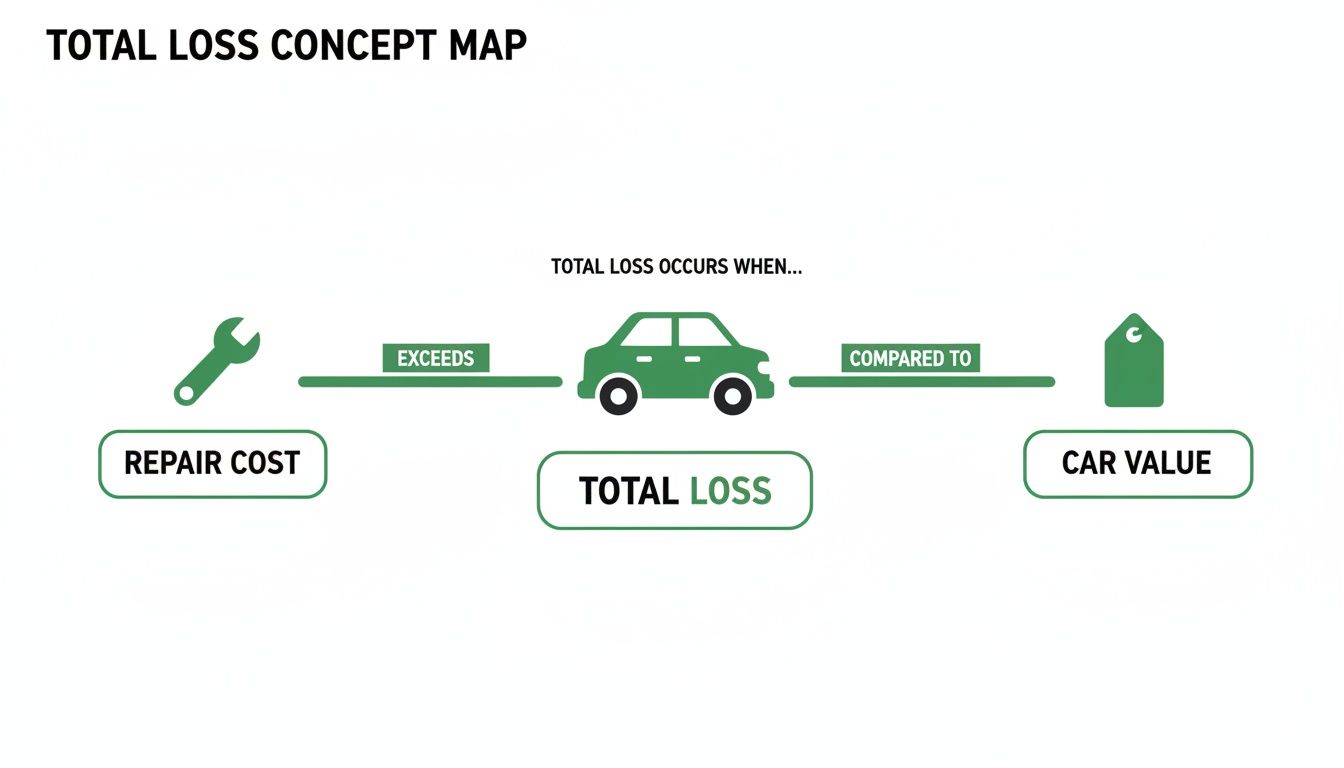

When the insurance adjuster tells you your car is a total loss, it’s easy to feel overwhelmed. This guide explains what that means and how to get the fair compensation you deserve. It simply means the insurance company has calculated that fixing your car will cost more than it was worth right before the crash.

Find a total loss appraiser near me

Understanding a Total Loss Declaration

A “total loss” doesn’t always mean your car is a twisted heap of metal. In fact, with how complex modern cars are, even moderate-looking damage can trigger a total loss declaration. A fender bender that might have been a simple fix a decade ago could now involve damaged sensors, cameras, and advanced driver-assistance systems (ADAS), sending repair estimates skyrocketing.

This is a financial tipping point for the insurer. It’s a business calculation: why spend thousands repairing a vehicle when it’s cheaper to write you a check for its pre-accident value? That pre-accident value has a specific name you need to know: Actual Cash Value (ACV).

What Is Actual Cash Value (ACV)?

Think of Actual Cash Value as a snapshot of your car’s fair market price in the moments before the accident happened. It’s not what you paid for it new, and it’s not the cost to buy a brand-new replacement.

