It’s one of the most common questions after a serious car accident: if the airbags deployed, is my car automatically considered a total loss? While deployed airbags are a significant red flag for insurance adjusters, the final decision isn’t based on the airbags alone.

The short answer is no, airbag deployment doesn’t guarantee a total loss. The decision is purely financial and boils down to one simple question: is it cheaper for the insurance company to pay for the repairs or to write you a check for your car’s pre-accident value?

Understanding Airbag Deployment and Total Loss Claims

Seeing deflated airbags hanging from the steering wheel and dashboard is a clear sign of a major impact. Replacing them is expensive and can easily add thousands of dollars to a repair bill, making a total loss more likely.

But a “total loss” isn’t determined by visual damage. It’s a cold, hard calculation where your insurance company compares two key numbers:

- The Estimated Repair Cost: This includes everything from bodywork to replacing every deployed airbag, sensors, the control module, and any other collision damage.

- The Actual Cash Value (ACV): This is a technical term for what your car was worth on the open market just moments before the crash.

If the repair bill crosses a specific percentage of your car’s ACV, the insurer will declare it a total loss. This percentage, known as the Total Loss Threshold, is set by state law and varies depending on where you live.

Why Airbags Signal a Deeper Look

Airbag deployment clearly indicates the collision was serious. According to the National Highway Traffic Safety Administration (NHTSA), there is a 90% probability of frontal airbags deploying in crashes with a velocity change of just 18-19 mph.

This is why a vehicle’s value often takes a permanent hit after the airbags deploy. Even with perfect repairs, the accident history follows it forever, slashing its resale value. This is a real financial loss that you can often recover through a diminished value claim.

Whether you’re dealing with a potential total loss or just a very expensive repair, understanding how insurers view deployed airbags is the first step toward a fair settlement.

Airbag Deployment Factors at a Glance

| Factor | What It Means for Your Claim |

|---|---|

| High Repair Costs | Replacing airbags, sensors, and control modules can add $2,000 to $6,000+ to the bill. |

| Severe Impact Indicator | It tells the insurer the crash was significant, triggering a closer look at potential structural damage. |

| Total Loss Calculation | The high repair cost makes it much more likely the vehicle will meet the state's total loss threshold. |

| Diminished Value | A car with deployed airbags has a permanent stigma, significantly lowering its resale value after repairs. |

| Safety System Integrity | The entire safety system needs professional inspection and recalibration, adding to the total cost. |

Ultimately, deployed airbags don’t automatically total your car, but they make the path to a fair insurance settlement much more complex.

Why Airbag Deployment Skyrockets Repair Costs

Seeing a deployed airbag is jarring, but the cost to replace it is often the bigger shock. The expense goes far beyond simply swapping out the fabric bag. Think of it like a plumbing leak inside a wall—the visible damage is often just the beginning of a much more complex and expensive problem.

A single airbag module can cost between $1,000 to $3,000, and modern cars often have multiple airbags—front, side, curtain, and knee airbags—that can deploy at once. That cost multiplies fast.

