Has your car been in an accident? Even after perfect repairs, your vehicle’s resale value has dropped, and getting the insurance company to pay what you’re truly owed is often an uphill battle. Insurers use their own formulas to minimize payouts, frequently leaving you with a lowball offer that doesn’t cover your actual loss. This is where a diminished value lawyer in Georgia can be a game-changer, helping you recover the full compensation you deserve.

Georgia Diminished Value Appraisals by City

- Atlanta diminished value appraisal

- Augusta diminished value appraisal

- Columbus diminished value appraisal

- Macon diminished value appraisal

- Savannah diminished value appraisal

- Athens diminished value appraisal

- Sandy Springs diminished value appraisal

- Roswell diminished value appraisal

- Johns Creek diminished value appraisal

- Albany diminished value appraisal

- Warner Robins diminished value appraisal

- Alpharetta diminished value appraisal

- Marietta diminished value appraisal

- Valdosta diminished value appraisal

- Smyrna diminished value appraisal

Why Insurance Companies Undervalue Georgia Diminished Value Claims

After a collision, the main focus is usually on repairs. But even a flawlessly repaired car now has an accident history, which significantly lowers its market price. This loss in resale value is called diminished value, and under Georgia law, you have the right to claim it.

The problem is that the insurance adjuster’s primary goal is to settle your claim for the lowest amount possible. They work for the insurance company, not for you. This conflict of interest is why initial settlement offers are often disappointingly low.

Common Tactics Insurers Use to Minimize Payouts

Insurance companies rely on a standard playbook to reduce what they pay on a diminished value claim. One of their most common tactics is using a flawed internal calculation known as the “17c formula.” This formula applies arbitrary caps and deductions that almost always result in a lowball figure.

You might also hear adjusters argue that:

- Perfect repairs made the vehicle “as good as new,” so there is no loss in value.

- Your car is too old or has too many miles to qualify for a significant claim.

- You can’t “prove” diminished value until you actually sell the car (which is false).

These arguments are designed to discourage you and pressure you into accepting a small payout. Without solid evidence and an expert negotiator on your side, many people leave thousands of dollars on the table.

The Georgia Advantage: Strong Consumer Protection

Georgia is one of the best states for consumers when it comes to diminished value. The landmark 2001 Georgia Supreme Court case, Mabry v. State Farm, established that insurers must pay for the loss in market value caused by an accident, not just the cost of repairs.

Hiring an attorney levels the playing field. A diminished value lawyer in Georgia understands these tactics and knows how to build a case that forces a fair negotiation based on real market data, not a biased formula. Armed with a certified appraisal from a trusted source like SnapClaim, your claim shifts from the insurer’s low estimate to the actual car value after an accident.

Understanding Your Rights Under Georgia Law

It’s easy to feel overwhelmed when dealing with an insurance company after an accident. However, Georgia vehicle owners have a powerful advantage thanks to a court decision that reshaped diminished value claims in the state.

Knowing your rights begins with one key case: State Farm Mutual Automobile Insurance Co. v. Mabry. In 2001, the Georgia Supreme Court ruled that insurance companies are legally required to compensate for the loss in a vehicle’s market value after a collision, even if the repairs are perfect. You can read the full details of the Mabry decision here, but the main point is simple: your car is worth less after a wreck, and the at-fault party’s insurer owes you for that loss.

First-Party vs. Third-Party Claims

The Mabry ruling is significant because it affirmed your right to file a first-party diminished value claim. This is a unique protection for Georgia drivers.

Here’s a simple breakdown:

- Third-Party Claim: This is the most common type. You file a claim against the at-fault driver’s insurance company.

- First-Party Claim: This is where Georgia is different. You can file a diminished value claim against your own insurance policy under your collision coverage, regardless of who was at fault.

This means your insurance contract must cover your total “loss,” which includes the hit to your car’s resale value. Any good diminished value lawyer in Georgia uses this case as the foundation of your claim.

The Problem with the “17c Formula”

You might think a Supreme Court ruling would settle the matter, but insurers adapted. They developed an internal calculation to minimize their payouts: the notorious “17c formula.” This formula is designed to protect their bottom line and almost always produces a low offer.