Instead, the ACV is based on a mix of factors:

- Vehicle Specifics: The make, model, year, and trim.

- Mileage: Fewer miles on the odometer usually means a higher value.

- Overall Condition: The state of the interior, exterior, and engine before the collision.

- Recent Upgrades: Did you just buy new tires or install a high-end sound system? Those can add value.

- Local Market Data: What are similar cars actually selling for in your area?

The insurer’s first ACV calculation is just their opening offer—nothing more. It’s their starting point, not the final word. These initial offers are often based on generic data from automated systems that can easily miss what made your car special.

An insurance company’s first offer is a business decision, designed to close your claim quickly and for the lowest amount possible. It’s your right to review their numbers, provide your own evidence, and negotiate for a payout that truly reflects what your car was worth.

Getting a grip on this process is the first step toward getting a fair settlement. You have every right to challenge the insurer’s valuation, and with the right proof, you can build a powerful case for the compensation you deserve. To learn more, check out our complete guide on Total Loss and Fair Market Value.

How Insurance Companies Calculate Your Car’s Value

Ever wonder what goes on behind the curtain when an insurance company declares a car a total loss? It’s not an arbitrary decision—it’s a cold, hard financial calculation. Understanding their math is the first step toward making sure you don’t get shortchanged.

At the end of the day, it all boils down to one simple question for the insurer: is it cheaper to fix your car, or is it cheaper to write you a check for its pre-accident value and sell the wreck for scrap?

This is the fork in the road where your car’s fate is decided.

As you can see, a total loss isn’t just about how bad the damage looks. It’s about the financial tipping point where the cost to repair your vehicle gets too close to—or even sails past—what it was worth just before the accident.

The Total Loss Formula Explained

Most insurance carriers lean on a version of the Total Loss Formula to make the official call. It sounds technical, but the logic is pretty straightforward.

Total Loss Formula: Cost of Repair + Salvage Value ≥ Actual Cash Value (ACV)

Let’s break down what those terms actually mean in plain English:

- Cost of Repair: This is the full estimate for all the parts and labor needed to get your vehicle back to its pre-accident condition.

- Salvage Value: This is the cash the insurer can get by selling your banged-up car to a salvage yard or at an auction. It’s not worthless to them.

- Actual Cash Value (ACV): This is what your car was worth on the open market a moment before the collision happened.

So, if the cost to fix your car plus what they can pocket from the salvage yard adds up to more than your car’s ACV, they’ll total it out. It’s nothing personal—it’s just a business decision designed to minimize their financial hit. For a deeper dive, check out our complete guide to understanding your total loss car valuation.

What Is the Total Loss Threshold?

On top of this general formula, states have specific laws that can force an insurer’s hand. This is known as the Total Loss Threshold (TLT), a percentage set by state regulators.

If the estimated repair costs climb past this percentage of the car’s ACV, the insurer is legally required to declare it a total loss and have a salvage title issued.

For example, say your car’s ACV is $20,000 and you live in a state with a 75% TLT. Any repair estimate that comes in over $15,000 automatically triggers a total loss. These thresholds can vary wildly from state to state, so it’s crucial to know the rules where you live.

How Insurers Determine Your Car’s ACV

So, how do they land on that all-important ACV number? They don’t just pull up Kelley Blue Book and call it a day. Insurers typically use third-party valuation services like CCC ONE or Mitchell. These platforms crunch data from dealer sales, auction results, and vehicle listings to spit out a valuation report.

But here’s the catch: these reports are often deeply flawed.

They might compare your meticulously maintained vehicle to beat-up auction cars, miss key features and upgrades you paid for, or fail to adjust for your car’s pristine condition. The data they rely on is generic and often doesn’t reflect the true market realities where you live.

This is why their first offer is just that—an offer. It’s based on their numbers, which are designed to serve their bottom line, not yours. Knowing how they got their number is your key to challenging it with better, more accurate evidence.

