Diminished Value & Total Loss Appraisal in

Maine

Get Your Free Estimate in a Minute!

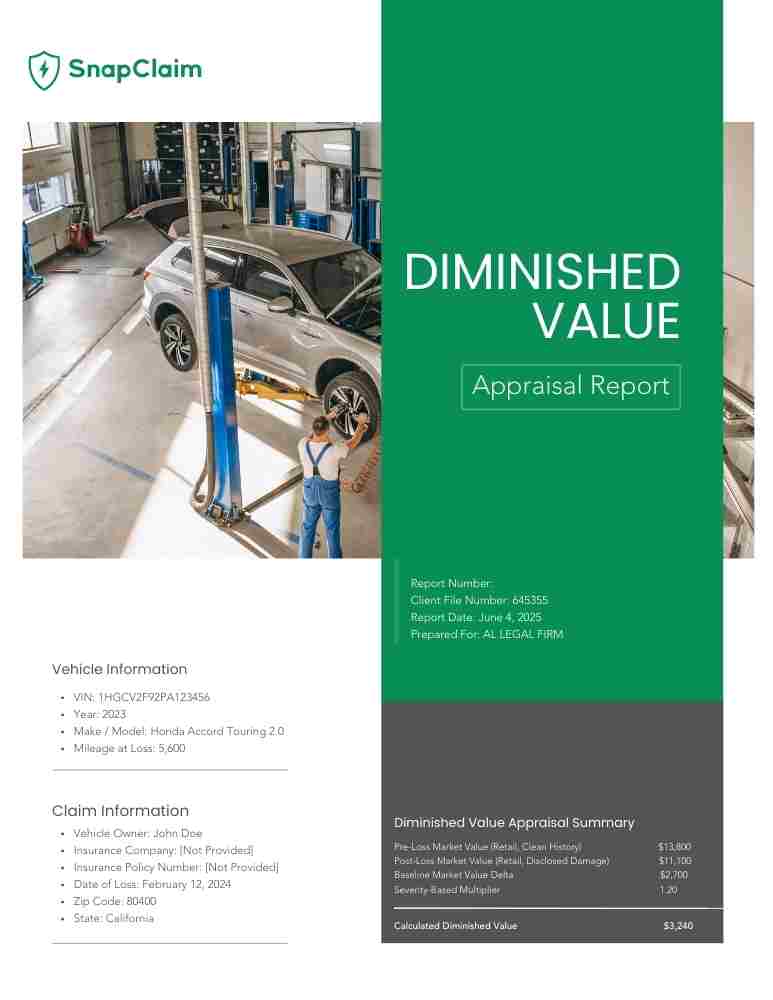

Recover your car’s lost value after an accident with a certified Maine appraisal. Our reports are fast, accurate, and court-ready — trusted by attorneys and insurers statewide.

No credit card required [Takes less than 30 second]

Last updated: August 18, 2025

Diminished Value & Total Loss Auto Appraisals in Maine: What You Need to Know

Maine drivers can recover losses for both diminished value (DV) and fair market value (FMV) claims after a car accident. Whether your vehicle was repaired or declared a total loss, state law allows you to pursue compensation for its true pre-accident value. This page explains how Maine diminished value appraisals and total loss auto appraisals work, what laws apply, key filing steps, and how a professional SnapClaim report can help you negotiate a fair insurance settlement. For city-specific information, visit our Maine Diminished Value Appraisal page.Does Maine Allow Diminished Value and Total Loss Claims?

Diminished Value (DV)

Yes. Maine allows drivers who were not at fault in an accident to pursue compensation for diminished value, provided there is credible market data supporting the reduction in resale value after repairs. While Maine has no specific diminished value statute, claims are recognized under general tort and property damage laws when supported with evidence and a certified appraisal.Fair Market Value / Total Loss (FMV)

Yes. When repair costs exceed your vehicle’s actual cash value, Maine insurers must settle based on its fair market value before the loss. If the insurer’s valuation seems too low, you can request an independent Fair Market Value Appraisal using verified Maine market data and comparable listings.Key Maine Laws & Regulations

- DV recognition: Permitted under Maine tort law when supported by credible appraisal and repair documentation.

- FMV requirement: Maine Bureau of Insurance Rule Chapter 350 — insurers must base total loss settlements on comparable vehicles available in the local market.

- Statute of limitations: Title 14, §752 — 6 years for property damage, including DV and FMV claims.

- Comparative negligence: Maine follows a modified comparative fault rule — recovery is barred if you are 50% or more at fault.

- Small claims: Maine District Courts handle claims up to $6,000 (Maine Judicial Branch).

- Insurance complaints: File with the Maine Bureau of Insurance.

What You Should Document

- Accident or police report: Obtain from the Maine State Police or your local police department.

- Repair invoices and supplements: Include all parts lists, calibration data, and photos.

- Vehicle photos: Before and after repairs, showing VIN and odometer.

- Comparable sales data: Maine dealership and private listings from your area (Portland, Lewiston, Bangor, South Portland, Auburn, Biddeford, Augusta, Scarborough, Saco, Westbrook, etc.).

- Certified Diminished Value or FMV Appraisal from SnapClaim.

Step-by-Step Claim Process

- Confirm your claim type: Diminished Value (DV) for repaired vehicles or Fair Market Value (FMV) for total loss.

- Gather documentation: Collect your police report, repair invoices, and vehicle photos.

- Order a professional appraisal: SnapClaim reports use verified Maine comparables and USPAP-compliant valuation methods.

- Submit a demand letter: Include your appraisal and cite Title 14, §752 (6-year statute) to support your claim.

- Negotiate or escalate: If the insurer undervalues your claim, use your report to pursue arbitration or file in small claims court.

Why a Professional Maine Auto Appraisal Matters

Insurers often rely on outdated or incomplete valuation systems. A SnapClaim Diminished Value Appraisal or Fair Market Value Appraisal uses verified Maine market data, local comparables, and certified methodologies accepted by courts and insurers. Every report is insurer-ready, court-defensible, and backed by our Money-Back Guarantee.Ready to Claim Your Vehicle’s True Value?

Start with a free estimate — no credit card required. SnapClaim is Maine’s trusted auto appraisal company for diminished value and total loss claims — combining certified appraisers, real-time market data, and AI-driven valuation tools to help you secure the settlement you deserve. Get My Free Estimate →Learn More About Maine Diminished Value Claims

For more details on eligibility, local laws, and sample reports, visit our Maine Diminished Value page to explore regional guides and city-specific resources. For other states, visit Diminished Value State Laws.

Order Your Auto Appraisal Report

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.