Here’s how it typically works:

- Starts with a Low Cap: The formula often caps the maximum diminished value at 10% of your car’s pre-accident value (using a source like Kelley Blue Book).

- Applies Damage “Modifiers”: It then reduces that amount using arbitrary multipliers for damage severity.

- Applies Mileage “Modifiers”: Finally, it applies another reduction based on your vehicle’s mileage, further shrinking the payout.

This method is completely detached from real-world market conditions. An experienced lawyer will immediately challenge the 17c formula and counter with a data-driven appraisal report that reflects your car’s true loss in value.

Building a Diminished Value Claim Insurers Can’t Ignore

Successfully recovering your car’s lost value depends on the quality of your evidence. Insurance adjusters are trained to dismiss weak arguments, so a strong diminished value claim must be built on undeniable proof. You can’t just tell them your car is worth less; you have to show them.

This is how you turn the tables. Instead of accepting an offer from a generic formula, you present a case so well-supported that they must take you seriously. While a diminished value lawyer in Georgia will lead this effort, the power of your claim begins with the evidence you gather.

Your Essential Documentation Checklist

Organizing your documents is the first step. Think of yourself as building a case file—each piece of paper strengthens your position. Start by collecting these key items.

| Document Type | Why It’s Important | Where to Get It |

|---|---|---|

| Official Police Report | Establishes the facts and who was at fault, which is crucial for a third-party claim. | The law enforcement agency that responded to the accident. |

| Pre-Accident Vehicle Records | Proves your car was a well-maintained asset. Maintenance logs show it was in good condition. | Your personal files, dealership, or mechanic’s shop. |

| Photos and Videos | Visual proof is powerful. Document the damage after the crash, during repairs, and the final result. | Your smartphone or camera. |

| Final Repair Invoice | This is a critical document detailing every part replaced and all labor performed, proving the damage’s severity. | The body shop that completed the repairs. |

This evidence tells the complete story of your vehicle, from its pre-accident condition to the extensive work needed to repair it.

The Cornerstone: An Independent Appraisal Report

While these documents form the foundation, your most powerful tool is a professional, independent diminished value appraisal. This expert evidence directly challenges the insurance company’s self-serving 17c formula.

An independent appraisal is a comprehensive market analysis from a certified expert. It provides a data-driven, objective valuation of your car value after an accident, grounding your claim in real-world facts.

A report from a trusted provider like SnapClaim analyzes comparable vehicle sales, auction data, and dealership input to pinpoint the financial loss your car’s specific make and model has suffered due to its accident history.

This professional assessment carries significant weight in negotiations because it’s impartial and based on industry-standard market data. When your lawyer presents this report, it forces the adjuster to move beyond their formula and address the actual market loss.

How to Find the Right Diminished Value Lawyer in Georgia

After an accident, you may be tempted to call any personal injury attorney. However, diminished value is a specialized field, and you need a lawyer who understands its unique challenges and opportunities, especially under Georgia’s consumer-friendly laws.

A general practice lawyer might be an expert in medical claims but may not know how to counter an adjuster using the “17c formula” or citing the Mabry v. State Farm ruling. You need a specialist.

Questions to Ask a Potential Attorney

Finding the right lawyer means asking the right questions. Treat your initial consultation as an interview to determine if they have the experience to handle your case effectively.

Here are essential questions to ask:

- How much of your practice is dedicated to diminished value claims? You want someone who focuses on these cases daily, not one who only handles them occasionally.

- What is your experience negotiating with my specific insurance company? A seasoned lawyer knows the tactics of major insurers like State Farm, Progressive, and Allstate and understands how to apply pressure effectively.

- How do you use independent appraisals in your strategy? The correct answer is that they use a certified report as the foundation of the demand, rejecting the insurer’s flawed formula.

- Can you explain your fee structure? The attorney should clearly explain how they get paid and what, if any, costs you might be responsible for.

An experienced diminished value lawyer in Georgia will provide clear, confident answers. Vague responses are a red flag. For more context on about diminished value appraisal in Georgia.

Understanding Legal Fee Structures

Most diminished value attorneys work on a contingency fee basis, which means you pay nothing upfront.

Here’s how it works:

- No Upfront Costs: You don’t pay anything to start your case.

- Paid Only If You Win: The lawyer takes an agreed-upon percentage (usually 33-40%) from the final settlement.