Insurer Valuation vs Comprehensive Appraisal

The gap between an insurer’s quick valuation and a true market appraisal can be huge. Here’s a side-by-side look at the difference.

| Valuation Factor | Typical Insurer Method | Comprehensive Appraisal Method (SnapClaim) |

|---|---|---|

| Comparable Vehicles | Uses a narrow, automated list of sold vehicles, often from wholesale auctions. | Analyzes a broad set of current retail listings for truly comparable vehicles in your local market. |

| Condition Adjustments | Applies generic, minimal adjustments for condition (e.g., “average,” “clean”). | Conducts a detailed assessment of your car’s actual condition, including maintenance records and upgrades. |

| Market Nuances | Ignores local market demand, seasonal trends, and specific trim package values. | Factors in real-time local market data, regional demand, and the specific value of your car’s options. |

| Data Sources | Relies on proprietary internal databases (like CCC or Mitchell). | Cross-references multiple industry sources like NADA, KBB, Black Book, and live market data. |

| Report Transparency | Often provides a confusing, hard-to-read report that obscures how the value was determined. | Delivers a clear, court-ready report that explains the methodology and justifies the valuation. |

As you can see, the insurer’s method is built for speed and cost-efficiency—for them. A comprehensive appraisal is built for accuracy and fairness—for you. Don’t just accept their number.

Common Reasons Your Insurer’s First Offer Is Too Low

After the shock of learning your car is a total loss, the next shoe to drop is the settlement offer from your insurance company. Brace yourself, because this initial number is almost always a lowball. It’s not personal—it’s just business. Insurance companies are built to minimize payouts, so you should treat their first offer as exactly what it is: an opening bid in a negotiation, not the final verdict.

The valuation reports they send over, often generated by third-party services like CCC ONE, are designed for speed and volume, not for pinpoint accuracy. These systems frequently pull from flawed data pools that completely miss the mark on your vehicle’s true pre-accident worth.

This isn’t just a hunch; it’s a growing trend. With repair costs skyrocketing—partly thanks to tariffs on imported parts—more than 30% of auto insurance claims in the U.S. are now being declared total losses. This economic pressure gives insurers even more incentive to write off cars instead of fixing them, which makes fighting for a fair valuation more critical than ever. You can dig deeper into how tariffs are reshaping the auto insurance market and fueling this trend.

Using Inappropriate Comparable Vehicles

One of the biggest culprits behind a lowball offer is the use of bad “comps,” or comparable vehicles. The insurer’s software might grab data from cars that are nothing like yours in the ways that actually matter. For instance, your meticulously maintained, low-mileage SUV could be compared against a stripped-down base model that sold at a wholesale auction three states away. It’s an apples-to-oranges comparison from the start.

These automated systems often completely ignore the details that drive up value:

- Trim Level: There’s a huge price difference between a premium trim package (like a Honda Accord EX-L) and a standard base model (the LX). Comparing them is a surefire way to get an offer that’s thousands of dollars too low.

- Geographic Location: A car’s value swings wildly based on where it’s sold. A 4×4 truck in Colorado is worth a lot more than the same truck in Florida, but the software often misses these critical local market details.

- Sale Type: Comps should come from actual retail listings at local dealerships—what you would have to pay to replace your car. Instead, they often pull from wholesale auction prices, which are far lower.

Overlooking Your Car’s Unique Features and Condition

Another classic mistake is failing to account for your car’s specific condition and features. The standard valuation report almost always defaults a vehicle to “average” condition, totally ignoring all the care and money you’ve poured into it over the years.

Key Takeaway: An automated report can’t see the pristine interior, notice the flawless paint, or read your detailed maintenance records. It’s up to you to prove what made your car better than “average.”

A proper appraisal digs into the details the insurer’s report will almost certainly miss:

- Recent Upgrades: Did you just put on a new set of tires? Install a new battery or an upgraded stereo? These aren’t freebies; they add real, tangible value.

- Exceptional Maintenance: If you have a folder full of receipts for regular oil changes, tune-ups, and preventative work, that’s hard proof your vehicle was in superior condition.

- Desirable Options: Factory-installed features like a sunroof, premium wheels, or a tech package all need to be identified and valued correctly.

At the end of the day, the insurer’s first offer is based on generic, mass-produced data. To get the settlement you truly deserve, you need to counter their assessment with specific, documented evidence about your car. A certified appraisal report from SnapClaim gives you the hard data you need to challenge their numbers and negotiate from a position of strength.

Exploring Your Options After a Total Loss Declaration

Once the insurance company officially declares your car is a total loss, the ball is in your court. You have some big decisions to make, and each one comes with its own financial reality. Understanding your options is the key to picking the one that works best for you and your wallet.

The most common route? You agree on a fair settlement, sign over the title, and let the insurer haul the vehicle away. For most people, this is the cleanest break. You take the payout and start shopping. But that’s not your only choice.

Option 1: Accept the Settlement and Surrender the Vehicle

This is the path most people take. Once you and the insurer land on a number for your car’s Actual Cash Value (ACV), you’ll sign some paperwork, hand over the keys and title, and get your settlement check.

