Every vehicle owner wants to know their car value after an accident—and accurately calculating salvage value can make or break your insurance total loss payout. In this guide, we break down car salvage value calculation in plain English, so you can confidently negotiate fair offers or strengthen a diminished value claim.

Calculating Car Salvage Value

Salvage value calculation tells you what a salvage yard or insurer will offer when your car is declared a total loss.

Salvage Value = (ACV – Repair Cost) × Salvage Percentage

Before plugging in numbers, get comfortable with these core terms:

- Actual Cash Value (ACV) – Your vehicle’s fair market value just before the damage.

- Repair Cost – The shop’s estimate for parts and labor to return the car to pre-accident condition.

- Salvage Percentage – The slice of ACV a buyer will pay when purchasing a salvage title.

Every state also sets a total loss threshold, usually between 70% and 100% of ACV. That threshold determines when repair plus salvage costs push a car into “totaled” territory.

Understanding Total Loss Threshold

Say your repair estimate is $8,000 and ACV is $10,000. A 75% threshold means any combined cost over $7,500 triggers a total loss.

- Under a 70% rule, repair + salvage over $7,000 on a $10,000 ACV means total loss.

- At 90%, you need repair + salvage north of $9,000 to reach that status.

Salvage threshold rules vary by state and insurer. Check your State Law Guide for details.

Core Salvage Value Formula

Salvage Value = (ACV – Repair Cost) × Salvage Percentage

| Vehicle Type | Typical Salvage Percentage |

|---|---|

| Economy Cars | 25 – 40% |

| Trucks | 30 – 45% |

| Electric Vehicles | 20 – 35% |

| Luxury Models | 35 – 50% |

These benchmarks help you compare offers to today’s market.

