When your insurance company declares your car a total loss, the settlement offer they send can be a shock. If that number feels far too low, you’re not alone. The good news is that their initial offer is just a starting point for negotiation, and you have the right to fight for the compensation you deserve.

This guide will walk you through the exact steps on how to fight a CCC valuation report. We’ll show you how to find the flaws in their numbers, build a strong case with real evidence, and negotiate effectively to get a fair insurance total loss payout.

Your Total Loss Offer Is Low—Now What?

That low offer you received wasn’t random. It almost certainly came from a report generated by a company called CCC Intelligent Solutions, which provides the software most insurers use to value a totaled vehicle. But let’s be clear: “standard” doesn’t always mean “fair.”

Feeling shortchanged is incredibly common. Your insurance policy entitles you to the Actual Cash Value (ACV) of your vehicle—what it was worth the moment before the accident. The CCC report is simply the insurer’s interpretation of that value, and it’s often filled with flaws that conveniently work against you.

Turning Frustration into Action

The first step in figuring out how to fight a CCC valuation report is to switch from feeling frustrated to being strategic. The insurance adjuster isn’t your enemy, but they have a job to do: close your claim efficiently and within their company’s guidelines. Your job is to build a compelling case that their valuation is wrong.

This process boils down to three key moves:

- Dissect Their Report: Get a copy of the CCC report and understand exactly how they arrived at their number—and where the holes are.

- Build Your Arsenal of Proof: Gather all documentation that proves your vehicle’s true condition, unique features, and recent upgrades.

- Launch a Counteroffer: Formally dispute their valuation with a logical, evidence-based argument for the higher payout you deserve.

Key Takeaway: Stop thinking of this as a complaint. You are walking into a business negotiation. Your success hinges on being prepared, professional, and persistent.

Pushing back against an insurance company can feel daunting, but you have more power here than you think. By following a clear strategy and backing up every claim with solid proof, you can take control of the negotiation and fight for the fair settlement you’re owed.

Decoding the CCC Report and Finding the Flaws

To effectively fight a lowball offer, you must understand where the insurer’s number came from. That number originates from the CCC valuation report—it’s the blueprint for their settlement, and learning to read it is your first step toward getting paid fairly.

At first glance, these reports look intimidating. But once you know what you’re looking for, you’ll see it’s mostly a collection of data points strung together to justify a low value.

Your job is to become a detective. Comb through this report line by line, hunting for inaccuracies, omissions, and flawed assumptions. This isn’t about arguing opinions; it’s about finding cold, hard facts that prove your vehicle is worth more.

What to Look For in Your CCC Report

Think of the CCC report in two main parts: the description of your vehicle and the list of “comparable” vehicles used to determine its value. An error in either section can cost you thousands. Start by triple-checking every detail about your car.

Here are the key areas to scrutinize:

- Vehicle Trim and Options: Did they list your car as a base model when it’s a premium trim like a Limited, Platinum, or Touring edition? Insurers often miss high-value factory options like sunroofs, advanced safety packages, or premium sound systems.

- Condition Rating: The report assigns a condition rating to your car (e.g., “Good,” “Average”). This is subjective and one of the easiest ways for adjusters to apply negative adjustments without justification. If your car was meticulously maintained, a generic “Average” rating is an immediate red flag.

- Mileage Accuracy: It sounds simple, but double-check the mileage. A typo here can make a significant difference in the final calculation.

The Problem With “Comparable” Vehicles

This is where CCC reports really fall apart. The system pulls listings for “similar” vehicles to establish a market value, but their definition of “similar” is often stretched to benefit the insurance company. They consistently use vehicles that aren’t truly comparable, which artificially drags your payout down.

The CCC system is infamous for pulling “comps” from distant geographical areas where car values are lower. If you live in a major city, a vehicle from a rural town 200 miles away is not a fair comparison.

Another massive issue is how these values are calculated. The CCC system primarily relies on advertised prices from dealer lots—not what the cars actually sold for. Industry data consistently shows that valuations based on actual sale prices are 3–10% higher than those based on inflated listing prices. This is a systemic bias against vehicle owners.

