When your car is in an accident, even the best repairs can’t erase one crucial detail: its new accident history. Filing a diminished value claim with Allstate is how you recover the drop in your car’s resale value, and it all starts with proving that loss. This guide will walk you through the steps to strengthen your claim and negotiate for the compensation you deserve. Learn more about Allstate diminished value claim.

What Is a Diminished Value Claim and Can You File One with Allstate?

Before you contact the adjuster, it’s important to understand what you’re asking for. A diminished value claim is not a bonus payout; it’s compensation for the real, measurable loss in your car’s market value that occurs after a collision.

Think about it from a buyer’s perspective. Even with flawless repairs, an accident is a permanent part of your vehicle’s history report. A smart buyer will check the CarFax or AutoCheck, see the accident, and offer you less money. The gap between your car’s pre-accident value and its post-repair value is its “diminished value.” You can learn more in our detailed Diminished Value guide.

Understanding Allstate’s Position

Allstate, like other major insurers, has a standard process for handling these claims. While they are obligated to “make you whole” if their insured driver was at fault, their definition of that term might be different from yours.

You will likely encounter their standard method for calculating this loss, often referred to as the “17c formula.” This formula is widely known for producing low offers because it applies caps and modifiers that don’t accurately reflect real-world used car market conditions.

Here’s what this means for you:

- Their first offer is a starting point, not the final word. Allstate’s initial number is calculated to minimize its payout.

- The burden of proof is on you. It’s your responsibility to demonstrate that their formula is inaccurate and your car has lost more value than they claim.

- An independent appraisal is your strongest tool. A data-driven report from a certified appraiser is the most effective way to counter a low offer with objective facts.

The Financial Impact of an Accident

The loss from diminished value can be significant. Vehicles with a documented accident history often lose 10% to 25% of their pre-accident value. For a newer car, this can easily amount to thousands of dollars that the repair check doesn’t cover.

Key Takeaway: You are not asking for a favor when you file a diminished value claim. You are asserting your right to be fully compensated for all damages caused by the at-fault driver, including the very real damage to your car’s market value.

Knowing your rights puts you in a much stronger negotiating position. For more insights on what you can recover after a collision, this guide on Motor Vehicle Accident Compensation offers a helpful overview.

Gathering the Right Evidence for Your Allstate Claim

When learning how to file a diminished value claim with Allstate, success depends less on what you say and more on what you can prove. An adjuster’s role is to manage financial risk, and they operate on data. Simply telling them your car value after an accident has dropped isn’t enough.

You need to build a professional case file that leaves no room for doubt. Presenting an organized, evidence-based package from the start signals to the adjuster that you are serious and well-prepared, setting a professional tone for the negotiation.

Your Allstate Diminished Value Documentation Checklist

Before you make the call, get your paperwork in order. Each document tells a piece of your vehicle’s story, from its pre-accident condition to the details of the repair.

Use this checklist to ensure you have everything needed to build a solid claim.

| Document | Why You Need It |

|---|---|

| Official Police/Accident Report | Establishes the facts of the incident and, most importantly, who was at fault. |

| Final Itemized Repair Invoice | This is your most critical evidence, proving the severity of the damage by detailing every part replaced and every hour of labor. |

| High-Quality “Before” Photos | If available, photos of your car in great condition create a powerful “before and after” narrative. |

| Detailed “After” Photos | After repairs are complete, take clear photos of the repaired areas from multiple angles to document the final outcome. |

| The Body Shop’s Estimate of Record | The initial estimate provides another layer of detail, showing the intended scope of work before repairs began. |

Organizing these documents into a single file makes your claim easy for the adjuster to review and much harder to dismiss.

Establishing Your Vehicle’s Pre-Accident Value

Next, you need to prove what your vehicle was worth the moment before the collision. This figure, known as the Fair Market Value (FMV), is the foundation of your claim. Allstate will have its own number; you need to come prepared with your own independent proof.

A good starting point is using a trusted online valuation tool like Kelley Blue Book. KBB allows you to input your vehicle’s specific details—year, make, model, mileage, and condition—to get an estimated value. While it’s a helpful baseline, an adjuster might dismiss it as a generic online estimate.

To truly strengthen your argument, you need real-world evidence.

Pro Tip: Search for comparable vehicles for sale in your local area. Find listings for the same year, make, model, and trim with similar mileage and in excellent (pre-accident) condition. Save these listings as PDFs.

This local market data is far more persuasive than a generic online quote because it shows what actual buyers are willing to pay for a car like yours without an accident history. Combining a KBB value with local listings creates a powerful, data-backed argument for your vehicle’s pre-accident worth.

