After a car accident, even the best repairs can’t erase one stubborn fact: your vehicle now has an accident history. This history permanently lowers its resale value—a loss known as inherent diminished value. If a driver insured by Farmers caused the collision, you have the right to file a Farmers Insurance diminished value claim to recover that lost money.

What a Diminished Value Claim Means for You

Think of a diminished value claim as the final step in making you financially whole again after an accident. The at-fault driver’s insurance is responsible not just for fixing the physical damage, but also for the drop your car’s market value takes. Since you didn’t cause the accident, you shouldn’t be left with that financial loss.

Filing this claim is simply about recovering the equity that was taken from your vehicle. It’s about ensuring the person responsible—and their insurer, Farmers—covers the full extent of the damage they caused.

Who Is Eligible to File a Claim with Farmers?

Figuring out if you qualify is usually straightforward. You can typically file a diminished value claim with Farmers if a few key conditions are met:

- You were not at fault for the accident. The claim is filed against the at-fault driver’s policy.

- The at-fault driver is insured by Farmers. This is known as a third-party claim because you’re claiming against someone else’s insurance, not your own.

- Your vehicle sustained significant damage. Minor paint scuffs won’t usually qualify. If your car needed structural work or major parts replaced, it almost certainly has diminished value.

- Your vehicle was repaired, not totaled. Diminished value applies to vehicles that are fixed and put back on the road. An insurance total loss payout is a separate process.

Why This Claim Is So Important

Ignoring diminished value is like leaving money on the table that legally belongs to you. When you go to sell or trade in your car, its accident history will appear on a vehicle history report, and any smart buyer will expect a steep discount.

A successful diminished value claim puts that lost money back in your pocket now, not years later. For a deeper look at the process, this comprehensive guide to diminished value claims offers excellent additional details. Understanding what is a diminished value claim empowers you to hold the at-fault party’s insurer accountable.

