When an insurance adjuster tells you your car is totaled, it’s not a personal judgment on your vehicle. It’s a purely financial decision: the cost to repair it is more than the car’s pre-accident value. Hearing your car is a total loss can be a shock, but understanding what happens next is the first step to taking back control of your claim.

Your Car Is Totaled. What Happens Next?

The moments after that phone call are often a blur of questions. Will the insurance total loss payout be fair? What happens to my car loan? Can I keep my car? It’s easy to feel overwhelmed, but remember, this is a business decision made by the insurance company. Your job is to shift from being a passive recipient of their news to an active participant in your claim.

This process starts with that first call from the adjuster. You need to know your rights. You are not required to accept their first offer, and you have every right to question how they calculated your vehicle’s value.

Understanding Your Immediate Path Forward

Right now, you’re at a fork in the road with two main options. The first is to accept the insurer’s settlement, sign over the title, and hand them the keys. For some, this is the quickest way to move on.

The second, more empowering path, is to challenge their valuation if you feel it’s too low. This isn’t about starting a fight; it’s about presenting clear, factual evidence to justify a higher payout for your totaled car. The key is knowing what proof to gather and how to present it effectively.

A “total loss” doesn’t mean your car is worthless. It is a financial determination that signals the beginning of a negotiation for your car’s fair market value.

Taking the First Steps

To handle this process well, take a breath and get organized. Don’t let the insurer rush you into signing anything. Your immediate focus should be on gathering information.

Here’s what to do first:

- Request the Valuation Report: Ask the insurer for a full copy of the report they used to determine your car’s value. This document is the basis for their offer.

- Gather Your Records: Collect all your maintenance receipts, records of recent upgrades (like new tires or a battery), and anything else that proves your car’s excellent condition before the crash.

- Don’t Surrender the Title Yet: Hold on to your car’s title until you have formally agreed on a settlement amount and have payment in hand. Signing it over too early kills your negotiating leverage.

By understanding that a “totaled” declaration is a starting point, not the final word, you can approach the insurance total loss payout process with confidence. To learn more about the specific signs an insurer looks for, check out our guide on how to tell if your car is totaled.

How Insurers Decide a Car is a Total Loss

So, how does an insurance adjuster decide your car is a total loss? It isn’t a gut feeling or based on how damaged the car looks. The decision hinges on a straightforward calculation.

Simply put, if it costs more to fix your car than what the car was worth right before the crash, the insurer will write it off. It doesn’t make financial sense for them to spend $15,000 on repairs for a car that was only valued at $12,000.

