If you decide to keep your totaled car, the insurer will subtract this amount from your ACV settlement.

Market conditions also play a huge role. For example, the microchip shortage in 2021 caused used car prices to skyrocket by over 40%. A fair valuation must account for these real-time market dynamics.

For a deeper dive, check out our guide on how to calculate your car’s Actual Cash Value. It’s your money, and you deserve to know the number you’re being offered is accurate.

How Insurers Calculate the Value of a Totaled Car

Ever wonder how an insurance adjuster arrives at a specific dollar amount for your totaled car? They don’t guess. Insurers rely on third-party valuation software, with platforms like CCC ONE and Mitchell dominating the industry.

These systems scan massive databases of dealer listings, recent auction sales, and private party ads to find vehicles that are supposedly “comparable” to yours. In theory, this process creates an objective snapshot of the current market.

The Problem with Automated Valuations

The trouble is, this automated process is built for speed, not pinpoint accuracy. It’s notorious for missing the unique details that made your car more valuable than the average one.

The software might compare your meticulously maintained vehicle with premium options to a basic model with higher mileage and a spotty history. These mismatched “comps” can unfairly drag down the calculated value of a totaled car, sometimes by thousands of dollars.

The insurer’s initial report is their opening argument, based on data that may not tell the whole story. Your job is to present the evidence that fills in the missing pieces.

This is why you should never accept the first offer without carefully reviewing their valuation report. You must understand how they got their number so you can show them where they went wrong.

Deconstructing the Valuation Report

Once you receive the insurer’s report, you’ll see a list of “comparable” vehicles they used to justify their ACV. This is your best opportunity to fight back. For every “comp” they list, ask these questions:

- Is the Trim Package Identical? A 2021 Honda Accord EX-L is worth much more than a base model LX. The report must compare apples to apples.

- Is the Mileage Similar? A so-called comparable car with 30,000 more miles than yours isn’t a fair comparison.

- What is the Condition Rating? If your car was in excellent shape, it’s unfair to compare it to vehicles rated as “fair” or “average.”

- Are the Options the Same? Did your car have a sunroof, leather interior, or an upgraded tech package that the comps are missing?

Insurers depend on detailed vehicle information. Understanding tools like what is a VIN decoder can show you why the specific features tied to your car’s VIN are so critical for an accurate appraisal.

A Real-World Example of Valuation Errors

Imagine you own a pristine 2022 Ford F-150 Lariat with the FX4 Off-Road package and low mileage. The insurer’s software generates a report using three “comps”:

- A base model 2022 F-150 XL with 25,000 more miles.

- A 2022 F-150 XLT—a lower trim level—with a minor accident on its record.

- A 2022 F-150 Lariat, but it’s located 200 miles away in a cheaper market.

Each comparison is flawed and systematically lowers your payout. The value difference between a stripped-down work truck and a fully-loaded Lariat can easily exceed $10,000. By ignoring your truck’s superior trim, condition, and options, the automated report produces a classic lowball offer.

A certified appraisal from SnapClaim provides the data-backed proof you need to negotiate fairly. Our reports are based on expert human analysis that correctly identifies your vehicle’s true features and market value, giving you the leverage to demand the compensation you deserve.