That payment should cover the ACV you agreed on, plus any state taxes and title fees that apply. If the claim is through your own policy, your deductible will be subtracted from the total. The money is then yours to pay off any loan and find a new ride.

Option 2: Keep Your Car (Owner Retention)

What if the damage is mostly cosmetic? Or maybe you’re a skilled mechanic who can get it back on the road for cheap. In most states, you have the right to keep your vehicle. This is often called “owner retention,” or simply “buying back” your car from the insurance company.

If you go this route, the insurance company pays you the ACV minus the vehicle’s salvage value. That salvage value is just what the insurer expected to get for your banged-up car at a salvage auction.

Important Note: If you keep the car, the state DMV will brand it with a salvage title. A salvage title is a permanent mark on the vehicle’s record, making it tougher to insure and tanking its future resale value. You’ll have to make state-mandated repairs and pass a tough inspection to get a “rebuilt” title before it’s legal to drive again.

Option 3: Navigating a Loan Balance with GAP Insurance

Having a car loan adds another layer of complexity to the total loss process. The settlement check from your insurer is legally required to go straight to your lender to pay off what you owe.

But what if you owe more on the loan than the car is actually worth? That’s called being “upside-down” or having negative equity. For instance, if your car’s ACV is $18,000 but you still owe $21,000, you’re facing a $3,000 shortfall even after the insurance payout.

This is where GAP (Guaranteed Asset Protection) insurance becomes a financial lifesaver.

- What is GAP Insurance? It’s an optional coverage that pays the difference—the “gap”—between your car’s ACV and what you still owe on your loan.

- How Does It Work? After your main insurance policy pays the ACV, you file a claim with your GAP provider. They cover the rest of the loan balance, so you aren’t stuck making payments on a car you can’t even drive anymore.

If you don’t have GAP coverage, you’re on the hook for paying off that remaining loan balance yourself. Before you make any final moves, it’s critical to lock in your final settlement amount. If you feel the insurer’s ACV is coming in low, you can arm yourself with a certified report. You can start by exploring the benefits of a professional total loss car appraisal to get the hard data you need for a fair fight.

How to Negotiate a Higher Total Loss Settlement

Getting a lowball settlement offer after your car is a total loss can feel like adding insult to injury. But you have to remember, the insurance company’s first offer is just that—an offer. It’s the start of a negotiation, not the final word. You absolutely have the right to push back with evidence showing what your vehicle was really worth.

Successfully negotiating a higher payout isn’t about arguing or getting emotional. It’s about building a solid, fact-based case. The goal is to systematically take apart the insurer’s low valuation using better data, proving point-by-point why your car was worth more than they claim. This takes a methodical approach and the right kind of proof.

Scrutinize the Insurer’s Valuation Report

Your first move is to demand a copy of the insurance company’s full valuation report. Don’t just skim it—go through it with a fine-tooth comb. These reports, usually generated by third-party services like CCC Intelligent Solutions or Mitchell, are notorious for errors and omissions that can cost you thousands.

Look for these common mistakes that drive down your car’s value:

- Incorrect Trim or Options: Did they list your top-of-the-line Limited model as a basic LE? Did they forget to include the premium sound system, sunroof, or technology package?

- Inaccurate Mileage: A simple typo here can slash the value. Make sure the mileage they used is correct for the date of the accident.

- Poor Condition Rating: Insurers love to default to “average” or even “fair” condition without any real justification. If your car was in excellent shape, you need to prove it.

- Flawed Comparable Vehicles: Take a hard look at the “comps” they used. Are they truly similar? Check for major differences in location, trim level, mileage, and overall condition.

Gather Your Own Powerful Evidence

Once you’ve spotted the weak points in their report, it’s time to build your own case with compelling proof. Your mission is to paint a crystal-clear picture of your vehicle’s pre-accident condition and its true market value.

Start by putting together a file with these documents:

- Maintenance Records: A complete service history with regular oil changes, tire rotations, and repairs shows your car was well-cared-for, justifying a higher condition rating.

- Receipts for Recent Upgrades: Did you install new tires, a battery, or brakes in the past year? Those receipts represent real, added value that must be included in your settlement.

- Original Window Sticker: If you have it, the Monroney sticker is the ultimate proof of every single feature and option your car had when it rolled off the factory line.

Next, you need to find your own comparable vehicles. Search online classifieds like Autotrader or Cars.com for listings of the exact same year, make, model, and trim in your immediate area. Save screenshots of these ads—they are powerful evidence of the current local market value.

