That sinking feeling hits the moment the adjuster calls. Your car isn’t just damaged—it’s a total loss. Then comes the settlement offer, and it’s so low you have to read it twice.

It’s a frustratingly common scenario, but don’t mistake their first offer for the final word. It’s just a starting point for a negotiation you need to be ready for.

Your Car Is Totaled—Now What?

You’re not powerless here. That initial offer is a business calculation, plain and simple. Your job is to push back with facts and evidence to get what you’re rightfully owed.

How Insurance Companies Calculate Your Car’s Value

Insurers determine your payout using a figure called Actual Cash Value (ACV). This isn’t what you paid for the car or what a new one costs. ACV is what your specific vehicle was worth on the open market the second before the accident.

To get to that number, they use third-party valuation software that crunches data based on a few key factors:

- The Basics: Your car’s year, make, model, and trim.

- Mileage: How many miles were on the odometer.

- Condition: The overall shape of the vehicle—interior, exterior, and mechanical—before the crash.

- Local Market: What similar “comparable” cars have recently sold for in your area.

So, Why Is Their First Offer Always So Low?

While the process sounds fair on the surface, the devil is in the details. The valuation reports these systems spit out are notorious for leaning in the insurer’s favor. They often contain errors or use skewed data that drives your payout down.

For example, an adjuster might compare your meticulously maintained, top-trim model to base models with high mileage and poor maintenance records. They might also overlook valuable upgrades or recent work you’ve done. Did you just put on a $1,200 set of new tires or have the transmission serviced? Those things add real value but are frequently missed in the initial report.

Key Takeaway: An insurer’s valuation report is their argument for what they think they owe you, not an undisputed fact. Your job is to pick apart their argument and build a stronger case for your car’s true value.

Before you can negotiate, you need to understand what’s in their offer and where to look for weaknesses.

Decoding Your Total Loss Settlement Offer

Your settlement breakdown is filled with industry jargon. This table will help you understand what each component means and what red flags to look for.

| Component of Offer | What It Means | Red Flags to Watch For |

|---|---|---|

| Vehicle Base Value | The starting value of a "clean" comparable car. | This number seems unusually low compared to real-world listings. |

| Comparable Vehicles ("Comps") | A list of similar cars used to determine your vehicle's value. | Comps are from distant areas, are lower trim levels, or are in poor condition. |

| Condition Adjustments | Deductions or additions based on your car's pre-accident condition. | Unfair negative adjustments for minor wear and tear; ignoring positive features. |

| Option/Mileage Adjustments | Changes to the value based on your car's specific features and mileage. | Missing valuable options (sunroof, tech package) or unfair mileage deductions. |

| Sales Tax, Title & Fees | Reimbursement for the taxes and fees you'll pay to replace your vehicle. | Failure to include these costs, as required by most state laws. |

| Deductible | The amount subtracted from the final settlement that you are responsible for. | Incorrect deductible amount applied. |

Scrutinizing their report is more than just your right—it’s the first and most critical step toward securing a fair insurance total loss payout.

Treat their first number for what it is: an opening bid in a negotiation. To learn more about fighting back, check out our complete guide to what to do when your car is totaled.

Why Insurance Companies Lowball Total Loss Claims

When you get a lowball offer for your totaled car, it feels like a personal insult. But here’s the thing you need to remember: it’s not personal, it’s just business.

Insurance carriers are massive, for-profit corporations. Their first financial duty is to their shareholders, not to you. Every single dollar they can avoid paying out on a claim goes straight to their bottom line. This isn’t some backroom conspiracy; it’s the core of their business model. They process thousands of claims every day, and they’ve built incredibly efficient systems designed to control costs and keep payouts to a minimum.

That initial low offer? It’s usually just their opening move in a negotiation you didn’t even know you were supposed to have.

