Jeffersontown

Diminished Value Appraisal

Get Your Free Estimate in a Minute!

Recover the lost value of your car after an accident with an Jeffersontown diminished value appraisal. Our reports are fast, accurate, and court-ready—trusted throughout Kentucky

No credit card required [Takes less than 30 second]

Jeffersontown Diminished Value Appraisal — Get the True Value of Your Car After an Accident

Even after professional repairs, your vehicle can lose resale value once its accident history appears on Carfax or AutoCheck. If your accident happened in Louisville, Lexington, or Bowling Green, a Jeffersontown diminished value appraisal helps document that loss — often worth $2,000–$7,000 depending on vehicle type and damage severity. SnapClaim delivers data-driven, court-ready appraisal reports used by Jeffersontown insurers, attorneys, and small-claims courts.Why Diminished Value Matters in Kentucky

Jeffersontown allows recovery for diminished value when you are not at fault in an accident. Even when repairs are performed properly, the market often discounts vehicles with an accident history.Why Jeffersontown Vehicle Owners Are Affected Most

- Jeffersontown’s mix of interstate travel and urban driving increases accident exposure and resale impact.

- High demand for reliable trucks, SUVs, and sedans (Ford, Chevrolet, Toyota, Honda) increases DV potential.

- Insurance offers in Jeffersontown often undervalue vehicles compared to actual retail listings.

What Your Jeffersontown Diminished Value Appraisal Report Includes

- Vehicle details (year, make, model, trim, mileage, options)

- Comparable listings pulled from Louisville, Lexington, Bowling Green, and nearby areas

- Pre- and post-accident market value estimates using verified Jeffersontown market data

- Jeffersontown DV calculation incorporating repair severity and dealer feedback

- Transparent methodology aligned with appraisal best practices (USPAP-aware)

- Optional expert-witness support for court or arbitration in Jeffersontown

Jeffersontown and Surrounding Areas We Serve

- Louisville

- Lexington

- Bowling Green

- Owensboro

- Covington

- Richmond

- Georgetown

- Florence

- Elizabethtown

- Hopkinsville

- Frankfort

- Paducah

- Erlanger

- Nicholasville

How to File a Jeffersontown Diminished Value Claim

- Order your Jeffersontown appraisal to document the loss with clear market evidence.

- Submit a DV demand letter to the at-fault driver’s insurer.

- Negotiate or escalate — our Jeffersontown reports are formatted for attorney and arbitration review.

- Recover compensation — many Jeffersontown clients recover between $3,000 and $6,500.

Local Insight: Common Jeffersontown Insurance Practices

- Listings pulled from AutoTrader, CarGurus, and Cars.com within the Jeffersontown market

- Dealer quotes within ~50 miles of Louisville metro area

- Localized adjustments for mileage, color, options, and regional demand across Jeffersontown

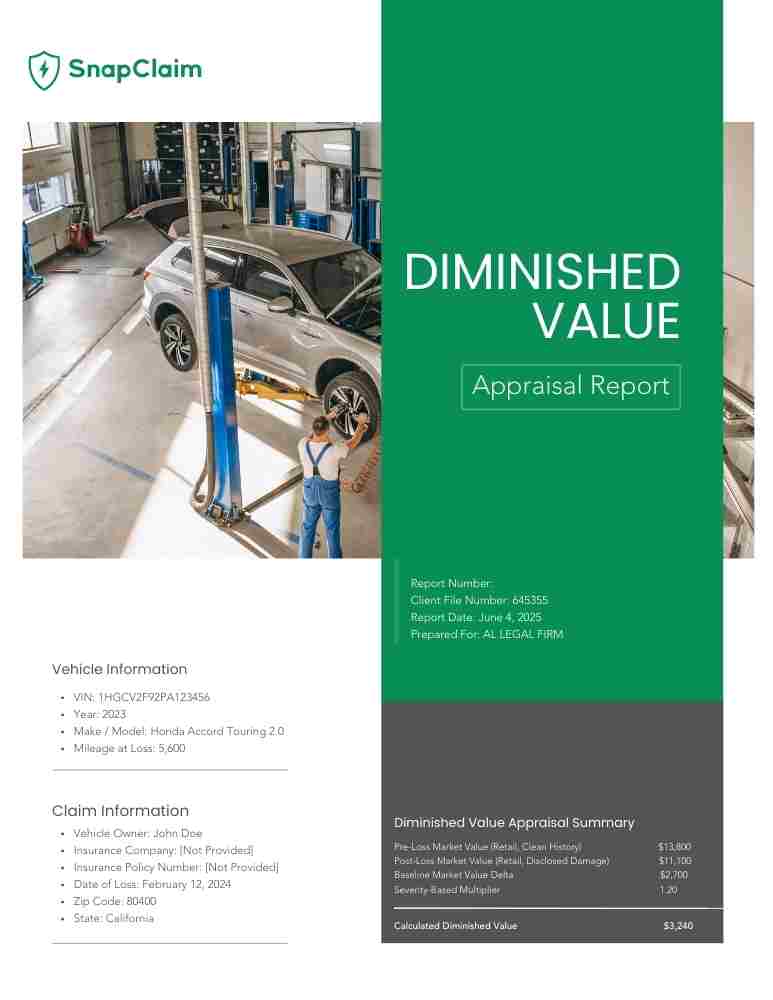

Example Jeffersontown Case Study

Vehicle: 2020 Toyota Camry XSERepair Cost: $6,400 (front-end collision)

