A car accident diminished value claim is your right to get paid for the money your car lost in resale value after an accident, even after it’s been perfectly repaired. Think about it—a car with an accident on its record is simply worth less than one without. This claim lets you recover that lost value from the at-fault driver’s insurance company.

Understanding Your Car’s Lost Value After a Crash

Let’s say you’re shopping for a used car. You find two identical models—same year, make, mileage, and color. But one has a clean history, while the other’s vehicle history report shows it was in a major collision last year.

Which one would you pay more for?

Exactly. You’d choose the one without the accident record or demand a steep discount on the repaired one. That drop in price is called car accident diminished value, and it’s a real financial loss you suffer because of someone else’s mistake. While insurance covers the repair bill, it doesn’t automatically cover this permanent loss in your car’s market value.

Three Types of Diminished Value after a a car accident

To file a successful claim, it helps to understand what kind of loss you’re trying to recover. Car accident Diminished value usually falls into three categories. Knowing the difference helps you build a stronger case.

| Type of Diminished Value | What It Means for You |

|---|---|

| Inherent Diminished Value | This is the most common loss. It’s the automatic drop in your car’s value simply because it now has a documented accident history. Even with flawless repairs, the stigma remains. |

| Repair-Related Diminished Value | This is extra value lost due to poor repair work. Think mismatched paint, cheap aftermarket parts, or a frame that’s not perfectly straight. These issues drag the value down even further. |

| Immediate Diminished Value | This is a more technical category, representing the difference between your car’s value right before the crash and its value as a wrecked vehicle, before repairs are done. |

For most drivers, Inherent Diminished Value is the core of their claim. It’s the unavoidable financial hit your car takes no matter how good the repairs are.

Key Takeaway: A car accident diminished value claim isn’t about the cost of repairs; it’s about recovering the market value your vehicle permanently lost due to its newly acquired accident history.

Experts at Kelley Blue Book have noted that a vehicle’s value can drop by thousands of dollars after a collision. You can learn more about how industry leaders view accident value estimations on KBB.com. This isn’t a minor detail—it’s a significant financial loss that dealers and private buyers recognize immediately. A certified appraisal from SnapClaim provides the solid proof you need to show the insurance company the true extent of your loss.

When Can You File a Car Accident Diminished Value Claim?

Not every ding or crash qualifies. Before you start the process, you need to make sure your situation meets a few key criteria.

- Someone Else Was At Fault: This is the most critical factor. You can only file a diminished value claim against the at-fault driver’s property damage liability insurance. If you caused the accident, you generally can’t file this type of claim.

- Your Car’s Value Matters: You have a stronger case if your vehicle is newer, has low mileage, and had no prior accidents. A one-year-old car has more value to lose than a ten-year-old vehicle with 150,000 miles.

- The Damage Was Significant: A minor scratch won’t cut it. The damage needs to be serious enough to appear on a vehicle history report like CarFax. This usually involves structural or frame damage, major component replacement (like doors or bumpers), or airbag deployment.

If you can say “yes” to these points, you likely have a strong case for a car accident diminished value claim. Want to see what your car’s value loss might be? Start with a free estimate from SnapClaim.

How Insurance Companies Calculate Your Loss (and Why It’s Wrong)

When you file a car accident diminished value claim, you expect a fair assessment of your car’s lost value. Unfortunately, that’s rarely what you get. Most insurance companies use a simple, in-house formula designed to do one thing: keep their payout as low as possible.

The Infamous “Rule 17c” Formula

The go-to method for many adjusters is a controversial calculation known as the “17c formula.” It’s a cookie-cutter equation that almost always produces a number far below your actual financial loss. The formula starts by immediately capping your potential loss at just 10% of your car’s pre-accident value—an arbitrary limit with no connection to reality.

Key Insight: The 17c formula is the insurance industry’s favorite tool because it churns out consistently low settlement offers. It completely ignores critical factors like market demand, the stigma of an accident on a vehicle’s history report, and the specific nature of the repairs.

