When your car is totaled in an accident, the insurance company hands you a document called a CCC ONE market valuation report. They present it as the final, non-negotiable word on your vehicle’s worth. But if that insurance total loss payout feels way too low, you have every right to be suspicious.

The reality is that CCC ONE market valuation report flaws are incredibly common. These automated systems often lowball vehicle values, leaving you with a check that’s far less than what you’re actually owed. This guide will walk you through how to spot these flaws and fight for the fair compensation you deserve.

Why Your Total Loss Offer Feels Low

After your vehicle is declared a total loss, the insurance company is legally required to pay you its Actual Cash Value (ACV). In simple terms, that’s the amount your car was worth just moments before the crash. To calculate this number, nearly every major insurance carrier uses a third-party company like CCC Intelligent Solutions.

CCC’s software generates a market valuation report that’s supposed to determine your car’s value by comparing it to similar vehicles listed for sale. For an insurer juggling thousands of claims, this automated process is highly efficient.

But that efficiency usually comes at your expense.

The Built-In Conflict of Interest

At its core, the problem is a massive conflict of interest. The same insurance company that has to pay your claim is the one choosing and paying for the valuation report. This dynamic creates a system where the unspoken goal is to keep payouts as low as possible.

It’s like selling your house, but you’re forced to accept an appraisal conducted by the buyer’s agent. Would you trust that number? Of course not. The agent is motivated to produce a lower value to benefit their client.

It’s no different with a CCC ONE report. The system is built to serve the insurer’s bottom line, not yours, leading to predictable and costly flaws.

Common Flaws in a CCC ONE Report at a Glance

| Flaw | How It Lowers Your Payout | What to Look For |

|---|---|---|

| Cherry-Picked “Comps” | The system selects cheaper, lower-trim, or poorly maintained vehicles for comparison. | Verify that the selected comparable vehicles truly match your car’s trim, options, and overall quality. |

| Unfair Adjustments | Arbitrary deductions are applied for mileage or condition without a real-world inspection. | Question any negative adjustment that isn’t backed by solid evidence from your specific vehicle. |

| Outdated or Fake Listings | The report uses stale, expired, or even phantom vehicle listings that don’t reflect current market prices. | Check if the comparable vehicles are still for sale at the listed price. Expired links are a big red flag. |

| Geographic Mismatch | It pulls comps from cheaper, distant markets, ignoring local pricing in your area. | Ensure all comparable vehicles are from your geographic market, as required by most state laws. |

These systematic issues can easily result in a settlement offer that’s thousands of dollars below what you’re rightfully owed. The first step to fighting back is knowing how to calculate a total loss accurately.

This guide will walk you through the specific CCC ONE market valuation report flaws to look for so you can challenge their lowball offer and get the fair payout you deserve.

The Problem with Comparable Vehicles

A fair market valuation hinges on one simple concept: comparing your car to nearly identical vehicles on the market. We call these “comparables,” or “comps” for short. It works just like a real estate appraisal—an appraiser finds your home’s value by looking at what similar houses in your neighborhood recently sold for.

If the comps are wrong, the final value is guaranteed to be wrong. This is where one of the biggest CCC ONE market valuation report flaws appears. The software’s automated system for picking comps is often a mess, creating a skewed, artificially low value for your car. This isn’t a human expert carefully vetting each vehicle; it’s an algorithm that can easily cost you thousands.

How the Algorithm Gets It Wrong

Let’s say your vehicle is a spotless, low-mileage SUV with a premium sound system and a panoramic sunroof. A fair valuation would compare it to other SUVs with similar mileage, the same high-end features, and a clean history—all for sale in your local area.

But the CCC ONE system often misses these critical details. Its algorithm can be programmed to prioritize data points that work in the insurer’s favor, actively hunting for lower-priced listings just to drag down the average value.

A common tactic is using “comparable” vehicles from hundreds of miles away in a cheaper market. This move directly violates fair claims practices in many states, which legally require comps to come from your local area.

