Ever wondered how your insurance company calculates a settlement offer so quickly after an accident? The answer is usually a powerful software platform called CCC ONE.

Think of it as the insurance industry’s standard tool for estimating repair costs and determining your car’s pre-accident value. Since most insurers and repair shops use it, understanding what it does—and what it doesn’t do—is critical to getting a fair payout.

How Insurance Companies Use CCC ONE to Value Your Car

The initial settlement offer from your insurance adjuster isn’t just a random number. In most cases, it’s generated by CCC ONE, a software platform that dominates the auto insurance and repair industry. Its purpose is to create consistency and efficiency, which is why it’s so widely used.

When you file a claim, an adjuster enters your vehicle’s details—like its VIN, mileage, options, and pre-accident condition—into the system. The software then compares this data against a huge database to produce a valuation report.

Understanding this process is the first step toward ensuring you don’t leave money on the table when settling your claim.

The Role of CCC ONE in Your Claim

At its core, CCC ONE performs a few key functions that directly affect your insurance payout, whether your car is a total loss or simply needs repairs. It acts as the central hub where insurers and body shops communicate and process claims.

The system is designed to provide a predictable, data-driven starting point for claims. Insurers rely on it because it gives them a documented, seemingly objective basis for their settlement offers. For you, this means the first offer you receive is based on standardized data, not necessarily the unique, real-world value of your specific vehicle.

Here’s a quick breakdown of how its main features can influence your claim.

CCC ONE At a Glance

| Feature | What It Means for Your Claim |

|---|---|

| Vehicle Valuation | Generates a pre-accident "fair market value" based on comparable vehicles in its database. This is the starting point for your total loss offer. |

| Repair Estimating | Calculates the cost of repairs using standardized part prices and labor rates. This determines if your car is declared a total loss. |

| Workflow Management | Connects insurers and body shops for communication and payment processing, speeding up the claims process. |

While this system is great for efficiency, it has major limitations. It often struggles to capture the true fair market value of a well-maintained vehicle and completely overlooks the financial impact of a diminished value claim.

Why Understanding This Tool Matters

Knowing your insurer’s offer comes from an algorithm is a game-changer. It means that first number isn’t a final verdict—it’s a starting point for negotiation.

The data inside a CCC ONE report can be challenged, but you need the right evidence to do it effectively. This guide will explain how CCC ONE works, what its reports look like, and—most importantly—where its valuation process often falls short, so you can build a stronger case for the compensation you deserve.

The CCC ONE Valuation: An Algorithm’s Best Guess

So, how does CCC ONE actually put a price tag on your car? It acts like a digital detective, searching a massive database for recently sold vehicles similar to yours. In the insurance world, these are called “comparables” or “comps.”

The software uses these comps to find a base value and then makes adjustments. It factors in your car’s mileage, adds or subtracts value for optional features, and applies a condition rating—a grade typically given by the insurance adjuster.

But here’s the problem: an algorithm can’t appreciate the meticulous care you put into your vehicle or understand the unique demands of your local market.

How The Algorithm Picks “Comparable” Vehicles

The foundation of a CCC ONE valuation is its choice of comparable vehicles. The system is programmed to find cars of the same make, model, and year that sold recently. The catch is that the quality and relevance of these comps can be inconsistent.

Often, the software pulls data that is outdated or from a different geographical market where cars are valued differently. A “comparable” car sold three months ago doesn’t reflect what your car was worth today. A car sold 200 miles away might as well be in another state when it comes to local market value.

These details can shave thousands of dollars off your valuation, leaving you with a settlement that falls short of your car’s actual worth before the accident.

Key Takeaway: The CCC ONE valuation is a starting point, not the final word. Its reliance on potentially outdated or geographically mismatched “comparable” vehicles is a major weakness you can challenge with better, more localized data.

The Problem with Generic Condition Ratings

Another major blind spot is how the software handles your car’s condition. An adjuster will assign a generic rating like “fair,” “good,” or “excellent,” which triggers a standard dollar adjustment in the CCC ONE software.

This one-size-fits-all approach misses the nuances that make your car different.

- Recent Upgrades: Did you just spend $800 on new tires or install an upgraded sound system? An algorithm can’t assign the proper value to those improvements.