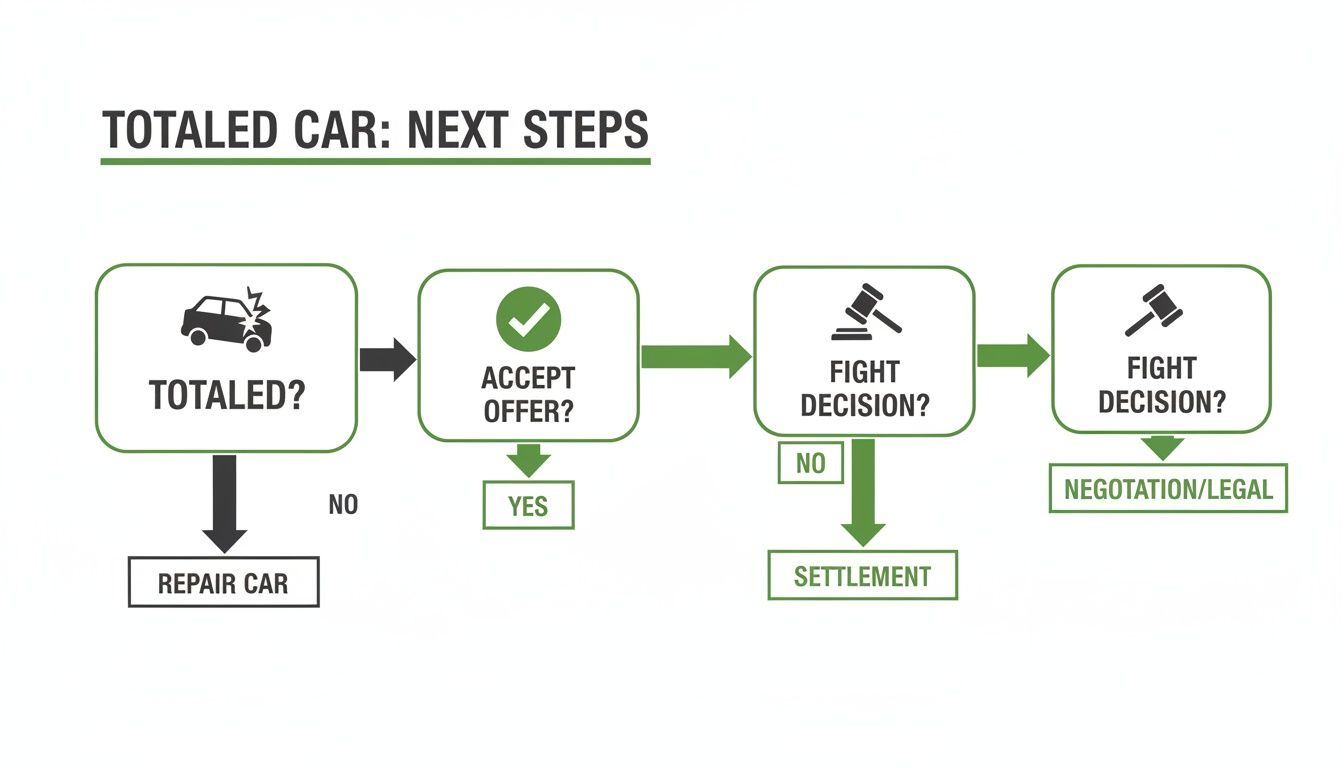

This flowchart breaks down the crossroads you’ll face once your car is declared totaled.

As you can see, the path splits right away. You must decide whether to accept their first offer or stand your ground and negotiate for what your car was really worth.

The Total Loss Formula Explained

Insurance companies use a specific equation to make the call. It might sound technical, but it’s just adding two numbers and comparing them to a third. A vehicle is usually considered a total loss when:

Cost of Repairs + Salvage Value > Actual Cash Value (ACV)

Let’s quickly explain those terms in plain English:

- Cost of Repairs: The full estimate for parts and labor to return your car to its pre-accident condition.

- Salvage Value: What the insurance company can get by selling your wrecked car to a salvage yard for parts or scrap.

- Actual Cash Value (ACV): This is the key figure. It’s the fair market value of your vehicle right before the accident occurred. It’s not what you paid for it, but what it was worth at that moment.

If the repair costs plus the salvage value add up to more than the car’s ACV, it’s almost always declared a totaled car. We have a detailed guide that shows exactly how a total loss calculation for a vehicle is put together.

State Laws and the Total Loss Threshold

On top of that formula, state laws play a massive role. Most states have what’s called a Total Loss Threshold (TLT). This is a set percentage of the car’s value that, if met or exceeded by repair costs, legally forces an insurer to declare the vehicle a total loss.

This creates a patchwork of rules across the country that can make a huge difference in your claim’s outcome.

Sample State Total Loss Thresholds (TLT)

The table below gives you a glimpse of how much these thresholds can vary. This percentage can be the deciding factor in whether you get your car back or a check from the insurer.

| State | Total Loss Threshold (TLT) | Rule Type |

|---|---|---|

| Texas | 100% | Percentage |

| South Carolina | 75% | Percentage |

| Colorado | 100% | Percentage |

| Iowa | 70% | Percentage |

| Alabama | 75% | Percentage |

So, if your car has a $20,000 ACV, repair estimates over $15,000 in South Carolina (75% TLT) would automatically trigger a total loss. But in Texas, the repairs would have to hit $20,000 (100% TLT) for the same to happen. Knowing your state’s rule is critical. You can check the specifics for your area on our state-specific law page.

Understanding how insurers arrive at their numbers for repairs, salvage, and especially your car’s ACV is the first step. Their initial offer is rarely their best—it’s the start of a negotiation.

