Filing a diminished value claim helps you recover the loss in your vehicle’s market value after a car accident that wasn’t your fault. In this guide, we’ll show you how to file a diminished value claim with your insurance company—step by step.

Filing a diminished value claim requires you to prove your vehicle’s market value dropped after an accident that wasn’t your fault. To succeed, you must provide the at-fault driver’s insurance company with hard evidence, like a certified appraisal report, showing the accident history has permanently damaged your car’s resale price—even after perfect repairs. This guide will walk you through exactly how to file a diminished value claim and strengthen your case for fair compensation.

Understanding Diminished Value and Your Eligibility

When your car is in an accident, even the best body shop can’t erase one critical detail: its accident history. That history follows your vehicle and makes it worth less to the next buyer. This loss in resale value is called diminished value. You can read more about how to file a diminished value claim and others experience in reddit posts here.

Filing a diminished value claim is simply exercising your right to recover that lost money from the at-fault driver’s insurance company.

Here’s a real-world example: say your 3-year-old SUV was worth $32,000 before someone ran a red light and hit you. After $8,000 in flawless repairs, a dealer might only offer you $28,400 on a trade-in because of the accident on its vehicle history report. That $3,600 difference is the diminished value you can and should claim.

The Different Types of Diminished Value

It helps to know the language insurance adjusters use. Understanding these terms gives you an advantage when building your case.

- Inherent Diminished Value: This is the most common type. It’s the automatic loss in value your car suffers simply because it now has an accident on its record, even if the repairs were perfect.

- Repair-Related Diminished Value: This occurs when the repairs themselves are poor quality. Maybe the new paint doesn’t quite match the factory finish, or the shop used cheaper, non-OEM parts. This loss is in addition to the inherent loss.

- Immediate Diminished Value: This is the drop in your car’s value right after the accident but before it’s been fixed. It’s not used as often in claims because the insurer typically pays to repair the car first.

For a deeper dive into these concepts, this comprehensive guide on diminished value claims is a fantastic resource.

Are You Eligible to File a Claim?

Before you invest time and energy into a claim, you need to make sure you qualify. Insurance companies look for reasons to deny claims, so let’s ensure yours is solid from the start.

Eligibility almost always boils down to three things: who caused the accident, the condition of your car, and the laws in your state.

Not sure if you have a case? This checklist will give you a good idea.

Quick Eligibility Checklist for a Diminished Value Claim

| Eligibility Factor | What You Need | Why It Matters |

|---|---|---|

| Fault | Another driver must be at fault for the accident. | You can’t claim against your own policy for diminished value (in most states). You file against the at-fault driver’s liability coverage. |

| Vehicle Age/Mileage | Your vehicle is relatively new (ideally under 5 years old) with lower mileage. | Older, high-mileage cars have less value to lose, making diminished value harder to prove. |

| Damage Severity | The accident caused significant structural or cosmetic damage. | A minor door ding or bumper scratch likely won’t create a measurable loss in value that an insurer will pay for. |

| State Laws | Your state must allow for third-party diminished value claims. | While most states do, the specific rules and precedents can vary. Some states are more consumer-friendly than others. |

| Ownership | You must still own the vehicle. | You can’t claim diminished value after you’ve already sold the car and taken the loss. |

If you checked off these boxes, you’re likely in a strong position to file a claim. You can get more context on the specifics of what vehicle diminished value is and how different states handle it in our detailed guide.

Building Your Evidence File for the Claim

To successfullyfile a diminished value claim, you can’t just tell the insurance company your car is worth less—you have to prove it. A strong claim is a well-documented one, and putting together your evidence file is the most important step.

Think of it like building a case. Your goal is to give the adjuster no room to argue the validity of your loss. Every document you add supports your negotiations and makes it harder for them to justify a lowball offer.

Essential Documents for Your Claim File

First, get organized. Create a dedicated folder—physical or digital—to keep everything in one place. This simple step will prevent the last-minute panic of trying to find a misplaced email or receipt.

Here’s what every solid evidence file needs:

- The Official Police Report: This establishes the facts of the accident, and most importantly, who was cited for being at fault.

- Photos and Videos: Visuals are incredibly powerful. You’ll want pictures from the accident scene showing the initial damage, photos taken during the repair process (if possible), and detailed photos of the completed work.

- All Communication Records: Keep a running log of every phone call, email, and letter with the insurance company. Note the date, time, the person you spoke with, and a quick summary of what was discussed.