How Farmers Calculates Diminished Value—And Why It Often Falls Short

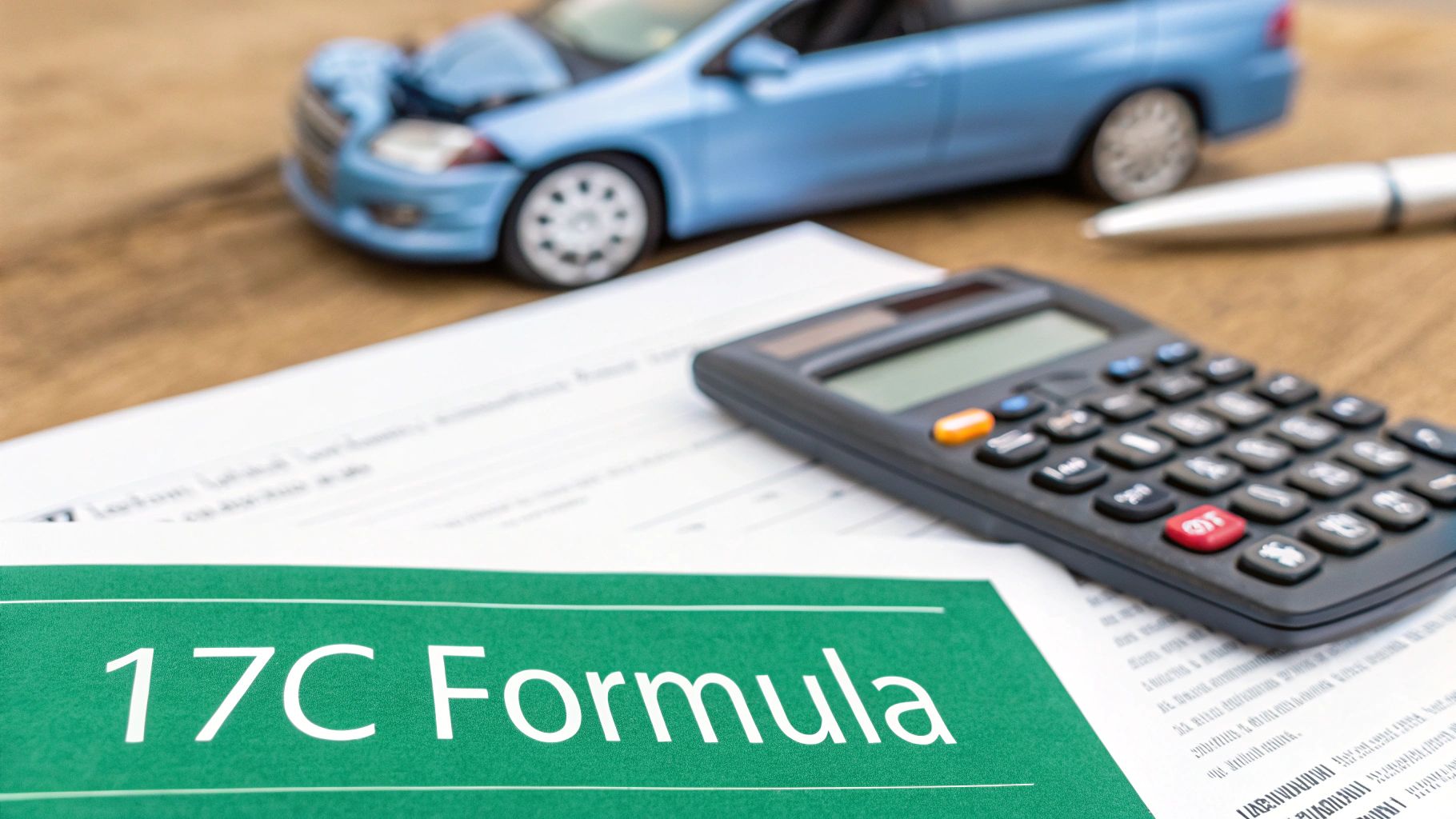

When you file a Farmers Insurance diminished value claim, the adjuster will likely use a controversial internal worksheet called the “17c Formula” to calculate their initial offer.

To negotiate effectively, you first need to understand where their lowball number comes from.

The 17c Formula became popular with insurers after a 2001 Georgia Supreme Court case, State Farm v. Mabry, which required them to create a standard process for these claims. The result was a predictable, insurer-friendly formula that rarely reflects a car’s true market value after an accident. It’s a system designed to protect their bottom line, not to make you whole.

The Big Problem with the 17c Formula

The fundamental issue with the 17c Formula is that it’s an internal calculation completely disconnected from real-world market data. It applies arbitrary caps and modifiers that have nothing to do with what a buyer would actually pay for a car with an accident history.

This multi-step reduction process is engineered to produce a low number that minimizes the insurance payout.

Let’s Look at an Example

Imagine your vehicle was worth $30,000 before the crash.

- The 17c Formula immediately caps the maximum loss at $3,000 (10% of the car’s value).

- If the damage was “moderate,” a 50% modifier might be applied, dropping the value to $1,500.

- Then, if your car has 60,000 miles, another 40% reduction could be applied, bringing the final offer down to just $900.

Meanwhile, an independent market appraisal might show the true diminished value is closer to $4,000. The formula simply makes it impossible for the adjuster to arrive at the real number for your car value after an accident.

Deconstructing the 17c Diminished Value Formula

This common formula used by insurers like Farmers is designed to minimize payouts through a series of caps and modifiers. Here’s how it works:

| Calculation Step | Description | Example: $30,000 Car |

|---|---|---|

| Step 1: Base Value | Start with the vehicle’s pre-accident market value (e.g., from NADA or KBB). | $30,000 |

| Step 2: 10% Cap | Immediately cap the maximum potential loss at 10% of the base value. | $3,000 |

| Step 3: Damage Modifier | Reduce the capped value based on the severity of the damage (e.g., 50% for “moderate”). | $1,500 |

| Step 4: Mileage Modifier | Reduce the value again based on the vehicle’s mileage (e.g., 40% for 60k miles). | $900 Final Offer |

As you can see, a formula that starts with a $30,000 asset quickly results in a payout of less than a thousand dollars.