The Problem with Third-Party Valuation Software

Insurers almost never calculate your car’s value in-house. They outsource it to third-party valuation services, with the biggest player being CCC Intelligent Solutions (you might see it listed as CCC ONE on your report). These platforms churn through huge databases of sales data to spit out a “market valuation report,” which then becomes the foundation for your settlement offer.

On the surface, it seems objective and data-driven. But it’s not that simple.

The methodology these services use has come under heavy fire and has been the subject of major legal challenges. Critics argue the software algorithms are often tweaked to favor the insurer. They can be programmed to pull lower-value “comparable” vehicles, apply aggressive and poorly explained condition adjustments, and ultimately generate a number that serves the insurance company’s financial goals.

This isn’t a mistake. Systematic undervaluation is a feature of a system built for one purpose: cost containment. Once you understand that, you can stop feeling like a victim and start preparing to fight their data with your own.

Common Tricks Used to Justify Low Offers

The valuation reports insurers send you look official, packed with data and fine print. But they’re often riddled with flaws designed to chip away at your car’s actual worth. Learning to spot these tactics is the first step toward dismantling their argument.

Here are the most common plays you’ll see:

- Using Bad “Comparables”: Your report might list vehicles that aren’t truly like yours at all. Maybe they’re base models when you had a premium trim package, or they have way more miles. Sometimes they’re even pulled from a completely different, cheaper market hundreds of miles away.

- Applying Vague “Condition Adjustments”: Insurers love to deduct money for pre-existing “wear and tear.” But these adjustments are almost always subjective and rarely justified. They might hit you with a huge deduction for a tiny door ding or normal scuffs on the interior, effectively penalizing you for just using your car.

- Making Hidden Adjustments: This is one of the sneakiest tactics. Some valuation reports bake in undisclosed deductions. A classic example is the “projected sold adjustment.” The software literally assumes a dealer would have negotiated the sales price down, so it subtracts that imaginary discount from your car’s value—even though no negotiation ever happened.

Legal Fights Are Exposing the Issue

These practices aren’t just frustrating—they’re attracting legal scrutiny.

In a major civil lawsuit, California’s Alameda County District Attorney went after USAA, accusing them of systematically lowballing their own policyholders. The suit alleges they used flawed valuation methods, cherry-picked junk comparable vehicles, and applied unfair adjustments to deliberately underpay claims.

The D.A.’s office estimated these tactics led to underpayments averaging $3,000 to $4,000 per vehicle. Across the state, that could add up to billions in losses for consumers. You can read more about this groundbreaking lawsuit over at ProgramBusiness.com.

This case proves that a low insurance total loss payout isn’t a one-off problem. It’s a widespread issue baked into the industry’s standard operating procedures. By understanding the game, you can build a strategy to counter their first offer and demand the fair market value you’re actually owed.

How to Build a Case for a Higher Payout

Think of an insurance low ball offer on totaled car as the opening bid in a negotiation, not the final word. The insurance company has made their case for what they think your car is worth. Now, it’s your turn to respond with a counter-argument built on cold, hard facts.

Emotion won’t get you far here, but solid data will. Your mission is to prove their valuation is inaccurate by showing what your car was truly worth the moment before the accident. This requires gathering specific proof to paint a complete and accurate picture of your vehicle’s fair market value.

Find Your Own Comparable Vehicles

Your single most powerful tool is a list of genuinely comparable vehicles—or “comps”—for sale right now in your local area. The insurer’s report likely includes comps, but I’ve seen countless reports where they’re poorly chosen, from distant markets, or in worse condition to justify a lower number.

Your job is to find better ones. Look for vehicles that are the same make, model, year, and trim level. But don’t stop there. Get granular:

- Mileage: Find listings with mileage close to or even slightly higher than yours.

- Condition: Zero in on cars described as “excellent” or “very good.”

- Location: Stick to dealerships and private sellers in your immediate geographic area. Car values change significantly from one region to another.