Insider Tip: Don’t settle for the final repair bill. Ask the body shop for a fully itemized invoice that breaks down every single part they replaced and the exact labor hours for each task. This detailed record proves the extent of the repairs far more effectively than a simple grand total.

The Power of Detailed Repair Invoices

A summary receipt that just says “$7,500 for collision repair” is weak because it doesn’t tell the full story. An itemized invoice, on the other hand, paints a vivid picture for the adjuster. It might show that structural components like the frame rail had to be cut, welded, and replaced.

That level of detail proves the vehicle underwent significant, invasive repairs—exactly the kind of thing that makes future buyers hesitant and permanently lowers its value. When an adjuster sees a list of replaced structural parts instead of a simple bumper swap, the reality of your car’s diminished value becomes much harder to ignore.

Finally, you need the document that puts a credible number on your loss. An independent, certified appraisal is the ultimate piece of evidence. As you gather your other documents, it’s a great time to learn more about a certified auto appraisal and why it’s so effective. This report will be the centerpiece of your demand letter.

Securing Proof of Your Car’s Lost Value

Once your car is back from the shop, you’ve reached the most critical stage of your diminished value claim: proving your financial loss. The insurance company has its own method for calculating what they owe, and it’s not designed to be generous. They often use generic formulas, like the infamous “17c,” which almost always undervalues your actual loss.

This is where you take control. You can’t just tell an adjuster your car is worth less; you need to provide undeniable, data-backed proof that they must take seriously. An opinion isn’t enough—you need a professional valuation.

Why Insurer Formulas Fall Short

Insurance companies created formulas like 17c to process claims quickly and, frankly, pay out as little as possible. The formula often starts by capping the maximum diminished value at 10% of your car’s pre-accident value, then reduces it with arbitrary deductions for damage and mileage.

The problems with this approach are clear:

- It’s arbitrary: The 10% cap isn’t based on real-world market data. A luxury vehicle with significant frame damage could easily lose far more than 10% of its value.

- It ignores market reality: These formulas don’t account for what real buyers think, demand in your local market, or the difference between frame damage and minor cosmetic scratches.

- It’s self-serving: The formula was created by the insurer, for the insurer. It’s a massive conflict of interest.

Relying on their math is like letting the opposing team’s coach referee the game. You need an impartial, expert analysis to counter their lowball offer.

The Power of a Certified Appraisal

This is your key piece of evidence. An independent, certified appraisal isn’t just an opinion—it’s a detailed, professional report built on recognized valuation standards. A high-quality report, like those from SnapClaim, provides the concrete proof you need to file a diminished value claim that gets results.

A USPAP-compliant appraisal is the gold standard. It means the report follows the Uniform Standards of Professional Appraisal Practice—a set of ethical and performance standards that courts and government agencies across the country recognize.

A certified appraisal strengthens your claim by:

- Providing an expert valuation: It analyzes real-time market data for comparable vehicles, looking at listings both with and without accident histories.

- Detailing the logic behind the loss: It explains why the value dropped, connecting the specific repairs to buyer psychology and market behavior.

- Giving you serious negotiating leverage: It shifts the conversation from the insurer’s flawed formula to a credible, market-based figure they can’t easily dismiss.

A SnapClaim appraisal gives you the proof needed to confidently reject an unfair offer and demand what you’re rightfully owed. We are so confident in our reports that we offer a money-back guarantee: if the insurance recovery from the claim is less than $1,000, your appraisal fee is fully refunded. This makes getting professional proof a risk-free step toward getting your money back.

Drafting and Submitting Your Demand Letter

Now that you have your evidence organized and a certified appraisal in hand, it’s time to formally present your case. This is done with a demand letter, which you will send directly to the at-fault driver’s insurance company.

The goal isn’t to be confrontational. It’s to be professional, clear, and firm. A well-written letter immediately signals to the adjuster that you are serious and have done your homework, setting a strong tone for the negotiation.

Key Components of a Strong Demand Letter

Your letter should be a concise summary of your claim. It doesn’t need to be long or filled with complex legal terms. Simple and direct is far more effective.

Make sure your letter includes these essential points:

- Your Information: Your full name, address, and phone number.

- At-Fault Driver’s Details: Their name, insurance policy number, and the claim number assigned to the accident.

- Accident Information: A brief mention of the date and location.

- Your Monetary Demand: State the exact dollar amount of diminished value you are claiming, citing your certified appraisal report as the source.