Why an Independent Appraisal Is Your Most Powerful Tool

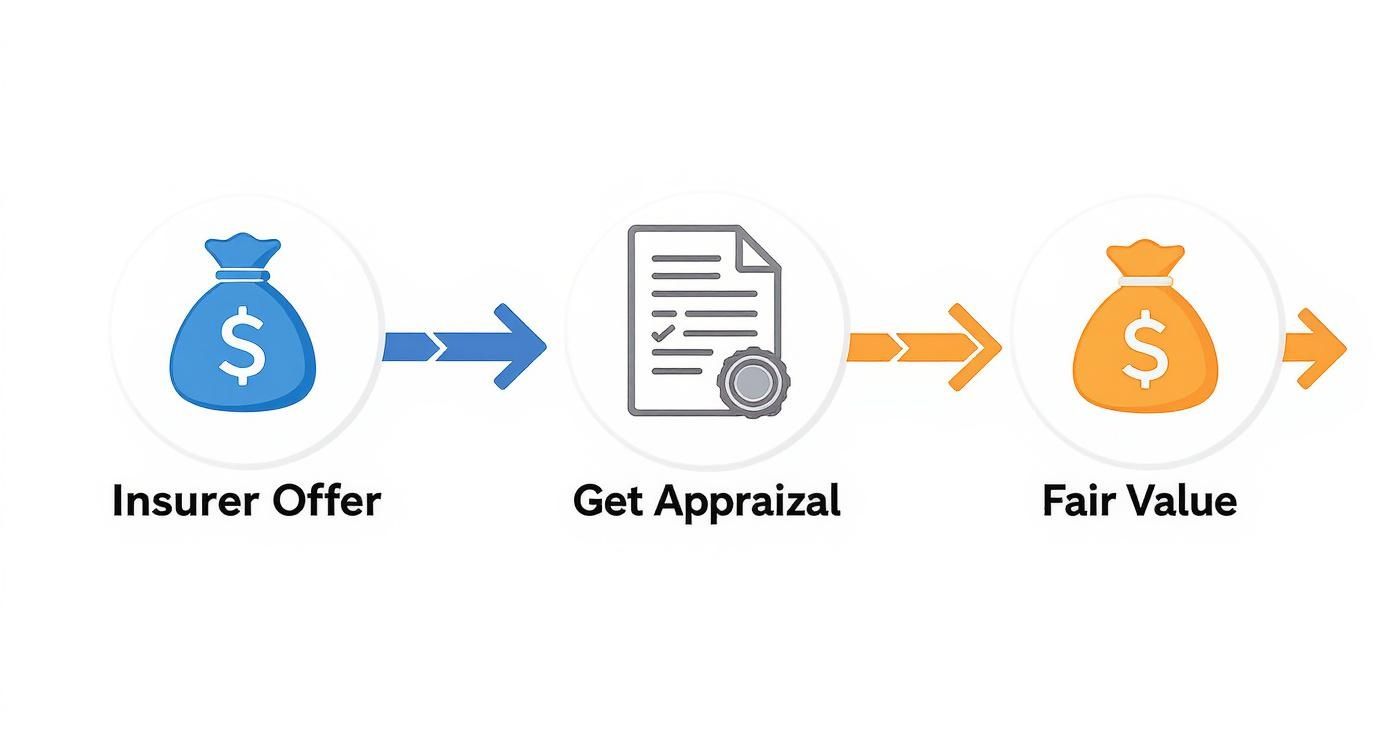

After you’ve gathered your initial documents, you’ve reached the most critical step: getting independent proof of your financial loss. The diminished value offer you receive from Allstate is their opening bid in a negotiation, calculated with a formula designed to protect their bottom line.

This is why a certified, independent appraisal isn’t just a good idea—it’s an essential tool for your claim. An appraisal report from a company like SnapClaim shifts the conversation from a subjective argument (“I feel my car is worth less”) to a factual, evidence-based discussion. The power dynamic changes when you introduce an expert opinion backed by hard market data.

The Problem with Insurer-Driven Valuations

Insurance companies rely on standardized formulas to process claims efficiently. When you file a diminished value claim with Allstate, you are often up against their internal method, sometimes known as the ‘17c formula.’

This formula considers factors like damage severity and repair costs, but it consistently fails to account for the single most important factor: how real buyers perceive a vehicle with a collision history.

This formulaic method has several major weaknesses:

- It ignores your local market. A generic formula cannot know the specific supply and demand for your exact vehicle in your city.

- It uses arbitrary caps. These formulas often include percentage caps based on mileage or damage type that don’t reflect how value is lost in the real world.

- It’s designed to benefit the insurer. At its core, the formula is a cost-control tool built to keep payouts as low as possible.

Without your own data, you’re forced to argue against their system on their terms—an uphill battle you are unlikely to win.