- Meticulous Maintenance: Detailed service records showing consistent oil changes and preventative care add real value. A generic rating rarely reflects that dedication.

- Garaged vs. Street-Parked: A garaged car will have a better-preserved exterior and interior, but this detail is often overlooked.

All these factors contribute to your car’s true fair market value, yet they get lost in the software’s automated adjustments. To see how these reports are structured, you can learn more about a CCC ONE market valuation report and identify where the gaps are.

The result is a valuation that serves the insurer’s need for a standardized number but fails to provide fair compensation. It’s an algorithm’s best guess—and that guess is often a lowball.

The Hidden Cost CCC ONE Completely Ignores: Diminished Value

While CCC ONE is a powerful tool for calculating repair costs and a car’s pre-accident value, it has a massive blind spot: diminished value. This is the primary reason vehicle owners are shortchanged by thousands of dollars on their insurance claims.

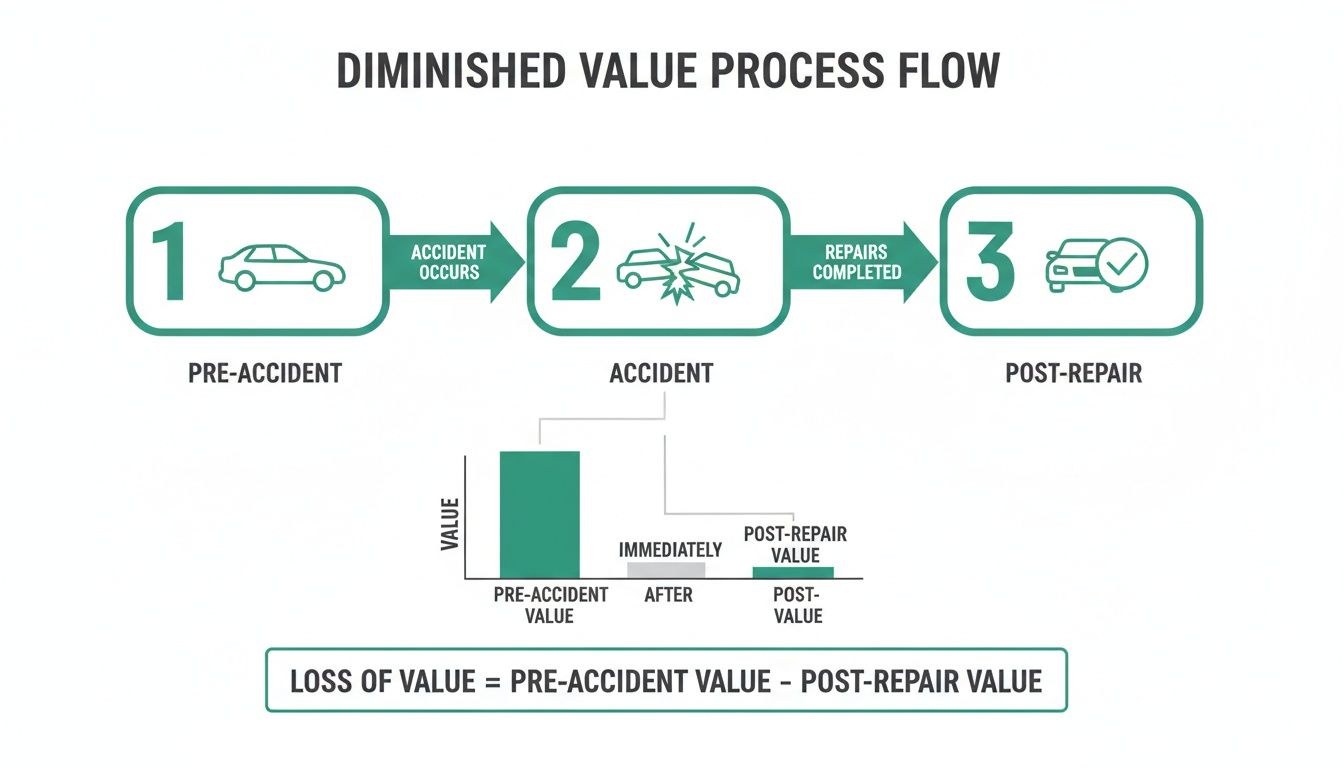

Let’s define that term. Inherent diminished value is the automatic, permanent drop in your car’s resale value simply because it now has an accident on its permanent vehicle history report. Even if the repairs are flawless, a car with a documented collision history is always worth less than an identical car with a clean record.