To help you spot these issues, here’s a quick look at the most common flaws we see every day.

Common Flaws in a CCC Valuation Report

This table highlights the frequent errors found in CCC reports and explains why they lead to an unfair, low valuation for your vehicle.

| Common Flaw | How It Undervalues Your Vehicle |

|---|---|

| Incorrect Trim Level | Listing a premium trim (e.g., Touring, Limited) as a base model ignores thousands in factory-installed value. |

| Missing Options/Packages | Forgetting a tech package, sunroof, or premium audio system means you aren’t credited for those valuable features. |

| Unfair Condition Rating | A subjective “Average” rating on a well-maintained car justifies deductions that aren’t based on reality. |

| Distant “Comparable” Vehicles | Using comps from cheaper geographic markets artificially lowers the established market value in your area. |

| Outdated Comps | Citing vehicles that have been for sale for months (and are likely overpriced) doesn’t reflect current market value. |

| Use of Advertised vs. Sold Prices | Basing value on advertised prices, not actual transaction prices, results in a systematically lower valuation. |

Spotting even one of these flaws gives you a powerful piece of evidence to challenge the insurer’s offer.

Unfair Condition Adjustments

One of the most frustrating parts of any CCC report is the “condition adjustments” section. These are deductions applied to the comparable vehicles to supposedly match your car’s pre-accident condition. In reality, these adjustments are often arbitrary and based on generic formulas that only work one way—down.

For example, the report might deduct for a minor scratch on a comparable car, but it will never add value for your vehicle’s brand-new tires or recent major service. The algorithm is built to find flaws, not to recognize value-adding features.

You can find more detailed examples of these flaws by exploring our deep dive into the CCC ONE market valuation report. Understanding these tactics is essential for building a strong counterargument.

Building Your Case with Strong Evidence

An adjuster won’t increase their offer just because you feel it’s too low. To get a better settlement, you need to prove it with facts. The goal is to build a file so packed with undeniable proof of your vehicle’s real value that the insurer has no choice but to see the flaws in their CCC report.

This isn’t about just grabbing a few online listings. It’s about creating a complete, detailed profile of your specific vehicle—its condition, its options, and its history. This is the groundwork that separates a frustrating negotiation from a successful one.

The Foundation: Your Documentation

First, gather every piece of paper you have related to your vehicle. This paperwork tells your car’s story and proves you were a responsible owner who kept it in great shape.

Your evidence file should include:

- Original Window Sticker (Monroney Label): This is the holy grail. It lists every factory-installed option, package, and the original MSRP. If you can’t find yours, try calling the dealership where you bought the car.

- Maintenance Records: Collect every service receipt you can find, from oil changes to major repairs. A consistent service history is powerful proof that your vehicle was mechanically sound.

- Receipts for Recent Upgrades: Did you install new tires six months ago? A new battery? Premium brake pads? Any major purchase that adds value needs to be documented.

Finding True Comparable Vehicles

The biggest weakness in almost every CCC report is its use of poor “comparable” vehicles. This is where you can land your strongest counterpunch. Your job is to find actual comps in your local market that show what your car was really worth.

Pro Tip: Your “local market” is generally a 75-100 mile radius. Don’t let an adjuster use comps from another state or a rural town where car values are lower.

When you’re searching on sites like Kelley Blue Book, Autotrader, or Cars.com, your focus must be on finding vehicles that are a near-perfect match.

Key Matching Criteria:

- Exact Trim Level: A Honda Accord EX-L is worth thousands more than a base LX model. Be precise.

- Similar Mileage: Look for vehicles within 5,000-10,000 miles of your car’s mileage at the time of the accident.

- Identical Options: Find cars with the same high-value packages, like technology or premium audio.

- Dealer Listings: Give more weight to listings from reputable dealerships, as they better reflect true retail market value.

Save and print PDFs of at least three to five of the strongest comps you find. These will be your direct evidence to counter the insurer’s low-value examples.

The Ultimate Weapon: An Independent Appraisal

While your own research is critical, the single most powerful tool you can have is a certified, independent appraisal. This is a formal, data-backed valuation report from an unbiased expert, not an online estimate.