The math is simple, and it’s why their first offer is almost always too low. You can run the numbers for your own vehicle using a diminished value 17c calculator to see what the insurer might offer. This is precisely why a generic worksheet is no match for a professional, market-backed appraisal from SnapClaim that proves what your car is really worth.

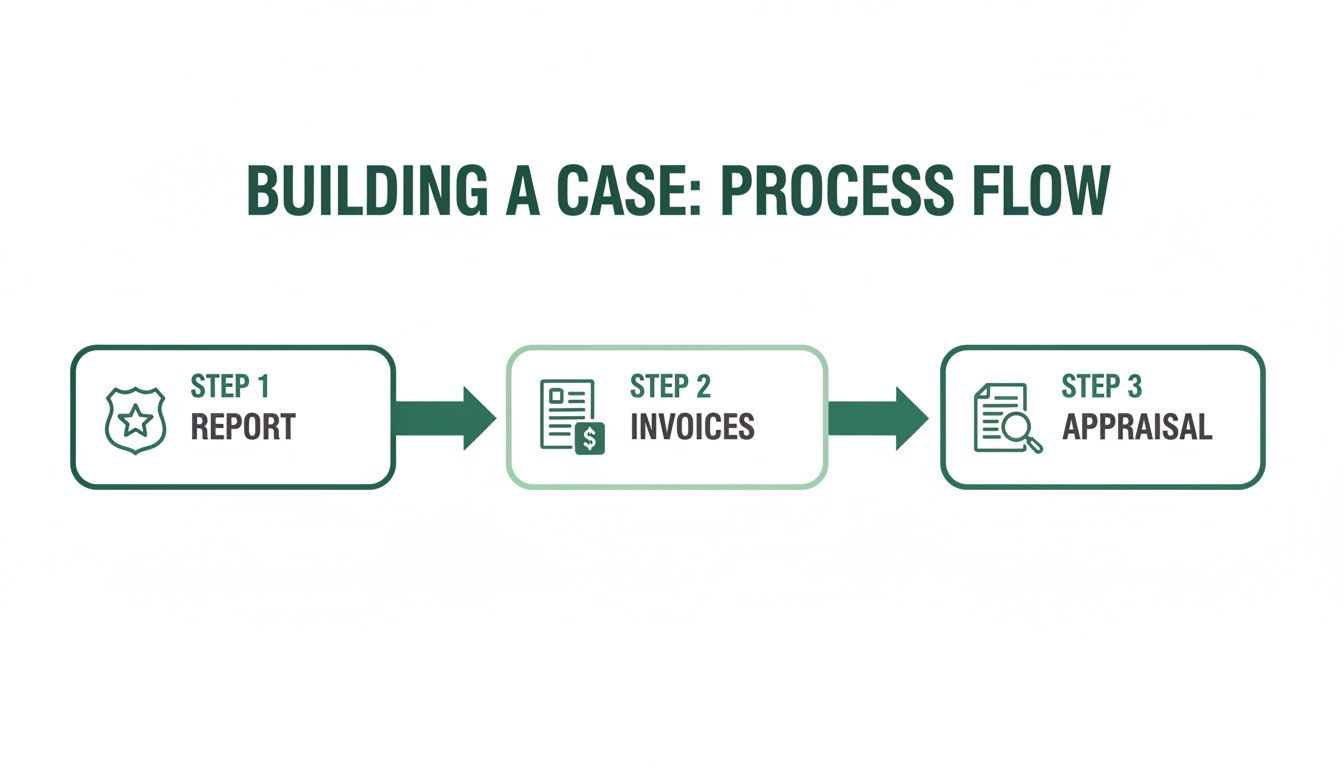

Building an Evidence-Based Case to Prove Your Loss

To get Farmers to move on a lowball diminished value offer, you need to build a rock-solid, evidence-based case that makes the true loss in your car’s value impossible to ignore.

The adjuster’s goal is to close your claim for as little as possible. Your job is to present them with undeniable proof that forces them to negotiate fairly. This starts by gathering every document that tells the full story of your vehicle—from its pre-crash condition to its post-repair reality.