- Supporting Documents: List every document you’re attaching, such as the police report, final repair invoice, and your appraisal report.

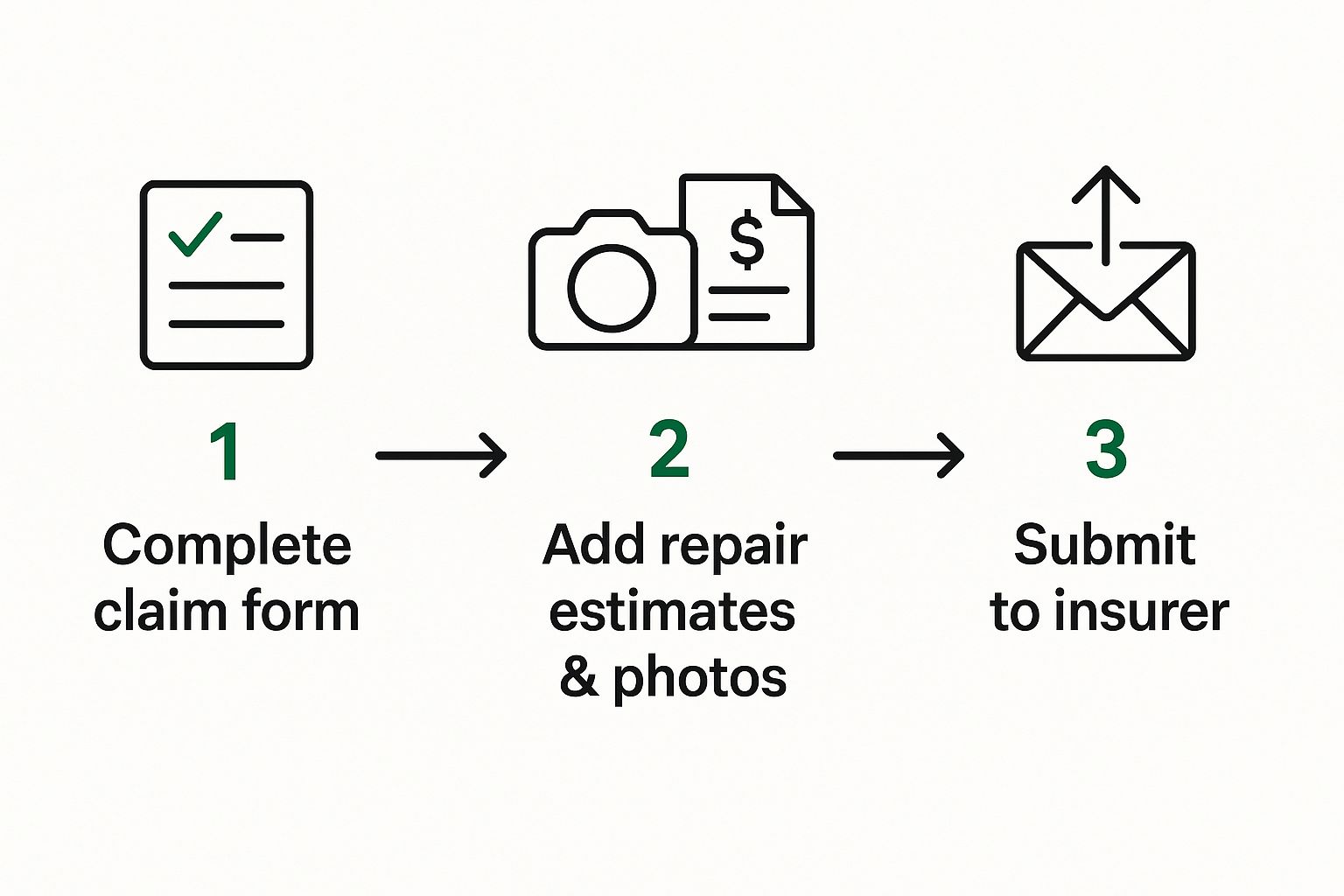

The graphic below breaks down the simple but critical steps for submitting your complete claim package.

Following this process ensures your demand, backed by solid evidence, lands on the adjuster’s desk and gets the attention it deserves.

How to Submit Your Claim for Maximum Impact

The important step on how to file a diminished value claim is making sure once you’ve drafted the letter and made copies of your documents, how you send it matters more than you might think. Don’t just use a regular stamp.