Why Your Car Is Worth Less After Repairs

Put yourself in a buyer’s shoes. You’re shopping for a used car and find two identical options—same year, make, model, and mileage. One, however, was in a significant accident. You would likely choose the one with no accident history or demand a steep discount on the repaired car.

That loss in market appeal is a real financial hit that you, the owner, are forced to absorb. The CCC ONE platform is built to determine what your car was worth before the crash and how much it costs to fix. It was never designed to calculate the critical loss in market value that occurs after repairs are complete.

When you accept a settlement based only on your insurer’s standard report, you agree to compensation that ignores this very real financial damage. That leaves you to cover the loss yourself when you eventually sell or trade in your car.

The Financial Impact of an Accident Record

The hard truth is that every accident leaves a digital footprint on services like CarFax and AutoCheck, making it impossible to hide from future buyers. When a potential buyer sees an accident on the report, they immediately become hesitant, which directly lowers your car’s resale value.

A vehicle can lose anywhere from 10% to 30% of its pre-accident value due to this stigma. On a $30,000 car, that’s a real-world loss of $3,000 to $9,000 that a standard CCC ONE-based settlement completely ignores. This is financial damage caused directly by the accident, and in most states, you are legally entitled to compensation for it. To learn about the laws where you live, check our state-specific law pages.

Recent roadway safety statistics show just how many incidents lead to these hidden financial losses. A progress report on the National Roadway Safety Strategy confirms that even with fewer fatal accidents, property damage claims remain a huge issue for vehicle owners. You can read more in the official government report on transportation safety.

Bridging the Gap Left by CCC ONE

Because the CCC ONE software isn’t built to calculate post-repair market value, relying on it alone means you’re negotiating with incomplete information. To successfully file a diminished value claim, you need independent, credible evidence that proves how much value your vehicle has lost.

This is where a specialized appraisal is essential. An independent report from a certified expert provides the data-backed proof needed to challenge the insurer’s limited valuation. It analyzes your specific local market, accounts for the severity of the damage, and calculates the precise financial loss caused by the accident history.

By presenting a defensible, market-correct appraisal, you change the conversation. It’s no longer about their algorithm; it’s about real-world facts. This gives you the power to demand fair compensation for the entire loss you suffered, not just the repair bill.

How to Challenge a Low CCC ONE Valuation

When an insurance company’s settlement offer arrives, it’s easy to feel like the number is final. But the truth is, their first offer—almost always based on a CCC ONE report—isn’t the end of the conversation. It’s the beginning of a negotiation.

That number is the output of an algorithm using a limited, generic dataset. By arming yourself with the right information, you can push back against that automated assessment and fight for the fair payout you deserve.

Common Weak Points in a CCC ONE Valuation

First, put the insurer’s report under a microscope to look for common errors and omissions. Because the valuation is automated, it’s full of weak spots that can lower your payout. Your goal is not to start a fight but to correct their data with your reality.

Here are the most common weak points to look for:

- Inaccurate Condition Rating: An adjuster may assign a generic “good” or “fair” rating. But if your vehicle was garage-kept with perfect service records, it’s worth more than the system’s default value.

- Poorly Chosen Comparables: The report might use “comps” from a cheaper market or from vehicles sold months ago. That outdated data fails to capture what your car is worth in your local area right now.

- Missing Features and Upgrades: Did you just install new tires or upgrade the sound system? These are real-world upgrades that add value, but a standard CCC ONE report often overlooks or undervalues them.

Once you spot these gaps, you can build a counter-argument backed by hard evidence. For a deeper dive, check out our guide on how to handle an insurance low-ball offer on your totaled car.

Gather Your Own Evidence to Prove True Value

After you’ve analyzed the insurer’s report, it’s time to build your own case with proof. The more documentation you have, the stronger your negotiating position. Think of it as creating a file that tells the true story of your vehicle’s worth.

Your personal records are often the most compelling evidence. They transform your car from a line item in a database into a well-maintained, valuable asset.

This evidence provides concrete proof of its condition and value right before the crash. Here’s what you need to collect:

- Detailed Service Records: Show a history of regular oil changes, tire rotations, and proper maintenance.

