Diminished Value Appraisal Near Me

Get a diminished value appraisal anywhere in the U.S.. We provide diminished value appraisal reports recognized by insurers, attorneys, and courts in all 50 states. Select your state to view local claim requirements.

No credit card required.

What Is a Diminished Value Appraisal?

A diminished value appraisal shows how much your car’s value drops after an accident — even after repairs.

- Insurance often covers only visible damage, not loss in resale value.

- A diminished value appraisal near you helps prove your financial loss.

- SnapClaim handles everything online — no inspection required.

- You’ll get a fast, data-backed report accepted by insurers, attorneys, and courts.

Claim rules differ by state — check our state laws guide to learn more. SnapClaim makes getting a certified diminished value appraisal simple, accurate, and court-ready.

How to Get a Diminished Value Appraisal Report

After an accident, your car can lose thousands in resale value — even after high-quality repairs. This loss is called diminished value. As SnapClaim explains, many drivers never recover this money simply because they don’t have a certified appraisal to prove their claim.

SnapClaim makes it easy to get a diminished value appraisal that’s accurate, fast, and 100% online. Our experts use verified market data, repair details, and advanced valuation models to prepare court-ready reports recognized by insurers and attorneys nationwide.

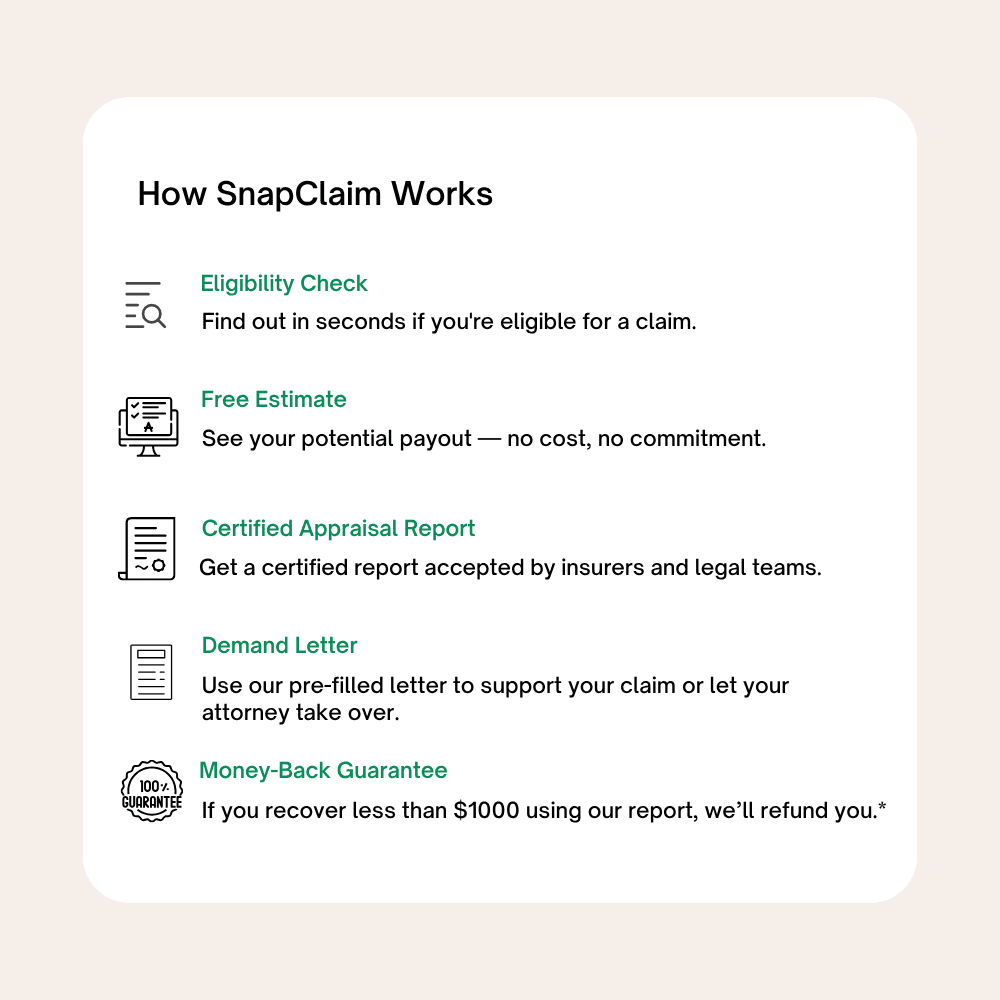

How SnapClaim Works

- Step 1: Check your eligibility in seconds — no inspection needed.

- Step 2: Get a free diminished value estimate instantly.

- Step 3: Receive your certified appraisal report within hours.

- Step 4: Use our demand letter template to file or dispute your claim with confidence.

Don’t leave money on the table. Start your diminished value appraisal today and get the payout you deserve.

Frequently asked questions:

-

What is a diminished value appraisal?

A diminished value appraisal determines how much your vehicle’s resale value has dropped after an accident, even if repairs were done correctly.

-

How much does a diminished value appraisal cost?

With SnapClaim, you can check eligibility and get a free diminished value estimate. Certified reports are affordable and fully refundable if you recover less than $1000.

-

How long does it take to get my report?

Most SnapClaim diminished value reports are completed within 1 hour and ready for insurance submission or attorney review.

-

Do I need an in-person inspection to get my appraisal?

No. SnapClaim provides 100% online desk appraisals. You simply upload repair documents, photos, and your VIN. Our valuation system uses verified market data to generate a certified report accepted by insurers and attorneys nationwide.

-

How long does it take to get my diminished value report?

Most diminished value appraisal reports are completed within about an hour after your information is submitted. You’ll receive a certified, court-ready document you can use to negotiate or dispute an insurance settlement.

-

Does SnapClaim cover my state?

Yes. SnapClaim provides desk-based diminished value appraisals in all 50 states. To learn about specific claim laws and timelines where you live, visit our Diminished Value State Laws guide.

Looking for a diminished value appraisal near you?

in minutes

SnapClaim provides diminished value appraisals nationwide — including major metro areas like Atlanta, Dallas, Miami, Los Angeles, Chicago, and Denver. No matter where you are, our certified appraisers can help you recover your vehicle’s lost value fast.

Free Estimate, no credit card required.