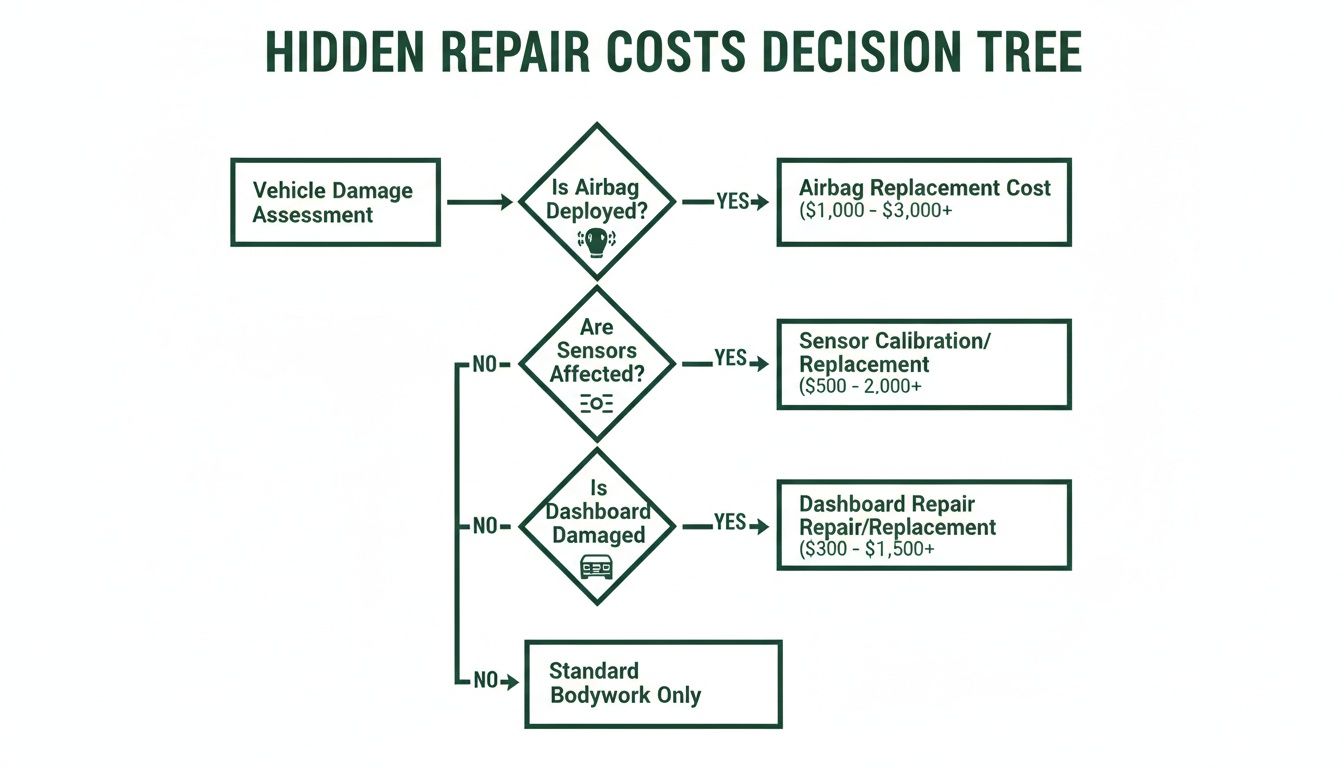

But the real reason the bill balloons is due to all the interconnected components designed as a one-time-use safety system.

The Hidden Costs of an Airbag System Replacement

Once an airbag deploys, any reputable repair shop will replace the entire supporting system of components. Cutting corners isn’t just a bad idea; it’s a massive safety risk.

Here’s a breakdown of what must be replaced, turning a seemingly straightforward repair into a major expense:

- The Airbag Control Module: This is the system’s brain. Once it sends the deploy signal, it must be replaced to factory standards.

- Crash Sensors: Located around your vehicle, these sensors detect the impact and tell the control module when to act. They are also single-use and require replacement.

- Seatbelt Pre-Tensioners: During a crash, your seatbelts lock up forcefully using a small explosive charge. This renders them unusable, and they must be replaced.

- Steering Wheel and Dashboard: The force of deployment often damages the steering wheel housing, dashboard panels, and other interior trim, all of which need to be replaced and perfectly matched.

This cascade of mandatory replacements is why the answer to “is your car totaled if the airbags deploy” so often leans toward yes, especially for older vehicles with a lower pre-accident value. The staggering cost of restoring the safety system can easily push the total repair estimate right past the insurer’s threshold.

Even after all those repairs, the accident history permanently crushes the car value after the accident, a loss you can and should pursue through a diminished value claim.

How Insurance Companies Calculate a Total Loss

When your car is badly damaged, the insurance adjuster follows a specific formula to decide if your car is a total loss. Knowing how this math works is your best defense against a lowball settlement offer.

The decision hinges on two numbers: your car’s Actual Cash Value (ACV) and the Total Loss Threshold (TLT) for your state.

Actual Cash Value (ACV)

Think of ACV as the price your car would have sold for on the open market moments before the accident. It has nothing to do with what you paid for the car or what you owe on a loan.

To determine the ACV, insurers look at:

- The year, make, and model of your vehicle.

- Its mileage at the time of the crash.

- The car’s overall condition, including any pre-existing dings, scratches, or mechanical issues.