Websites like AutoTrader and Cars.com, along with local dealership sites, are your best resources. Save screenshots or printouts of at least five to seven strong examples to send to the adjuster.

Document Every Upgrade and Recent Repair

Did you just put on a fresh set of Michelins? Upgrade the sound system? Get the timing belt replaced last fall? Every dollar you recently invested in your vehicle adds value, and these are exactly the kinds of details adjusters overlook in their initial offer.

Go through your records and pull receipts for any significant work done in the last 1-2 years. This includes things like:

- New tires or custom wheels

- Major mechanical work (e.g., new transmission, engine repairs)

- Aftermarket additions like a roof rack or an upgraded infotainment system

- Key maintenance services like brake jobs or suspension work

These documents are your proof that your car was not just “average.” They show it was a well-maintained asset, which directly impacts the car value after accident determination.

Prove Your Car’s Excellent Condition

Without ever laying eyes on your car pre-accident, adjusters often default to labeling its condition as “average.” This is a quick and easy way for them to lower its value from the start. If your car was pristine, you need to prove it.

Your best bet is time-stamped photos or videos taken before the crash. Did you take pictures on a recent road trip? A family event? If they clearly show a clean interior and a scratch-free exterior, they’re gold.

On top of that, gather your complete service history. A thick folder of maintenance records showing every oil change, tire rotation, and inspection tells a powerful story of meticulous care—far from the “average” vehicle they’re assuming.

Here’s a quick checklist to help you organize your evidence gathering.

Your Evidence Gathering Checklist

This table breaks down exactly what you need to collect to build a rock-solid case against the insurance company’s lowball offer.

| Evidence Type | Where to Find It | Why It's Important |

|---|---|---|

| Local Comps | AutoTrader, Cars.com, local dealer sites | Shows the real, current market price to replace your exact car. |

| Repair & Upgrade Receipts | Your personal files, mechanic's office | Proves you invested in the car, increasing its value beyond the "book" price. |

| Maintenance Records | Your files, dealership, or mechanic's shop | Demonstrates the car was in above-average condition. |

| Pre-Accident Photos | Your phone, social media, cloud storage | Visual proof that contradicts the adjuster's "average" condition rating. |

| Original Bill of Sale | Your purchase documents | Shows the trim level and any optional packages you paid for. |

| Independent Appraisal | Certified appraisal firms (like SnapClaim) | An unbiased, expert valuation that dismantles the insurer's biased report. |

Having these documents organized and ready to go shows the adjuster you are serious and prepared.

Key Insight: Having a professional eye on your maintenance history can be a game-changer. If you have detailed service records, it helps to find a trustworthy mechanic to review them and confirm the vehicle’s excellent pre-accident condition.

The Power of an Independent Appraisal

While your own research is essential, the ultimate weapon for dismantling a low offer is a certified, independent appraisal. This is like bringing your own expert witness to the negotiation.

An independent appraiser has no allegiance to the insurance company. Their sole function is to determine the true, unbiased Actual Cash Value (ACV) of your vehicle using comprehensive market data and industry-standard methods.

A professional report from a firm like SnapClaim provides the proof you need to negotiate fairly. It’s no longer your opinion versus theirs; it’s your expert’s data-driven analysis against their self-serving one. This is often what it takes to get an adjuster to back down and negotiate in good faith.

By systematically building your case with this evidence, you completely change the dynamic. You’re no longer just a claimant hoping for a better offer—you’re a prepared negotiator armed with the facts needed to secure the insurance total loss payout you’re rightfully owed.

Mastering the Negotiation with Your Insurer

Now that you’ve gathered all your evidence, it’s time to talk to the adjuster. The goal is to shift the conversation away from their lowball offer and anchor it to the real fair market value of your totaled car. Be firm and professional, but avoid being confrontational.

Your first move should always be in writing—an email is perfect. This creates a paper trail right from the start, documenting your counter-offer and the proof you’ve collected to back it up. In that email, you’ll simply state that you’re rejecting their offer and present your own valuation, supported by all the evidence you’ve put together.