What Makes a Professional Appraisal So Effective

A high-quality, professional appraisal report is the great equalizer. It is a comprehensive, defensible analysis built on industry-accepted methodologies. Unlike an insurer’s internal calculation, a SnapClaim report provides a detailed, transparent breakdown of exactly how your vehicle’s market value was damaged.

A strong report from a certified appraiser will always include:

- Real-Time Market Analysis: It uses data from your specific local market, comparing your car to similar ones that have recently sold.

- Verifiable Comparables: The report shows specific examples of comparable vehicles (“comps”) to establish a credible pre-accident value.

- Expert Opinion: You receive a signed statement from a certified appraiser who has reviewed all evidence to arrive at a precise loss figure.

- Clear Methodology: It shows the math and explains exactly how the final diminished value number was calculated, leaving no room for guesswork.

The Bottom Line: A professional appraisal provides the concrete evidence needed to dismantle a lowball offer. It explains the “why” behind your claim, making it much harder for an adjuster to dismiss.

Understanding your report is key to using it effectively. For a closer look, our guide on how to read an appraisal report breaks down each section so you can negotiate with total confidence.

Turning the Tables in Your Negotiation

When you submit a professional appraisal with your demand letter, you immediately change the tone of the interaction. You are no longer just a claimant asking for money; you are a prepared vehicle owner presenting a documented, quantifiable financial loss.

This strategic move accomplishes several things:

- It Forces a Specific Response: The adjuster can no longer hide behind a generic formula. They must address the specific data and expert analysis you’ve presented.

- It Demonstrates You’re Serious: Submitting a professional report signals that you know your rights and are prepared to advocate for a fair settlement.

- It Provides a Negotiation Anchor: Your appraisal’s conclusion becomes the new starting point for the discussion, not their low initial offer.

SnapClaim reports are designed to deliver the clear, data-driven proof you need to strengthen your claim. And with our Money-Back Guarantee, you can move forward confidently. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

How To Submit Your Claim And Negotiate With The Adjuster

You’ve done the work, gathered evidence, and have a professional appraisal ready. Now it’s time to make your case. This is where your careful preparation pays off, allowing you to confidently navigate the conversation with the Allstate adjuster.

Your goal isn’t to be aggressive but to be firm, factual, and unwavering in the proof you’ve collected. That independent appraisal is the anchor of your entire claim.

Crafting And Sending Your Demand Letter

Your first official step is sending a formal demand letter to the adjuster assigned to your case. This letter formally opens your diminished value claim and presents all your evidence. Think of it as your opening statement.

A good demand letter is professional and to the point. It should clearly:

- State your intent: Begin by stating that you are filing a claim for the diminished value your vehicle suffered as a result of the accident.

- Present your proof: Mention the attached documents, especially the certified appraisal and the final repair bill.

- Make your demand: Clearly state the exact dollar amount you are seeking—this should be the diminished value figure from your independent appraiser.

The most efficient way to send this is via email. Combine your demand letter and all supporting documents into a single PDF to keep everything organized and create a digital paper trail.

Navigating The Negotiation Process

Once your demand is submitted, the negotiation begins. The adjuster’s role is to protect Allstate’s bottom line, which means scrutinizing your claim to minimize the payout. Expect them to counter with a lower offer or ask questions. This is normal, so don’t be discouraged.

Your job is to stay calm, stick to the facts, and repeatedly bring the conversation back to your strongest asset: the appraisal report.

As the chart shows, your report is the professional evidence that closes the gap between an initial lowball offer and the true car value after an accident.

Common Allstate Responses And How To Counter Them

Insurance adjusters are trained negotiators with a playbook of common arguments. Knowing these tactics ahead of time is critical when you want to learn how to file a diminished value claim with Allstate and succeed.

| Adjuster’s Tactic | Your Evidence-Based Response |

|---|---|

| “Our formula calculated the loss at a much lower amount.” | “I understand you have an internal formula, but it doesn’t reflect my local market. My certified appraisal uses real-time sales data from comparable vehicles in this area to prove the loss on my car.” |

| “The repairs were high-quality and made the vehicle whole again.” | “While I appreciate the quality of the repairs, the vehicle now has a permanent accident history that cannot be erased. My appraisal documents this market reality, which is what causes the loss in resale value.” |

| “We don’t accept third-party appraisals.” | “This report was prepared by a certified, independent appraiser using industry-standard methodologies. It provides a verifiable analysis of my financial loss. Can you please point to the specific data or methods in the report that you disagree with?” |

| “Your vehicle has high mileage, so there is no diminished value.” | “My vehicle’s mileage was already factored into its pre-accident fair market value. The appraisal calculates the percentage of value lost due to the new accident history, which is a separate issue from normal depreciation.” |

Being prepared with these rebuttals shows the adjuster you’ve done your homework and won’t be easily dismissed.