Assembling Your Core Documentation

First, get your paperwork in order. These documents create the factual foundation of your claim and justify your request for compensation.

Your core documentation checklist should include:

- The Police Report: This is non-negotiable. It officially establishes who was at fault, a critical requirement for any third-party diminished value claim.

- The Final Repair Invoice: A detailed, itemized bill from the body shop is your proof of the damage’s severity. It shows exactly what was fixed or replaced. Invoices showing structural or frame damage are especially powerful.

- Pre- and Post-Accident Photos: Use photos of your car before the crash to establish its condition. Combine them with photos of the car after repairs to document that a significant collision occurred.

Key Takeaway: Solid documentation shifts your claim from a simple request into a factual demand. An adjuster can argue with your opinion, but they can’t easily dispute an official police report or a multi-page repair invoice.

The Most Powerful Tool: An Independent Appraisal Report

While the documents above are essential, the single most effective tool you have is a certified diminished value appraisal report. This isn’t just another piece of paper; it’s your expert witness.

An independent appraisal from a trusted provider like SnapClaim immediately moves the conversation away from the insurance company’s flawed 17c formula and reframes it around actual market data. Our certified reports provide data-backed proof for fair compensation.

A professional report delivers an unbiased valuation of your vehicle’s lost worth based on comparable vehicle sales in your specific market. This is how you turn a complaint into an authoritative demand. You can learn more about finding the best diminished value appraisers to ensure your report has maximum impact.

Ultimately, a certified appraisal forces the Farmers adjuster to defend their low number with market evidence of their own—something they almost always struggle to do. It’s the key to leveling the playing field and helps strengthen your claim.

Filing and Negotiating Your Claim with Farmers

With your evidence gathered, you’re ready to formally file your Farmers Insurance diminished value claim. The goal is to be professional, firm, and consistently bring the conversation back to the facts in your documentation.

Your first move is to send a formal demand letter. This is a concise, professional document that lays out your position and officially requests compensation. In it, you’ll state the pre-accident value, the post-repair value, and the resulting diminished value figure, all supported by your independent appraisal.

Crafting Your Demand and Starting the Conversation

The demand letter sets the tone for the entire negotiation. Skip emotional language and stick purely to the facts. A simple, direct, and professional opening works best.

Here’s an example of what that looks like:

“Attached, please find my formal demand for diminished value compensation in the amount of [Your DV Amount] for my [Year, Make, Model], related to claim number [Claim #]. This figure is supported by a certified appraisal report, which is also attached, detailing the market-based loss in value resulting from the accident caused by your insured.”

This language is non-confrontational but leaves no room for doubt. It immediately positions your appraisal as the central piece of evidence. After you send the demand, give the adjuster a reasonable amount of time to review it—typically 7-10 business days—before following up with a polite phone call.

Navigating Common Objections from the Adjuster

Farmers adjusters are trained to minimize payouts and have a standard playbook of objections. Knowing these arguments ahead of time is key to staying in control of the conversation.

Here are common tactics and how to respond:

- “We don’t pay for diminished value.” This is a common opening line but is often false for third-party claims. Your response should be calm and factual: “My understanding of [Your State] law is that the at-fault party is responsible for making me whole, and that includes the loss in my vehicle’s resale value.” You can verify this on our state-specific law pages.

- “Your appraisal is just an opinion.” Counter this by highlighting the professional methodology: “This report isn’t an opinion; it’s a market analysis based on real-world sales data for comparable vehicles. Can you provide any market data that supports your lower valuation?” This puts the burden of proof back on them.

- “We already repaired the car to pre-accident condition.” This confuses two separate issues. Clarify by saying, “The repairs addressed the physical damage, but they couldn’t erase the vehicle’s accident history, which is what caused the inherent diminished value.”

Stay persistent and polite, and always bring the conversation back to the evidence you’ve provided. A well-supported claim is much harder to ignore.