Presenting Your Counter-Offer

When you send that counter-offer, get straight to the point and let the facts do the talking. Emotional language won’t help you here; solid data will. To successfully counter an insurance lowball offer on totaled car, you need to lean on effective and powerful contract negotiation strategies.

Keep your email structured and simple:

- A Clear Rejection: Start by politely stating that their settlement offer is not enough to replace your vehicle with a comparable one in your local market.

- Your Proposed Value: Clearly state the figure you’ve calculated as the true Actual Cash Value (ACV).

- Attached Evidence: Attach all your documentation—your comps, receipts, photos, and especially your independent appraisal report—as a single PDF file to make it easy for them to review.

This organized approach immediately tells the adjuster you’re serious and you’ve done your research, which can completely change the dynamic of the negotiation.

Handling Common Adjuster Pushback

Adjusters are professional negotiators, and they have a script for dealing with people who push back. If you know what’s coming, you won’t get flustered or feel pressured to back down.

Here are a few lines you’ll almost certainly hear:

- “Our valuation software is the industry standard.” This is a classic. Your response should be calm and factual: “I understand you use that system, but as my evidence shows, it has produced an inaccurate valuation for my specific vehicle. The market data I’ve attached reflects its true replacement cost.”

- “Those comparable vehicles you sent aren’t valid.” They might try to pick apart your comps for small, irrelevant reasons. Don’t let them. Stand your ground by saying, “These vehicles are currently for sale in my immediate area and are the closest match in trim, mileage, and condition to my car before the loss.”

- “We don’t consider aftermarket parts.” This is often a bluff, especially for upgrades that are permanently attached to the vehicle. Check your policy and your state’s laws, then push back accordingly.

Key Takeaway: The adjuster’s job is to close your claim for as little money as possible. Your job is to make their low number impossible to justify by providing overwhelming, well-organized, and factual evidence.

Many adjusters use valuation systems like CCC ONE, which are known to have their own set of flaws. If you want to get ahead of their arguments, it’s worth learning how to dispute a CCC ONE market valuation report and understanding the data it pulls from.

The Importance of a Paper Trail

While you’ll probably talk to the adjuster on the phone, always follow up with an email summarizing the conversation. It can be as simple as, “Per our conversation today, you confirmed you have received my counter-offer and will review the provided documentation.”

This creates an official record and prevents any “he said, she said” arguments down the road. If the dispute escalates, this written log will be absolutely essential.

It’s also crucial to realize that some tactics are more than just negotiation—they’re systemic problems. Persistent, evidence-based challenges are not only necessary but can also be successful. By mastering this negotiation process, you give yourself the best possible shot at securing the fair insurance total loss payout you’re entitled to.

What to Do When the Insurance Company Won’t Budge

So, you’ve laid out a solid case, backed it with hard evidence, and the adjuster still won’t move on their insurance low ball offer on totaled car. It’s frustrating, but honestly, it’s a common roadblock. When the back-and-forth stalls, it doesn’t mean you’ve hit a dead end. It just means it’s time to change your strategy.

Don’t let the adjuster’s silence or stubbornness pressure you into taking a bad deal. You have some powerful options to get things moving again and fight for the fair settlement you’re entitled to.