The Danger of Bad Data

The problems run deeper than just location. Time and again, we see CCC ONE reports include comps with huge, value-crushing issues that aren’t spelled out clearly. These can include:

- Vehicles with Previous Accidents: A car with an accident on its record is worth far less than one with a clean history.

- Salvage or Branded Titles: The system might pull a vehicle with a salvage, rebuilt, or even a lemon-law title, all of which decimate its market value.

- Inaccurate Trim Levels: Pitting your fully-loaded “Limited” model against a basic “LX” model is an apples-to-oranges comparison that guarantees a lower value.

- Missing Options and Packages: The report may completely overlook valuable factory add-ons, like a technology package, upgraded wheels, or a tow hitch.

These aren’t just hypotheticals; they’re well-documented issues. Critics argue that the system often works backward—it starts with a lowball target value and then cherry-picks comps to justify it.

This practice of using junk comparables can produce settlement offers that are thousands of dollars lower than valuations based on clean, verified sales data. For a deeper dive, check out our complete guide to a CCC ONE Report.

How Unfair Adjustments Chip Away at Your Payout

Even if a CCC ONE report uses the right comparable vehicles, the final number can still be completely wrong. The next trick is a series of small, negative “adjustments” that systematically chip away at your car’s value, one bogus deduction at a time.

These adjustments are another one of the major CCC ONE market valuation report flaws. They’re standardized, often arbitrary penalties the software applies for things like mileage and condition, all designed to reduce the insurance payout.

What’s troubling is that these deductions are applied automatically by a computer program. No one physically inspects your car or the comps. It’s like a computer deducting money for “wear and tear” on a car it has never seen.

The Problem with Condition Adjustments

One of the most common deductions is a “condition adjustment.” In theory, this accounts for physical differences between your car (before the accident) and the comparable vehicles.

But the process is deeply flawed. The CCC system often assumes every comparable vehicle is in perfect, “dealer ready” condition. From there, it penalizes your car for any perceived imperfection, creating a one-way street of deductions. The software almost never applies a positive adjustment if your vehicle was in better-than-average condition.

This faulty logic means your well-maintained, garage-kept car gets judged against an imaginary, perfect standard. Any deviation results in a penalty. It’s a game rigged to guarantee a lower valuation.

Mileage Adjustments That Don’t Add Up

Another frequent deduction is the “mileage adjustment.” If your car has more miles than the comps, the report subtracts a set amount. This sounds logical, but the per-mile deduction rate is often based on generic, outdated averages that have nothing to do with your specific vehicle or local market.

For example, a high-mileage Toyota known for reliability shouldn’t be penalized at the same rate as a European luxury car notorious for costly repairs. These blanket adjustments ignore the nuances that drive a car’s real-world value.

The Flaw of Using Advertised Prices

The foundation for all these unfair adjustments is CCC’s reliance on advertised prices instead of actual sale prices. An advertised price is just a starting point—the final amount a vehicle sells for is almost always lower.

Industry experts have pointed out that valuations based on realized sale prices can produce values 3–10% higher than automated systems that only look at ads. On a $20,000 vehicle, a 5% undervaluation is a $1,000 shortfall. This is exactly the kind of discrepancy fought over in disputes over total loss reports.

This flawed methodology is a core reason why your insurance company’s first offer is almost always too low.