Why Initial Settlement Offers Are Often Too Low

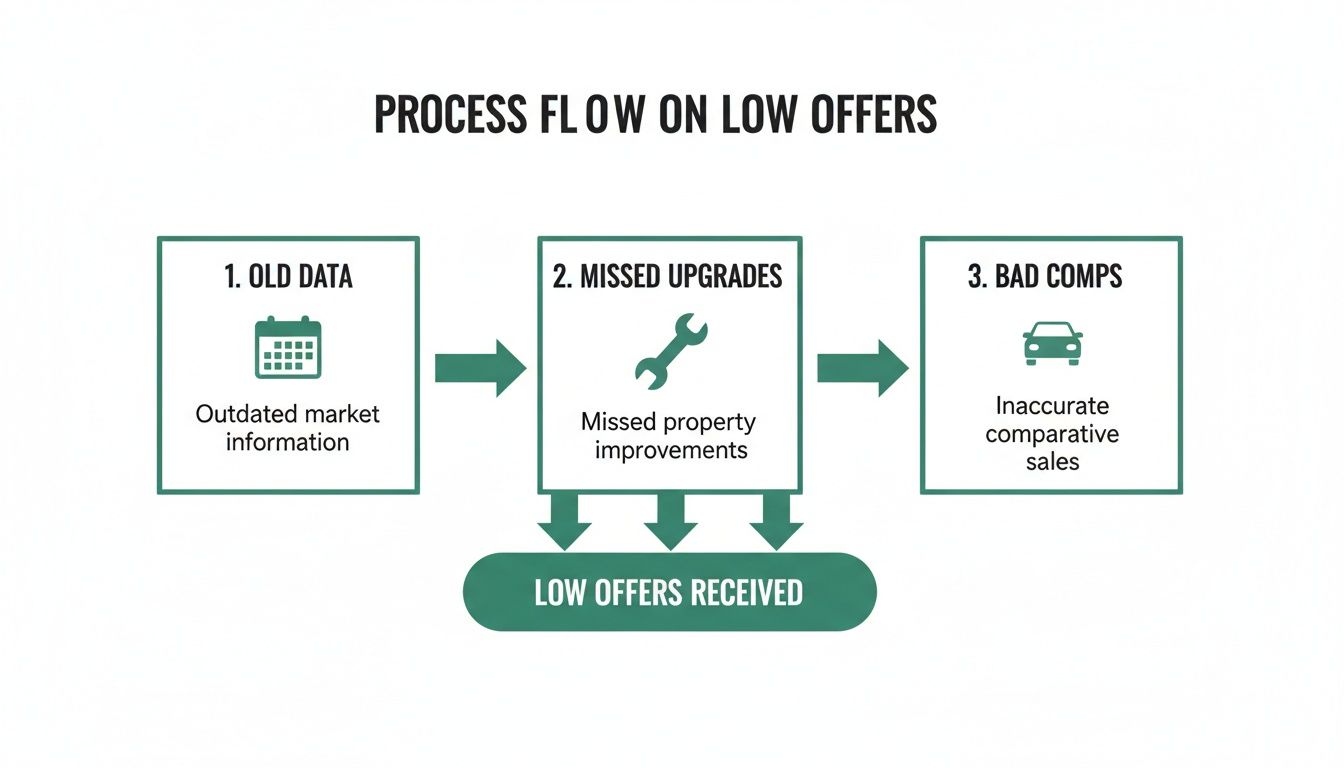

Receiving a low settlement offer for your totaled car is frustrating but common. This initial offer is rarely personal; it’s the product of an automated, profit-driven system designed for efficiency, not accuracy.

The valuation software insurers use often misses the details that made your car unique. Understanding these common flaws is the first step toward building a strong case for the true value of a totaled car and turning their low offer into a fair insurance total loss payout.

Outdated Market Data and Averages

One of the biggest reasons for a low offer is outdated or generalized market data. The used car market changes quickly, but the databases insurers use might not reflect current pricing trends in your specific area.

Their system could be using sales data from three months ago, missing a recent spike in demand for your car’s model. This reliance on averages almost always penalizes owners of well-maintained vehicles.

Overlooked Upgrades and Recent Investments

Did you just spend $1,500 on new tires? Maybe you recently had major engine work done or installed a premium sound system? An automated system won’t know about these significant investments unless you provide clear documentation.

These upgrades add real value to your car but are consistently missed in initial valuations. Forgetting to account for these items can easily cost you hundreds, if not thousands, of dollars.

The insurer’s first offer isn’t a final decision—it’s an invitation to negotiate. Your role is to provide the specific evidence their automated system overlooked.

Cherry-Picking Inaccurate “Comps”

The core of any valuation report is the list of “comparable” vehicles, or “comps,” and this is where the biggest errors often happen. The software is frequently programmed to find the cheapest available examples on the market to justify a lower payout.

This practice leads to several major problems:

- Mismatched Trim Levels: Your top-of-the-line model might be compared to a base model with fewer features.

- Ignoring Vehicle Condition: A comp vehicle with higher mileage or a history of accidents is not truly “comparable” to your well-kept car.

- Incorrect Adjustments: The software applies generic deductions for mileage or condition that don’t reflect the real world.

These systemic flaws stack the deck against you. Learning how to identify and dispute a lowball insurance offer is crucial for securing the payout you are rightfully owed.

A Step-By-Step Guide to Disputing a Low Offer

Getting a low settlement offer is frustrating, but it’s also an opportunity. The key is to turn that frustration into focused, fact-based action to prove the true value of a totaled car.

Let’s walk through the exact plan for challenging the insurer’s initial number.

Step 1: Request the Insurer’s Valuation Report

Your first move is simple: formally ask for a complete copy of the insurer’s valuation report. This document is the foundation of their offer, and you have a right to see it. It will detail the “comparable” vehicles they used and any adjustments they made.

Politely but firmly insist on getting the full report. Without it, you’re negotiating in the dark. This document is your roadmap for finding their mistakes.

Step 2: Scrutinize the Report for Errors

Once you have the report, it’s time to look for mistakes. The initial offer is almost always low because of flaws in the automated valuation process. This is where most of the money is left on the table.

Look for these specific red flags in your report:

- Incorrect Vehicle Options: Did they list your car as a base model when you had the premium trim? Look for missing features like a sunroof, leather seats, or advanced safety systems.

- Unfair Condition Rating: If your car was in “excellent” shape before the accident but they rated it as “average,” challenge it. Their rating must reflect its pre-accident state.

- Flawed Comparable Vehicles (“Comps”): Are the comps they used genuinely similar to your car in trim, mileage, and condition? Often, they are not.