An independent appraisal neutralizes the insurer’s automated CCC report. It provides a court-ready document that analyzes your car’s specific condition, features, and real local market data.

This move shifts the entire dynamic of the negotiation. A SnapClaim report, for instance, delivers the certified data you need to force a fair negotiation. This one step transforms your argument from an opinion into an expert-backed fact.

How to Negotiate With Your Insurance Adjuster

Once your evidence is organized, it’s time to formally challenge the insurer’s lowball offer. Approach this negotiation with a clear strategy. Remain professional, firm, and focused on the facts you’ve gathered to turn an emotional ordeal into a business transaction.

Your first move should always be in writing. A well-crafted dispute letter or email creates a paper trail and lets you lay out your case logically. This document is your formal opening, clearly stating your disagreement and presenting the evidence that backs up a higher valuation.

Crafting Your Dispute Letter

Your dispute letter needs to be clear, concise, and professional. Stick to the facts. The goal is to methodically dismantle their CCC report by presenting superior, real-world evidence.

Your letter should hit these key points:

- State Your Position Clearly: Start by saying you are formally disputing the total loss valuation provided on [Date] for your [Year, Make, Model], claim number [Your Claim #].

- Identify CCC Report Flaws: Point out the specific errors you found. Did they list the wrong trim level, miss key options, or use an unfair condition rating? Say so.

- Present Your Evidence: Systematically introduce your proof. Attach your comparable vehicle listings, maintenance records, and receipts. Most importantly, attach your certified independent appraisal.

- Make Your Counteroffer: State the value you believe is fair, supported by your evidence—especially the figure from your independent appraiser.

Key Takeaway: A professional dispute letter shows the adjuster you are serious and organized. It forces them to address your points one by one.

Managing Phone Conversations

After you send your letter, the adjuster will likely call you. Have your evidence file in front of you and stick to your talking points.

Here are a few tips for handling calls with your adjuster:

- Document Everything: Take detailed notes during every call. Jot down the date, time, the adjuster’s name, and a summary of what was discussed. Follow up with a brief email confirming the conversation.

- Stay Calm and Factual: Do not get angry or emotional. If the adjuster makes a point you disagree with, respond with facts from your research.

- Know When to Escalate: If the adjuster is dismissive, politely ask to speak with their supervisor or a claims manager. Sometimes, a fresh set of eyes can break a stalemate.

Responding to Common Adjuster Tactics

Adjusters are trained negotiators with a playbook of tactics designed to shut down disputes. Knowing them helps you hold your ground.

One common line is, “We can only use the CCC report.” This is not true. Your policy requires them to pay Actual Cash Value (ACV), not just whatever their software spits out.

If they refuse to budge, it’s time to invoke a powerful tool in your insurance policy: the appraisal clause. This provision allows both you and the insurer to hire independent appraisers to resolve the dispute. An impartial umpire then makes a final, binding decision. Our guide to total loss appraisals can walk you through this process in more detail.

Why an Independent Appraisal Is Your Strongest Weapon

When you’re staring down a CCC valuation report, it can feel like your word against a massive corporation. To level the playing field, you need to bring in an expert. This is where a certified independent appraisal becomes your single most powerful tool.

An independent appraisal isn’t just another opinion. It’s a detailed, data-backed analysis of what your vehicle was actually worth. The insurer’s CCC report is spit out by an algorithm designed to find the lowest possible value. A professional appraiser does the manual legwork, focusing on your specific car in your local market.

The Critical Difference An Expert Makes

Here’s a simple way to think about it: the CCC report is like a fast-food burger—cheap, fast, and one-size-fits-all. An independent appraisal is like a custom-tailored suit, built from the ground up to fit your car’s exact specifications.

A certified appraiser digs into what made your car valuable, looking at things the CCC algorithm ignores:

- Real Local Market Data: They find actual comparable vehicles that recently sold in your area, not just cheap listings cherry-picked from hundreds of miles away.

- Condition and Upkeep: Your meticulous maintenance records, recent upgrades, and the pristine condition you kept it in are given the weight they deserve.