The Ultimate Tool: An Independent Appraisal

While doing your own homework is critical, the single most effective weapon for fighting a lowball offer is a certified, independent appraisal. Let’s be clear: an insurer’s valuation is created to serve their financial interests. An independent appraisal is created to find the truth.

An independent appraisal from a certified expert like SnapClaim provides unbiased, data-driven proof of your vehicle’s fair market value. It replaces the insurer’s questionable numbers with a defensible report built on verifiable market evidence.

This report isn’t just someone’s opinion; it’s a detailed, professional analysis that gives you the leverage to negotiate on equal footing. For a complete walkthrough, check out our step-by-step guide to disputing a total loss offer.

SnapClaim reports provide the data-backed proof you need to negotiate fairly. Plus, our Money-Back Guarantee ensures you have nothing to lose. If your insurance recovery from the claim is less than $1,000, SnapClaim refunds the full appraisal fee—guaranteed.

Invoking the Appraisal Clause

If the adjuster won’t budge even after you’ve presented your evidence, your auto policy likely contains a powerful tool you can use: the appraisal clause. This provision is designed to resolve valuation disputes and allows both you and the insurer to hire independent appraisers.

Here’s how it usually works:

- You hire your own certified appraiser (a SnapClaim report is perfect for this).

- The insurance company hires its own appraiser.

- The two appraisers negotiate on your behalf. If they can agree on a value, that amount is binding.

- If they can’t agree, they select a neutral third appraiser (an “umpire”) who makes the final, binding decision.

Invoking the appraisal clause takes the power out of the adjuster’s hands. It transforms the fight from a David-and-Goliath battle into a structured, evidence-based process where your certified report ensures your voice is heard loud and clear.

What to Do When Your Car is a Total Loss: Next Steps

Navigating a total loss claim can feel like a full-time job, but you don’t have to do it alone. By understanding the process and equipping yourself with the right evidence, you can challenge a low insurance total loss payout and secure the compensation you’re rightfully owed.

The key is to replace the insurer’s lowball offer with data-backed proof of your vehicle’s true fair market value. A certified appraisal report from SnapClaim is designed to do exactly that, providing the clear, defensible evidence you need to strengthen your claim and negotiate with confidence.

Get your free estimate today or order a certified appraisal report to strengthen your insurance claim.

Frequently Asked Questions

Can I claim diminished value if my car is a total loss?

No. A diminished value claim applies when your car is repaired after an accident, leaving it with a lower resale value. If your car is a total loss, you are negotiating the full pre-accident value (ACV) of the vehicle, so a diminished value claim is not applicable.

Can I keep my car if it is a total loss?

Yes, in most states, you have the option to keep your vehicle. This is called “owner retention.” The insurance company will pay you the Actual Cash Value (ACV) minus the vehicle’s salvage value. However, the car will be issued a salvage title, which makes it difficult to insure and sell in the future.

How long does a total loss claim take?

A standard total loss claim typically takes about 30 days to resolve. However, the timeline can be longer if there are disputes over the car’s value, delays with your lender, or if you need to invoke the appraisal clause in your policy.

What if I owe more on my loan than the settlement amount?

This is called being “upside-down.” If your loan balance is higher than the insurance payout, you are responsible for the remaining amount. This is where GAP (Guaranteed Asset Protection) insurance is crucial, as it covers this difference. Without it, you must pay the remaining balance out of pocket.

About SnapClaim

SnapClaim is a premier provider of expert diminished value and total loss appraisals. Our mission is to equip vehicle owners with clear, data-driven evidence to recover the full financial loss after an accident. Using advanced market analysis and industry expertise, we deliver accurate, defensible reports that help you negotiate confidently with insurance companies.

With a strong commitment to transparency and customer success, SnapClaim streamlines the claim process so you receive the compensation you rightfully deserve. Thousands of reports have been delivered to vehicle owners and law firms nationwide, with an average of $6,000+ in additional recovery per claim.

Why Trust This Guide

This guide was reviewed and verified by SnapClaim’s auto appraisers, who specialize in diminished value and total loss disputes.

Our team continually updates every article to reflect current insurer guidelines, valuation standards, and court-accepted appraisal practices, ensuring that you’re relying on information trusted by professionals nationwide.

Get Started Today

Whether you’re challenging a low total loss settlement or proving your vehicle’s post-repair loss in value, SnapClaim makes it simple to take the next step.

Generate a free diminished value or total loss estimate in minutes and see how much compensation you may be owed.