- Aligned Motivation: Since their payment depends on your success, their goal is the same as yours: to secure the maximum possible settlement.

This “no win, no fee” model makes expert legal help accessible, leveling the playing field against large insurance companies. Always get the fee agreement in writing. If you’re weighing your options, our guide can help you decide when to consider hiring a lawyer for your diminished value claim.

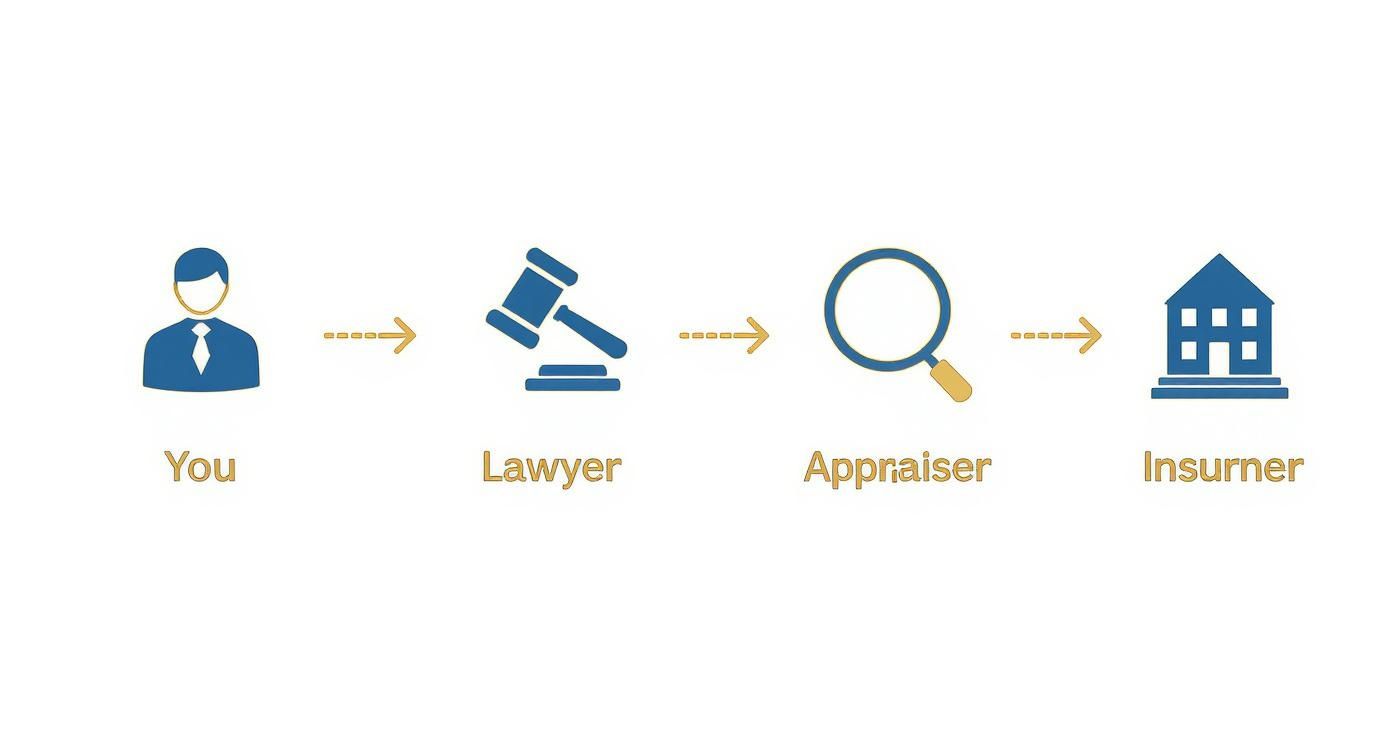

The Winning Combination: Your Lawyer and Appraiser

A successful diminished value claim in Georgia relies on a powerful partnership between a sharp lawyer and a certified appraiser. This combination creates an airtight case that insurance companies cannot easily dismiss. Your lawyer acts as the strategist, while the appraiser provides the critical evidence.

The Lawyer’s Role as Your Advocate

Your diminished value lawyer in Georgia manages the entire legal process, protecting your rights at every step.