Key Insight: The goal isn’t to win an argument but to bring the adjuster back to the facts. By consistently referencing your report, you force them to address your data instead of relying on generic talking points.

Negotiating takes patience. Keep a log of every conversation, noting the date, time, and what was discussed. If Allstate makes a counteroffer, always ask the adjuster to justify it with their own market data. Often, they can’t provide anything that contradicts a comprehensive appraisal, which strengthens your position.

What to Do When Allstate Denies or Lowballs Your Claim

It’s frustrating when you’ve done your homework, submitted your claim, and Allstate comes back with a denial or an unfairly low settlement offer. It’s easy to feel like you’ve hit a wall.

However, this is often just a part of the negotiation process. When Allstate digs in its heels, it’s not time to give up—it’s time to push back using the evidence you’ve already gathered.

Ask for a Manager: Go Up the Ladder

Your first move should be to escalate the issue within Allstate. Politely but firmly tell the adjuster you are not satisfied with their offer and would like to speak with a supervisor or claims manager. This simple request often gets a fresh pair of eyes on your file—someone with more authority to settle claims.

When you speak with the supervisor, remain professional and stick to the facts:

- Calmly explain that their offer does not cover your documented financial loss.

- Direct them back to your independent appraisal report.

- Ask them to provide the specific market data they used to justify their number.

Front-line adjusters often have strict settlement limits. A manager usually has more flexibility to resolve disputes, making this a critical first step.

File a Complaint With Your State’s Department of Insurance

If speaking with a manager doesn’t resolve the issue, your next step is your state’s Department of Insurance (DOI). This government agency regulates insurance companies and protects consumers. Filing a complaint is free and gets an insurer’s attention quickly.

When the DOI sends an official inquiry, the insurance company is legally required to respond. This raises the stakes for Allstate, often motivating them to take your claim more seriously. To learn more about this process, read our guide on what to do when your car insurance claim is denied.

Consider Small Claims Court or an Attorney

If you’re still being stonewalled, you may need to consider legal action. For many diminished value claims, small claims court is an excellent, low-cost option. The system is designed for individuals to represent themselves without a lawyer, and the rules are less formal than a traditional courtroom.

If your diminished value loss is substantial, it might be worth consulting an attorney who specializes in insurance disputes. They can take over the negotiation and, if necessary, file a lawsuit on your behalf.

Remember, with SnapClaim’s Money-Back Guarantee, if you recover less than $1,000 from the insurance company, we refund your entire appraisal fee. This guarantee means you can fight for fair compensation with minimal financial risk.

FAQ: Your Top Allstate Diminished Value Questions

Filing an insurance claim can bring up many questions. This section addresses some of the most common concerns vehicle owners have when filing a diminished value claim with Allstate, giving you clear answers to help you move forward.

Can I claim diminished value if the accident was my fault?

In most cases, the answer is no. A diminished value claim is a “third-party claim,” meaning you file it against the at-fault driver’s insurance—in this case, Allstate. Your own collision coverage is designed to pay for the physical repairs to your vehicle, not to cover the loss in its market value due to an accident history. When another driver is at fault, their liability insurance is responsible for making you “whole,” which includes compensating you for that lost value.

Is there a time limit to file a diminished value claim?

Yes, this is very important. Every state has a legal deadline called the statute of limitations for property damage claims. This deadline typically ranges from two to four years from the date of the accident, depending on your state. You can find your state’s specific laws on a state-specific law page or government website. It is critical to file your claim well before this time runs out, or Allstate will have a guaranteed reason to deny it.

Does Allstate pay for an independent appraisal?

Allstate generally will not pay for the cost of your appraisal upfront. However, the appraisal fee can often be included as part of your final settlement negotiations. Many vehicle owners successfully argue that the appraisal was a necessary expense to accurately document the loss caused by Allstate’s insured driver. A SnapClaim appraisal is an investment in strengthening your claim, and our Money-Back Guarantee minimizes your risk. If your insurance recovery is less than $1,000, we refund the full appraisal fee.

What if my car was a total loss?

If your car was declared a total loss, a diminished value claim does not apply. When an insurer declares your vehicle a total loss, their settlement is meant to pay you its full Fair Market Value (FMV) right before the crash. Since you are being compensated for the vehicle’s entire pre-accident value, there is no remaining value to be “diminished.” Your focus should instead be on ensuring the insurance total loss payout is fair. If Allstate’s offer seems low, you can challenge it with a Total Loss appraisal from SnapClaim.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your free estimate diminished value estimate today