From that already low ceiling, the formula applies more “modifiers” to slash the number even further.

A Step-by-Step Example of a Flawed Calculation

Let’s say your car was worth $30,000 before the accident. Here’s how an insurer using the 17c formula would calculate your car accident diminished value:

- Establish a Base Loss: The formula starts by taking 10% of the car’s pre-accident value.

- $30,000 x 0.10 = $3,000. This is the absolute maximum they will consider.

- Apply a Damage Modifier: Next, they apply a multiplier based on damage severity (e.g., 0.50 for moderate damage).

- $3,000 x 0.50 = $1,500. Your potential claim was just cut in half.

- Apply a Mileage Modifier: Finally, they use a mileage penalty (e.g., 0.60 for 50,000 miles).

- $1,500 x 0.60 = $900.

Just like that, your actual loss—which could easily be thousands of dollars—is whittled down to a $900 settlement offer. The 17c formula is a one-size-fits-all calculation that serves the insurer, not you. You can learn more about state-by-state claim rules or comprehensive review of state law to see how different states handle these calculations.

This is exactly why you can’t just accept the insurance company’s number. To get what you’re rightfully owed, you need to bring your own proof to the table. An independent, certified appraisal from SnapClaim provides a detailed, market-based valuation that an adjuster can’t easily ignore.

Filing Your Claim with Confidence

Knowing your car has lost value is one thing; getting that money back from an insurance company is another. The process of filing a car accident diminished value claim can feel intimidating, but with a clear, step-by-step approach, you can build a solid case that gets results.