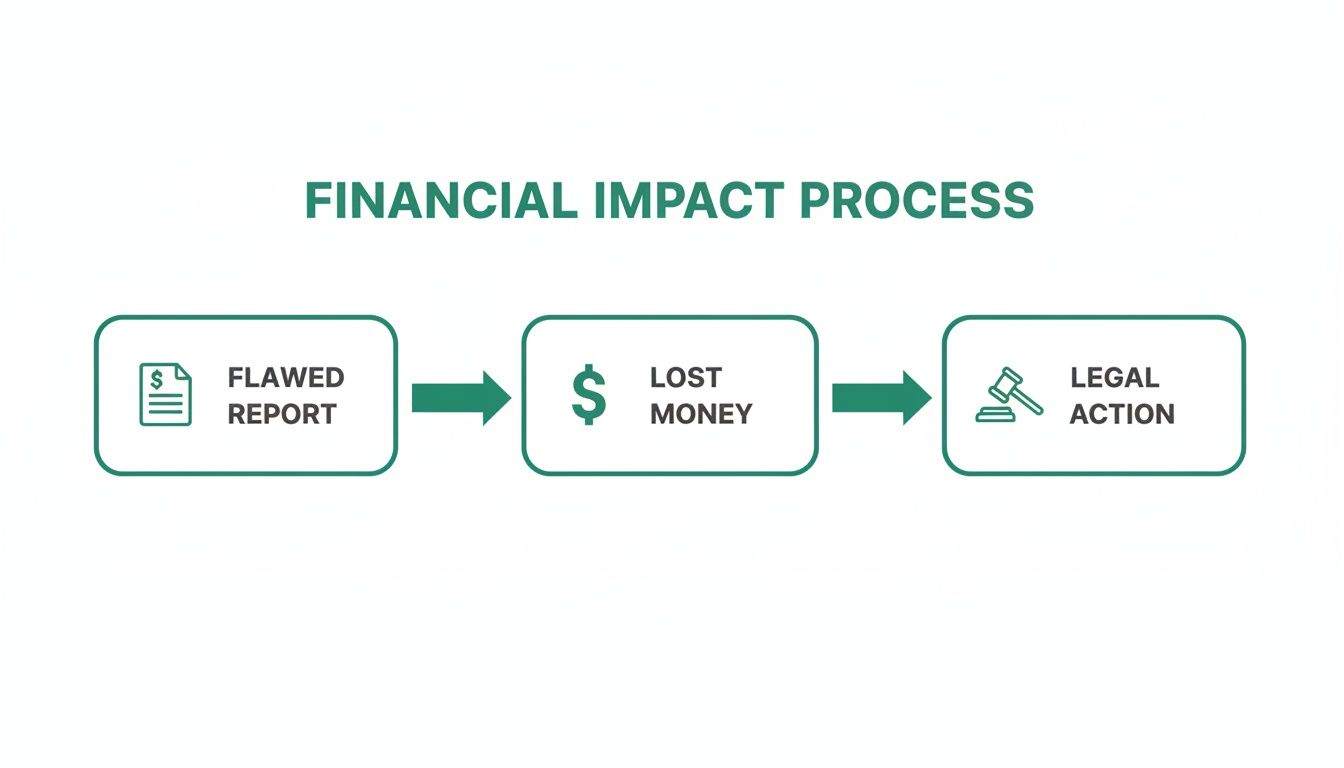

The Real Financial Impact of a Flawed Report

The problems with cherry-picked comps and unfair adjustments aren’t just minor details—they directly translate into a smaller check from your insurance company. This is where the flaws in a CCC ONE market valuation report hit you right in the wallet.

For many car owners, the shortfall can be thousands of dollars. That gap between your car’s true value and the insurer’s lowball offer gets even wider for newer, high-value, or specialty vehicles.

From Personal Frustration to a Documented Problem

If you have a gut feeling you’re being underpaid, you’re not alone. The systematic lowballing of vehicle values is so common that it’s sparked major legal battles across the country.

Multi-million dollar class-action lawsuits have been filed against major insurance carriers who lean exclusively on these flawed reports. This isn’t just a few unhappy customers; it’s documented evidence that validates your suspicion. The problem isn’t just your claim—it’s a systemic practice.

When you challenge an insurer’s offer, you’re standing on a mountain of legal precedent. This shifts the power dynamic back in your favor. Even the National Highway Traffic Safety Administration (NHTSA) provides tools and recall information, showing how critical accurate vehicle data is—details that automated reports often miss.