- Recent sales data for similar cars in your local area.

Insurers often rely on their own valuation services, which are known for producing low values. This is why you need your own proof of what your car was really worth.

Total Loss Threshold (TLT)

The Total Loss Threshold is a percentage set by your state’s law. If the estimated repair bill meets or exceeds that percentage of your car’s ACV, the insurance company must declare it a total loss.

For instance, many states use a 75% threshold. If your car’s ACV is $20,000, and the body shop estimates repairs will cost $15,000 or more, it’s totaled. Because every state is different, it’s crucial to know the law where you live. A solid understanding of your insurance for your car policy will also help you navigate this process smoothly.

This is where airbag deployment becomes a huge factor. The cost isn’t just the airbags; it’s a domino effect.

As you can see, replacing the airbags also means replacing sensors, control modules, and often entire dashboards. Those costs stack up incredibly fast.

Example Total Loss Calculation

Here’s a breakdown of how an insurer applies the total loss formula in a real-world claim.

| Metric | Value/Calculation | Description |

|---|---|---|

| Vehicle | 2019 Sedan | The damaged car in question. |

| State TLT | 75% | The legal threshold set by the state. |

| ACV | $18,000 | The car's fair market value pre-accident. |

| Repair Cost | $14,000 | The body shop's estimate for all repairs. |

| Total Loss Test | $14,000 ÷ $18,000 | Repair cost divided by ACV. |

| Result | 77.8% | This percentage is compared to the state TLT. |

| Decision | Total Loss | Since 77.8% is greater than the 75% TLT. |

In this scenario, because the repair cost is 77.8% of the car’s value, it’s declared a total loss. The insurance company would then owe the owner the $18,000 ACV, minus their deductible.

If you believe the insurer’s ACV is too low, you have the right to challenge it. You can learn more in our guide to total loss claims.

How State Laws Influence Your Total Loss Claim

The rules insurance companies follow to declare a car a total loss aren’t the same everywhere. They’re dictated by state-specific regulations that can be wildly different.

This means a car that might be repaired after a crash in one state could easily be totaled for the exact same damage in another. Understanding the laws where you live is a crucial first step before negotiating with an insurance adjuster.

Total Loss Threshold vs. Total Loss Formula

Most states use one of two main methods. The most common is the Total Loss Threshold (TLT), a simple percentage of your car’s pre-accident value (ACV). If the repair bill meets or exceeds that percentage, the insurer must declare it a total loss.

For example, a state with a 75% TLT means a car valued at $20,000 will be totaled if repair estimates reach $15,000 or more.

Some states use the Total Loss Formula (TLF), which includes the car’s potential salvage value. The math is:

- Cost of Repairs + Salvage Value ≥ Actual Cash Value

If the cost to fix your car plus what it’s worth as scrap meets or exceeds its pre-accident value, it’s a total loss.

Why Your State’s Law Matters

The difference between these approaches can be huge. A state with a high threshold like Texas (100%) makes it much harder to total a car compared to Iowa (50%). The high cost of airbag replacement can easily push a vehicle over a lower threshold.

Because these rules are so specific, you need to know what’s on the books in your area. You can usually find a list of total loss regulations on your state’s DMV website. Knowing this gives you the power to understand exactly how the adjuster is calculating your insurance total loss payout and ensures they’re playing by the rules. It’s a key piece of the puzzle when you’re wondering if your car is totaled if the airbags deploy.

What Happens If Your Car Is Repaired After Airbags Deploy

So, your car dodged a total loss verdict. While that may seem like good news, the financial headache is just beginning. A vehicle that’s been in a wreck severe enough to deploy airbags now has a permanent black mark on its history report.

This permanent hit to its resale value is what we call diminished value. It’s a real, tangible financial loss you’ve suffered. Even if the accident wasn’t your fault, your asset is now worth thousands less. The good news? In most states, you have the right to recover that lost value from the at-fault driver’s insurance company.

Proving Your Car’s Lost Value

Simply telling the insurance adjuster your car is worth less won’t work. They will almost certainly deny your claim or make a tiny, “go-away” offer. To get the compensation you’re owed, you need proof of exactly how much value your car has lost.