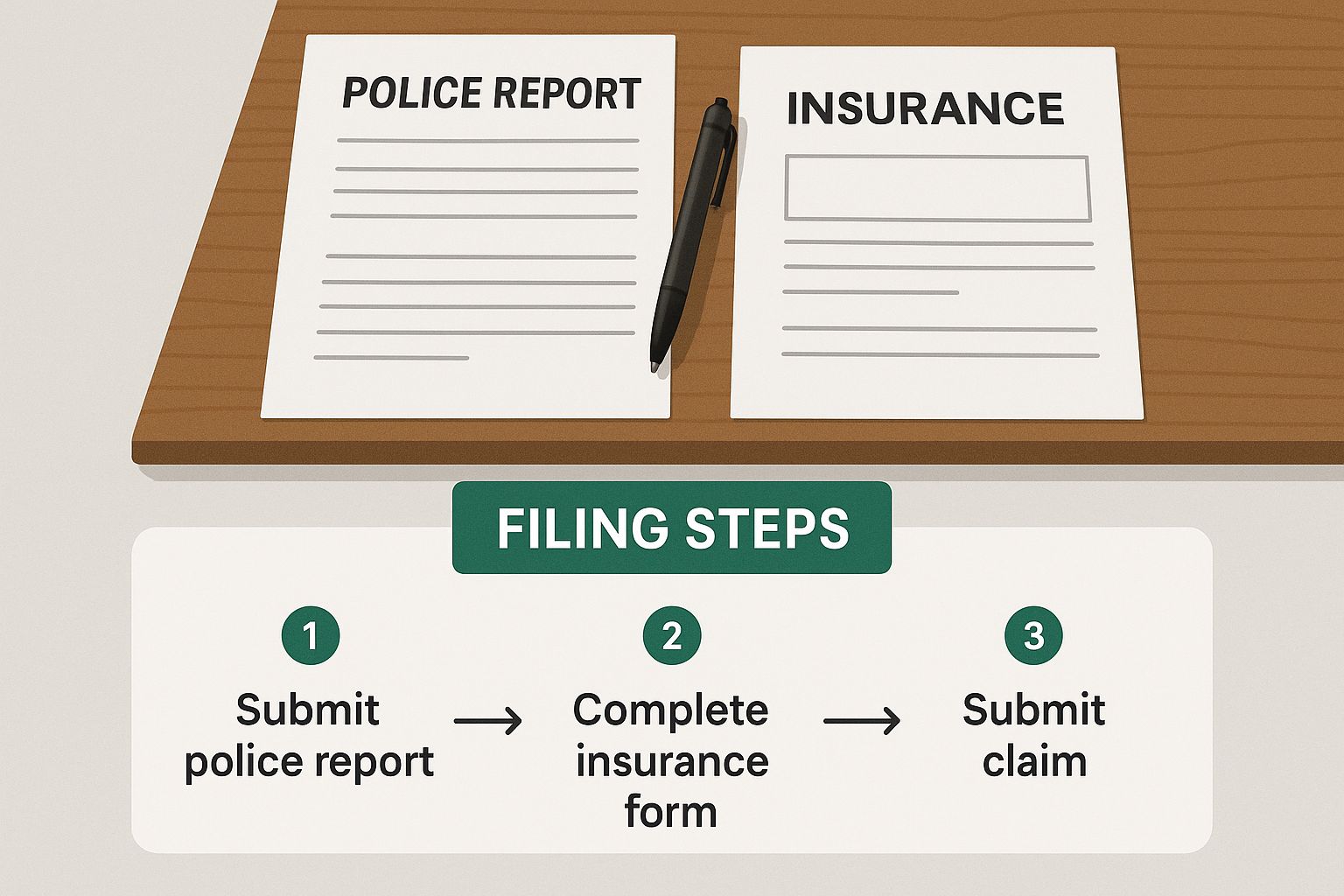

Step 1: Confirm Fault with the Police Report

First, get a copy of the official police report. This document is the cornerstone of your claim because it officially names the at-fault driver. You can only file a diminished value claim against the other driver’s insurance, and the police report is the objective proof you need to establish their liability.

Step 2: Gather All Your Documentation

Next, create a complete paper trail that tells the whole story. Your evidence package should include:

- The official police report

- Photos and videos of the damage at the scene

- The final, itemized repair bill from the body shop

- The insurance company’s initial estimate of repairs

Step 3: Get a Certified Independent Appraisal

This is your secret weapon. The insurance company will use their flawed formula to generate a lowball offer. You need expert evidence to fight back. A certified appraisal from SnapClaim is a detailed report grounded in real-world market data. It analyzes your vehicle’s condition, the quality of repairs, and actual sales data of similar cars—both with and without accident histories. This report becomes the anchor for your claim.

Step 4: Write a Professional Demand Letter

With your evidence gathered, you’re ready to draft a formal demand letter to the at-fault driver’s insurance adjuster. Your letter should be professional and factual, clearly stating:

- Your contact information and the claim number.

- The date and location of the accident.

- A clear statement that you are seeking compensation for your car’s inherent diminished value.

- The specific dollar amount you are demanding, supported by your certified appraisal report.

Step 5: Submit Your Complete Claim Package

Finally, assemble your demand letter, the police report, repair invoices, and—most importantly—your certified appraisal report into one organized package. Send everything to the insurance adjuster using a method with proof of delivery, like certified mail or email with a read receipt.

Following these steps transforms you from a victim into a prepared claimant ready to negotiate for the compensation you deserve. Get a free estimate from SnapClaim today.

Why an Independent Appraisal Is Your Strongest Tool

When you file a car accident diminished value claim, that first lowball offer from the insurance company is just their opening move. To counter it, you need more than an opinion—you need objective proof. This is where a certified independent appraisal becomes your single most powerful asset.

A professional appraisal report acts as objective, third-party evidence that substantiates your claim amount. It is far more credible and difficult for an adjuster to dismiss than your personal opinion of what the car is now worth.

What a Professional Appraisal Examines

A SnapClaim appraisal report digs into the details that truly determine a car’s market value, considering critical factors the 17c formula ignores:

- Real-World Market Data: We analyze recent sales of comparable vehicles in your area, comparing those with clean histories to those with accident records.

