After an accident, even perfect repairs can’t restore your car’s full resale value. This loss—called diminished value—can be recovered with a well-written diminished value claim letter. In this guide, we’ll show you exactly how to write a diminished value claim letter using our free template to help you get fair compensation from your insurance company.

Why You Need a Diminished Value Claim Letter

After an accident that wasn’t your fault, your focus is naturally on getting your car fixed. But even when it looks showroom-new again, its fair market value has taken a serious, permanent hit. This is called inherent diminished value, and in most states, you are legally entitled to be compensated for it.

A well-written diminished value claim letter does more than just ask for money; it transforms your request into a serious demand that insurance companies must address.

Sending a formal letter signals to the insurance adjuster that you know your rights and are documenting everything. It creates a professional paper trail and puts the insurer on notice to respond officially to your claim for the lost value.

Turning Lowball Offers into Fair Settlements

Insurance companies are businesses, and their goal is often to minimize payouts. They typically use internal formulas that don’t reflect the true market loss your vehicle has suffered. Your formal demand letter, backed by solid proof, is the tool that forces them to look beyond their own calculations.

Here’s a quick checklist of what your diminished value claim letter must contain to be taken seriously.

Essential Parts of Your Diminished Value Letter

| Component | Why It’s Critical for Your Claim |

|---|---|

| Claim & Policy Information | Ensures your letter is immediately routed to the correct adjuster and file. |

| Accident Details | Briefly establishes the who, what, when, and where of the incident. |

| Your Diminished Value Amount | States your demand clearly and confidently right from the start. |

| Supporting Evidence | Mentions your attached appraisal, repair invoices, and other proof to build your case. |

| Response Deadline | Sets a clear expectation for when you expect a reply (e.g., 15 days). |

| Your Contact Information | Ensures the adjuster can easily reach you to begin negotiations. |

Getting these details right sets a professional tone and shows the insurer you have prepared a serious claim. With a strong demand letter and an independent appraisal, you can often negotiate for a much fairer settlement. For more background, see our guide on what is a diminished value claim.

A formal diminished value claim letter isn’t just a request—it’s the official start of your negotiation. It compels the insurer to treat your claim with the seriousness it deserves.

If you don’t make a formal demand backed by solid proof, you’re leaving money on the table. A certified appraisal report from SnapClaim, attached to your letter, provides the objective, data-driven evidence needed to counter lowball offers and successfully negotiate for what you’re rightfully owed.

Anatomy of a Powerful Claim Letter

When you’re writing a diminished value claim letter, it’s not about being confrontational. It’s about being clear, organized, and armed with the facts. A powerful letter is a complete demand package, carefully constructed to show the insurance adjuster you mean business.

First, get the header right. This sounds basic, but it’s critical. Include your full contact information, the adjuster’s details, and most importantly, the claim number. Placing the claim number at the top ensures your letter lands on the right desk immediately.

Crafting a Clear Opening Statement

Your opening paragraph needs to get straight to the point. State who you are, identify your vehicle (including the VIN), mention the date of the accident, and declare that this letter is your formal demand for diminished value compensation.

Keep your tone professional and stick to the facts.

For example, a strong opener looks something like this:

“This letter is a formal demand for compensation for the inherent diminished value of my [Year, Make, Model], VIN [Your VIN], resulting from the accident on [Date] (Claim #: [Claim Number]). The enclosed evidence substantiates a value loss of [Your Demand Amount].”

This sets a serious, professional tone from the get-go and tells the adjuster exactly what you want and why.