Pro Tip: Always send your demand letter and all supporting documents via Certified Mail with a return receipt requested. This provides a legal paper trail, proving exactly when the insurance company received your claim and preventing them from claiming it was “lost in the mail.”

This small step adds a layer of professionalism that adjusters notice. It shows that you are organized and prepared to see the process through.

While most claims can be resolved directly with the insurer, sometimes you may encounter resistance. If you feel things are getting overly complicated, it might be time to understand the role of attorneys in diminished value claims and learn about your options.

After your package is sent, the negotiation phase begins.

How to Negotiate with the Insurance Adjuster

You’ve sent your demand letter, and the insurance adjuster has responded with an initial offer. It will almost certainly be a lowball figure, nowhere near what your certified appraisal says you’re owed.

Don’t worry. This is a standard opening move. Your job is to stay calm, be professional, and stick to the facts you’ve gathered.

The adjuster’s goal is to close your claim for as little money as possible. They handle hundreds of these cases and often assume you are uninformed or too busy to fight back. By having a SnapClaim appraisal, you’ve already provided independent, verifiable evidence they can’t easily dismiss.

Common Adjuster Tactics and How to Respond

Knowing the adjuster’s arguments beforehand is half the battle. They often use the same tactics to reduce your claim’s value. When you see them coming, you can respond with calm, fact-based counters that keep the negotiation on track.

Here are a few classic lines you’ll likely hear:

- “Your appraisal is just an opinion.” They will try to equate your certified report with their flawed 17c formula. Your response should be to calmly point out that your appraisal is a USPAP-compliant document based on real-world market data, not an arbitrary internal calculation.

- “We don’t pay for diminished value in this state.” This is often misleading or incorrect. Simply state that your research confirms your right to claim this loss against the at-fault driver’s liability policy according to state law.

- “We need you to get appraisals from our approved vendors.” Politely decline. An appraiser paid by the insurance company has a clear conflict of interest. Let them know you have already secured an independent, unbiased valuation.

Keep a Detailed Communication Log

From the very first call, document everything. This log becomes your single source of truth and a powerful tool if a dispute arises.

Pro Tip: After every phone call with the adjuster, send a quick follow-up email summarizing the conversation. For example: “Hi [Adjuster’s Name], just confirming our call today where you offered $XXX and I stood by my claim for $XXX based on my certified appraisal.” This creates a paper trail they can’t dispute later.

Understanding Market Dynamics in Your Negotiation

Adjusters may also try to use market trends to their advantage. It’s true that shifting market dynamics impact vehicle valuations. For example, the average age of cars on the road and fluctuating used car prices are real factors that influence how diminished value is calculated.

A professional appraisal from SnapClaim already incorporates these real-time market conditions into its valuation. So, when an adjuster brings up depreciation or a “soft” used car market, you can confidently state that your report already reflects the current value based on today’s sales data.

For more tips on getting the most out of your claim, check out these expert strategies for negotiating insurance settlements successfully. The key is to always bring the conversation back to the hard data in your certified report.

Frequently Asked Questions About How to File a Diminished Value Claim

Navigating the aftermath of an accident can be confusing. Here are answers to some of the most common questions vehicle owners have about filing a diminished value claim.

Can I file a diminished value claim if I was at fault?

No, in almost all cases you cannot. A diminished value claim is considered a “third-party claim,” which means you file it against the other driver’s liability insurance. Your own collision policy is designed to cover repair costs, not the loss of your car’s resale value.

Do I need a lawyer to file a diminished value claim?

For most claims, you do not need a lawyer. Vehicle owners can successfully file and negotiate a diminished value claim on their own, especially when supported by a strong appraisal report. However, if the insurance company is unresponsive, denies the claim outright, or the financial loss is exceptionally large, consulting an attorney can be a valuable step.

How long does a diminished value claim take?

The timeline can vary from a few weeks to several months. It depends on factors like the insurance company’s responsiveness, the complexity of the accident, and the quality of your documentation. The single best way to streamline the process is to submit a comprehensive, evidence-based claim package from the start, with a certified appraisal as its foundation.

What if I lease my car or have a loan on it?

You generally can not file for diminished value claim if you have leased the car. But you can file for diminished value claim if you have an outstanding loan. The lost value still impacts you, as you are responsible for the vehicle’s condition and value at the end of your loan term. Any compensation you receive can help offset potential negative equity on your loan.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today