- Your Vehicle‘s Specifics: We assess your car’s pre-accident condition, mileage, trim level, and unique features.

- The Quality of Repairs: The report evaluates the extent of the damage and the quality of the repair work.

- Accident Stigma: We factor in the negative perception and buyer hesitation that comes with any vehicle that has a documented accident history.

This is the concrete proof you need to justify your claim and push back against the insurer’s low initial offer.

Insurer’s Formula vs. Independent Appraisal

The difference between their formula and a professional appraisal is stark, highlighting just how much money they save by ignoring the real world.

| Factor | Insurer’s 17c Formula | SnapClaim Independent Appraisal |

|---|---|---|

| Starting Point | Arbitrary 10% cap on vehicle value | Your vehicle’s actual pre-accident market value |

| Damage Analysis | A simple, generic damage multiplier | In-depth review of repair invoices and damage severity |

| Market Factors | Ignores real-world buyer behavior | Analyzes comparable sales data and local market trends |

| Outcome | A low, formula-driven settlement offer | A data-backed valuation to support fair compensation |

A Risk-Free Investment in Your Claim

We understand that paying for an appraisal might feel like another bill when you’re already dealing with accident costs. That’s why we stand behind our reports with SnapClaim’s money-back guarantee. If the insurance recovery from the claim is less than $1,000, your appraisal fee is fully refunded. This reassurance allows you to arm your claim with expert evidence without any financial risk.

Ready to get the proof you need? Order your certified appraisal report from SnapClaim and take control of the negotiation.

FAQs: Your Diminished Value Questions Answered

Filing a car accident diminished value claim can bring up a lot of questions. Here are clear answers to some of the most common ones we hear from vehicle owners.

Can I file a diminished value claim if I was at fault?

No, in almost all states, you cannot. Diminished value claims are filed against the at-fault driver’s property damage liability insurance. Your own collision policy is designed to cover repair costs, not the loss in market value. The only notable exception is Georgia, which allows for first-party claims. For more information, you can check your state’s Department of Motor Vehicles (DMV) website.

Is there a deadline for filing my claim?

Yes, every state has a “statute of limitations” for property damage claims, which is a firm deadline. This window is typically between two to six years from the date of the accident. It’s crucial to check your state’s deadline and start the process well before it expires, or you could lose your right to any compensation.

What if the insurance company ignores my claim?

Don’t give up. If an adjuster is unresponsive, follow up professionally in writing. Restate your demand and re-attach your certified appraisal report. If you still don’t hear back, ask to speak with a claims supervisor. If that fails, your next step is to file a formal complaint with your state’s Department of Insurance. This often motivates the insurer to respond and negotiate in good faith.

Do I need a lawyer to file a car accident diminished value claim?

For most claims, a lawyer is not necessary. The process is straightforward enough for vehicle owners to handle on their own, especially when you have a strong, independent appraisal report to support your claim. A report from SnapClaim provides the expert proof needed to negotiate effectively. For extremely high-value vehicles or complex cases involving injuries, consulting an attorney is wise.

Are you ready to recover the money your car lost after an accident? SnapClaim provides the certified, data-driven appraisal reports you need to strengthen your claim and negotiate a fair settlement. And with our money-back guarantee, there’s no risk—if your insurance recovery is less than $1,000, we’ll refund your appraisal fee.

Get Your Free Estimate or Order a Certified Appraisal Report Now

Don’t let an accident diminish your car’s value without fair compensation. SnapClaim offers expert appraisals to ensure you get what you deserve.

About SnapClaim

SnapClaim is your trusted partner in navigating the complexities of diminished value claims. We provide certified, data-driven appraisal reports that empower vehicle owners to seek fair compensation after an accident. Our mission is to demystify the process and equip you with the strongest possible evidence to counter lowball insurance offers. With a commitment to transparency and a risk-free money-back guarantee, SnapClaim ensures you can pursue your claim with confidence and recover the true market value your vehicle has lost.