Diminished Value Appraisal in

Oregon

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with a certified Oregon< diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted by insurers and attorneys across Oregon

No credit card required [Takes less than 30 second]

Filing a Diminished Value Claim in Oregon: What You Need to Know

Oregon Diminished Value Appraisal — Recover the True Market Loss After an Accident

Even after a professional repair, your vehicle’s resale value can drop significantly once its accident history appears on Carfax or AutoCheck. If your crash happened anywhere in Oregon—including Portland, Salem, Eugene, or Beaverton—a Oregon diminished value appraisal helps you recover that lost value from the at-fault party’s insurance company.SnapClaim provides court-ready, data-driven appraisals recognized by Oregon insurers, personal injury attorneys, and small claims courts across the state.

Does Oregon Allow Diminished Value Claims?

Third-party (at-fault driver’s insurer)Yes. Oregon law allows recovery for diminished value when another driver is at fault. The difference between your vehicle’s pre-accident and post-repair market value can be claimed with proper evidence, such as a professional appraisal.

First-party (your own insurer)

Generally no, unless your insurance policy explicitly provides diminished value coverage.

Key Oregon Law & Claim Authority

- Statute of limitations: You have 6 years to file property damage and diminished value claims in Oregon (ORS § 12.080).

- Consumer protection: The Oregon Division of Financial Regulation oversees insurance practices and assists with claim disputes.

- Small claims court: You can file DV disputes up to $10,000 in Oregon Small Claims Court.

What Your Oregon Diminished Value Appraisal Report Includes

- Vehicle specifications: year, make, model, mileage, and condition

- Comparable listings filtered by Oregon ZIP codes (e.g., Portland, Salem, Eugene)

- Pre-accident vs. post-repair market value using verified local sales data

- Professional DV calculation accounting for damage severity and local resale trends

- Transparent, insurer-approved methodology aligned with USPAP standards

- Optional expert witness support for arbitration or court presentation

Oregon Areas We Serve

SnapClaim provides Diminished Value and Total Loss appraisals throughout Oregon, including:- Portland, OR