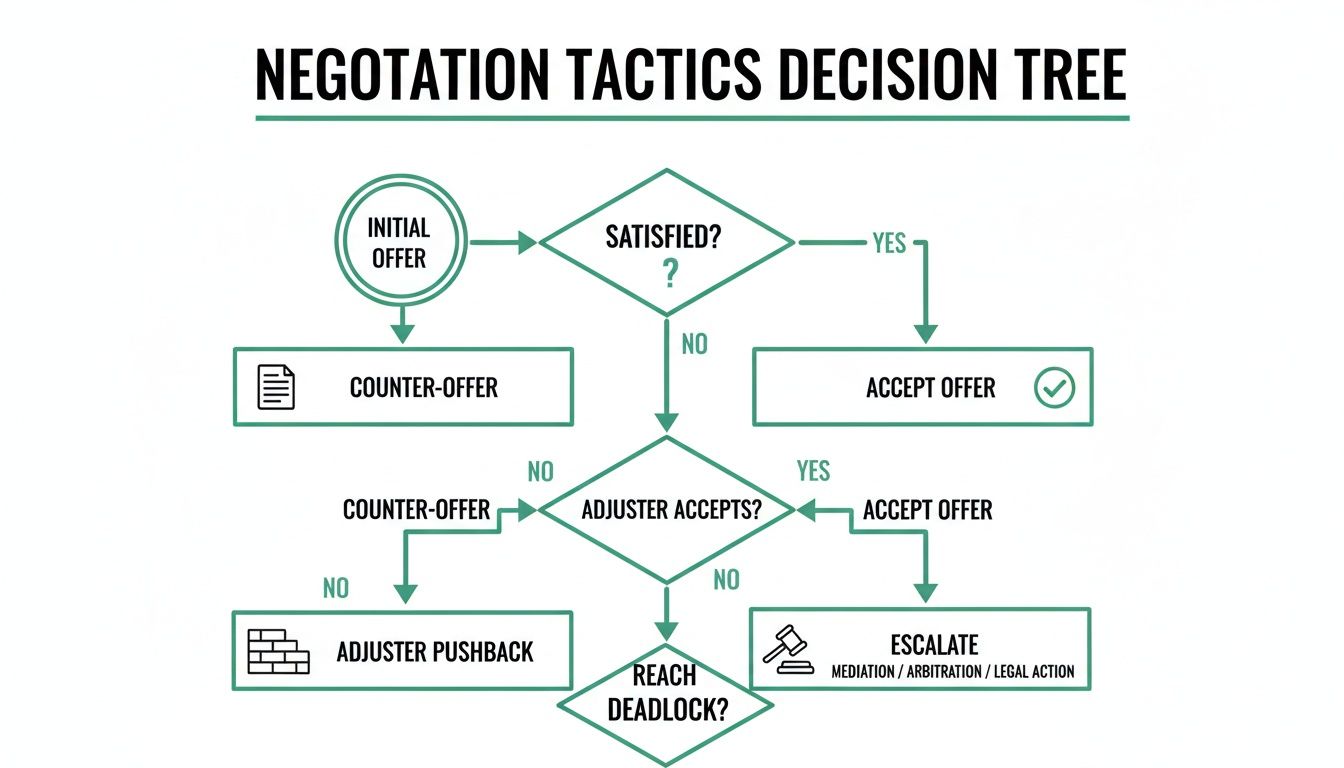

This decision tree gives you a clear visual of the escalation path when you’re getting nowhere with the adjuster.

As you can see, a stalled negotiation isn’t the end. It’s the trigger for more formal, structured methods designed to break the deadlock and get you a fair outcome.

Invoke the Appraisal Clause

Tucked away in the fine print of almost every auto insurance policy is a powerful tool you probably didn’t know you had: the appraisal clause. This is your contractual right to force a tie-breaker when you and the insurer can’t agree on your car’s value.

Here’s how it works. When you invoke the clause, you and the insurance company each hire an independent, impartial auto appraiser. Those two appraisers go to work, evaluating your vehicle’s value. If they can agree on a number, that’s it—the amount is binding.

If they can’t reach an agreement, they’ll bring in a third, neutral appraiser called an “umpire” to make the final call. The appraisal clause effectively takes the decision-making power away from a biased adjuster and puts it into the hands of neutral experts. It can be a real game-changer. You can learn more about invoking the appraisal clause and see if it’s the right move for you.