- Recent Receipts: Gather receipts for new tires, brakes, a battery, or any other significant parts replaced in the last year.

- Original Window Sticker: The sticker is the ultimate proof of all the factory-installed options and packages that add value.

- Detailed Photos: Find clear, recent photos of the interior and exterior that prove its excellent pre-accident condition.

Dealing with the aftermath of an accident is stressful enough, from handling repairs to arranging a car rental after an accident. Having your evidence ready is key to ensuring all your losses are fully covered.

How An Independent Appraisal Strengthens Your Claim

If your insurance company provides a settlement offer based on the limited data from a CCC ONE report, the solution is simple: you need better data. A certified, independent appraisal is your most powerful tool in any claim negotiation.

A professional report isn’t just a second opinion. It’s a market-correct valuation designed to directly counter the shortcomings of automated software like CCC ONE. It provides the factual, defensible evidence you need to argue for a fair settlement.

The Power of Local Market Data

Unlike the broad averages often used in a CCC ONE valuation, a SnapClaim appraisal is built on hyper-local, real-time market data. We analyze what cars like yours are actually selling for in your specific area right now.

This method accounts for regional demand and local economic factors that a nationwide algorithm can’t see. By focusing on your immediate market, we establish an accurate pre-accident value that reflects reality, not a generic estimate.

An independent appraisal shifts the conversation from the insurer’s standardized numbers to the specific, verifiable value of your vehicle in your local market. It replaces assumptions with facts.

This focused approach is crucial for establishing the true fair market value for a total loss claim and serves as the baseline for calculating diminished value. You can learn more in our guide on what a car appraisal entails.

Presenting Defensible and Certified Evidence

An independent appraisal is more than just a different number; it’s a comprehensive document prepared by certified professionals. That credibility makes it difficult for an insurance adjuster to dismiss.

Each SnapClaim report delivers:

- Detailed Vehicle Analysis: We go beyond basic condition ratings, accounting for recent upgrades, maintenance history, and unique features that CCC ONE overlooks.

- Relevant Local Comparables: We pinpoint comparable vehicles sold recently in your geographic area, ensuring the data is current and relevant.

- Clear Valuation Methodology: Our reports transparently show how the final value was determined, giving you a logical and defensible basis for your claim.

This certified evidence puts you in a much stronger negotiating position. It proves that your request for a higher payout is based on professional analysis, not just wishful thinking.

Mitigating Risk with a Guarantee

We understand that challenging an insurance company can feel daunting. That’s why we stand behind our work with a straightforward promise. SnapClaim’s Money-Back Guarantee ensures you can pursue fair compensation without financial risk.

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

This guarantee empowers you to take the next step with confidence. An independent appraisal provides the proof you need to level the playing field, helping you negotiate for the compensation you rightfully deserve.

FAQ: Common Questions About CCC ONE and Your Claim

Can I get a copy of the CCC ONE report from my insurer?

Yes, you have the right to review any documentation used to determine your settlement offer. Simply ask your claims adjuster for a copy of the full CCC ONE valuation report. This document is the key to identifying inaccuracies in their assessment, such as an incorrect condition rating or poorly chosen comparable vehicles.

Is the CCC ONE valuation always wrong?

It’s not that the valuation is “wrong,” but rather that it’s often incomplete. The CCC ONE software is designed for efficiency and relies on standardized data, which means it has blind spots. It often undervalues well-maintained vehicles, misses recent upgrades, and, most importantly, does not calculate diminished value at all. Think of it as the insurer’s opening offer, not the final word.

What if the insurer rejects my independent appraisal?

While an insurer may prefer to rely on their own tools, they are generally obligated to consider any credible evidence you provide. A professional appraisal from a certified source like SnapClaim is defensible evidence based on local market data. If an adjuster dismisses it, calmly ask for a written explanation of their dispute, and don’t hesitate to escalate the issue to a supervisor.

Does every state allow diminished value claims?

Most states allow you to file a diminished value claim, particularly when the other driver is at fault (this is known as a third-party claim). However, laws and legal precedents vary significantly. Some states have more consumer-friendly regulations than others. To understand your rights, check our detailed state-specific law pages to see the rules where you live.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.

👉 Get Your Total loss Appraisal Today