- Salem, OR

- Eugene, OR

- Gresham, OR

- Hillsboro, OR

- Beaverton, OR

- Bend, OR

- Medford, OR

- Springfield, OR

- Corvallis, OR

- Albany, OR

- Tigard, OR

- Lake Oswego, OR

- Grants Pass, OR

- Oregon City, OR

How to File a Diminished Value Claim in Oregon

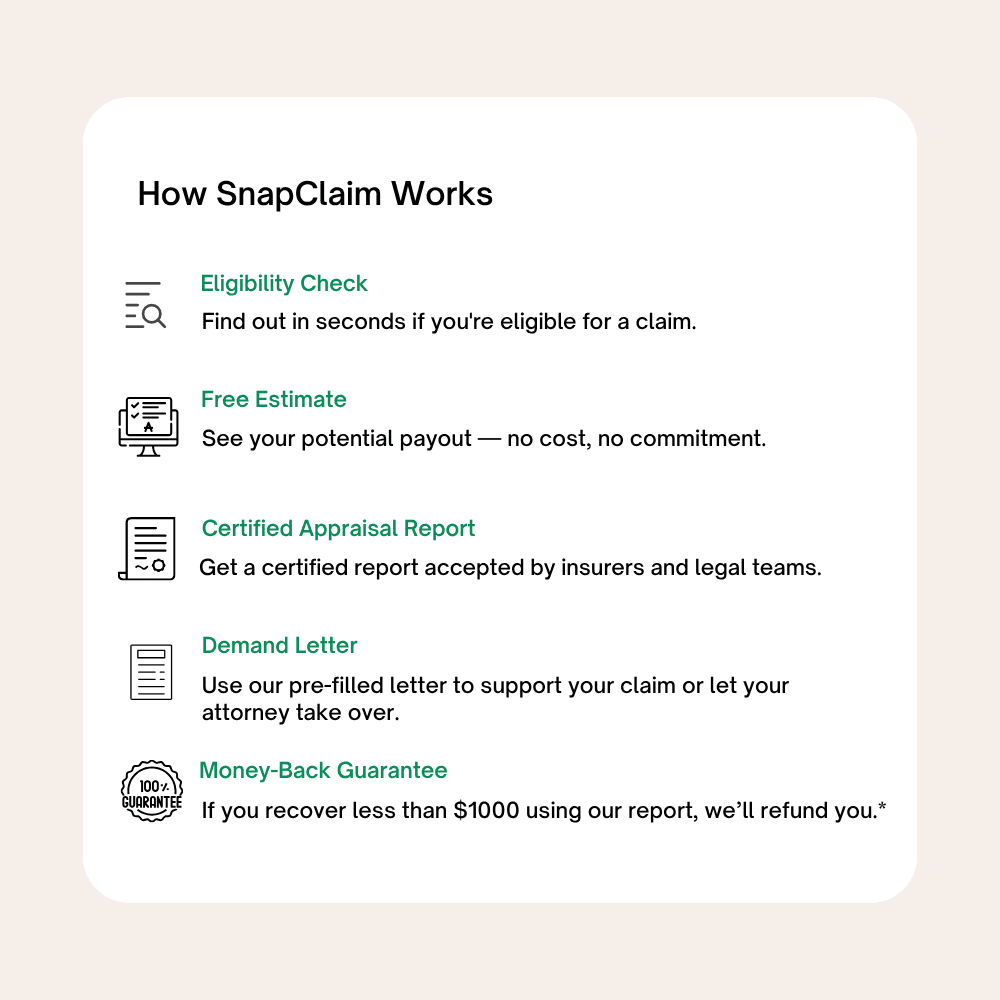

- Order your appraisal — get a professional report quantifying your post-repair loss in value.

- Submit a demand letter to the at-fault insurer with your appraisal attached.

- Negotiate or file — our reports are formatted for insurance claims, attorney review, or small claims court.

- Recover your loss — many Oregon drivers recover thousands depending on the vehicle and extent of damage.

Oregon Insurance Practices to Know

Some insurers use formulas that underestimate losses. SnapClaim reports use:- Verified Oregon listings from AutoTrader, CarGurus, and Cars.com

- Dealer quotes within 50 miles of your ZIP code

- Adjustments for model, options, mileage, and color

Example Oregon Case Study

Vehicle: 2020 Subaru Outback PremiumRepair Cost: $6,500 (rear-end damage)

Initial Insurer Offer: $1,000

SnapClaim DV Result: $4,300

Final Settlement: $4,000 after negotiation

Helpful Oregon Resources

- ORS § 12.080 — 6-year statute of limitations for property damage

- Oregon Division of Financial Regulation — insurance oversight and consumer help

- Oregon Small Claims Court — filing instructions and jurisdiction limits

Ready to Get Your Oregon Diminished Value Appraisal?

Start now — quick turnaround, verified local data, and reports accepted by Oregon insurers and attorneys.- No credit card required

- Delivery in about 1 hour

- Includes appraisal + demand letter template

Click a pin to open the city’s diminished value page.

Find your Oregon city below to order your Diminished Value Appraisal.

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Oregon

If your vehicle was damaged in a Oregon car accident, it may lose resale value even after high-quality repairs. This is called diminished value. With a Oregon diminished value appraisal, you can prove your vehicle’s loss in value and recover it under v state law. In fact, Oregon is one of the most favorable states for pursuing diminished value claims.

SnapClaim makes filing a Oregon diminished value claim fast and stress-free. We provide a free diminished value estimate, a certified Oregon diminished value appraisal report, and an insurer-ready demand letter you can submit immediately. No waiting. No confusion. Just accurate, court-ready documentation trusted by attorneys and insurance adjusters across Oregon

“After my car was hit on a rainy morning in Portland, I thought the body shop had made it as good as new. But when I went to trade it in, I discovered the accident had quietly shaved thousands off its value. SnapClaim’s Oregon diminished value appraisal uncovered the real loss with solid local data. I used their report, and the insurance company paid the difference within days.”

Lucas F.,

Portland, OR

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.