Putting a Number on the Damage

So, how much money are we talking about? The financial fallout from these flawed reports is staggering. Litigation and regulatory probes have forced multi-million dollar settlements, revealing the true scale of the underpayments.

Analysis from these cases shows the average shortfall often lands between several hundred to a few thousand dollars per vehicle. You can learn more about the scale of these legal fights and their monetary consequences on DiminishedValueExpert.com.

These legal battles prove this is a documented pattern of underpayment. That’s why you have to push back on a low offer backed by a CCC ONE report. A certified appraisal gives you the hard evidence you need to build your case and demand what you’re rightfully owed.

How to Dispute Your CCC ONE Valuation Report

Getting a lowball total loss offer is frustrating. But here’s the thing: you don’t have to just accept it. Knowledge is your best weapon, and taking clear, strategic action gets results.

Spotting the flaws in a CCC ONE market valuation report is step one. The key to getting a fair payout is knowing how to effectively dispute their number. It’s not about arguing with your adjuster; it’s about dismantling their flawed report with cold, hard facts.

Step 1: Get the Full Report

First, you need the complete CCC ONE report. Often, an adjuster only sends a summary page showing the final number. That’s not good enough. You are entitled to the entire document, which details every comparable vehicle and adjustment.

Politely but firmly, ask for the full report, including all pages. This document is the blueprint for their low offer, and you can’t pick apart what you can’t see.

Step 2: Pick Apart Their “Comparable” Vehicles

This is where the insurance company’s valuation usually falls apart. Go through their list of “comps” with a fine-tooth comb and find every inaccuracy. For each vehicle, ask:

- Is it a real match? Does it have the same trim, engine, and factory options? A base model is not a fair comparison for your fully-loaded version.

- Is it local? Most state regulations mandate that comps come from your local market. If they’re pulling cars from 300 miles away where vehicles are cheaper, that’s a huge red flag.

- What’s its history? Does the comp have a branded title (salvage, rebuilt) or an accident history? These cars are worth a fraction of a clean-title vehicle.

Document everything. This is the start of your counter-argument.

Step 3: Find Your Own, Better Comparables

Now it’s your turn. Build your own case by finding legitimate, accurate comparable vehicles. Search online for cars that are an exact match for your vehicle in its pre-accident condition. You’re looking for proof of what it would cost to replace your car today, in your area.

For instance, you can use trusted resources like Kelley Blue Book or Edmunds to research your car’s true market value and then back it up with live dealer listings.

Save screenshots and listings for at least three to five local vehicles that are a true match. This is your ammunition—concrete evidence that contradicts their lowball number. For more background, it helps to understand effective strategies to negotiate an insurance settlement.

Step 4: Present Your Case Like a Pro

Once you’ve gathered your evidence, send it to your adjuster. Write a clear, professional email outlining the specific flaws you found in their report and attach the better comparables you discovered. Keep your tone calm and stick to the facts.

Accepting a flawed report has real financial consequences, which is why fighting back is so important. This process highlights how a bad valuation leads directly to you losing money.

Your Action Plan for Disputing a CCC ONE Report

Feeling overwhelmed? Don’t be. Just follow these steps to build a rock-solid case against an unfair insurance valuation.

| Step | Action | Why It’s Important |

|---|---|---|

| 1. Request the Full Report | Politely ask the adjuster for the complete, multi-page CCC ONE valuation report. | You can’t dispute hidden data. The full report reveals their comps and adjustments. |

| 2. Audit Their Comparables | Review each “comp” for inaccuracies in trim, options, location, and vehicle history. | This is where most reports are weakest. Documenting these flaws invalidates their valuation. |

| 3. Find Your Own Comps | Use online auto sites to find 3-5 local listings for cars that are an exact match to yours. Save screenshots. | This provides real-world, market-based evidence of your car’s true replacement cost. |

| 4. Build Your Case | Create an email outlining the flaws in their report and attaching your superior comparables as proof. | An organized, fact-based presentation is professional and much harder for an adjuster to dismiss. |

| 5. Escalate if Necessary | If the adjuster refuses to negotiate, bring in an expert or invoke your policy’s appraisal clause. | This signals you’re serious and forces them to re-evaluate their position with credible, third-party data. |

By following this roadmap, you transform from a frustrated victim into a prepared negotiator.