Initial Insurer Offer: $1,200 (formula-based)

SnapClaim DV Result: $5,000

Final Settlement: $4,800 after submitting our Jeffersontown report and demand letter

Helpful Kentucky Resources

- Kentucky Department of Insurance

- Kentucky Attorney General — Consumer Protection

- Kentucky Judicial Branch — Small Claims

Ready to Get Your Jeffersontown Diminished Value Appraisal?

- No credit card required

- Delivery in about 1 hour

- Includes appraisal and demand-letter template

Related Kentucky Locations

Order Your Diminished Value Appraisal

Get Your Appraisal Report and Demand Letter Now!

Free Estimate, no credit card required.

Recover Diminished Value After an Accident in Jeffersontown

How SnapClaim Helps Jeffersontown Drivers

- Eligibility Check: See if your accident qualifies for a claim in just seconds.

- Free Estimate: View your potential payout based on i market data — no cost, no obligation Jeffersontown .

- Detailed Appraisal Report: Get a data-backed valuation that reflects actual resale prices across Metro Jeffersontown.

- Demand Letter: Submit your claim easily using our pre-filled kentucky demand letter template.

- Money-Back Guarantee: If your recovery is under $1,000 using our report, we’ll refund your appraisal cost.

Start your Jeffersontown diminished value appraisal today to see how much your car lost in resale value — and take the first step toward getting it back.

“SnapClaim made the whole process surprisingly smooth. Here in Jeffersontown, their team handled my diminished value appraisal quickly and kept me updated the entire time. The report was detailed, professional, and backed by solid data — it helped me secure a fair payout from my insurance company.”

— Angela R., Jeffersontown, KY

Frequently Asked Questions :

- What is a diminished value appraisal in Jeffersontown

A Jeffersontown diminished value appraisal determines how much value your vehicle lost after an accident, even after quality repairs. It compares pre-accident and post-repair market values using local kentucky sales data to support your insurance claim.

- Who qualifies for a diminished value claim in kentucky?

You qualify if: You were not at fault for the accident, Your vehicle was repaired, and You still own the vehicle law recognizes the right to kentucky recover loss in value after repairs, as confirmed in Oliver v. Henry (2011).

- How much can I recover for diminished value in {kentucky?

Most Jeffersontown drivers recover between $2,000 and $7,000, depending on vehicle type, age, repair quality, and local market demand in the Jeffersontown area.

- How long does it take to get my Jeffersontown diminished value report?

Most reports are completed within about one hour after your vehicle and repair information is submitted. Each report includes an insurer-ready demand letter for faster claim processing in Jeffersontown.

- What areas around Jeffersontown do you serve?

SnapClaim serves the entire state of Kentucky, including Louisville, Lexington, Bowling Green, Owensboro, Covington, Richmond, Georgetown, Florence, Elizabethtown, Hopkinsville, Nicholasville, Henderson, Frankfort, and Jeffersontown.

- Do insurance companies in Kentucky accept SnapClaim reports?

Yes. SnapClaim reports are widely accepted by insurers and attorneys across Iowa because they use standardized, USPAP-aligned valuation methods backed by real market data.

- Can I file a diminished value claim myself, or do I need an attorney?

You can file your claim directly using your SnapClaim appraisal and demand letter. If your insurer disputes the claim, an attorney can use our court-ready report to support negotiation or arbitration.

- Where can I order Kentucky diminished value appraisal?

You can order online through the SnapClaim free estimate tool. Select your Kentucky city — such as Louisville, Lexington, or Bowling Green — and get your certified appraisal report today.

- What documents do I need to get a diminished value appraisal?

You’ll need: Your repair invoice or estimate, Vehicle details (VIN, mileage, year, make, and model), and Photos of the damage or repair area (optional but helpful). SnapClaim’s appraiser team uses this information to calculate accurate pre- and post-accident market value.

Diminished Value & Total Loss Appraisal Reports

Instant Free Estimate

Instant diminished value and total loss appraisals — no guesswork, no delays, backed by a 100% money-back guarantee.

Free Estimate, no credit card required.