Their responsibilities include:

- Driving the Legal Strategy: They use their deep knowledge of Georgia law, including the landmark Mabry v. State Farm case, to build the strongest possible argument.

- Handling All Communications: Your lawyer becomes the single point of contact with the insurance company, preventing you from saying anything that could weaken your claim.

- Negotiating Aggressively: Armed with solid evidence, they challenge lowball offers and fight for a settlement that reflects your car’s true loss in value.

- Preparing for Litigation: While most cases settle, a great lawyer is always prepared to go to court if the insurer refuses to negotiate fairly.

The Appraiser’s Role as the Fact-Finder

The certified appraiser provides the objective, data-backed evidence that proves the exact amount of your diminished value.

An independent appraiser’s report:

- Analyzes real-world market data for vehicles similar to yours.

- Considers the specific nature and severity of the damage sustained.

- Produces a detailed, defensible report that withstands scrutiny.

This report is the factual foundation of your claim, forcing the negotiation away from the insurance company’s biased formulas and grounding it in market reality. This is where a SnapClaim report provides the proof you need to negotiate fairly.

How This Partnership Maximizes Your Recovery

This tag team of legal and appraisal expertise creates a powerful force. When an adjuster claims repairs made your car “good as new,” your lawyer can use the appraisal data to show that similar vehicles with accident histories consistently sell for thousands less.

This professional approach signals that you are serious and prepared, dramatically increasing your chances of securing a fair insurance total loss payout or diminished value settlement quickly.

Navigating Your Claim: From Negotiation to Settlement

Once you have your evidence and a certified appraisal, the negotiation begins. Your diminished value lawyer in Georgia will draft a formal demand letter to the insurance company. This letter outlines the facts, cites relevant Georgia laws, and presents the certified valuation of your loss.

This demand officially starts the negotiation. The adjuster, who may have initially offered a low amount based on the 17c formula, must now respond to a serious legal claim backed by hard data.

The Negotiation Process

The insurance company will likely respond with a counteroffer that is still too low. They may try to discredit your appraisal or downplay the accident’s impact on your car’s value. This is a standard tactic, and an experienced lawyer knows how to handle it.

Your attorney will manage all communications, refuting the adjuster’s arguments and reinforcing the strength of your evidence. The process may involve several rounds of offers and counteroffers, with your lawyer fighting for a fair settlement.

When Settlement Fails

The vast majority of diminished value claims are settled out of court. It is usually more cost-effective for an insurance company to agree to a fair settlement than to face a lawsuit.

However, if an insurer refuses to make a reasonable offer, your attorney will be prepared to file a lawsuit. Often, the act of filing is enough to bring the insurer back to the negotiating table with a more serious offer. Your lawyer will guide you through this process, ensuring you understand what to expect at every stage.

To get a better idea of what your claim might be worth, you can get a free estimate from SnapClaim. Our certified reports help strengthen your claim, providing the proof you need to negotiate fairly. And with our Money-Back Guarantee, you can move forward with confidence. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Frequently Asked Questions About Georgia Diminished Value Claims

Can I claim diminished value in Georgia if the accident was my fault?

Yes. Thanks to the landmark Mabry v. State Farm ruling, Georgia is a “first-party” state. This means you can file a diminished value claim against your own insurance policy using your collision coverage, even if you were at fault.

What is the deadline to file a diminished value claim in Georgia?

In Georgia, the statute of limitations for property damage is four years from the date of the accident. However, it is best to start the process as soon as your vehicle repairs are complete to ensure all evidence is fresh and market data is current.

How much does a diminished value lawyer in Georgia cost?

Most diminished value lawyers in Georgia work on a contingency fee basis. This means you pay nothing upfront. The lawyer’s fee is a percentage of the final settlement they secure for you, typically between 33% and 40%. Their goal is aligned with yours: to get you the largest settlement possible.

Do I always need a lawyer for my claim?

Not every claim requires a lawyer. However, you should consider hiring one if the insurance company denies your claim, makes a very low offer, or refuses to negotiate in good faith. For high-value claims involving luxury cars or new vehicles, an expert diminished value lawyer in Georgia is highly recommended.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉Get your free estimate today or order a appraisal report in Georgia to strengthen your insurance claim.