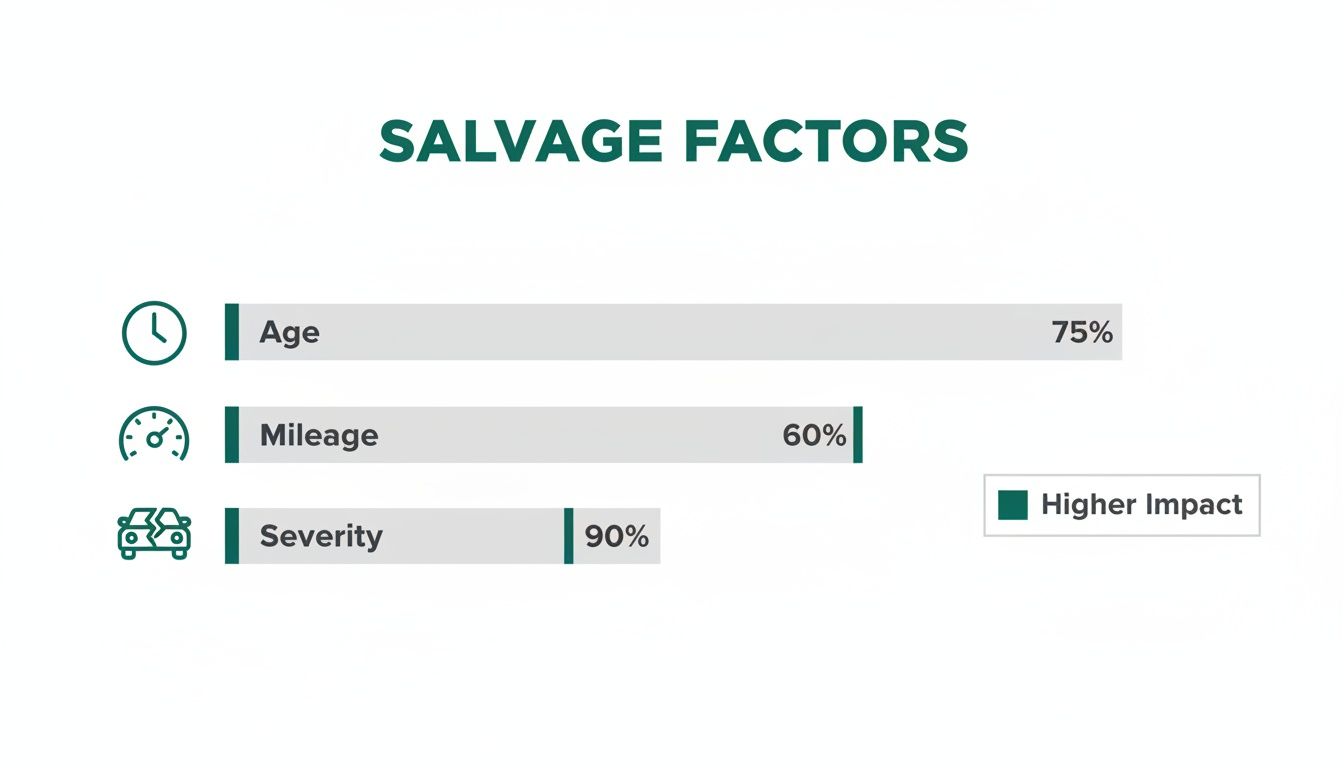

Factors Influencing Salvage Percentage

- Vehicle Age: Older cars often fetch less as parts demand declines.

- Mileage: Lower miles suggest more usable life, increasing value for rebuilders.

- Model Popularity: High-demand parts drive bids higher on certain makes.

- Season & Scrap Prices: Metal values and seasonal trends lead to monthly swings.

Knowing these variables lets you spot if a quoted percentage really reflects current scrap rates.

Why Salvage Value Matters

Accurate salvage value:

- Protects you from accepting an undervalued buyback.

- Exposes repair cost estimates that stray from local norms.

- Guides your decision to keep the car or hand it over.

Check Your Car Worth

Before you calculate salvage, verify ACV with verified sources like Kelley Blue Book or our ACV calculator guide.

Learn more about negotiating a diminished value claim in our Diminished Value guide.

Factors That Affect Salvage Value

When your car is totaled, the salvage figure an insurer offers isn’t random. They balance age, mileage, damage severity and local market swings. Knowing these levers gives you the upper hand if an offer feels too low.

Vehicle Mileage Trends

High miles usually drive salvage values down—but nuances exist. In the UK scrap car market for 2025/26, salvaged vehicles averaged 103,286 miles, nearly 30,000 miles fewer than straight-to-scrap cars.

Damage Severity Impact

A dinged fender might leave core systems intact, while a crushed frame obliterates most value.

A 2018 Honda Civic with front-end damage but a perfect interior fetched 35% of its ACV. Complete frame crush drops value to 15%.

Parts Demand Trends

Popular parts like transmissions and ECUs can boost bids. Insurers tap auction and dealer data to gauge hot items.

| Region | Scrap Premium |

|---|---|

| Coastal Areas | +10% |

| Urban Hubs | 0% |

| Rural Zones | -5% |

Compare offers to SnapClaim auction logs for fairness.

Metal Weight Pricing

- Steel: ~$0.10/lb

- Aluminum: ~$0.25/lb

- Copper wiring: ~$1.50/lb

Get local yard quotes to confirm metal-weight calculations.

Model Popularity Impact

- BMW 3 Series engine sold for $1,200 at auction despite 50% damage.

- Tesla Model S batteries often fetch $3,000+.

- Ford F-150 powertrains boost salvage offers by 5–10%.

SnapClaim appraisals automatically include these trends so no value goes unnoticed.

Common Salvage Calculation Methods

Insurers use three main approaches: percentage-of-ACV multipliers, cost deduction, and total-loss thresholds. Knowing each method helps you challenge low offers and confirm fair salvage value.

Percentage-of-ACV Multipliers

Applies a multiplier to ACV based on parts and scrap demand.

| Vehicle Type | Salvage % Range | Clean Value Multiplier |

|---|---|---|

| Economy Cars | 25–40% | 0.25–0.40 |

| Trucks | 30–45% | 0.30–0.45 |

| Electric Vehicles | 20–35% | 0.20–0.35 |

| Luxury Vehicles | 35–50% | 0.35–0.50 |

| Motorcycles | 30–50% | 0.30–0.50 |

Regional quirks can push percentages up by 5–10% in coastal scrap hubs. For industry trends, see IAAI Findings.

Cost Deduction Method

Break down repairable components’ demand values, subtract recycling fees, then deduct from ACV. Requires current junkyard rates or parts databases for accuracy.

Total-Loss Thresholds

Compares repair cost plus salvage value to a percentage of ACV.

- 70% Threshold: Total at 70%.

- 80% Threshold: Common in many states.

- 90% Threshold: Higher repair ratios allowed before write-off.

Knowing your state’s threshold sets expectations. Check our Total Loss guide.