What to Do When Farmers Denies or Lowballs Your Claim

Getting a lowball offer or an outright denial on your Farmers Insurance diminished value claim can be frustrating, but it’s rarely the final word. This isn’t a dead end—think of it as your cue to escalate your strategy.

When the adjuster stops negotiating, you still have effective tools to keep fighting for the compensation you deserve.

Invoking the Appraisal Clause

Buried in the fine print of an auto insurance policy is something called the “Appraisal Clause.” This is a powerful but often overlooked tool designed to resolve disagreements over the value of a loss.

Invoking this clause takes the decision away from the insurance adjuster and puts it into the hands of neutral experts. The process usually works like this:

- You hire an independent appraiser to determine the true amount of diminished value.

- Farmers hires their own appraiser to conduct an assessment.

- A neutral umpire steps in. If the two appraisers can’t agree, a third-party umpire is chosen to make a final, binding decision.

This process forces a resolution based on expert analysis, not the insurer’s self-serving formulas.

Expert Tip: Before formally invoking the appraisal clause, send one last written notice to the adjuster declaring your intent. Sometimes, just showing you’re serious is enough to bring them back to the table with a more reasonable offer.

Taking Your Fight to Small Claims Court

If the appraisal clause isn’t an option, small claims court is another highly effective venue. This path is far less intimidating and expensive than a full-blown lawsuit.

Filing in small claims court is a great move when:

- Your claim amount fits within your state’s limit. Most states cap small claims cases between $5,000 to $10,000, which often covers a diminished value claim.

- You have rock-solid evidence. Your independent appraisal, repair invoices, and police report become your evidence for the judge.

- Farmers is completely stonewalling you. When an insurer refuses to negotiate in good faith, letting a judge decide is a logical next step.

Knowing these escalation paths exist should give you confidence. You have clear, actionable ways to continue your fight for fair compensation.

Finalizing Your Settlement and Getting Paid

Once you’ve secured a fair settlement offer, a few critical steps remain. First, get the offer in writing. A verbal agreement over the phone is not enough. Insist on an email or formal letter confirming the exact dollar amount.

Next, Farmers will send a “Release of All Claims” form. Read this document carefully before signing. It is a legally binding contract that closes your claim for good.

Make sure you check for a few key things:

- Does the payout amount match the number you agreed on?

- Is the release strictly for property damage? You don’t want to accidentally sign away your rights to a future injury claim.

- Are all details, like names and vehicle information, correct?

Signing this form is the final step before they process your payment. This is also where SnapClaim’s commitment to your success provides total peace of mind. Our Money-Back Guarantee ensures that if your insurance recovery from the claim is less than $1,000, we refund the full appraisal fee—guaranteed.

Frequently Asked Questions (FAQ)

Here are straightforward answers to common questions about filing a Farmers Insurance diminished value claim.

Can I claim diminished value if the accident was my fault?

Usually, no. Diminished value is almost always a third-party claim filed against the at-fault driver’s insurance. If you caused the accident, Farmers typically won’t allow a first-party claim against your own policy for the drop in value. The main exception is in states like Georgia, where you may be able to claim under your Uninsured/Underinsured Motorist (UIM) coverage. Always check your specific state’s laws.

How long do I have to file a diminished value claim?

Every state has a statute of limitations for property damage, which includes diminished value. This deadline can range from two to six years from the date of the accident. However, don’t wait. The best time to file is right after your vehicle’s repairs are complete to ensure you don’t lose your right to claim.

Does a leased or financed car qualify for a claim?

Yes, and you absolutely should file a claim. When you trade in the car or return it at the end of a lease, the accident history will lower its value, and the bank or leasing company will hold you responsible for that financial shortfall. A diminished value payout gives you the money now to cover that future loss.

Does Farmers have to accept my independent appraisal?

While Farmers isn’t legally required to accept your appraiser’s number, a professional report from SnapClaim supports your case with certified data. It puts the burden of proof on the adjuster to provide their own credible market data to justify a lower offer—something they often can’t do. An independent appraisal is the most powerful tool you have to prove your loss and negotiate fairly.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Order your Diminished Value Appraisal Report