Decoding Your Total Loss Settlement Offer

Think of the first settlement offer as the insurance company’s opening bid, not the final word. Understanding how they came up with that number is your key to getting a fair deal for your totaled car. The entire process hinges on one critical figure: the Actual Cash Value (ACV), which is what they believe your vehicle was worth moments before the crash.

This ACV number is the foundation for their payout. Insurers use third-party valuation services, like CCC ONE or Mitchell, to generate a market report. While these reports look official, they can be full of errors, outdated comparable vehicles, or unfair adjustments that lower your car’s value. Your job is to analyze that report carefully.

Scrutinizing the Insurer’s Valuation Report

When the valuation report arrives, don’t just skim to the final number. Dig into the details to see how they built their case. This is where most lowball offers are born.

Keep an eye out for these common mistakes:

- Incorrect Vehicle Trim and Options: Did they list your car as a base model when you had the premium version? Missing features like a sunroof or advanced safety packages can slash thousands from the ACV.

- Unfair Condition Adjustments: The report will often grade your car’s condition as “average.” If you kept your vehicle in excellent shape, that’s a red flag. They may also apply deductions for minor, pre-existing dings or normal tire wear.

- Flawed Comparable Vehicles (“Comps”): The report will list several “comparable” vehicles for sale. But are they really comparable? Check if the comps are from distant cities, have more miles, or are listed by questionable dealerships.

Building Your Counter-Evidence

To successfully fight a low ACV, you can’t just say you disagree. You need to show them why with facts. Your goal is to build a file that tells the true story of your car’s value.

The insurer’s valuation report is their opinion of your vehicle’s value. Your job is to present a fact-based argument supported by tangible proof to correct their assessment.

Start gathering these key documents right away:

- Maintenance Records: A complete service history proves your car was well-maintained, directly challenging any low condition rating.

- Receipts for Recent Upgrades: Recently put in new tires, brakes, or a battery? These receipts are proof of added value that automated reports often miss.

- Photos and Videos: If you have pictures of your car from before the accident that show its excellent condition, use them.

- Your Own Market Research: Find online listings for vehicles that are truly comparable—same year, make, model, trim, and similar mileage—for sale at dealerships in your area.

Understanding reports from services like CCC is critical. To get ahead, check out our guide on how to read a CCC ONE Market Valuation Report and spot the errors. Arming yourself with this knowledge is how you negotiate a fair insurance total loss payout.

Your Three Options for a Totaled Car

When the insurance company declares your car a total loss, you have three distinct paths forward. Each comes with its own financial and practical trade-offs.

The most common route is simply taking the settlement. You agree on the ACV, sign over the title, and the insurance company cuts you a check (minus your deductible).

Option 1: Accept the Settlement and Surrender the Vehicle

This is the most straightforward path. If the insurer’s offer is fair and reflects your car’s pre-accident value, accepting it is a quick way to move on. This gets cash in your hand so you can find a replacement vehicle without a long fight.

But the key word here is fair. Never accept the first offer without doing your homework. Always review their valuation report and compare it against your own research.

Option 2: Keep Your Car and Get a Salvage Title

What if you want to keep your car? You can, through what’s called “owner retention.” In this scenario, the insurance company pays you the ACV, but first, they subtract your deductible and the car’s salvage value—the cash they would have received by selling the wreck.

If you choose this path, be aware of the consequences:

- You get less cash: Your payout will be smaller since the salvage value is deducted.

- The car gets a salvage title: This is a permanent brand on the car’s record that hurts its future resale value.

- Repairs are your problem: You are responsible for fixing the vehicle and getting it to pass a strict state safety inspection before it’s legal to drive again.

- Insurance can be difficult: Many companies won’t offer full coverage on salvage-titled cars.

This option really only makes sense if the damage is mostly cosmetic, you can do the repairs yourself, or the car has significant sentimental value.

Option 3: Dispute the Valuation and Negotiate

If the insurance company’s offer seems too low, your third option is to fight for a better settlement. You are never obligated to accept an unfair offer for your totaled car.

Your insurer’s first offer is a starting point for negotiation, not the final word. Arming yourself with evidence is the key to securing the compensation you rightfully deserve.