Step 3: Assemble Your Own Evidence

Now it’s time to build your case. Your opinion isn’t enough; you need documentation to prove your vehicle’s higher value.

Gather these key items:

- Maintenance Records: Proof of regular oil changes and service appointments shows your car was well-cared for.

- Receipts for Upgrades: Did you buy new tires, replace the brakes, or install a new stereo? Every receipt adds value.

- Pre-Accident Photos: Clear photos of your car’s pristine interior and exterior are perfect for disputing a low condition rating.

- Original Window Sticker: This is the ultimate proof of every factory-installed option your car came with.

Step 4: Obtain a Certified Independent Appraisal

While your own evidence is a great start, a certified appraisal from an independent expert is your single most powerful tool. It replaces the insurer’s biased report with an objective, data-driven valuation.

An appraisal from SnapClaim provides the professional, defensible proof needed to negotiate on equal footing. Our reports are designed to be presented to insurance carriers and are backed by industry-standard methodologies. A staggering 70% of claimants accept the first offer, often leaving thousands on the table.

Step 5: Draft and Send a Professional Demand Letter

With your evidence compiled, present your case in a professional demand letter. To successfully dispute a low offer, it’s critical to understand the strategies that can maximize your auto accident settlement.

Your letter should be clear and concise. Structure it logically:

- State Your Purpose: Clearly state that you are rejecting their offer and providing evidence for a higher valuation.

- Present Your Value: Propose your counter-offer, supported by your independent appraisal.

- Outline the Errors: List the specific mistakes you found in their report (e.g., wrong comps, missed options).

- Attach Your Proof: Include copies of your receipts, photos, and the full certified appraisal report.

- Set a Deadline: Request a written response within a reasonable timeframe, like 14 days.

This structured approach shows the adjuster you are serious and have the evidence to back up your claim for the true value of a totaled car.

Secure Your Fair Payout with a Certified Appraisal

When you’re up against an insurance company, you need hard evidence, not just an opinion. A certified, independent appraisal is the most powerful tool for securing the full value of a totaled car. It’s a data-driven report that methodically dismantles an insurer’s lowball offer.

An appraisal from SnapClaim is built to serve your interests. It delivers the objective, verifiable proof you need to challenge their number and demand what you’re rightfully owed.

How a SnapClaim Report Strengthens Your Claim

Our methodology goes far beyond the automated software that produces low initial offers. We combine deep market analysis with the expertise of licensed appraisers to pinpoint your vehicle’s true pre-accident value with precision.

A SnapClaim appraisal strengthens your claim by:

- Correcting Errors: We find and document every feature, upgrade, and unique characteristic of your car that the insurer’s report missed.

- Using Accurate Comps: Our appraisers find genuinely comparable vehicles in your local market to ensure an apples-to-apples valuation.

- Providing Expert Authority: A certified report shows the adjuster you are serious and have a professionally prepared case, giving you instant negotiating leverage.

Your Confidence Is Guaranteed

We understand that paying for an appraisal can feel like a risk, especially after an accident. That’s why we stand behind our reports with a straightforward promise.

Our Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This guarantee removes the risk from your shoulders. It’s our way of showing you how confident we are that our reports deliver the results needed for a fair settlement.

Don’t let an automated system dictate the value of a totaled car you worked hard to own. Our certified total loss appraisal reports provide the undeniable proof you need to turn a lowball offer into the fair settlement you deserve.

Frequently Asked Questions About Total Loss Claims

Dealing with a total loss can bring up a lot of questions. Here are clear, simple answers to some of the most common concerns vehicle owners have.

Can I keep my car if it’s a total loss?

Yes, in most states, you have the right to keep your totaled vehicle through a process called “owner retention.” The insurance company will pay you the car’s Actual Cash Value (ACV) minus its salvage value (what the wrecked car is worth for parts). Be aware that the state will issue a salvage title, which can make the car difficult to insure or register for road use again.

What if I owe more on my loan than the settlement?

This situation is known as being “upside-down” or “underwater” on your loan. If the insurance settlement for the value of a totaled car is less than your outstanding loan balance, you are responsible for paying the difference. This is where Guaranteed Asset Protection (GAP) insurance helps. If you have GAP coverage, it is designed to pay off that remaining loan balance.

Can I claim diminished value on a totaled car?

No, you cannot. A diminished value claim is for a vehicle that has been repaired after an accident and has lost resale value due to its accident history. A total loss claim, on the other hand, compensates you for the entire pre-accident value of the car because it is not being repaired. You can learn more in our Diminished Value Guide.

How long does an insurance company have to settle a total loss claim?

Timelines are regulated by state law. Most states require insurers to settle claims “promptly,” which usually means within about 30 days after you have submitted all the necessary documentation. If you feel they are delaying unfairly, you can contact your state’s Department of Insurance for assistance.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free total loss appraisal report today