- Specific Features: That high-end factory sound system or premium package the initial report missed? A real appraiser will spot it and factor it into the value.

This expert valuation completely changes the conversation. You’re no longer just poking holes in their report; you’re presenting a superior, more accurate one of your own. You can learn more about the independent car appraisal process to see how much leverage it provides.

Forcing the Insurer to Justify Their Offer

Once you submit a professional appraisal, the burden of proof shifts back to the insurance company. Now, they have to defend their flawed, automated number against a credible, expert-backed document. That flips the dynamic in your favor.

An independent appraisal isn’t just evidence—it’s leverage. It makes it much harder for an adjuster to dismiss your claim and forces them into a fact-based discussion where you’re holding the stronger hand.

A SnapClaim report is built from the ground up to be your best weapon in this fight. Our certified methodology produces a court-ready document that insurers and attorneys take seriously. It gives you the clear, data-driven proof you need to negotiate with confidence.

We stand behind our reports with a Money-Back Guarantee. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed. This makes getting an expert valuation a risk-free investment in securing the fair settlement you deserve.

What to Do If the Insurance Company Refuses to Budge

Even with a mountain of evidence, some insurance adjusters will dig in their heels. It’s a frustrating tactic designed to wear you down. But an adjuster’s “no” is rarely the final answer.

When negotiations stall, you have powerful options. The most effective next step is often written right into your own insurance policy.

Invoking the Appraisal Clause

Almost every auto insurance policy has an appraisal clause, a built-in dispute resolution tool. Invoking this clause takes the decision out of the adjuster’s hands and moves it into a structured, neutral process that’s legally binding.

Here’s how it works:

- You hire your own certified appraiser. This is your expert, who will advocate for your vehicle’s actual cash value.

- The insurance company hires its appraiser. They will represent the insurer’s position.

- The two appraisers select a neutral umpire. This third party is an impartial expert who acts as a tie-breaker.

- A binding decision is made. When any two of the three parties agree on a value, that amount becomes the final settlement.

This process is a game-changer. It forces the insurer to stop stonewalling and defend its CCC report against a real, independent expert.