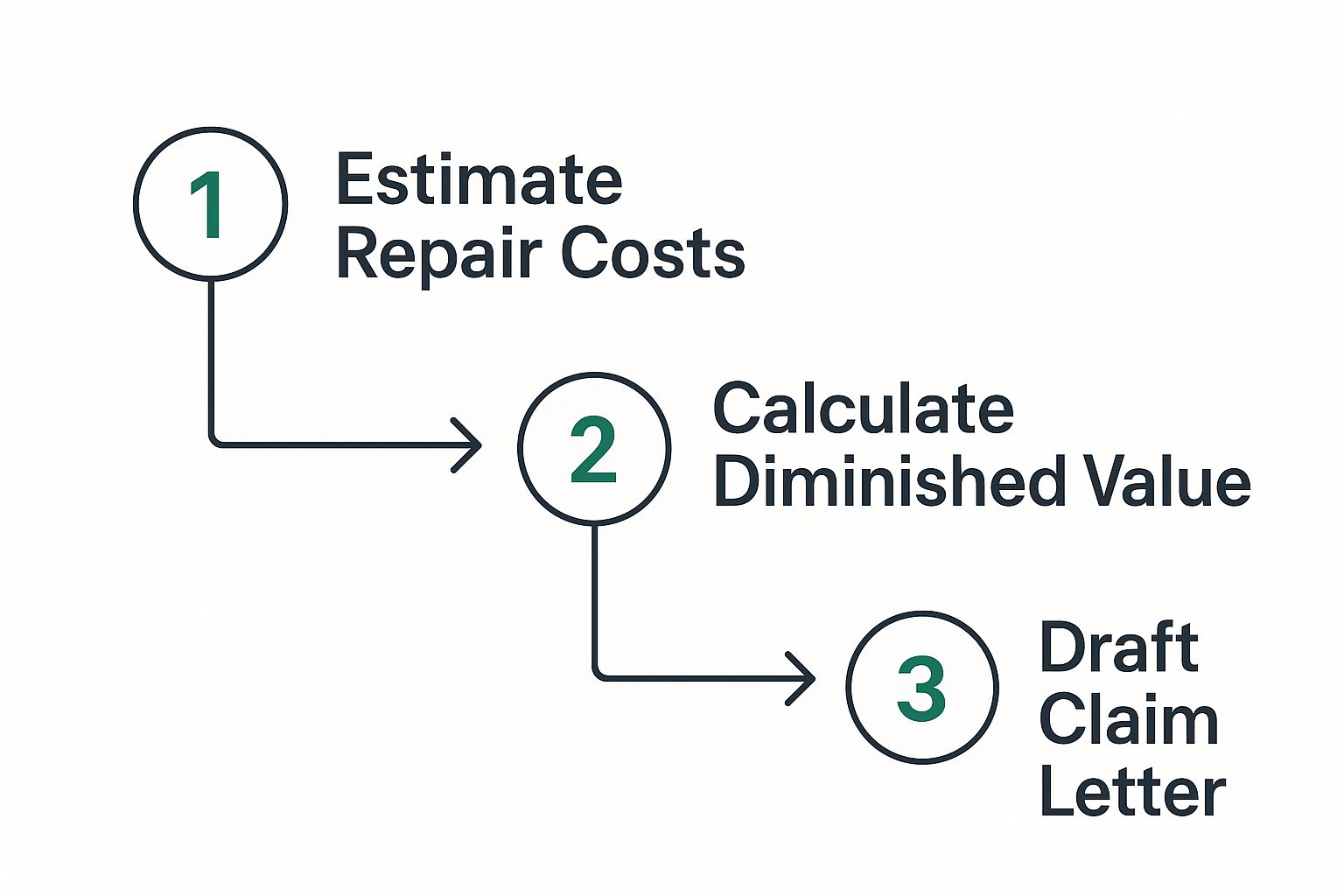

This visual breaks down the workflow. It starts with understanding the repair costs, moves to calculating the actual value loss, and finishes with drafting your formal claim letter.

Each step logically builds on the last, giving you the solid foundation needed to make a convincing argument.

Building Your Case in the Body

The body of the letter is where you lay out your argument. Briefly recap the accident, detail the completed repairs, and state the exact diminished value amount you are demanding.

This is where you introduce your most important piece of evidence: the certified appraisal report. A report from a trusted, independent source like SnapClaim provides objective, market-driven data that insurers find very difficult to argue with.