Real-World Example Of Salvage Calculation

Ella, a mid-size sedan owner, experiences a front-end collision. The insurer totals her car. Her inbox shows a shockingly low salvage offer.

Insurer’s baseline:

- ACV: $12,000

- Repair Cost Estimate: $9,000

- Salvage % Used: 30%

Calculation:

(ACV – Repair Cost) = $3,000

$3,000 × 0.30 = $900

Refining Inputs

- Scan online salvage auctions (Copart, IAAI) for closing bids.

- Pull OEM part prices for bumpers and radiators.

- Get local scrap yard steel rates (e.g., $0.10/lb).

In coastal markets, steel at $0.12/lb can boost percentage to 35%:

$3,000 × 0.35 = $1,050

Upgrades like alloy wheels can push salvage % 2–5% higher. Document receipts and photos to strengthen your case.

| Input | Data Source | Strategy |

|---|---|---|

| ACV | KBB | Filter listings by mileage, year, features |

| Repair Cost Estimate | Three certified shop quotes | Compare and average |

| Salvage Percentage | Auction and scrap data | Track bids and metal rates weekly |

Use these figures to negotiate from a position of strength with data-backed evidence.

Verifying and Contesting Salvage Estimates

If your salvage payout feels low, counter with real-time market data:

- Auction results from Copart and IAAI

- Parts dealer quotes for high-demand components

- Certified SnapClaim appraisal reports

Gathering Market Data

Live auction prices set the salvage baseline. Industry research shows online salvage auctions grew from USD 3.45 billion (2023) to USD 10.74 billion (2025), forecast at USD 22.15 billion by 2030 Read the full research about online salvage auctions market.

Documenting Discrepancies

| Data Point | Insurer Estimate | Market Evidence |

|---|---|---|

| Salvage Percentage | 25% | 30–35% |

| Steel Scrap Rate per Pound | $0.08 | $0.10–$0.12 |

| Key Parts Demand Premium | Not Included | +5–10% |

This comparison chart focuses the dispute on exact gaps.

Drafting Your Dispute Letter

- Reference the insurer’s numbers and your evidence.

- Attach auction snapshots, parts quotes and your SnapClaim appraisal.

- Cite salvage-title regulations from National Highway Traffic Safety Administration salvage policy page.

- See our A Step by Step Guide to Disputing a Total Loss Offer.

How SnapClaim Supports Your Salvage Dispute

SnapClaim delivers certified calculations grounded in real data, so you have proof to negotiate higher salvage values.

Certified Methodology

- Auction results from Copart and IAAI

- Regional scrap yard rates and parts quotes

- NHTSA salvage guidelines and state law thresholds

Our proprietary algorithm and licensed appraisers ensure accuracy on every report.

“SnapClaim’s data-backed reports revealed a 15% higher salvage multiplier than my insurer’s figure.”

For more, explore our Diminished Value guide and Total Loss guide.

Market Data Integration

We cross-check multiple data streams:

- Kelley Blue Book values

- State salvage-title regulations

- Industry trend reports

Your report includes a comparison table highlighting any insurer undervaluation.

Money-Back Guarantee

If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee — guaranteed.

Fast Turnaround

Receive your certified report in under 60 minutes:

- Visit our Free Estimate page

- Enter vehicle and accident details

- Get instant preliminary numbers plus a completed report

Explore pricing on our appraisal service page.

Next Steps

With a SnapClaim report, drafting a persuasive dispute letter is straightforward. Reference each data point, attach your report, and consult your Total Loss State Law Guide for legal thresholds.

Frequently Asked Questions

Can I claim diminished value if the accident wasn’t my fault?

Yes. You can file a diminished value claim against the at-fault driver’s insurer. A SnapClaim appraisal report provides the evidence you need to support the loss in your car’s market value.

How does salvage value affect my insurance total loss payout?

Salvage value is deducted from your ACV to determine the claim payout. A higher salvage value lowers your payout less—maximizing your insurance recovery.

What evidence do insurers require for a dispute?

Insurers look for recent auction sales, parts-dealer quotes, scrap-metal rates, repair estimates, and certified appraisal reports. SnapClaim bundles these into a court-ready document.

How do state rules impact salvage calculations?

States set total loss thresholds (70–90% of ACV) that dictate when a vehicle is totaled. Check your state’s specifics in our Total Loss State Law Guide.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step. Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.