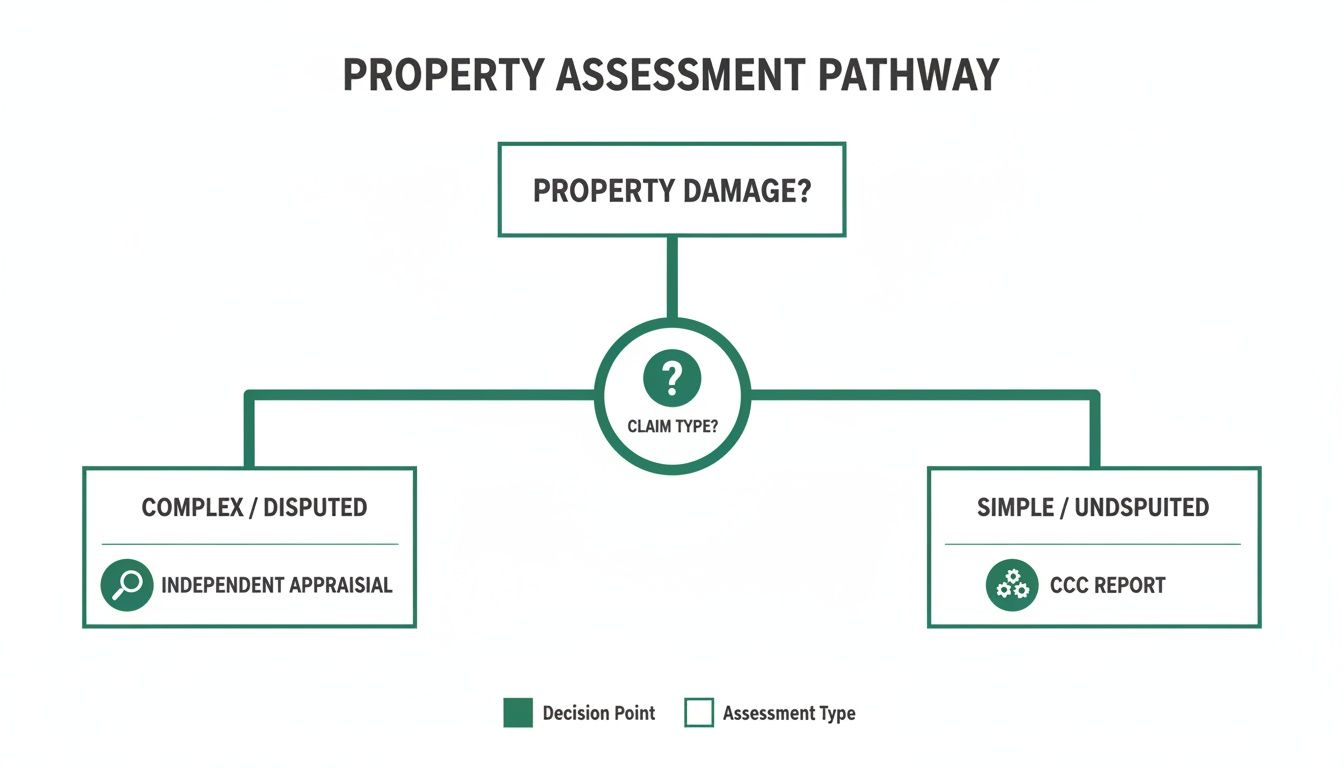

The flowchart below shows the clear difference between blindly accepting the insurer’s report and taking control with an independent appraisal.

As you can see, commissioning your own appraisal creates a direct, evidence-based path to challenge a low valuation, putting you in a much stronger position.

Filing a Complaint with Your State

If the insurer is clearly acting in bad faith—ignoring your evidence or refusing to communicate—you can file a formal complaint with your state’s Department of Insurance. This government body regulates insurance companies and investigates consumer complaints. An official investigation puts serious pressure on the insurer to negotiate fairly.

When to Consider Legal Counsel

If the insurer still won’t budge or the value of your vehicle is particularly high, it might be time to bring in an attorney. A lawyer specializing in insurance claims can take over all communications and apply legal pressure that you can’t on your own.

This is becoming more necessary. With rising repair costs, insurers are quicker than ever to total out cars. Over 70% of total loss valuations target vehicles that are seven years or older, according to recent analysis from CCC Intelligent Solutions. An experienced attorney understands this landscape and knows how to protect your rights.

Common Questions About Fighting a CCC Valuation

When your car is declared a total loss, you’re bound to have questions. Here are answers to the most common concerns we hear from vehicle owners fighting a lowball CCC valuation report.

Can I really dispute the insurance company’s valuation?

Yes, absolutely. Your insurance policy is a contract that says you’re owed the Actual Cash Value (ACV) of your vehicle—not just whatever number their software provides. You have every right to challenge their assessment and bring your own proof to the negotiating table. Think of their first offer as the starting line, not the finish line.

Is an independent appraisal really worth the money?

Yes. An independent appraisal is a small investment that can completely change the outcome of your claim. While gathering your own evidence is a great first step, a certified report from an unbiased expert provides the ultimate leverage. It’s often the key to unlocking thousands more than the insurer’s initial lowball offer, making it an invaluable tool that helps strengthen your claim.

What is the appraisal clause in my policy?

The appraisal clause is a tool built into most auto insurance policies to settle valuation disputes. If you and your insurer are at a stalemate, this clause lets you both hire certified appraisers. Those two appraisers then agree on a neutral “umpire.” Any value agreed upon by two of the three becomes legally binding, forcing a fair resolution. You can find more details in our Total Loss guides.

How long do I have to fight a CCC valuation report?

You need to act quickly, as deadlines vary by state and policy. The most important first step is to tell your adjuster—in writing—that you are formally disputing their valuation as soon as you receive it. Do not sign any final settlement paperwork or cash the check from the insurance company, as this can be seen as accepting their offer and may end your ability to negotiate for more.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get your Total loss Appraisal Today