File a State Department of Insurance Complaint

Every state has a Department of Insurance (DOI) that acts as a watchdog, regulating insurers and protecting consumers like you. If you feel your insurer is acting in bad faith—maybe they’re using endless delay tactics or just flat-out refusing to justify their low offer—filing a complaint is a great next step.

It’s completely free and you can usually do it right on their website. Once you file, the DOI opens an investigation into your claim. This puts real pressure on the insurance company to clean up their act, because the last thing they want is regulatory scrutiny or fines.

Pro Tip: When you file your complaint, stay professional and stick to the facts. Don’t make it an emotional rant. Instead, attach all your documentation: their lowball valuation, your counter-offer with evidence, and a log of your calls and emails. A well-documented complaint gets taken seriously.

Consider Legal Consultation

What if the appraisal clause isn’t an option in your policy, and the DOI complaint doesn’t light a fire under the insurer? It might be time to talk to an attorney who specializes in insurance disputes.

This doesn’t automatically mean you’re headed for a lengthy court battle. Often, a single, strongly-worded demand letter from a law firm is all it takes to make an insurer suddenly become much more reasonable. An attorney can review your case, tell you if you have solid ground to stand on, and advise you on the best path forward. This step is particularly important if there’s a big gap between their offer and your car’s true value, or if the insurer is clearly breaking state laws.

Answering Your Questions About Total Loss Offers

When your car is totaled, the questions start piling up fast. An insurance low ball offer on totaled car only makes things more confusing. Let’s walk through some of the most common concerns I hear from vehicle owners to give you some clarity and confidence.

Can I keep my car if it’s declared a total loss?

Yes, in most states, you absolutely can. This is often called “owner-retained salvage.” If you go this route, the insurance company pays you the car’s actual cash value (ACV) but subtracts its salvage value—the amount they would have received selling the wrecked car at auction.

Just be warned: rebuilding a salvage vehicle is a serious undertaking. The car will be issued a “salvage title,” and it must pass tough state inspections to become road-legal again. Plus, finding an insurer willing to provide full coverage for a car with a branded salvage title is difficult.

How do they figure out the Actual Cash Value of my car?

Actual Cash Value (ACV) is what your car was worth on the open market a moment before the accident—not what you paid for it or what a new one costs. Insurers use third-party valuation software to calculate this number based on your car’s year, make, model, mileage, condition, and local market sales data.

The problem is, these reports often contain errors or use poor “comparable” vehicles to lower your insurance total loss payout. That’s why you must do your own homework and present your own evidence to ensure the valuation is fair. For a deeper dive, check out our guides to total loss claims.

What if my independent appraisal is higher than theirs?

This is where you gain real leverage. When you provide a certified appraisal that values your car higher, the insurer can’t just ignore it. While they don’t have to automatically match the number, they are legally required to consider it in good faith.

A data-driven report from an expert source like SnapClaim gives you the objective, market-backed proof needed to pick apart their lowball offer. It changes the conversation from your opinion versus theirs to a battle between two professional valuations, forcing the adjuster to justify their low number or raise their offer.

How long does the insurance company have to settle?

This depends on your state’s laws. Most states have “prompt payment” laws that require insurers to act within a reasonable timeframe, typically between 15 to 60 days after you’ve submitted all required paperwork and an amount has been agreed upon.

If you’re fighting over the vehicle’s value, that timeline can stretch out. If you feel the adjuster is intentionally dragging their feet, document every communication. If delays become unreasonable, you can file a complaint with your state’s Department of Insurance. You can usually find the specific rules for your state on its official DMV or insurance commissioner website.

Get the Payout You Deserve

Fighting an insurance low ball offer on totaled car feels like an uphill battle, but you don’t have to go it alone. The single most effective thing you can do is arm yourself with a professional, data-backed appraisal to negotiate with real strength.

SnapClaim delivers certified, court-ready reports that give you the leverage you need to secure a fair settlement. Our process is quick, transparent, and backed by a Money-Back Guarantee: If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your Total loss Appraisal Today