To succeed, you need to build a case with evidence like comparable vehicle listings and maintenance records. For the strongest leverage, you can invoke the appraisal clause in your policy and get a professional report. A data-backed appraisal from an expert like SnapClaim provides the objective proof needed to negotiate on equal footing and recover the true car value after accident.

How to Dispute a Low Total Loss Offer

That first settlement offer for your totaled car? It’s not a final decision. If their number feels off, you have the right to push back.

The secret is getting organized, not angry. Successfully disputing a low offer means moving the conversation away from opinion and grounding it in market data.

Step 1: Formally Reject the Offer

First, officially reject their offer both over the phone and in writing. A simple, professional email to the adjuster is perfect.

State that you do not accept their proposed settlement because their Actual Cash Value (ACV) calculation is inaccurate. Let them know you will be sending documentation to support a more realistic valuation. Knowing how to reject an insurance settlement offer correctly protects your rights.

Step 2: Present Your Evidence

This is where your preparation pays off. Pull together all the documentation you’ve gathered: receipts for new tires, maintenance records, and photos that prove your car was in excellent condition.

Bundle this information with the comparable vehicle listings you found. Present it to the adjuster as a clean, organized package. Your goal is to make it easy for them to see why their initial report missed the mark.

The most powerful tool in any settlement negotiation is objective, third-party proof. An independent appraisal report moves the discussion away from opinions and grounds it in market reality.

Step 3: Invoke the Appraisal Clause

What if the adjuster won’t budge? It’s time to use the strongest tool in your policy: the appraisal clause.

This clause, found in most auto policies, outlines a formal process for settling valuation disputes. It allows both you and the insurer to hire independent appraisers. If those two appraisers can’t agree on a value, they bring in a neutral “umpire” to make a final, binding decision.

Step 4: Secure a Certified Appraisal Report

The foundation of a winning dispute is credible, independent proof. A certified appraisal report from an expert like SnapClaim becomes your biggest asset. A data-driven report gives you the leverage to negotiate fairly.

Here’s how a SnapClaim report helps strengthen your claim:

- It Provides Objective Data: The report uses real-time market analysis, not the potentially outdated data insurers use.

- It Corrects Their Errors: It catches common mistakes in the insurance report, like the wrong trim package or unfair condition deductions.

- It Adds Legitimacy: A certified report from a recognized expert carries far more weight than personal research alone.

It provides the proof you need to negotiate fairly and secure the payout you deserve. With SnapClaim, you can even get started risk-free. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

FAQ: Common Questions About a Totaled Car

When your vehicle is declared a totaled car, it’s normal to have a lot of questions. Here are clear, simple answers to some of the most common concerns.

Can I keep my totaled car?

Yes, you can. This is called “owner retention.” The insurance company will pay you the car’s Actual Cash Value (ACV) minus your deductible and the vehicle’s salvage value (what they could sell the wreck for). However, the car will be given a salvage title, which makes it difficult to insure and resell, and you’ll be responsible for all repairs and passing a state inspection.

What if I owe more on my car than the settlement amount?

If you have a loan, the insurance company pays your lender first. If the settlement is less than what you owe, you are responsible for paying the remaining loan balance. This is where GAP (Guaranteed Asset Protection) insurance is helpful, as it is designed to cover this “gap.”

How long does a total loss claim take?

A straightforward total loss claim can be resolved in one to two weeks if you accept the initial offer. However, if you dispute the valuation, the negotiation process can extend the timeline to several weeks or even a couple of months.

Will my insurance cover a rental car?

Rental reimbursement is an optional coverage. If you have it, your policy will typically cover a rental for a set period (e.g., 30 days) or up to a certain dollar limit. Be aware that this coverage often ends just a few days after the insurance company makes a settlement offer on your totaled car, whether you’ve accepted it or not.

Challenging an insurer’s low offer on your totaled car requires more than an opinion—it requires proof. SnapClaim provides the certified, data-driven appraisal reports you need to strengthen your claim and negotiate for the fair market value you rightfully deserve. Our process is simple and backed by a Money-Back Guarantee: if your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your Total loss Appraisal Report Today