This is where a certified appraisal from an expert like SnapClaim becomes your most powerful tool. It breaks down key factors to establish a credible, defensible number for your loss:

- Severity of Damage: It documents the full extent of the collision, highlighting that airbag deployment signals a major impact.

- Quality of Repairs: The report assesses how well the vehicle was restored to its pre-accident condition.

- Market Stigma: It compares real-world sales data for cars like yours—some with clean histories, some without—to quantify how much less buyers are willing to pay for a car with an accident on its record.

An independent appraisal transforms your claim from a simple request into a formal, evidence-based demand. It provides the proof you need to negotiate fairly and counter an insurer’s attempts to undervalue your loss.

Navigating the Claim Process

Winning a diminished value claim requires a methodical approach. It starts with knowing your rights and the specific laws in your state. Regulations like the recent Florida Tort Reform can significantly impact how insurance claims are handled.

Once you’re armed with a certified appraisal report, you can present a rock-solid case to the insurance adjuster. That report becomes your primary evidence, backing up every dollar you claim with market data and expert analysis. It helps you recover the compensation you rightfully deserve.

How a Certified Appraisal Maximizes Your Payout

Whether you’re facing a total loss or a diminished value claim, the insurance company’s first offer is just their starting point—and it’s almost always in their favor. To get the full compensation you are owed, you need objective, undeniable proof of your vehicle’s true value.

An independent appraisal from SnapClaim isn’t just an opinion; it’s a court-ready document built on verifiable market data. It gives you the concrete evidence needed to challenge an insurer’s lowball Actual Cash Value on a total loss or to prove the exact dollar amount of your diminished value. This step shifts the negotiation from their assumptions to your hard facts.

The Power of a Data-Driven Report

Insurance adjusters are trained to minimize payouts. When you provide a certified report from a trusted third party, it fundamentally changes the conversation. You are no longer just disagreeing with their numbers; you are presenting a detailed analysis they are professionally obligated to address.

A SnapClaim report helps strengthen your claim by:

- Establishing Fair Market Value: For a total loss, it proves what your vehicle was actually worth before the crash, directly countering the insurer’s low valuation.

- Quantifying Diminished Value: For repaired vehicles, it calculates the precise loss in resale value caused by the accident history.

- Providing Unbiased Evidence: The report is prepared by certified experts using industry-standard methodologies, giving your claim the credibility it needs.

By arming yourself with an expert appraisal, you level the playing field. It shows the insurer you’ve done your homework and are prepared to fight for a fair insurance total loss payout.

A Risk-Free Path to Fair Compensation

We understand that paying for an appraisal while dealing with other accident-related expenses can feel like a burden. That’s why SnapClaim offers a Money-Back Guarantee.

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This makes getting a certified report a risk-free way to gain the leverage you need. A professional report from SnapClaim provides the proof you need to negotiate fairly and supports your case with certified data, whether that means securing a higher total loss settlement or recovering your vehicle’s lost resale value.

Explore our total loss appraisal reports to see exactly how we build a rock-solid case for our clients.

Frequently Asked Questions (FAQ)

Navigating an insurance claim when airbags go off and the term “total loss” is involved can be confusing. Here are clear answers to common questions.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you have the option to keep your vehicle through a process called “owner-retained salvage.” The insurance company pays you the car’s Actual Cash Value (ACV) minus its salvage value. However, your car will receive a salvage title, which can make it very difficult and expensive to insure or sell later.

Does fault matter when deciding if a car is totaled?

No, fault plays no role in the total loss calculation itself. The decision is purely financial, comparing the repair cost to the car’s pre-accident value (ACV). Fault is only critical for determining who pays the bill—the at-fault driver’s insurance or your own collision coverage.

What if I disagree with the insurance company’s valuation?

You have the right to challenge the insurer’s ACV offer if you feel it’s too low. The most effective way to do this is by providing your own objective evidence. Your most powerful tool is a certified, independent appraisal from a service like SnapClaim. A data-driven report provides the proof needed to negotiate for the fair value you are owed.

Can I claim diminished value if the accident wasn’t my fault?

Yes. If the other driver was at fault, you can file a diminished value claim against their liability insurance policy to recover the loss in your car’s resale value. A certified appraisal is essential for proving the exact amount of this loss.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.