The Ultimate Weapon: A Certified Appraisal

What if the adjuster still won’t budge? A certified, independent appraisal from SnapClaim is the single most powerful tool you can use. Our reports provide the credible, data-backed evidence needed to force a fair negotiation.

When an insurer is presented with a professional appraisal from a licensed expert, they are far more likely to raise their offer to avoid a costly dispute. In some situations, you may need to formally challenge their valuation. Understanding how to invoke the appraisal clause in your insurance policy is a game-changing step that can compel the insurer to pay what you’re rightfully owed.

Ditch the Algorithm, Get a Fair Payout with a Certified Appraisal

After seeing the CCC ONE market valuation report flaws firsthand—from mismatched comparables to bogus adjustments—it’s clear that accepting the insurance company’s number is a losing game. Their system is designed to protect their bottom line, not make you whole. This is where an independent appraisal from SnapClaim changes the dynamic.

Unlike a report spit out by a computer, a SnapClaim appraisal is built by a certified human expert. We perform a deep, local market analysis to find your vehicle’s true pre-accident value.

How a Certified Appraisal Levels the Playing Field

When you hand your adjuster a SnapClaim report, you’re not just giving them an opinion. You’re giving them a defensible, court-ready document that’s hard to ignore. Insurance companies respect our reports because they’re built on transparent, verifiable data that stands up to scrutiny.

Suddenly, the conversation shifts from their biased numbers to a fair discussion based on actual market facts. An independent appraisal is the proof you need to negotiate effectively and makes it nearly impossible for them to justify a lowball offer. It’s the single best tool for recovering what you’re truly owed for your diminished value claim or total loss.

A Risk-Free Path to a Fair Settlement

We are so confident in the accuracy of our reports that we back them with a powerful promise. It’s our way of ensuring you can fight the insurer’s low offer with total peace of mind.

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

This guarantee takes all the financial risk off your shoulders. You can get the professional evidence you need to fight for a fair settlement, knowing you have nothing to lose and potentially thousands to gain.

Frequently Asked Questions

Can I reject an insurance company’s total loss offer?

Absolutely. An insurance settlement is an offer, not a final command. You have the right to reject it if you believe it’s too low, especially when you can point to the specific CCC ONE market valuation report flaws that prove your case. Presenting your own evidence, such as better comparable vehicles or an independent appraisal, is a standard part of negotiating a fair car value after an accident.

What if my adjuster says the CCC ONE report is the “industry standard”?

This is a common tactic to discourage you from questioning their offer. While CCC Intelligent Solutions is a widely used platform, “industry standard” doesn’t mean it’s accurate or legally binding. Acknowledge their point, but pivot back to the facts of your report. The most effective response is to counter their flawed report with a professional, data-driven appraisal of your own.

Is an independent appraisal worth it for my total loss claim?

Yes, especially because an unfair valuation can cost you hundreds or thousands of dollars needed to buy a replacement vehicle. An independent appraisal provides the proof you need to negotiate fairly and strengthen your claim. To make it a risk-free decision, SnapClaim offers a Money-Back Guarantee: if your insurance recovery from the claim is less than $1,000, we refund the full appraisal fee.

How does a SnapClaim appraisal differ from a CCC ONE report?

The key differences are objectivity and methodology. A CCC ONE report is an automated tool paid for by the insurance company, creating a potential conflict of interest. A SnapClaim appraisal is a manual report prepared by a certified, independent expert who works for you. We use real, local market data to determine your vehicle’s true value, providing a defensible document that supports your case with certified data.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes. Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

👉 Get your free estimate of your total vehicle actual cash value today