Your letter absolutely must include your contact information, the vehicle’s VIN, a description of the damage, and a clear demand for compensation. You’ll also want to attach proof like your independent appraisal, repair invoices, and photos to make your position undeniable. Pro tip: send the whole package via certified mail to get documented proof that the insurer received it.

Your Editable Diminished Value Claim Letter Template

Here is the practical tool you need to get your claim rolling: a professionally structured, fill-in-the-blanks diminished value claim letter template.

We’ve designed this so you can simply copy and paste it into your own document. Every section is clearly marked to take the guesswork out of the process.

Using a solid template like this shows the insurance adjuster you’re serious and organized. It prevents your demand from getting lost or dismissed as just another informal complaint. It’s all about presenting a polished, credible, and professional case right from the start.

How to Use This Template

Simply find the bracketed information, like [Your Name] or [Claim Number], and replace it with your own details.

The most important part is your demand amount. You’ll plug in the figure directly from your certified appraisal report. An amount backed by an expert report carries significantly more weight than a number you estimate on your own.

If you don’t have that number yet, you can get a general idea of your loss by using a free online tool to estimate your vehicle’s diminished value.

Here’s the template you can copy:

[Your Name][Your Address][Your Phone Number][Your Email Address]

[Date]

[Insurance Adjuster’s Name][Insurance Company Name][Insurance Company Address]

RE: Formal Demand for Diminished ValueClaimant: [Your Name] Claim Number: [Claim Number] Date of Loss: [Date of Accident] Vehicle: [Year, Make, Model], VIN: [Your VIN]

Dear [Mr./Ms. Adjuster’s Last Name],

This letter serves as my formal demand for compensation for the inherent diminished value of my vehicle, a [Year, Make, Model], resulting from the accident on [Date of Accident] caused by your insured.

Even after completing all necessary repairs, my vehicle has suffered a significant loss in fair market value. This loss is a direct result of the accident history now permanently attached to my vehicle’s record.

As evidence, I have attached a certified diminished value appraisal report from SnapClaim. The report substantiates a value loss of $[Your Demand Amount]. This figure includes the cost of the appraisal itself, which is a direct expense incurred as a result of the collision.

I expect to receive payment in full within 15 days of your receipt of this letter.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature] [Your Printed Name]Enclosures:

- Certified Diminished Value Appraisal Report

- Copy of Final Repair Invoice

- Copy of Police Report

How to Back Up Your Claim with Cold, Hard Evidence

Your diminished value claim letter sets the stage, but it’s the evidence you attach that does the heavy lifting. Without solid proof, your demand is just a number on a page, and insurance adjusters are trained to dismiss unsupported claims.

To get them to take you seriously, you need to build a case that leaves no room for doubt.

The single most important document you can have is a certified, independent diminished value appraisal. This isn’t just an opinion; it’s a detailed, data-driven report from an expert who analyzes vehicle market dynamics. A professional car appraisal after an accident provides the objective analysis that supports negotiations with insurers. It’s the cornerstone of your entire claim.

Your Essential Evidence Checklist

While the appraisal is your key piece of evidence, you need a few other documents to create a complete and undeniable claim package. Think of it as building a case file that tells the entire story of your loss, from the moment of impact to the final, repaired state of your car.

Here’s a checklist of the documents you should include to build a claim the insurer can’t easily ignore.

| Document Type | Its Purpose in Your Claim |

|---|---|

| Certified DV Appraisal | Provides an unbiased, expert valuation of your car’s lost market value. |

| Police Report | Establishes the facts of the accident and officially documents fault. |

| Damage & Repair Photos | Visually demonstrates the severity of the collision before and after repairs. |

| Final Repair Invoice | Details every repair performed, proving the extent of the damage. |

| Vehicle History Report | Shows the accident is now a permanent, value-killing part of your vehicle’s record. |

Putting together this file shows the adjuster you’re organized, serious, and have done your homework. It immediately strengthens your claim.

Submitting a claim without a certified appraisal is like going to court without your key witness. It leaves your demand open to interpretation and makes it easy for the insurer to counter with their own lowball formula.

We understand that paying for an appraisal before you’ve been compensated might feel like a risk. That’s why SnapClaim offers a straightforward money-back guarantee. If the insurance recovery from your diminished value claim is less than $1,000, we’ll refund your appraisal fee completely. This takes the financial risk off your shoulders, letting you confidently get the professional proof you need to negotiate from a position of strength.

Costly Mistakes to Avoid When Filing Your Claim

The most common mistake? Getting emotional. An accident is frustrating, but your demand letter is a business document. Keep it professional, stick to the facts, and let your certified appraisal report do the talking. Angry language will only hurt your case.

Don’t Fall for Their Lowball Formulas

Never blindly accept the insurance company’s first offer. It’s almost guaranteed to be a lowball figure generated by an internal formula, like the notorious “17c formula.” This method is designed to benefit them, not you. It applies a series of arbitrary modifiers that can slash your payout and rarely reflects your vehicle’s actual loss in the open market.

Another huge pitfall is cashing the first check they send you. In many states, depositing that check can be legally interpreted as accepting their offer as payment in full. If the amount is less than what you demanded, do not cash it until you have a final, written settlement agreement. To get a better sense of how insurers operate, it’s worth reviewing some common reasons for insurance claim denials.

Pro Tip: Always send your demand letter and all supporting documents via certified mail with a return receipt requested. This gives you undeniable legal proof of when the insurance company received your paperwork, starting the clock on their response time.

This same logic applies if your car is declared a total loss. If the insurer’s offer seems too low, it probably is. You can challenge it with the right evidence, just as you would with a diminished value claim. Learn more in our step-by-step guide to disputing a total loss offer.

Frequently Asked Questions

Navigating a diminished value claim can be confusing. Here are straightforward answers to some of the most common questions vehicle owners ask.

How Long Do I Have to File a Diminished Value Claim?

The time limit to file a diminished value claim is determined by your state’s statute of limitations for property damage. This typically ranges from two to three years from the date of the accident. However, it’s always best to file as soon as possible while the evidence is fresh. Waiting too long can make it harder to prove your case, and missing the deadline means you lose your right to file a claim entirely.

What if the Insurance Company Rejects My Claim Letter?

Don’t panic. An initial denial is a common tactic used by insurance companies, who hope you’ll simply give up. If your claim is rejected, your next step is to respond professionally and ask for the specific reason for the denial in writing. Often, the denial is based on an internal formula (like the 17c formula) that doesn’t hold up against a credible, independent appraisal. Your certified report is the best tool for countering their rejection and continuing negotiations.

Do I Need a Lawyer to File a Diminished Value Claim?

For most straightforward claims, you do not need a lawyer. A strong demand letter paired with a certified appraisal report from a reputable service like SnapClaim is often enough to negotiate a fair settlement. However, if your claim is for a high-value vehicle, involves complex legal issues, or the insurance company refuses to negotiate in good faith, consulting with an attorney may be a good idea.

Remember, a SnapClaim appraisal is backed by our money-back guarantee. If your insurance recovery is under $1,000, your appraisal fee is fully refunded, removing the financial risk for you.

What is a diminished value claim letter?

A diminished value claim letter is a formal request sent to an insurance company asking for compensation for your car’s reduced market value after an accident.

Do insurance companies accept diminished value claim letters?

Yes. Many insurers, including USAA and State Farm, review formal claim letters supported by professional appraisal reports.

What should I include in a diminished value claim letter?

Your letter should include your vehicle details, accident date, pre-loss and post-repair value, and a supporting appraisal report.

Where can I get a sample diminished value claim letter?

You can download SnapClaim’s free diminished value claim letter template to start your claim immediately.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This article was reviewed by SnapClaim’s team of certified auto appraisers and claim specialists with years of experience preparing court-ready reports for attorneys and accident victims. Our content is regularly updated to reflect the latest industry practices and insurer guidelines.

Get Started Today

Ready to prove your claim? Generate a free diminished value estimate in minutes and see how much you may be owed.

Get your free estimate today